Discussing final arrangements with your family is a difficult conversation, but creating an end-of-life plan is important before your family has to pay for a funeral. Planning now can reduce the financial stress on your family in the future, especially considering that many funeral homes require upfront payment for services.

There are several payment methods and resources available to make funeral arrangements financially feasible. Explore your options for how to pay for a funeral and tips to reduce costs while planning your arrangements.

1. Determine Your Arrangements

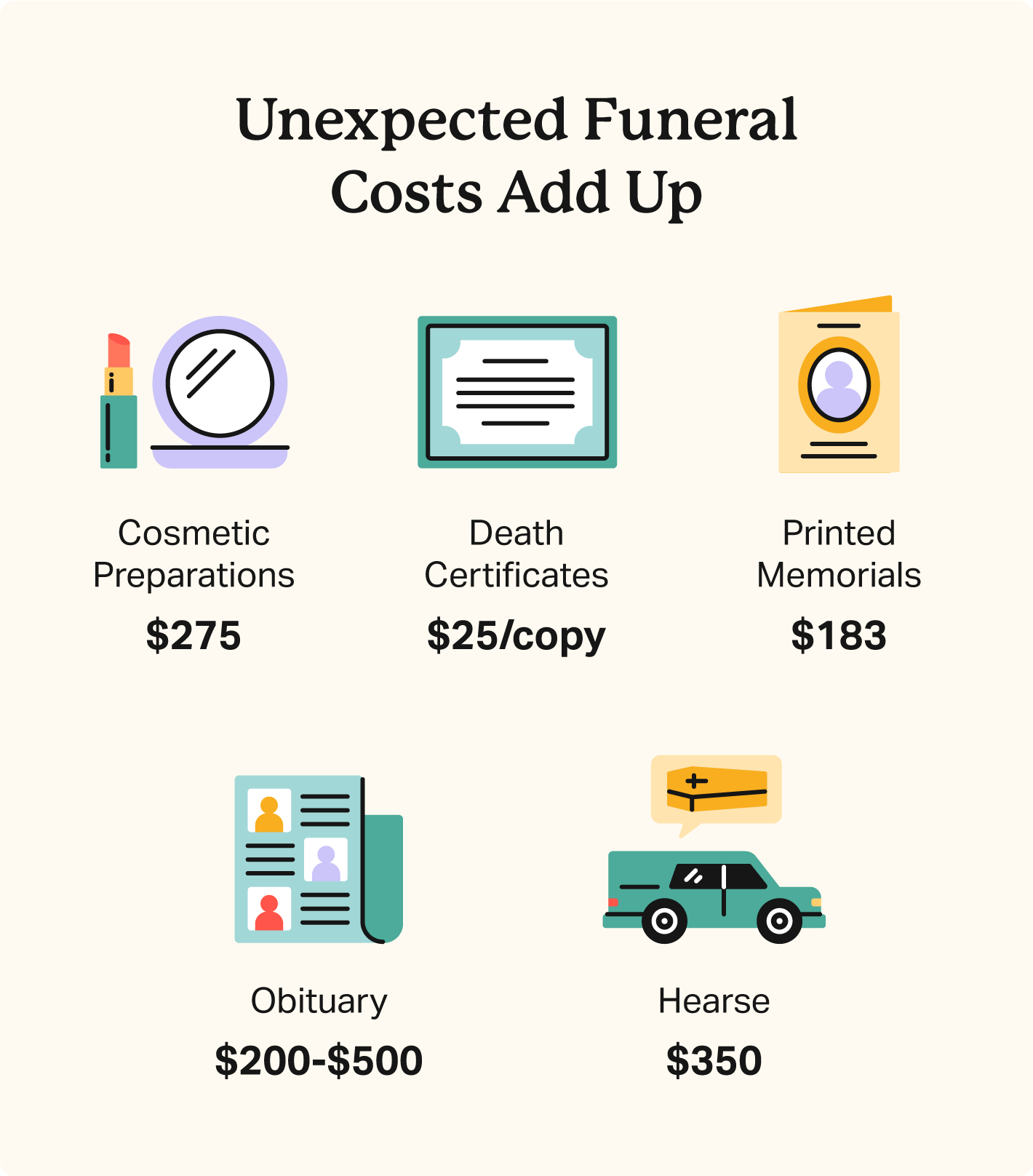

Funeral costs vary depending on your burial arrangements, location, and more. Additional expenses like viewing refreshments and printed obituaries add up quickly, so determine your final wishes and begin budgeting for your funeral.

