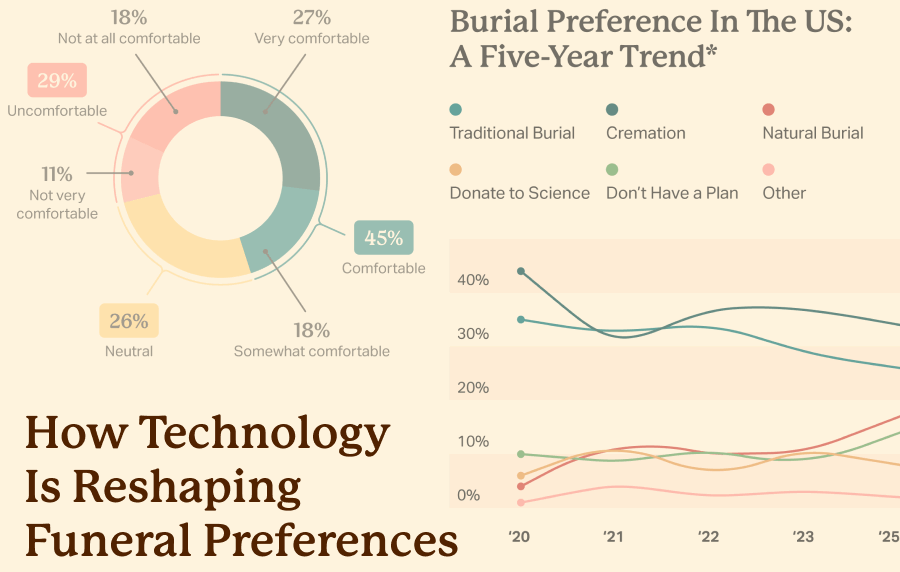

Few life events are as certain as death, yet financial preparation for funerals is surprisingly rare. Most people don’t fully consider the costs until it’s too late, leaving families to shoulder unexpected expenses during an already difficult time.

When focusing on adults ages 45 and older, our survey found significant gaps in perception and preparation regarding funeral costs. Differences between men and women, as well as across generations, highlight a striking disconnect between perception and reality and the potential financial burden families can face when final arrangements are left unplanned.

Over One-Half Of U.S. Adults Ages 45 And Older Underestimate The Price of Funerals

