Globe Life offers no-medical-exam term life insurance with the convenience of an online application and a rate of just $1 for the first month. The real monthly premium starts in the second month and increases every five years. It’s term insurance, which means the policy will terminate at 80 or 90 (depending on the state), leaving you uninsured.

If you need a small amount of term insurance, Globe is a good option to consider. However, if you need more than $25,000 in term life insurance, many other insurance companies offer more competitive rates with stable pricing over time.

Finally, if you need insurance to cover your final expenses, Globe Life would be a terrible choice. That’s because the policy will expire at age 80 or 90, at which point you would be uninsured. Then, you wouldn’t have a financial tool to pay for your burial expenses. Additionally, the underwriting is strict, making it very difficult for seniors with pre-existing conditions to qualify.

- No medical exam is required to qualify.

- Immediate coverage for natural or accidental death if you’re approved.

- You can see quotes and fully apply online or via mail.

- A handy mobile app to manage your policy.

- Many applicants with common pre-existing conditions will be declined.

- Numerous other providers offer cheaper term insurance with a fixed rate.

- The company has an abnormally high number of consumer complaints.

- Does not offer guaranteed life insurance.

AM Best’s Financial Strength Rating (FSR) is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. The scores range from A++ to D-.

Moody’s Investors Service rates the creditworthiness of companies. The Moody’s Rating Scale has 21 possible scores ranging from “Aaa” (highest mark) down to “C” (lowest mark).

S&P Global Inc. issues credit ratings on a scale from “AAA” (highest rating) to “D” (lowest rating).

The Complaint Index compares a company’s performance to other companies in the market. The National Complaint Index is always 1.00. That means a company with a complaint index of 2.00 is twice as high as expected in the market. Reported scores are for the most recently available year and for “Individual Life” products.

The BBB rating is based on information BBB is able to obtain about the business, including complaints received from the public. BBB seeks and uses information directly from businesses and from public data sources. BBB assigns ratings from A+ (highest) to F (lowest). If a business has been accredited by the BBB, it means BBB has determined that the business meets accreditation standards, which include a commitment to make a good faith effort to resolve any consumer complaints.

Globe Life Insurance Policies Explained

Globe Life mainly offers no medical exam term life insurance and whole life insurance for children and adults. Although no exam is required, you will be asked to answer health questions (except for their accidental death plans).

Term life insurance

Globe term life insurance will last until you’re 80 or 90 years old, depending on your state. The premium increases every five years, each time you reach an age that ends in one or six (41, 46, 51, 56, etc.). When the policy ends, you are no longer insured, and you will not receive a refund of your premiums.

To qualify, you have to answer health questions by speaking with one of their agents or by utilizing their online application. Adults with severe or chronic health conditions will find it difficult to qualify. Many consumers with issues such as diabetes (and many other conditions) have reported that Globe denied their application.

If you are indeed approved, you’re fully covered with no waiting period. If you die while the policy is active, Globe will pay the full death benefit, tax-free, to your beneficiaries, who can then spend it without restrictions.

Final expense insurance

Most insurance companies offer final expense insurance policies as a type of whole life insurance. However, Globe’s final expense insurance is merely their term life insurance policy (the same one explained above) packaged as “final expense insurance.”

You can buy term insurance to cover your end-of-life costs, but that is a significant risk, as you may outlive the policy (which is often the case).

Whole life insurance

Globe whole life insurance for adults is available with coverage of up to $50,000. It’s permanent life insurance that builds cash value and has a fixed monthly cost. You must answer health questions to qualify, and if approved, coverage will be effective immediately.

Globe Life does not disclose the cost of its adult whole life insurance on its website. You must call and speak with one of their agents verbally to obtain quotes and apply.

Mortgage protection insurance

Globe Life mortgage protection insurance is actually accidental death insurance that will only pay out if you die from an accident. It’s not life insurance.

With virtually every company, mortgage protection insurance is life insurance that would pay a tax-free cash death benefit for any natural or accidental death. It’s very deceptive for Globe Life to characterize their accidental death insurance as mortgage protection coverage.

Childrens life insurance

Globe children’s life insurance can be purchased for up to $30,000, and you can quote and buy it directly on their website. It’s whole life insurance that builds cash value, has a fixed price, and lasts forever.

