Although Colonial Penn Life Insurance Company is a legitimate insurer, the truth is that they are rarely worth considering because most other insurers offer lower prices, higher coverage options, and better terms. The biggest problem is that $9.95 buys an incredibly small amount of coverage, and you must wait two years before being covered for natural causes of death.

For example, a 65-year-old male would spend $119.40 monthly with Colonial Penn for about $10,000 in coverage (with a waiting period). That same man could get a $20,000-$25,000 policy for roughly $120 monthly from many other life insurance companies. This glaring disparity in value is why Colonial Penn is one of the least attractive life insurance providers for seniors.

Also, if you prefer a guaranteed acceptance policy, companies such as Mutual of Omaha, AAA, or Physicians Mutual are substantially cheaper than Colonial Penn.

The LifeChoice® whole life insurance policy for New York residents is reasonably priced and is an excellent option (it’s not available in any other state). However, we’ve heard from many customers that they frequently deny applicants with various pre-existing health conditions.

- Guaranteed acceptance coverage.

- Whole life insurance with a fixed cost and coverage that lasts your entire life.

- Financially sound insurance company.

- Very overpriced life insurance options compared to other companies.

- The 995 plan has a two-year waiting period before you’re covered for nonaccidental death.

- An enormous number of negative reviews.

AM Best’s Financial Strength Rating (FSR) is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. The scores range from A++ to D-.

Moody’s Investors Service rates the creditworthiness of companies. The Moody’s Rating Scale has 21 possible scores ranging from “Aaa” (highest mark) down to “C” (lowest mark).

S&P Global Inc. issues credit ratings on a scale from “AAA” (highest rating) to “D” (lowest rating).

The Complaint Index compares a company’s performance to other companies in the market. The National Complaint Index is always 1.00. That means a company with a complaint index of 2.00 is twice as high as expected in the market. Reported scores are for the most recently available year and for “Individual Life” products.

The BBB rating is based on information BBB is able to obtain about the business, including complaints received from the public. BBB seeks and uses information directly from businesses and from public data sources. BBB assigns ratings from A+ (highest) to F (lowest). If a business has been accredited by the BBB, it means BBB has determined that the business meets accreditation standards, which include a commitment to make a good faith effort to resolve any consumer complaints.

