Following our editorial standards, we are committed to creating accurate and helpful content that empowers users with information to decide whether to buy an insurance product.

Our insurance review system combines quantitative data and subjective analysis performed by insurance experts who presently sell life insurance. We conduct reviews of both insurance companies and insurance agencies (brokers).

For transparency, we provide a clear outline of the scoring factors and formula used to evaluate life insurance companies and agencies. All scores are rounded to one decimal place.

The current scoring methodology is version 1.1.

Scoring Factors

Our review formula is based on a 5-star scoring system, with five being the best possible score. The review factors vary based on the product and entity being studied.

Overall Score

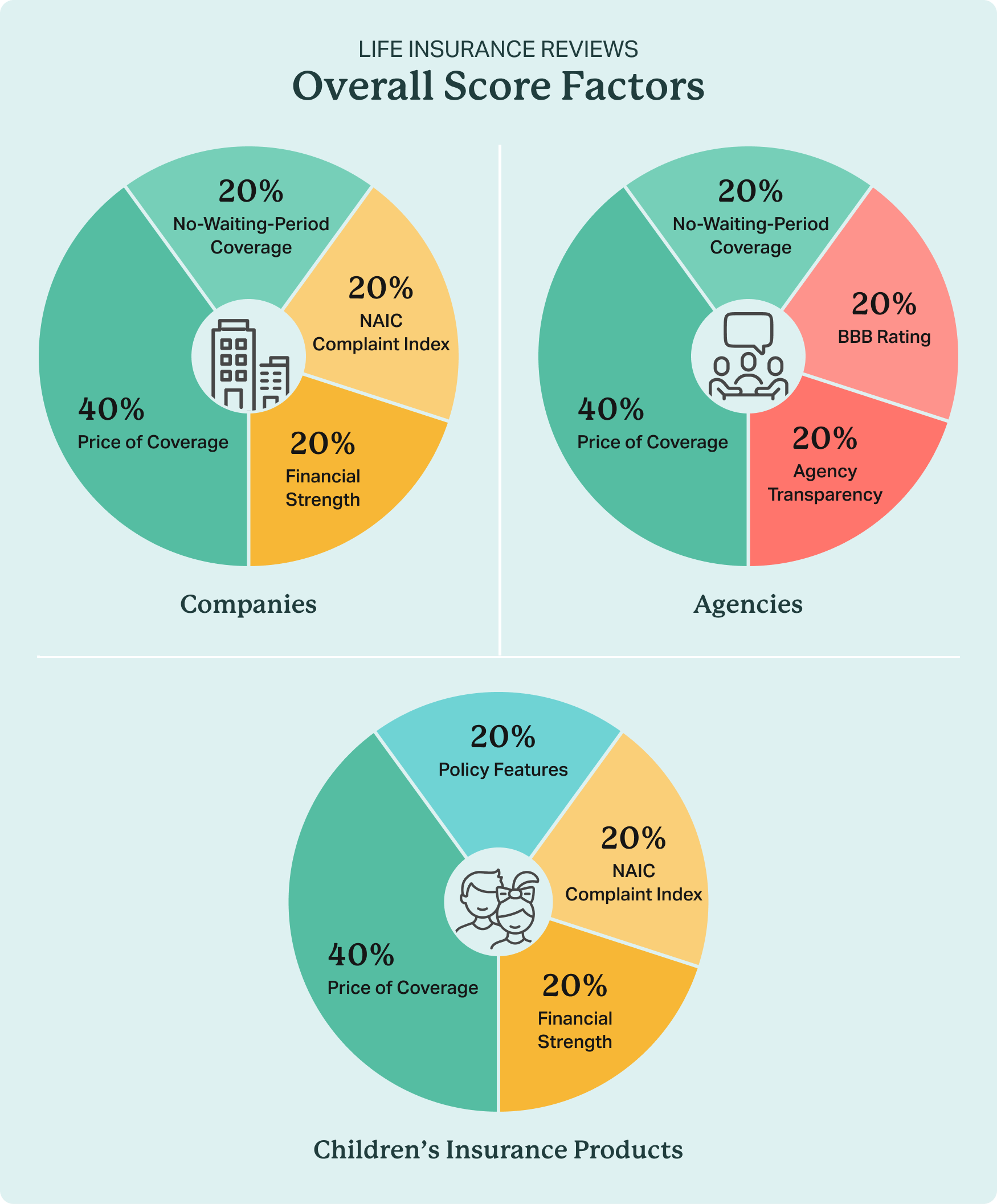

The Overall Score summarizes how attractive an insurance offer is. Our review formula generates the Overall Score by applying a weighted average of four factors to determine a numerical score between 0 and 5.

Each factor is equally weighted except for the Price of Coverage factor. This element carries twice as much weight as the other factors because nearly every consumer life insurance survey confirms that the insurance cost is the most important variable.