Generally, cremations are much more affordable than traditional funerals. You can reduce cremation costs by donating your body to science so the beneficiary pays for cremation. Alternatively, you may purchase a cremation plot in a cemetery, which will up the cost of your arrangements.

Home funerals are also a cost-effective option that’s legal in most states. This means you can celebrate the life of your loved one where they’re most comfortable and save on funeral home services.

| Average Cost Of Arrangements | |

|---|---|

| Cremation • Cremation • Urn • Service fees • Viewing and funeral service | $6,280 • $2,183 • $295 • $2,495 • $1,025 |

| Direct Cremation | $2,185 |

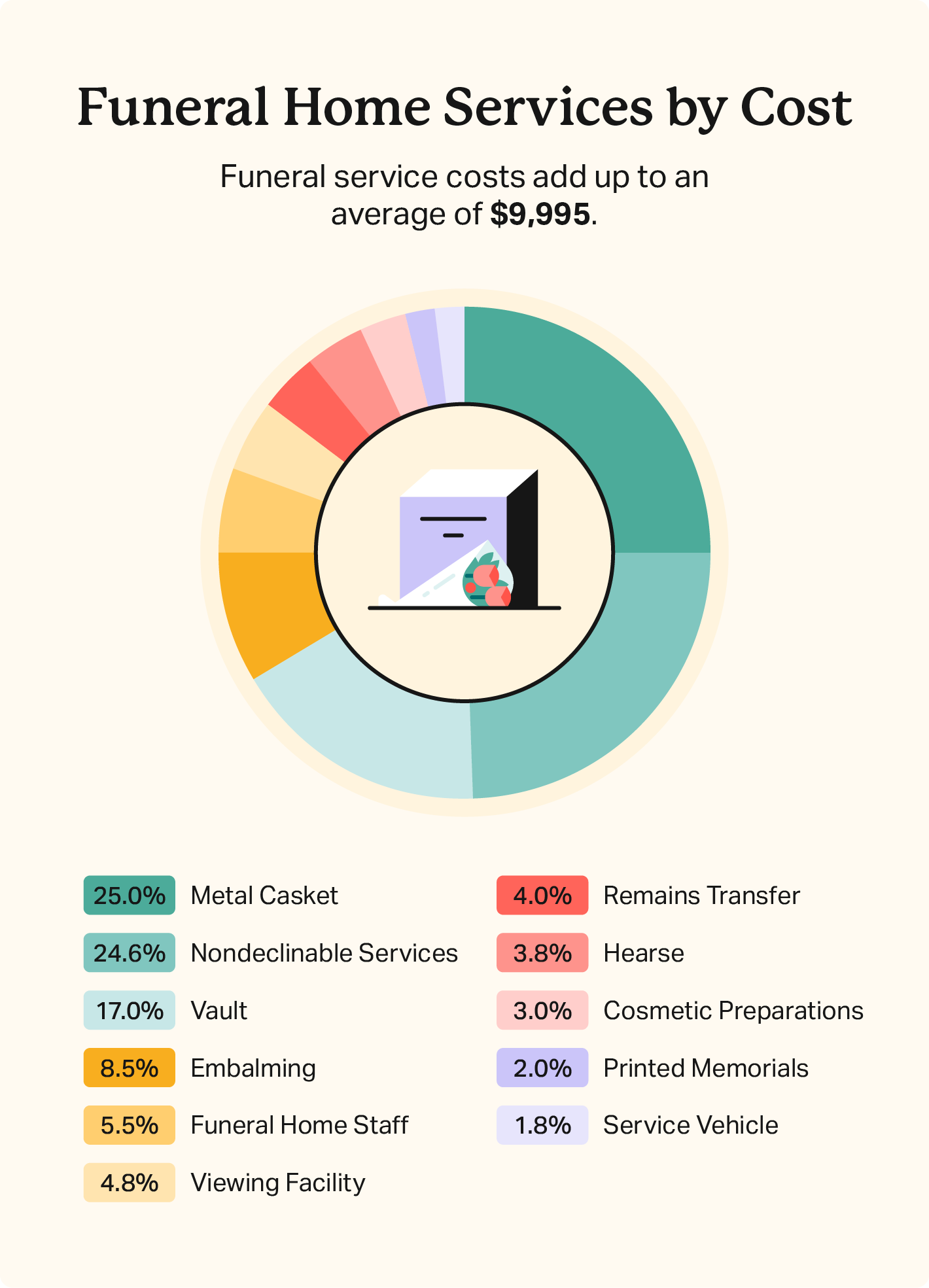

| Cemetery Burial • Vault • Casket • Service fees • Viewing and funeral service • Embalming | $9,995 • $1,695 • $2,500 • $2,459 • $1,025 • $845 |

| Direct Burial | $5,114 |

| *Prices are averages and not a complete list of funeral-related charges, therefore may not add up to the total average arrangement cost listed. | |

There’s no right, one-size-fits-all answer, so explore your options, compare costs, and discuss them with your family to finalize your arrangements.