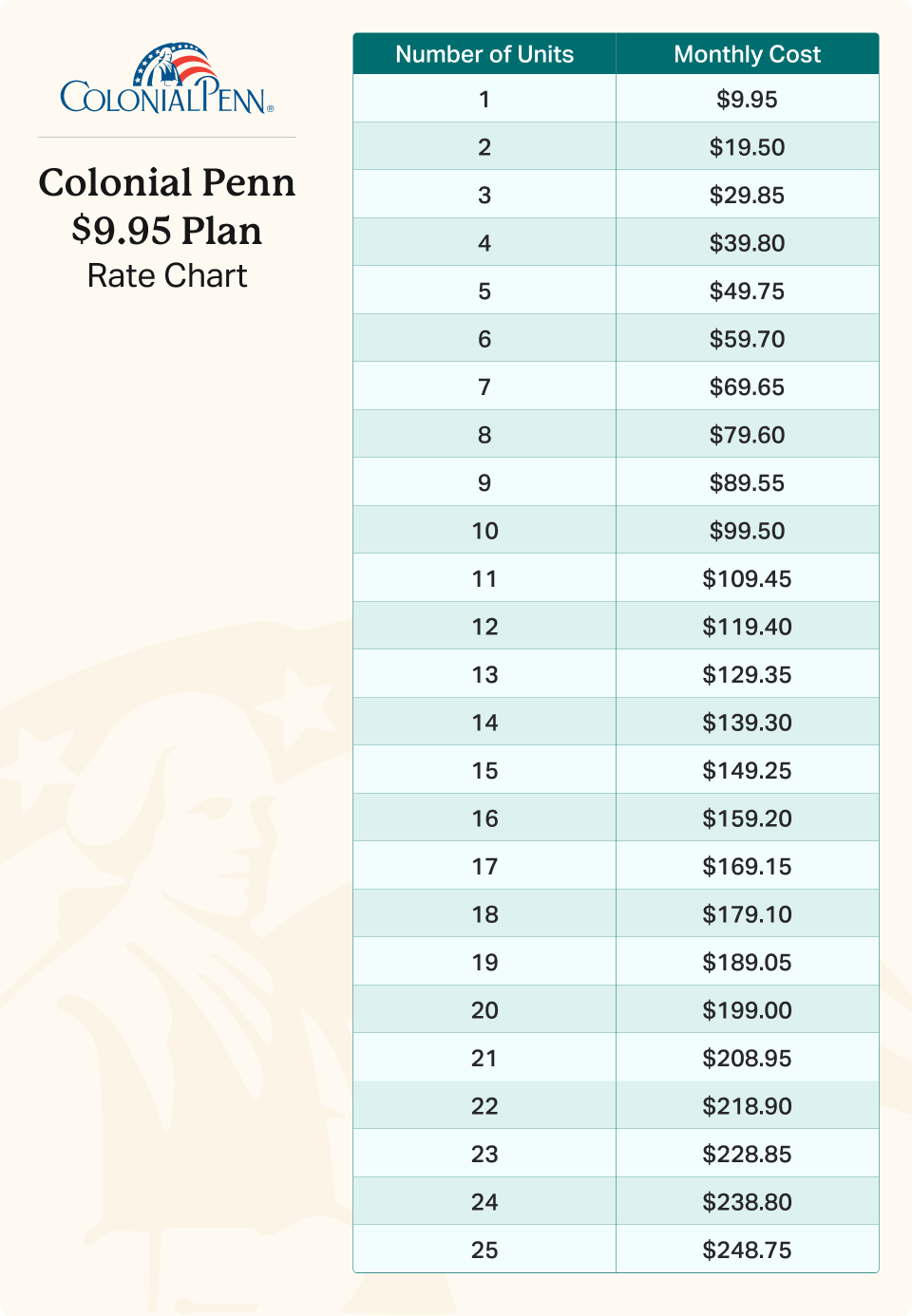

Colonial Penn $9.95 Plan Life Insurance Rate Chart & Coverage Calculator

The 9.95 plan is a guaranteed acceptance life insurance policy that does not require you to take a medical exam or answer health questions. The fine print notes that there is a two-year waiting period, during which death would only result in a refund of your premiums to your beneficiaries.

Colonial Penn sells the $9.95 plan using a unit system where everyone, regardless of age or gender, pays just $9.95 monthly for one unit of coverage. Your age and gender determine the net death benefit per unit. For example, a 57-year-old male gets $1,313 in coverage per unit, whereas a 77-year-old male gets only $493 in coverage.

Depending on the amount of life insurance you want for your beneficiaries, you might need to buy more than one unit. If a 57-year-old male wanted at least $10,000 in coverage, he would need to buy eight units (1,313 x 8 = $10,504 in net coverage), costing him $79.60 per month.

Use the calculator or table below to determine the coverage per unit and the total monthly cost.