For example, a 2021 JD Power survey found that 38% of life insurance shoppers didn’t purchase a policy because the price was too high. Furthermore, Choice Mutual interacts with tens of thousands of life insurance shoppers monthly. They regularly report to us that securing the lowest cost is their chief concern.

Below is the breakdown of the individual factors and their weights in the Overall Score for life insurance companies:

| Score Factor for Companies | Score Value |

| Price of Coverage |

40%

|

| No-Waiting-Period CoverageNo Waiting Period |

20%

|

| Insurer’s Financial StrengthFinancial Strength |

20%

|

| NAIC Complaint Index |

20%

|

Below is the breakdown of the individual factors and their weights in the Overall Score for life insurance agencies:

| Score Factor for Agencies | Score Value |

| Price of Coverage |

40%

|

| No-Waiting-Period CoverageNo Waiting Period |

20%

|

| Better Business Bureau RatingBBB Rating |

20%

|

| Agency Transparency |

20%

|

Below is the breakdown of the individual factors and their weights in the Overall Score for children’s life insurance products:

| Score Factor for Children's Insurances | Score Value |

| Price of Coverage |

40%

|

| Insurer’s Financial StrengthFinancial Strength |

20%

|

| Policy Features |

20%

|

| NAIC Complaint Index |

20%

|

Whether we are assessing an insurance company or agency, the 0-5 star score signifies the following:

These scores are impressive, and you should quickly engage with any company within this range.

With a score in this range, you can feel confident you’re getting a quality, competitively priced policy from a trustworthy company.

There may be cause for concern. However, accepting a company with this score may be the only option if your life situation prevents you from qualifying with a company that scores 3.0 or higher. For example, if you’re on dialysis, you don’t have the luxury of being able to qualify with any company you desire. You will likely have to accept a policy from a company that is more expensive than most other competitors.

These are very poor scores. We strongly advise that you avoid companies with scores in this range.

Price of Coverage

The Price of Coverage factor measures a company’s cost relative to its competitors. For reviews of life insurance companies or agencies, we use this quote calculator to compare the price of the insurer’s coverage to the three least expensive competitors with equivalent products. The score they receive is based on how close their price is to those providers.

Below is a breakdown of our scores and how they are calculated:

- 50-5% more expensive

- 46-10% more expensive

- 311-20% more expensive

- 221-30% more expensive

- 1≥ 40% more expensive

For a life insurance company, we measure the price of the most common product they promote if there are multiple policy options.

For a life insurance agency, we measure the price of the most common product they sell from whichever company emerges as their preferred provider.

When we conduct our cost test, we use the following variables to generate the rates:

| Gender | Age | Tobacco | Coverage | State |

|---|---|---|---|---|

| Female | 65 | Non-user | $10,000 | Texas |

For children’s life insurance product reviews, we compare a policy’s price to the most common competitors noted below that have equivalent products. The score the policy receives is based on how close its price is to the least expensive one.

Below is a breakdown of our scores and how they are calculated:

- 50-5% more expensive

- 46-10% more expensive

- 311-15% more expensive

- 216-20% more expensive

- 1≥ 21% more expensive

When we conduct our cost test, we use the following variables to generate the rates:

| Gender | Age | Coverage | State |

|---|---|---|---|

| Male | 9 | $25,000 | Texas |

As of June 15th, 2024, our cost test yielded the following results:

No-Waiting-Period Coverage

The No-Waiting-Period Coverage scoring factor assesses whether an insurance company or agency offers a policy with immediate coverage (for natural or accidental death) and, if so, how difficult it is to qualify for it.

This factor is a subjective score that a seasoned licensed life insurance agent assigns. We consider the following variables when determining this score:

- Is there an application health questionnaire?

- Does the company check your MIB file?

- Does the company check your Milliman IntelliScript prescription data?

- Does the company check your Milliman IntelliScript medical data?

- What is the direct consumer feedback from people who have previously applied with the company?

- Might a medical exam or medical records be required?

Below is a breakdown of the scores and what they mean:

- 5Most applicants qualify

- 4Fairly easy qualification

- 3Somewhat difficult qualification

- 2Very difficult qualification

- 1No-waiting-period coverage unavailable

For a life insurance company, we evaluate the most common product they promote if there are multiple policy options.

For a life insurance agency, we evaluate the most common product they sell from whichever company emerges as their preferred provider.

Insurer’s Financial Strength

The Insurer’s Financial Strength score is based on A.M. Best’s Financial Strength Ratings (FSR). These ratings measure an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. This scoring factor only applies to life insurance company reviews because A.M. Best’s primary focus is on insurers’ financial health, not insurance agencies.