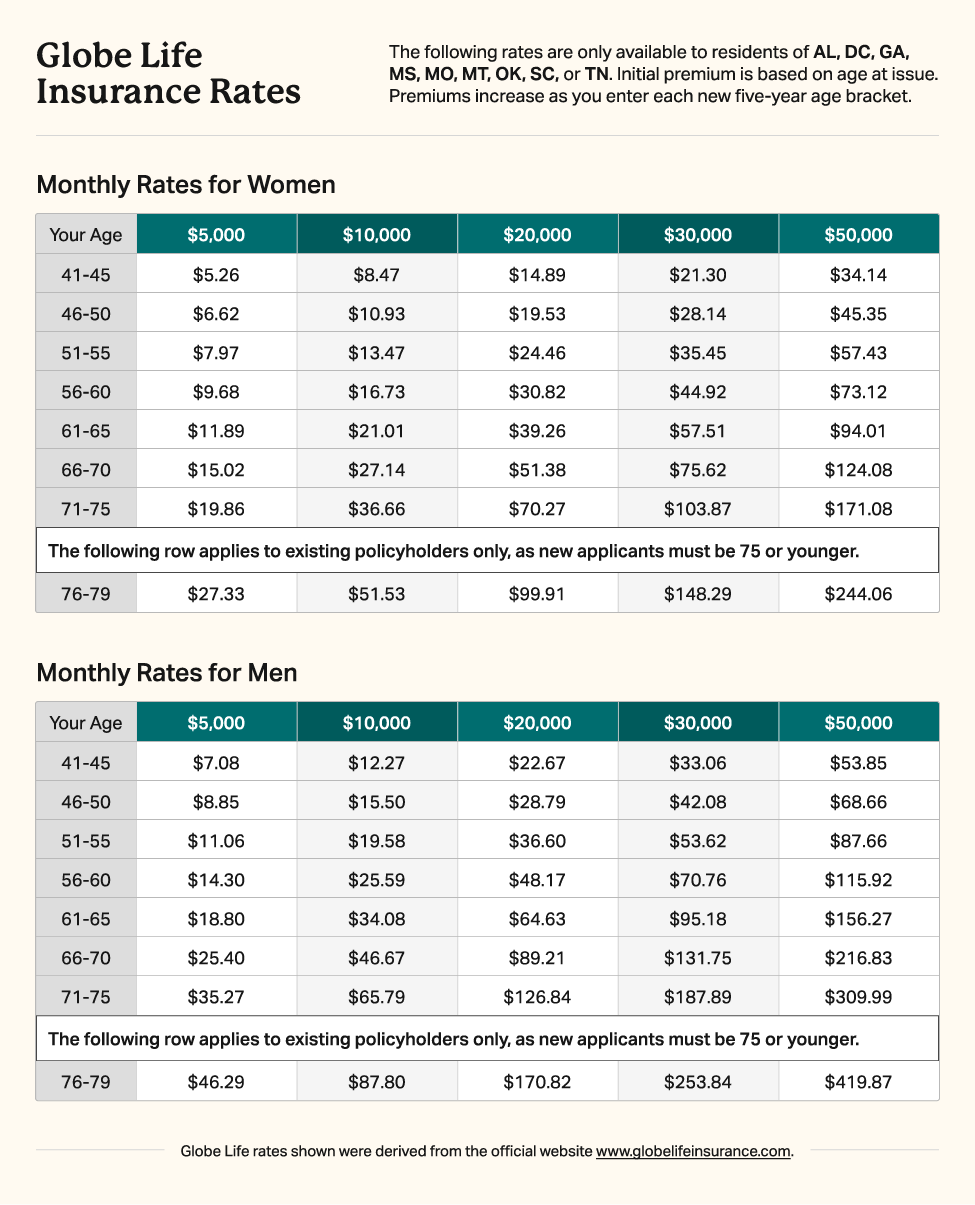

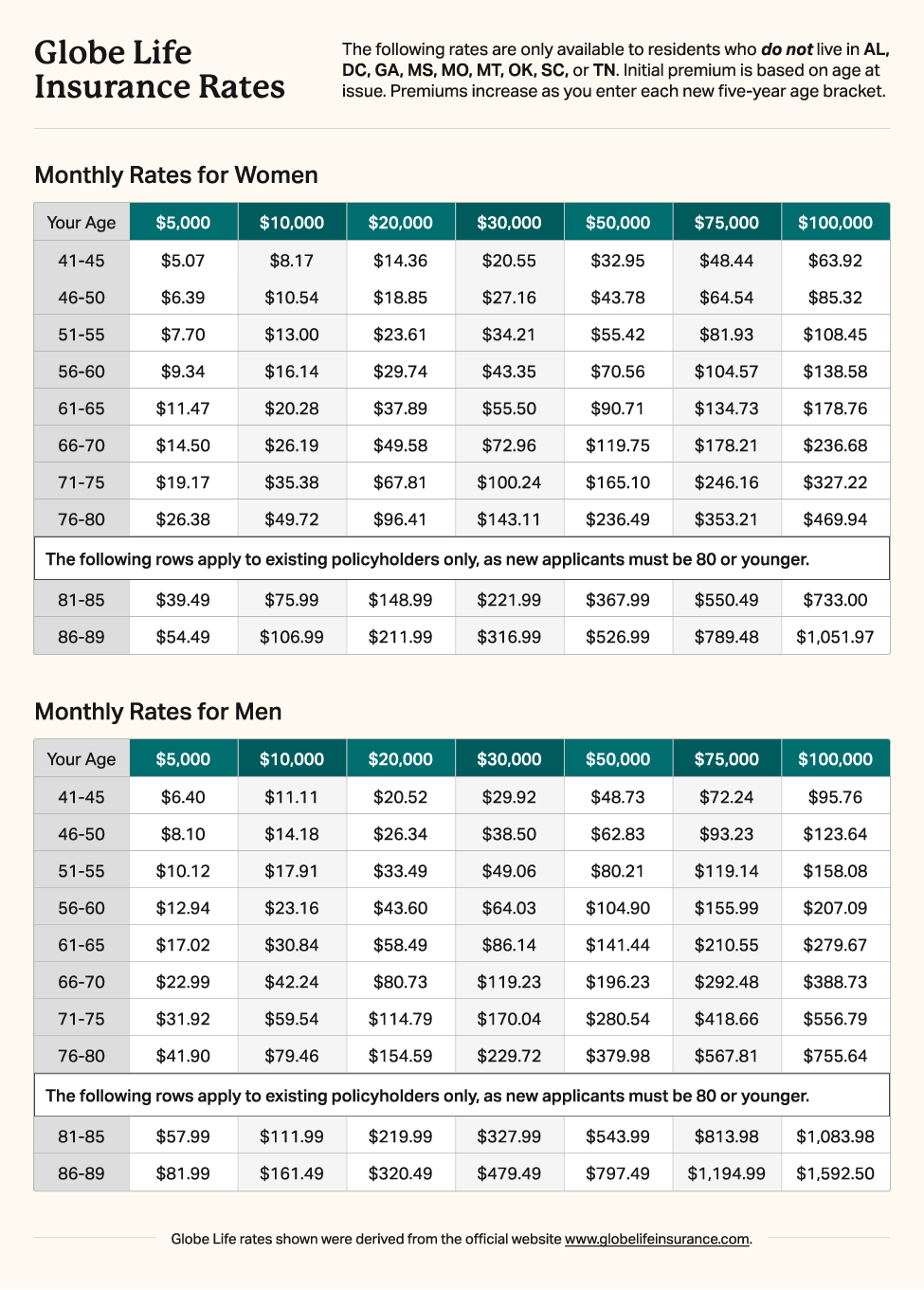

How Much Does Globe Life Insurance Cost For Adults?

Globe Life customers always pay $1 for the first month. After the first month, the actual price will take effect, which can range from $10 to $500 per month, depending on your age, gender, state of residence, and the amount of coverage you purchase.

Below are some Globe Life rate charts that show the monthly cost of their term life insurance.

When Is It A Good Idea To Buy Globe Life Insurance?

Globe Life Insurance is only worth considering in a couple of circumstances, such as:

- You need $5,000 to $25,000 of term life insurance.