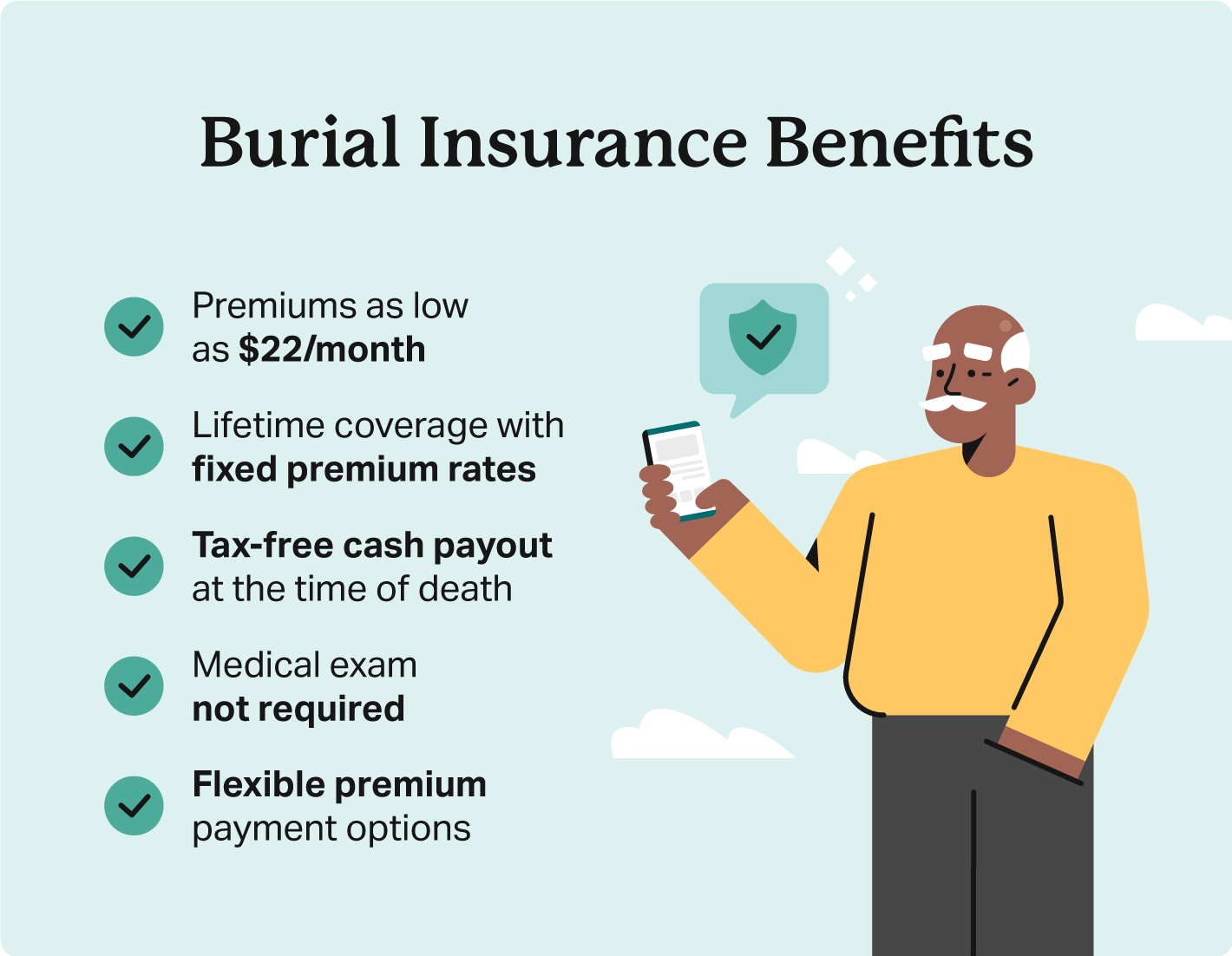

2. Get Burial Insurance Coverage

Final expense insurance is a type of whole life insurance that covers the cost of end-of-life expenses like funeral arrangements. It’s also commonly called funeral or burial insurance.

These policies finance burial costs with tax-free payouts to the deceased’s loved ones or their chosen funeral home. Families can then carry out last wishes without having to pay for a funeral themselves.

While burial insurance covers funeral arrangements, beneficiaries can technically spend it on anything, like paying off debt. This provides peace of mind for beneficiaries during a difficult time, and they can keep any remaining money they don’t apply to final expenses or estate costs.

3. Use Personal Savings

Personal savings accounts are a good place to start collecting funds for funeral expenses. Early saving allows contributions to compound with interest.

High-yield savings accounts are convenient liquid assets with annual percentage yields (APY) as high as 5%. Many banks offer high-yield savings accounts, so shop around and compare rates locally or online.

Payable on death accounts are another FDIC-insured savings option you can withdraw from as you need. A beneficiary automatically receives the funds at the time of death, so there’s no wait to cover expenses.

Experienced investors can also explore higher ROI opportunities like blue chip stocks or real estate. These are relatively secure investments over a long period of time, but they’re not very liquid if you need access to the cash quickly. It’s always wise to consult a financial advisor before investing.

4. Save Money By Shopping Around

Funeral home and service costs vary among providers and even by location. Contact multiple facilities to compare available services and their prices to find the best fit for your budget.