Understanding the various A.M. Best FSR ratings is essential. Here is an explanation of their scale:

| Rating Category | Rating Symbols | Financial Strength Risk |

|---|---|---|

| Superior | A+ or A++ | Not vulnerable |

| Excellent | A- or A | Not vulnerable |

| Good | B+ or B++ | Not vulnerable |

| Fair | B- or B | Vulnerable |

| Marginal | C+ or C++ | Vulnerable |

| Weak | C- or C | Very vulnerable |

| Poor | D or Not Rated | Extremely vulnerable |

Below is a breakdown of how we assign an insurer’s financial strength score given their A.M Best rating:

- 5Superior (A+ or A++)

- 4Excellent (A- to A)

- 3Fair/Good (B- to B++)

- 2Weak/Marginal (C- to C++)

- 1Poor (D or Not Rated)

When developing the formula to rank an insurer’s financial strength, we excluded ratings from Moody’s or S&P Global because it’s rare for a life insurance company to have a rating assigned from those agencies.

NAIC Complaint Index

The NAIC (National Association of Insurance Commissioners) Complaint Index score measures how frequently an insurer obtains consumer complaints relative to an industry-wide median score. This scoring factor applies only to life insurance companies because the NAIC regulates insurers rather than agencies.

Our scoring model is based on an insurer’s NAIC Complaint Index for the most recently available year and for “Individual Life” products.

Below is a breakdown of the scores and what they mean:

- 50.0 - 1.0 (Average or below-average number of complaints)

- 41.01 - 1.5 (Slightly above average number of complaints)

- 31.51 - 2.0 (Up to twice the average number of complaints)

- 22.01 - 3.0 (Up to three times the average number of complaints)

- 1≥ 3.01 (More than three times the average number of complaints)

BBB Rating

The BBB Rating score is based on the Better Business Bureau’s rating of the business. The Better Business Bureau assigns ratings to companies based on what information it can obtain about them, including complaints from the public. They assign a letter rating from A+ to F, or a company may be unrated.

Below is a breakdown of how we assign our scores given their rating with the BBB:

- 5A rating

- 4B rating

- 3C rating

- 2D rating

- 1F rating or Not Rated

This scoring factor only applies to insurance agencies. We did not include a company’s BBB rating as a scoring factor for life insurance companies because more relevant and essential data (NAIC complaint index and AM Best ratings) is available to evaluate insurers. That said, within each life insurance company review, we do list their BBB rating for enhanced context.

Agency Transparency

The agency transparency score measures how well an insurance broker reveals critical business information to the public. To develop this score, we conduct extensive online research to answer the following objective questions and assign a pass (yes) or fail (no) result:

- When you request prices on the agency website, do they actually show them, or do they respond with a message like “We’ll be in touch” after giving the impression that you’ll see instant quotes?

- Does the agency refrain from using deceptive marketing tactics such as “coverage for pennies per day” or “new state-regulated burial programs?

- Are the agency’s partner insurance companies publicly available?

- Are the agency’s license numbers publicly available?

- Does the agency make it clear which products they sell?

- Is the physical location of the agency clearly revealed?

- Is it clear which people lead the agency?

Based on the data we gather, we assign a score from 1 to 5. A higher score indicates a higher level of transparency.

Below is a breakdown of how we assign each score:

- 57 questions passed

- 45-6 questions passed

- 33-4 questions passed

- 22 questions passed

- 10-1 questions passed

This scoring factor is called Agency Transparency because it only applies to insurance agencies, not insurance companies.

Policy Features

The policy features score for a children’s life insurance product is a cumulative assessment of the following variables. To develop this score, we answer the following objective questions and assign a pass or fail result:

| Question | Pass | Fail |

|---|---|---|

| What is the age range for new applicants? | Pass:≥ 17 | Fail:< 17 |

| Is guaranteed insurability included? | Pass:Yes | Fail:No |

| What is the coverage maximum? | Pass:≥ $50,000 | Fail:< $50,000 |

| Is there an online application? | Pass:Yes | Fail:No |

| Is there a limited pay feature? | Pass:Yes | Fail:No |

| Does policy ownership automatically change at any age? | Pass:No | Fail:Yes |

Based on the data we gather, we assign a score from 1 to 5. A higher score indicates a higher level of transparency.

Below is a breakdown of how we assign each score:

- 56 questions passed

- 44-5 questions passed

- 33 questions passed

- 22 questions passed

- 10-1 questions passed

The policy features scoring factor only applies to children’s life insurance product reviews.

Non-Scoring Factors

Every review article includes current data about a company from the following consumer review platforms:

The data from these sources does not influence our scores. We provide this information to enhance the context of consumer feedback for a life insurance company or broker.

For life insurance company reviews only, we showcase rankings from Moody’s and S&P Global if they have ratings from either agency.

Changelog – Scoring Formula Changes From Version 1.0 to 1.1

Scoring formula 1.0 ended on July 5th, 2024. The primary difference between 1.0 and 1.1 is that the current version overwhelmingly ties scores to objective data points. Version 1.0 was primarily a subjective measurement in which an insurance expert assessed the various aspects of a life insurance company or agency and then assigned a score.

While 1.0 scores were helpful and authentic in context, scoring version 1.0 could not provide a detailed audit regarding which factors determined each score and its rank.