| AGE | 1 Male Unit ($9.95) | 1 Female Unit ($9.95) |

|---|---|---|

| 50 | $1,669 in coverage | $2,000 in coverage |

| 51 | $1,620 in coverage | $1,942 in coverage |

| 52 | $1,565 in coverage | $1,890 in coverage |

| 53 | $1,515 in coverage | $1,845 in coverage |

| 54 | $1,460 in coverage | $1,802 in coverage |

| 55 | $1,420 in coverage | $1,761 in coverage |

| 56 | $1,370 in coverage | $1,719 in coverage |

| 57 | $1,313 in coverage | $1,669 in coverage |

| 58 | $1,258 in coverage | $1,620 in coverage |

| 59 | $1,200 in coverage | $1,565 in coverage |

| 60 | $1,167 in coverage | $1,515 in coverage |

| 61 | $1,112 in coverage | $1,460 in coverage |

| 62 | $1,057 in coverage | $1,420 in coverage |

| 63 | $1,000 in coverage | $1,370 in coverage |

| 64 | $949 in coverage | $1,313 in coverage |

| 65 | $896 in coverage | $1,258 in coverage |

| 66 | $846 in coverage | $1,200 in coverage |

| 67 | $802 in coverage | $1,167 in coverage |

| 68 | $762 in coverage | $1,112 in coverage |

| 69 | $724 in coverage | $1,057 in coverage |

| 70 | $689 in coverage | $1,000 in coverage |

| 71 | $657 in coverage | $949 in coverage |

| 72 | $627 in coverage | $896 in coverage |

| 73 | $608 in coverage | $846 in coverage |

| 74 | $578 in coverage | $802 in coverage |

| 75 | $549 in coverage | $762 in coverage |

| 76 | $521 in coverage | $724 in coverage |

| 77 | $493 in coverage | $689 in coverage |

| 78 | $468 in coverage | $657 in coverage |

| 79 | $441 in coverage | $627 in coverage |

| 80 | $426 in coverage | $608 in coverage |

| 81 | $424 in coverage | $578 in coverage |

| 82 | $423 in coverage | $549 in coverage |

| 83 | $421 in coverage | $521 in coverage |

| 84 | $420 in coverage | $493 in coverage |

| 85 | $418 in coverage | $468 in coverage |

| Source: www.colonialpenn.com. Data retrieved on 9/12/2024. | ||

How Much Does Colonial Penn Whole Life Insurance Cost?

If you live in New York, Colonial Penn also offers LifeChoice whole life insurance. It’s a simplified issue policy without a medical exam. However, eligibility is based on your current and prior health issues. If you’re approved, there is no waiting period, meaning you will get the full death benefit payout starting on the first day of your policy.

Below is a whole life rate table that outlines the prices for this policy.

| Age & Gender | $10,000 | $15,000 | $25,000 |

|---|---|---|---|

| Female age 50 | $28.20 | $41.40 | $67.80 |

| Male age 50 | $33.50 | $49.35 | $81.05 |

| Female age 55 | $35.70 | $52.65 | $86.55 |

| Male age 55 | $42.20 | $62.40 | $102.80 |

| Female age 60 | $43.80 | $64.80 | $106.80 |

| Male age 60 | $53.10 | $78.75 | $130.05 |

| Female age 65 | $59.30 | $88.05 | $145.55 |

| Male age 65 | $74.30 | $110.55 | $183.05 |

| Female age 70 | $79.70 | $118.65 | $ |

| Male age 70 | $100.80 | $150.30 | N/A |

| Female age 75 | $106.90 | $159.45 | N/A |

| Male age 75 | N/A | N/A | N/A |

| Source: www.colonialpenn.com. Data retrieved on 06/03/2025. | |||

Should Anyone Buy Colonial Penn Insurance?

There is no scenario in which the Colonial Penn 995 plan should be purchased. You can obtain significantly more coverage from multiple other providers for a substantially lower price.

In addition, the 9.95 plan has a two-year waiting period before you’re covered for natural causes of death. Dozens of other final expense life insurance companies offer no waiting period policies that fully cover you starting on day one.

The cost comparison tool below clearly illustrates just how expensive Colonial Penn is compared to its competitors for a $10,000 policy.

Jonathan Lawson, the pitchman in their TV commercials, makes Colonial Penn insurance sound like a fantastic value. However, the numbers below paint a completely different picture and prove the point.

Which Company Offers The Best Final Expense Insurance Policy?

It’s helpful to remember that no particular company offers the best final expense policy for every single person. That said, below are three companies that have a high chance of offering you the lowest rate and favorable policy terms.

- $10K Policy Cost$43.99/month*

- New Applicant Ages45-80

- Death Benefit Options$2,000-$50,000

- 2-Year Waiting PeriodNo

- $10K Policy Cost$41.01/month*

- New Applicant Ages45-85

- Death Benefit Options$2,000-$50,000

- 2-Year Waiting PeriodNo

- $10K Policy Cost$50.00/month*

- New Applicant Ages45-85 (50-75 in NY)

- Death Benefit Options$2,000-$25,000

- 2-Year Waiting PeriodYes

Use this life insurance quotes tool to compare final expense insurance prices from dozens of companies alongside Colonial Penn.

The purpose of senior burial insurance is peace of mind, knowing that your loved ones will not be burdened by having to pay for your funeral costs.

You’ll generally find the best life insurance options by working with a licensed insurance agent.

Independent agents represent numerous companies, so they compare multiple policies to find you the best rates. Working with an agent is especially important if you have any pre-existing health conditions.