Some funeral homes may even offer payment plans once you book your arrangements with them.

5. Prepay Your Funeral Arrangements

You may have the option to prepay your funeral costs when you plan the arrangements in advance. Funeral service providers may allow you to pay it in full or over 3, 5, or 10-year periods if you’re under 85 years old.

Paying for a funeral in advance protects against inflation and cost between $2,000 and $10,000 in total. These payments work out to $125-$300 a month.

While prepaid funeral plans are convenient and help reduce the burden of a lump-sum payment, they’re often more costly than the prepaid plan itself in the long run.

6. Pay With A Personal Loan Or Credit

In a pinch, you can also use a personal loan or credit card to cover funeral costs. These options do charge interest, so you’ll ultimately overpay for your services, but it can make the expense more manageable with monthly payments.

Some lenders offer funeral loans with no interest for a set number of months. This is a great way to access extra cash with little wiggle room to repay the debt without collecting interest charges.

7. Set Aside Money For Funeral Expenses

There are also ways to set aside money in advance, specifically for funeral costs. Setting up one of these accounts can help ease the financial pressure on your loved ones when you pass.

- Funeral Trust: You can place funds in a funeral trust account that is managed by a funeral service provider or bank or trust company and specifically designated to cover funeral-related costs. While it ensures these expenses are pre-funded, it does not identify the arrangement wishes of the deceased, so it’s important to clarify your wishes elsewhere among your personal documents.