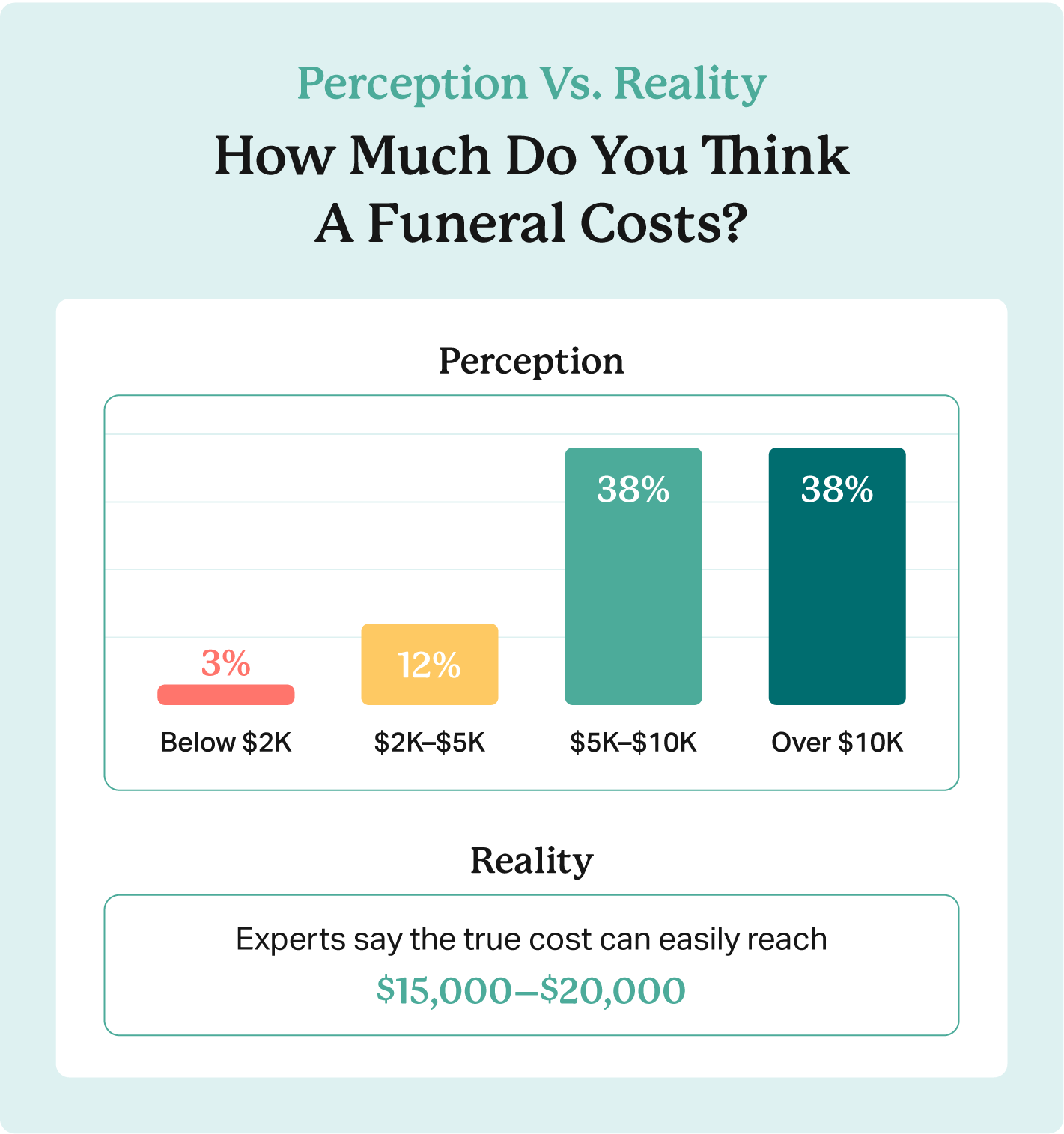

For many Americans, the actual cost of a funeral may come as a shock. Our survey found that more than one-half of U.S. adults ages 45 and older believe a funeral costs less than $10,000 — well below what industry experts report.

“Most people underestimate just how much funeral expenses can add up to — when you factor in funeral services, the casket, printed materials, professional services, body transportation and preparation, the total can easily approach $15,000-$20,000,” said Anthony Martin, Owner & CEO of Choice Mutual. “That gap between perception and reality often leaves families unprepared.”

Making matters worse, even the national reported averages are dangerously misleading. The National Funeral Directors Association (NFDA) reports an average cost of $8,300 for a funeral with a casket and burial, but in reality, most families face bills that climb much higher.

The result is a striking disconnect between expectation and reality, leaving families vulnerable to unanticipated expenses during an already difficult time.