Lastly, most seniors who need a policy to cover their funeral expenses should not opt for guaranteed acceptance plans. In fact, most applicants can qualify for life insurance coverage with health questions, which will result in a policy that covers you for the full benefit amount and likely has a lower insurance quote.

Frequently Asked Questions

The life insurance benefit per $9.95 unit varies based on gender and age. For example, a 50-year-old male would get $1,669 in coverage, whereas a 50-year-old female would get $2,000. The older you are, the less coverage you get per unit.

The Colonial Penn guaranteed issue life insurance policy (995 plan) costs only $9.95 monthly per unit. If you want more than one unit, you will multiply $9.95 by the number of units you’d like, yielding the total monthly premium. For example, if you buy ten units, the total monthly cost would be $99.50. Remember that how much coverage you get per unit depends on your age and gender.

Colonial Penn 9.95 life insurance policies have a two-year waiting period. Life insurance claims during the first 24 months will only result in your loved ones receiving a refund of your premiums. In New York only, Colonial Penn offers a simplified issue whole life policy with the peace of mind of immediate coverage if you qualify (you must answer health questions).

According to the products page of their website, Colonial Penn does not offer term life insurance. They only sell permanent whole life insurance.

In most states, applicants aged 50-80 can pay an additional nominal fee to add an accidental death benefit rider that would pay out extra money if death is explicitly caused by an accident.

[accordion title="Does Colonial Penn offer burial insurance?"]

Colonial Penn policies can be used to pay for final expenses. All life insurance policies pay out a tax-free cash benefit once the policyholder dies. There are never any restrictions regarding how the money is spent.

With the Colonial Penn 9.95 plan, 25 units is the maximum amount of coverage you can buy. The amount of coverage you receive from 25 units depends on your age and gender. To calculate the total, multiply the number of units you want by the coverage per unit. For example, a 66-year-old male gets $846 in coverage per unit. 25 units would yield a maximum coverage amount of $21,150 (846 x 25).

Colonial Penn allows customers to pay via credit card, EFT (bank draft), or direct bill. You can also make a payment via their online portal.

Colonial Penn is a duly licensed American life insurance company authorized to sell insurance throughout the USA. It has an A rating with AM Best and the Better Business Bureau. While Colonial Penn is accredited by the Better Business Bureau (BBB), it has a substantial number of consumer complaints. That said, if you have a policy with Colonial Penn and die, they will honor the terms of the contract and pay your beneficiaries the due amount once they have a death certificate.

Our Insurance Review Methodology

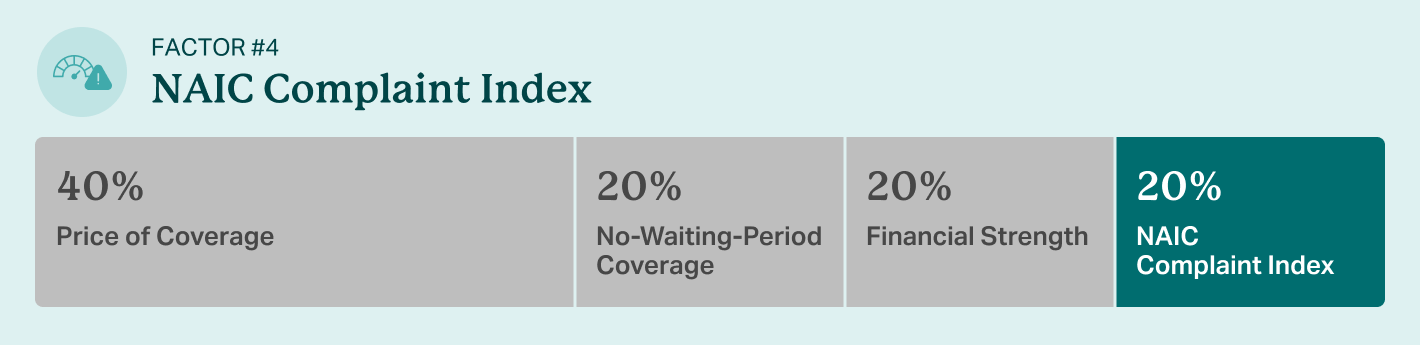

Every company we review has an overall score that illustrates how well it stands out in the market relative to its competitors. These scores are not subjective. Instead, we utilize a defined 5-star scoring system that applies a weighted average of particular factors, all of which are outlined below and on our review methodology page.

