1) Fake Live Streams

Given the mainstream acceptance of livestreaming due to the COVID-19 pandemic, most funeral homes now offer a live feed of the funeral so that loved ones can attend virtually when they cannot do so in person.

Scammers will locate the deceased’s loved ones on social media websites such as Facebook and send out fake links to what they believe is a livestream to the funeral, only to be directed to a webpage that charges a fee for access to said livestream. Once the fee is paid, they collect the money and retain your payment details for future withdrawals.

2) Phony Bills & Impersonating Funeral Home Staff

As reported by the NFDA and the FTC, scammers will scour recent obituaries (which are public) so they can identify family members of the deceased. Then the scammer will pose as a funeral home employee and call families, telling them they owe more money or that a security deposit is required for the funeral services. They will usually pressure victims into paying the money immediately, or else services will be cancelled.

To trick families into thinking they are legitimate, the scammer will typically use the full name of the deceased, the funeral home name, and even the name of the funeral director. They might even spoof their caller ID to match the funeral home’s number.

3) Falsifying The Death Of Someone

Essentially, the scammer chooses someone (literally, it can be anyone) and they make it appear as if they died. They will use AI to create fake images and websites so they can announce the death of the person they chose and the upcoming funeral.

The scammer then locates the deceased’s friends and family on social media and sends them a link to the fake website, where they can make donations to help cover funeral expenses. When someone tries to donate, it gives the scammer your payment details, allowing them to spend your money.

As reported by CNN, this exact scam happened to a prominent Los Angeles Times reporter named Deborah Vankin.

4) Prepaid Funeral Scam

Essentially, the funeral home accepts your money for a prepaid funeral. However, instead of putting the funds in a trust or pre-need life insurance policy as they are required to do, they spend the money on personal expenses, such as cars or vacations.

The FBI reported on a multi-state prepaid funeral Ponzi scheme that operated from 1992 to 2008, employing this very tactic. In total, there were over 450 million in losses.

Another way a prepaid funeral scam can manifest is when the scammer creates fake advertisements promoting a prepaid funeral. They often use a real funeral home’s name and act as one of their representatives.

When it comes to payment, they will insist that you pay via a third-party service such as Venmo or PayPal (which no funeral home will ever do).

5) Fake Funeral Fundraisers

Scammers will start a GoFundMe (or other fundraising platform) with an elaborate backstory about the tragic and often unforeseen death of a fictitious person. The end goal is to solicit donations to help cover end-of-life expenses, but in reality, they pocket the cash.

They will utilize various social media platforms to share this story, aiming to garner sympathy from those who, upon reading the sad story, wish to help. Typically, they use artificial intelligence to craft a story that is both heartbreaking and believable, and to create fake photos, all to make it seem real to the unsuspecting victims.

6) Burial Insurance Scams

Burial insurance scams can take many forms. The two most common ones are:

- Selling accidental death as life coverage: This is when an agent or company sells you an accidental death insurance policy but makes you think it will also pay out for natural causes of death. The extremely low cost is the primary hook. Accidental death insurance costs literally $5-$15 monthly (for a lot of coverage) since it’s so rare that people die from an accident. The extremely low cost is so attractive to victims that they often don’t consider asking why it’s so cheap. They are just elated with how much money they are saving.

- Withholding the truth about a waiting period: This occurs when an agent sells you a final expense life insurance policy with a two-year waiting period, but they fail to disclose this fact. Policies with a waiting period will only refund your premiums if you die during that time. So you think you’re insured immediately, but in reality, you’re not covered for 24 months.

Red Flags: How To Spot And Avoid Funeral Scams

You can avoid becoming a victim if you trust your gut instincts when something seems off (which will likely be the case) and you follow some basic principles.

- Don’t give in to any pressure to act immediately. One common theme with scammers is that they will heavily stress that you must pay right now or face consequences, such as them canceling the funeral services. Legitimate funeral homes will never pressure you.

- Don’t pay money until you verify who it is. If you’re contacted by anyone claiming to be connected with the funeral service provider and they ask for payment, never do so on that initial call. Instead, always call the funeral home back at their known phone number before paying anything.

- Know how scammers ask you to pay them. Scammers will always ask you to pay them via a wire transfer, cryptocurrency, gift card, Venmo, or PayPal. Also, never accept a check from someone who, in turn, asks you to send them money back. No real funeral service provider will do any of this.

- No real livestream will require you to pay a fee to access it. Video livestreams on Zoom or other streaming platforms will not require you to pay a fee for access.

- Pay attention to poor communication or a lack of transparency. If anyone representing a funeral provider sends you correspondence via email or verbally that is riddled with grammatical errors, misspellings, or simply has a message that is hard to follow, you should consider it a big red flag. If they fail to respond to you in a timely manner, that’s also a red flag. Funeral directors and their employees are professionals and typically act as such. Actual correspondence from a funeral home will likely be punctual, grammatically correct, free of misspellings, and easy to understand.

- Asking for your personal information. No funeral home will ever ask you for your Social Security number. Only a scammer would.