Men Lag Behind Women In Planning For Funeral Costs

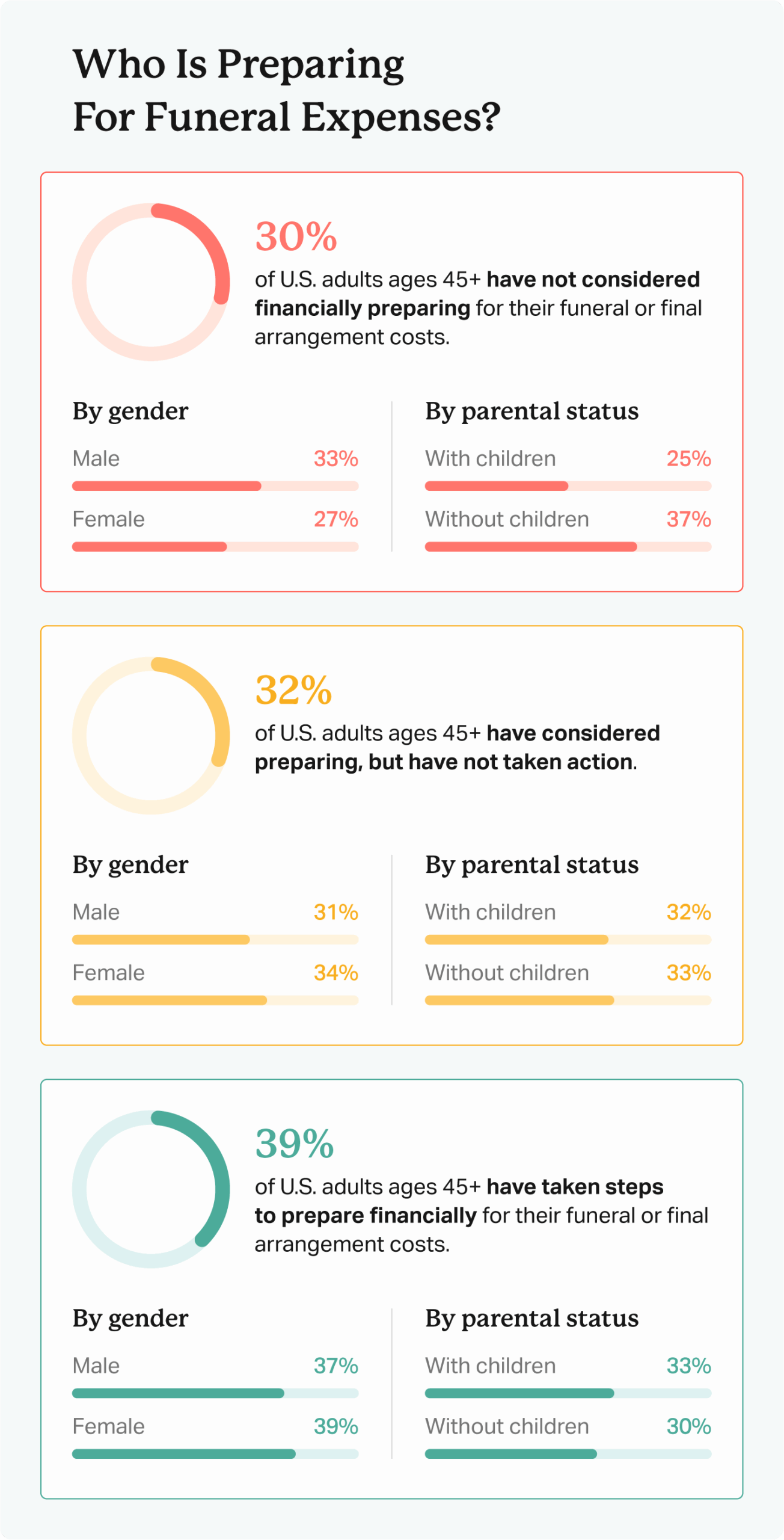

Planning ahead for funeral expenses is not always top of mind, but some groups, like women and parents, are more likely to financially prepare than others. Among adults ages 45 and older, 30% say they have not thought at all about covering the cost of their own funeral, with men (33%) more likely than women (27%) to fall into this group.

Men also fall behind in preparing for the cost of a loved one’s funeral or final arrangements. Only 56% of men have either taken steps or considered taking steps to financially prepare for a loved one’s final arrangements, compared with 59% of women. Across the board, men trail in considering funeral costs and taking concrete action to prepare.

Responsibility for loved ones appears to be a motivating factor. U.S. adults without children are less likely to plan than parents, with 37% reporting no preparation compared to 25% of parents. Those with children may feel a stronger obligation to shield their family from unexpected costs, while adults without children face the same financial risks without that added social prompt to act.