We measure the price of a company’s most popular they promote relative to its competitors. The closeness of their cost to other companies determines the final score. Read a full breakdown of the price of coverage factor on our review methodology page.

This factor assesses whether a company offers immediate coverage and, if so, how difficult it is to qualify for it. Read a full breakdown of the no waiting period coverage factor on our review methodology page.

A company’s financial strength is based on its rating with A.M. Best. Read a full breakdown of the financial strength factor on our review methodology page.

The National Association of Insurance Commissioners’ complaint index measures an insurer’s frequency of consumer complaints compared to the rest of the market. The score the insurer receives is based on how it stacks up to the median score of other insurers. Read a full breakdown of the NAIC complaint index factor on our review methodology page.

Why trust Choice Mutual?

When we review products, our findings are unbiased and free of any influence from partnerships or methods of compensation. All findings, good or bad, are solely the derivative of our objective analysis of any given product or company.

As noted on our review methodology page, our researchers evaluate the financial stability of the insurer, policy costs, product limitations, state availability, customer satisfaction, waiting periods (if applicable), and other relevant factors. We aggregate all this cumulative data to develop objective overall scores based on pre-defined weighted factors.

In addition, a qualified expert who is well-qualified to speak on the matter will provide opinion-based feedback about the company or product being reviewed.

For over a decade, Choice Mutual has been an insurance agency specializing in final expense life insurance. Our expertise in this type of insurance is well-documented in numerous authoritative publications, some of which are listed below:

Choice Mutual’s mission is to provide consumers with unbiased expert commentary and explanations of the topics being discussed. We want our readers to be armed with information and tools that cannot be found anywhere else on the internet, so they can truly make an informed decision.

All content on this website is written by Anthony Martin, who is a licensed life insurance agent with over a decade of expertise in this industry and has been quoted as an expert source hundreds of times by many reputable news outlets.

Per our editorial guidelines, we have never, and will never, use artificial intelligence to create our content. Every word printed on this website is produced and curated 100% by human beings who have firsthand experience with the subject matter.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

Colonial Penn website. https://colonialpenn.com/products/insurance

-

$9.95 plan. https://colonialpenn.com/products/guaranteedacceptance

-

Colonial Penn guaranteed acceptance plan. https://colonialpenn.com/products/guaranteedacceptance

-

LifeChoice whole life insurance. https://colonialpenn.com/products/lifechoice-wholelife

-

A.M. Best. https://ratings.ambest.com/DisclosurePDF.aspx?AMBNum=6240

-

Moody's. https://ir.cnoinc.com/financials/financial-ratings/

-

S&P Global. https://ir.cnoinc.com/financials/financial-ratings/

-

BBB. https://www.bbb.org/us/pa/philadelphia/profile/insurance-companies/colonial-penn-life-insurance-company-0241-80001800

-

Trustpilot. https://www.trustpilot.com/review/www.colonialpenn.com

-

Google. https://www.google.com/maps/place/Colonial+Penn+Life+Insurance+Company/@39.9506348,-75.1516416,16z/data=!3m1!5s0x89c6c88446e79631:0xedc6cdcc6712c19c!4m8!3m7!1s0x89c6c8844712c7c7:0x36df3df4d2e9e0b5!8m2!3d39.9506308!4d-75.1467707!9m1!1b1!16s%2Fg%2F1tgw5_2_?entry=ttu

-

Yelp. https://www.yelp.com/biz/colonial-penn-insurance-philadelphia

-

NAIC Complaint Index. https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=62065&REALM=PROD&COCODE=62065&REALM=PROD

-

BBB Score & Accreditation. https://www.bbb.org/us/pa/philadelphia/profile/insurance-companies/colonial-penn-life-insurance-company-0241-80001800

-

www.colonialpenn.com. https://colonialpenn.com/quote

-

accidental death benefit rider. https://colonialpenn.com/documents/7880008/7878584/ADR_GBL_new.html/5c8897fa-5ede-1dc3-f89f-b6286d13b2ba?t=1630500060773

-

online portal. https://www.mycolonialpenn.com/customerservice/pay-your-bill