- You need inexpensive life insurance for a child or grandchild. Additionally, if you need life insurance for a young adult child or grandchild aged 18-24, Globe is an unparalleled option. Nearly all life insurance companies stop offering children’s life insurance after age 17.

Outside of those situations, you should seek out other providers if you need life insurance. In most cases, other companies offer better pricing, policy terms, and usually have fewer consumer complaints.

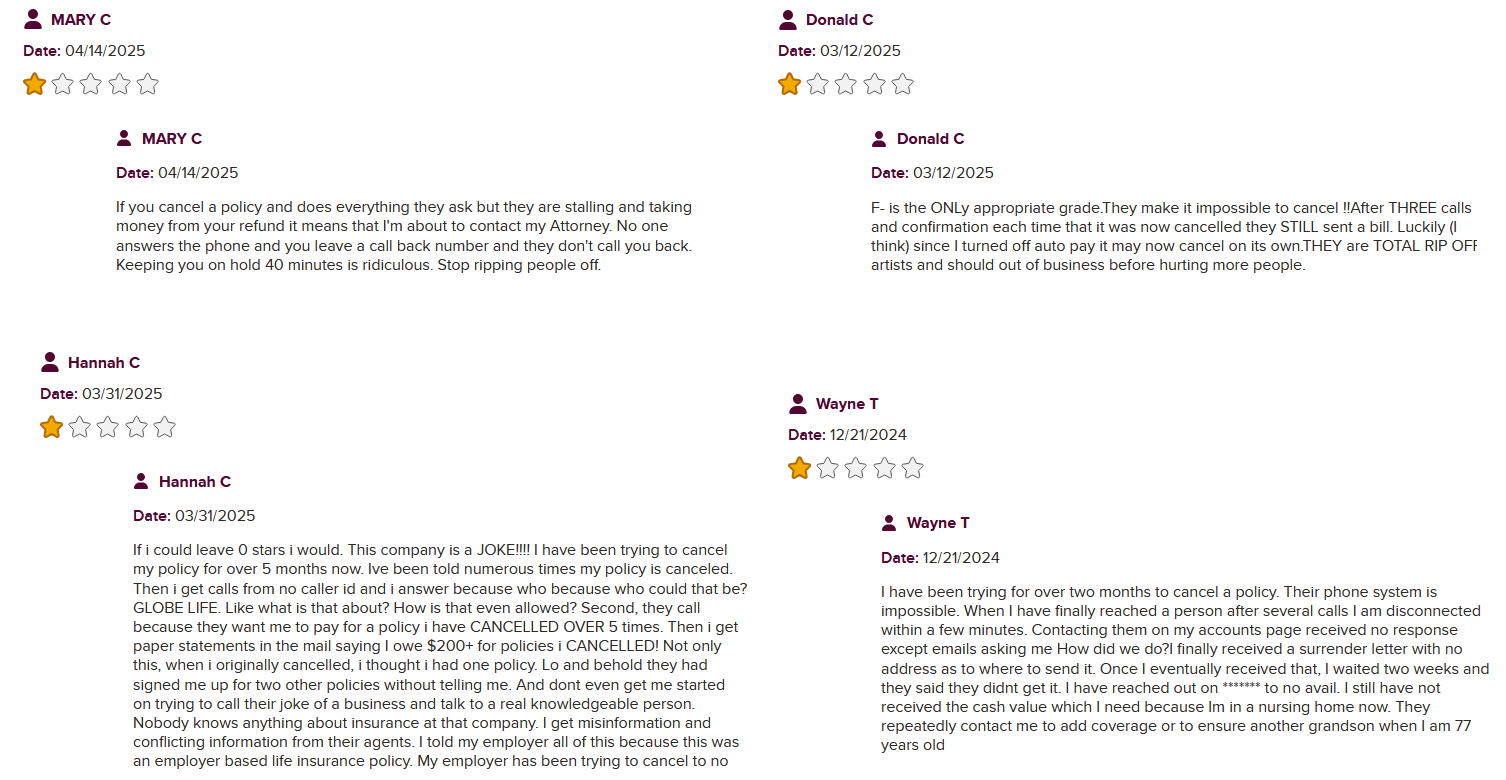

What Are Customers Saying About Globe Life Insurance?