For those who haven’t planned, the reality of funeral costs can be a harsh surprise. “What surprises most families is how fragmented the costs are,” says Parham Nikfarjam, Senior Trial Attorney at J&Y Law. “The package they bought might not include essentials like transportation or obituary notices, for example.” These overlooked costs can quickly add up without careful planning, turning a difficult time into a financial scramble.

Older Generations And Women Take Greater Responsibility For Final Arrangements

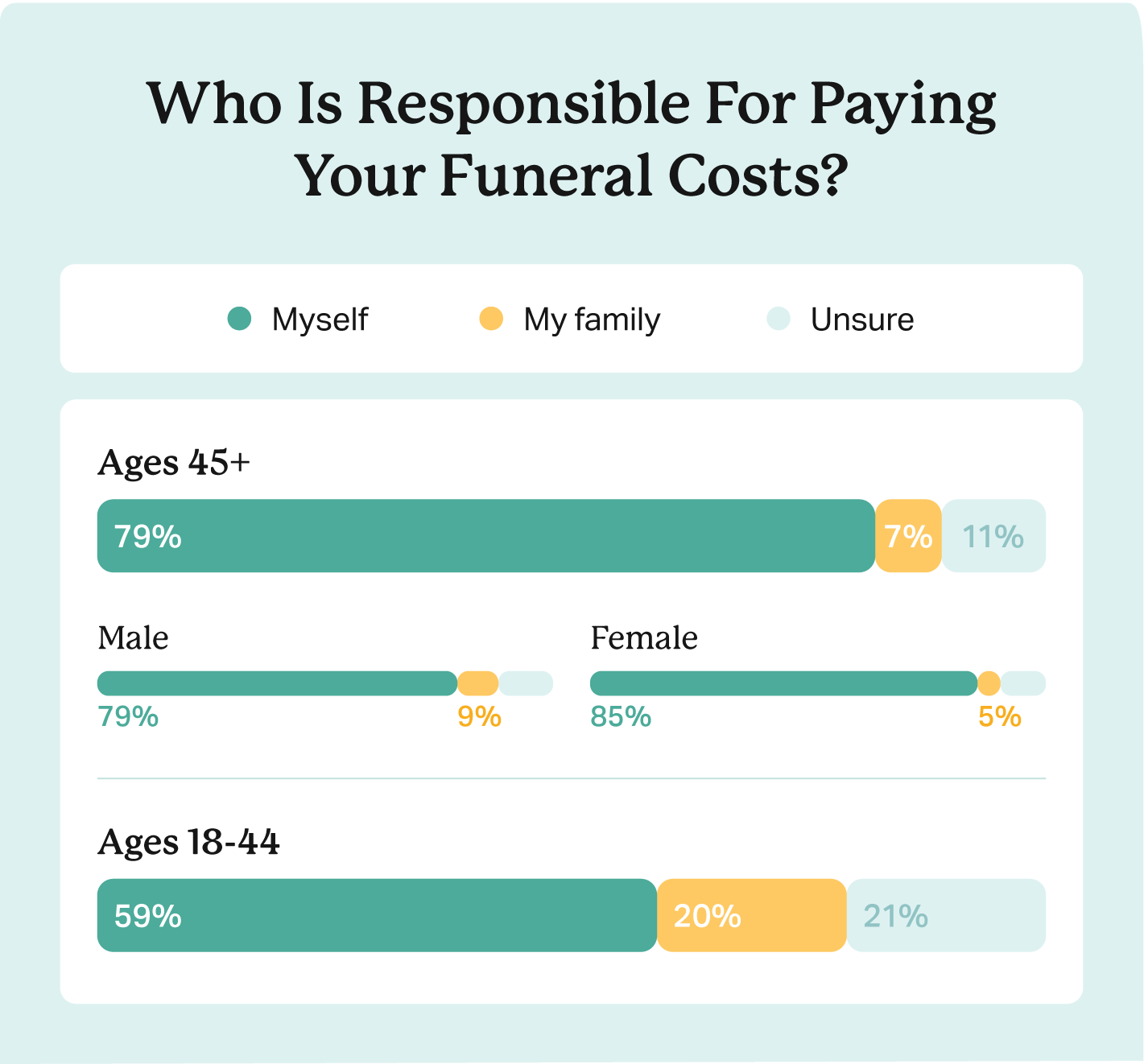

The survey also reveals a clear generational divide in who feels responsible for their own funeral costs. Among Gen X, boomers, and the silent generation, 82% say covering their own funeral expenses is a personal responsibility. Still, 7% in this group assume their families will pay — a view that can leave loved ones with unplanned bills.

Younger generations show a very different and concerning outlook. Millennials and Gen Z are far less likely to take responsibility for their own funeral costs, with many expecting family members to cover the expenses. For many in these groups, funerals feel like a distant concern, making planning seem unnecessary.

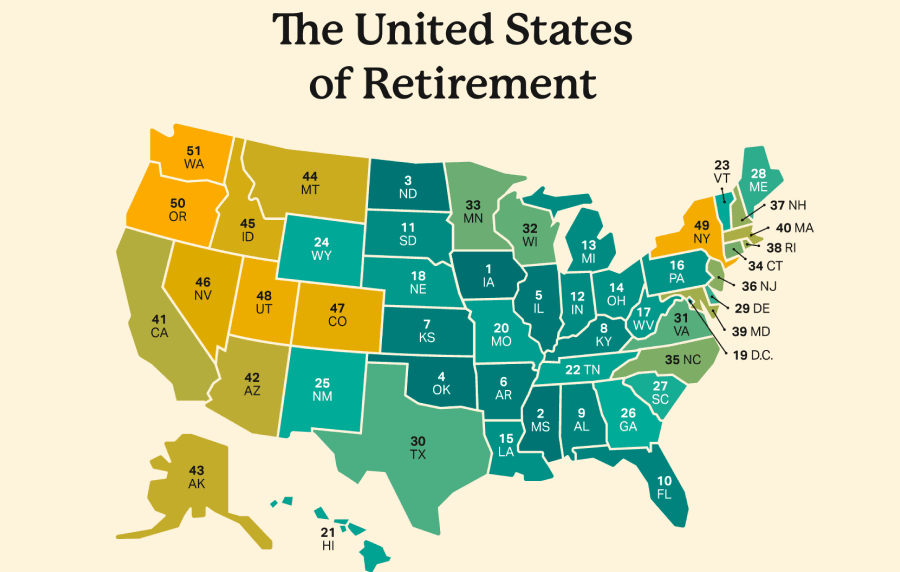

“Families are usually aware that there are burial or cremation expenses, but they’re often caught off guard by the costs associated with holding a meaningful gathering afterward,” says Lindsey Nickel, celebration of life event planner. “Venue site fees, catering, florals, signage, event planner, and printed materials can add up quickly, and the price point looks very different depending on the region of the country.”

Once again, gender also shapes how adults approach responsibility for funeral costs. Among the 45 and older group, 85% of women view covering final expenses for themselves as a personal responsibility, compared with 79% of men.

This lack of ownership over funeral costs leaves critical decisions to chance, with preparation depending on who happens to step up rather than being intentional.

Methodology

The survey was conducted online by YouGov among a total of 2,502 U.S. adults ages 18 and older. Fieldwork took place from August 19 to August 21, 2025. Respondents were selected from the YouGov panel using randomized invitations and completed the survey via an online interview.

The results have been weighted to reflect the demographic profile of the U.S. adult population, ensuring that the findings are representative of all adults in the United States.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

National Funeral Directors Association. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral

-

YouGov . https://today.yougov.com/