- POD Account (Payable upon death): A payable upon death (POD) account is a financial arrangement that allows you to designate a specific beneficiary to inherit the funds in the account upon your death. This type of account allows for the seamless transfer of assets without probate, providing a straightforward way to pass on financial assets to your chosen beneficiary.

8. Explore Resources To Pay For A Funeral Without Money

Funerals are expensive and an unexpected expense in many cases. Several federal, nonprofit, and local organizations provide resources for families to pay for a funeral and reduce their financial burdens during difficult circumstances.

Here are some resources to connect with if you’re trying to pay for a funeral without money:

- Veterans Benefits: veterans and surviving spouses may qualify for a free burial

- Social Security Survivors: surviving spouses and dependents of Social Security benefits may receive a $225 lump sum in death benefits and monthly benefits

- Employer Survivor Benefits: surviving spouses of federal and civil service retirees may qualify to receive up to 55% of the retiree’s monthly benefits

- FEMA Disaster Relief: select funeral expenses for loved ones lost in a major disaster or emergency may be covered by the Federal Emergency Management Administration (FEMA)

- Victim’s Assistance: State Crime Victims Compensation Programs may provide financial assistance for crime victim’s medical or burial costs, and other related expenses

- Call 211: a helpline for community services that can connect you with local organizations and assistance

- Crowdfunding: a fundraising method that relies on small donations from a large pool of donors via sites like GoFundMe

Frequently Asked Questions

Funeral homes offer prepaid services that require payment in full prior to any ceremony or burial. Some funeral homes may be willing to negotiate installment payments, but it’s not a guarantee.

If you’re worried about paying the full funeral cost at once, plan ahead and consider prepaid funeral arrangements or burial insurance.

Traditionally the deceased’s estate or family will pay for a funeral, but nobody’s required to cover the bill. If no one takes charge of funeral planning, the executor of the deceased’s will or their closest relative (appointed executor by a probate court if necessary) manages the estate’s assets to collect the necessary funds.

If there are already funeral arrangements at the time of death, the person who signed that contract is responsible for paying the funeral home. This may be the deceased who agreed to a prepaid plan or a spouse that purchased companion plots with them.

Families can release the deceased’s body to the state or county coroner, who will either bury or cremate the remains. At this point, loved ones may be able to receive cremated remains for a small fee. If no one claims the remains, the coroner will bury them in a common grave.

There are federal and local organizations available that may be able to help families cover burial costs if they can’t afford a funeral, so explore local resources if you’d like to plan a funeral.

The average funeral costs $9,995 in the U.S., but prices vary widely depending on your location, funeral home, and arrangements.

For example, a direct burial (without a viewing and other services) costs an average of $5,114, while funerals in Connecticut cost $1,617 more than funerals in Arizona. Shop around to compare funeral home prices and determine what arrangements fit your budget and personal needs.

Get Peace Of Mind With Funeral Insurance

The financial burden of paying for a funeral is hard enough, but grief and a complicated legal process can compound it. Funeral insurance guarantees that your funeral providers meet your final wishes and your family can grieve without worrying about thousands of dollars in burial bills.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

printed obituaries. https://everloved.com/articles/obituaries-and-funeral-announcements/how-much-do-obituaries-cost/

-

annual percentage yields (APY) as high as 5%. https://www.investopedia.com/best-high-yield-savings-accounts-4770633

-

Veterans Benefits:. https://www.benefits.va.gov/compensation/claims-special-burial.asp

-

Social Security Survivors:. https://www.ssa.gov/pubs/EN-05-10008.pdf

-

Employer Survivor Benefits:. https://www.opm.gov/support/retirement/faq/survivor-benefits/

-

FEMA Disaster Relief:. https://www.fema.gov/pdf/media/factsheets/2011/dad_funeral.pdf

-

Victim’s Assistance:. https://www.benefits.gov/benefit/4416

-

Call 211:. https://www.211.org/

-

GoFundMe. https://www.gofundme.com/

-

Ever Loved. https://everloved.com/articles/obituaries-and-funeral-announcements/how-much-do-obituaries-cost/