On websites such as Consumer Affairs and the Better Business Bureau, actual Globe Life customers have lodged a variety of complaints.

The majority of criticisms reference how incredibly difficult it is to cancel a policy. Below are a few screenshots of such complaints taken from the BBB page for Globe Life.

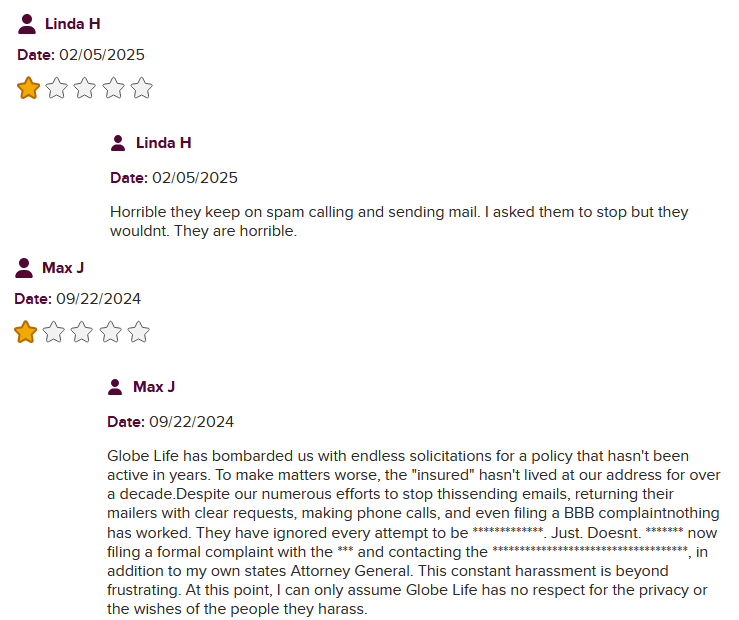

Aside from protests about the difficulty of canceling, another common objection is about the incessant phone calls, emails, and mail advertisements. Below are some examples taken from their Better Business Bureau (BBB) page.

There are other objections aside from these, such as issues with death claims or difficulty with making changes to the policy. Clearly, Globe Life has a host of customer service issues, which is likely why its complaint ratio with the National Association of Insurance Commissioners (NAIC) is far higher than usual.

It’s rather strange how Globe Life ranked fairly high in JD Power’s most recent U.S. Individual Life Insurance Study, given how it’s at odds with what actual customers consistently convey about the company.

There is virtually no customer reporting on Reddit. All the comments about Globe Life on Reddit are overwhelmingly about what it’s like to work for the company.

Frequently Asked Questions

All Globe Life Insurance has no waiting period. To qualify for Globe’s insurance, you must answer questions about your health history and subsequently be approved. If your application is approved, you’re fully covered with no waiting period from the day you make your first payment.

Globe Life is a legitimately licensed insurance company authorized to sell insurance in all states, including the District of Columbia, and it has strong financial ratings. That said, Globe has a disproportionately high number of negative consumer reviews, similar to companies like Colonial Penn. While that may indicate poor service or inferior products, it doesn’t mean that Globe is a scam or not an actual insurance company.

You can cancel a Globe Life policy at any time. However, if you have their term policy and cancel it, you will not receive any money back. Conversely, if you have their whole life coverage, Globe will give you the cash surrender value if the policy has accrued any cash value when you formally cancel it.

The length of a Globe Life policy depends on which type of coverage you buy. Their flagship product is a term life insurance plan that lasts from 80 to 90 years (varies by state) and remains in force until your 80th or 90th birthday. However, their whole life coverage lasts forever.

Only Globe’s whole life insurance policies have cash value. Their term life insurance does not.

Buying Globe Life insurance to cover your final expenses is not advisable because their term life insurance policy will terminate on your 80th or 90th birthday. The best final expense companies sell whole life policies to cover funeral costs. That way, you have coverage guaranteed to last a lifetime.

Our Insurance Review Methodology

Every company we review has an overall score that illustrates how well it stands out in the market relative to its competitors. These scores are not subjective. Instead, we utilize a defined 5-star scoring system that applies a weighted average of particular factors, all of which are outlined below and on our review methodology page.