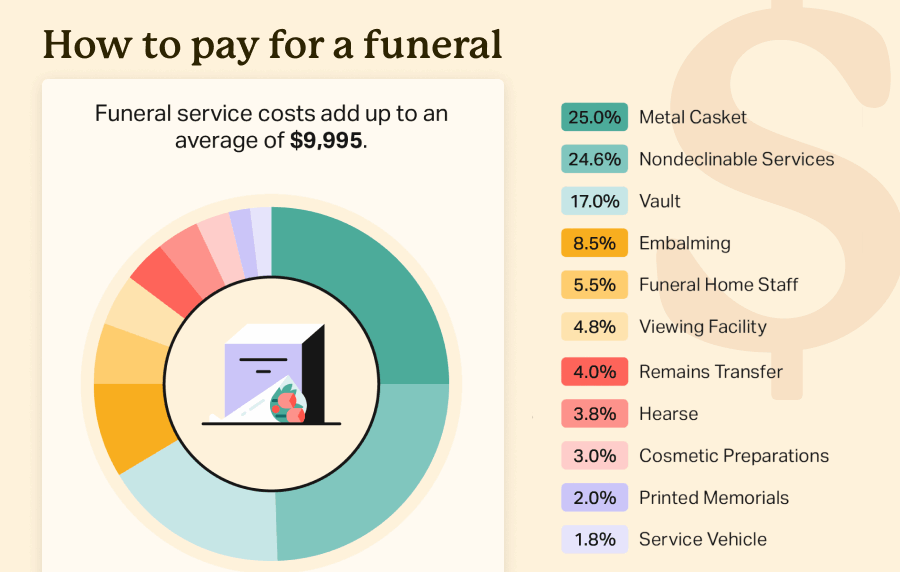

- Avoid funeral homes that are vague about costs or have unexplained fees. The FTC’s Funeral Rule requires funeral homes to provide you with clear up-front prices in writing before accepting any payment. If they fail to provide this information or refuse to explain the nature of the charges, you should consider seeking out another provider. Only a shady funeral home would operate this way.

- Thoroughly research the funeral provider. You should search online as much as you can about the funeral home. Look for consumer reviews to see what their previous customers had to say about them. If the funeral home is reputable, it should have a positive online sentiment.

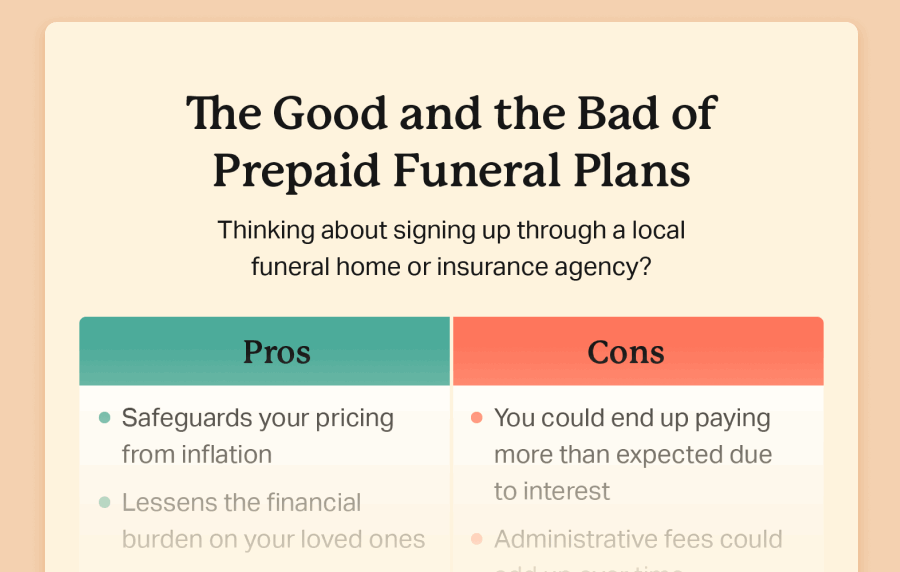

- Review prepaid funeral contracts thoroughly. Prepaid funeral plans are an excellent way to preplan and ensure your funeral is paid for. That said, to avoid being a victim of a funeral home that seeks to steal your money, be sure to review the contract thoroughly. Ensure the money you’re paying is being held in a trust or a pre-need funeral policy. You may even want to have an attorney review it. Don’t be afraid to ask questions about anything you don’t understand. The funeral home should willingly answer any questions you may have. If they hesitate or avoid doing so, you should immediately back out and seek out another funeral home.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

NFDA. https://nfda.org/news/in-the-news/nfda-news/id/7302/scam-alert--phony-bill

-

FTC. https://www.ftc.gov/business-guidance/blog/2023/06/scammers-impersonate-funeral-home-staff-prey-mourning-families-can-it-get-any-lower

-

spoof their caller ID. https://www.fcc.gov/consumers/guides/spoofing

-

CNN. https://www.cnn.com/2024/03/19/us/fake-obituary-scams-ai-cec

-

Deborah Vankin. https://www.latimes.com/people/deborah-vankin

-

FBI reported. https://www.fbi.gov/news/stories/prepaid-funeral-scam

-

accidental death insurance policy. https://www.trustage.com/learn/add/what-is-accidental-death-dismemberment-insurance

-

FTC’s Funeral Rule. https://www.ftc.gov/news-events/topics/truth-advertising/funeral-rule