We measure the price of a company’s most popular they promote relative to its competitors. The closeness of their cost to other companies determines the final score. Read a full breakdown of the price of coverage factor on our review methodology page.

This factor assesses whether a company offers immediate coverage and, if so, how difficult it is to qualify for it. Read a full breakdown of the no waiting period coverage factor on our review methodology page.

A company’s financial strength is based on its rating with A.M. Best. Read a full breakdown of the financial strength factor on our review methodology page.

The National Association of Insurance Commissioners’ complaint index measures an insurer’s frequency of consumer complaints compared to the rest of the market. The score the insurer receives is based on how it stacks up to the median score of other insurers. Read a full breakdown of the NAIC complaint index factor on our review methodology page.

Why trust Choice Mutual?

When we review products, our findings are unbiased and free of any influence from partnerships or methods of compensation. All findings, good or bad, are solely the derivative of our objective analysis of any given product or company.

As noted on our review methodology page, our researchers evaluate the financial stability of the insurer, policy costs, product limitations, state availability, customer satisfaction, waiting periods (if applicable), and other relevant factors. We aggregate all this cumulative data to develop objective overall scores based on pre-defined weighted factors.

In addition, a qualified expert who is well-qualified to speak on the matter will provide opinion-based feedback about the company or product being reviewed.

For over a decade, Choice Mutual has been an insurance agency specializing in final expense life insurance. Our expertise in this type of insurance is well-documented in numerous authoritative publications, some of which are listed below:

Choice Mutual’s mission is to provide consumers with unbiased expert commentary and explanations of the topics being discussed. We want our readers to be armed with information and tools that cannot be found anywhere else on the internet, so they can truly make an informed decision.

All content on this website is written by Anthony Martin, who is a licensed life insurance agent with over a decade of expertise in this industry and has been quoted as an expert source hundreds of times by many reputable news outlets.

Per our editorial guidelines, we have never, and will never, use artificial intelligence to create our content. Every word printed on this website is produced and curated 100% by human beings who have firsthand experience with the subject matter.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

S&P Global. https://home.globelifeinsurance.com/about/financial-strength-and-insurance-ratings

-

BBB. https://www.bbb.org/us/tx/mc-kinney/profile/insurance-companies/globe-life-inc-0875-2425

-

Trustpilot. https://www.trustpilot.com/review/globelifeinsurance.com

-

Yelp. https://www.yelp.com/biz/globe-life-and-accident-insurance-company-mc-kinney

-

BBB Score & Accreditation. https://www.bbb.org/us/tx/mc-kinney/profile/insurance-companies/globe-life-inc-0875-2425

-

Globe term life. https://www.globelifeinsurance.com/termlifeinsurance

-

Globe’s final expense insurance. https://home.globelifeinsurance.com/life-insurance/final-expense-insurance

-

Globe whole life insurance. https://home.globelifeinsurance.com/life-insurance/whole-life-insurance

-

Globe Life mortgage protection. https://home.globelifeinsurance.com/life-insurance/mortgage-protection-insurance

-

accidental death insurance. https://www.progressive.com/answers/life-insurance-vs-accidental-death-insurance/

-

BBB page for Globe Life. https://www.bbb.org/us/tx/mc-kinney/profile/insurance-companies/globe-life-inc-0875-2425/customer-reviews

-

complaint ratio. https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=91472&REALM=PROD&COCODE=91472&REALM=PROD

-

U.S. Individual Life Insurance Study. https://www.jdpower.com/business/press-releases/2024-us-individual-life-insurance-study

-

Globe Life on Reddit. https://www.reddit.com/r/InsuranceAgent/comments/19aqqnw/should_i_work_for_globe_life/

-

A.M. Best. https://news.ambest.com/PR/PressContent.aspx?refnum=35243&altsrc=2

-

Google. https://www.google.com/search?client=firefox-b-1-d&q=globe+life+mckinney+texas+google#lrd=0x864c15e097e61a35:0xf574b4d6237060dd,1,,,,

-

NAIC Complaint Index. https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=91472&REALM=PROD&COCODE=91472&REALM=PROD