Whether you’re trying to choose the right life insurance policy or you’re a beneficiary of an existing policy, it’s valuable to know the average life insurance payout you might expect in the U.S.

Here’s what beneficiaries can expect on average:

- Average payout: $189,000

- Time to payout: 30-60 days after filing

How much you or your family will receive depends on your policy and other factors, like if you borrowed against the policy while living.

Learn more about life insurance policies, tips to file, and what will impact your policy payout below.

Life Insurance Payouts

Life insurance is purchased to provide a cash payout at the time of the policyholder’s death. The policy provides payout, called a death benefit, to the beneficiaries named in the policy or the policyholder’s heirs to provide financial support and stability after death.

The benefit can pay for funeral arrangements, debt, or any other expenses the beneficiaries choose to spend it on.

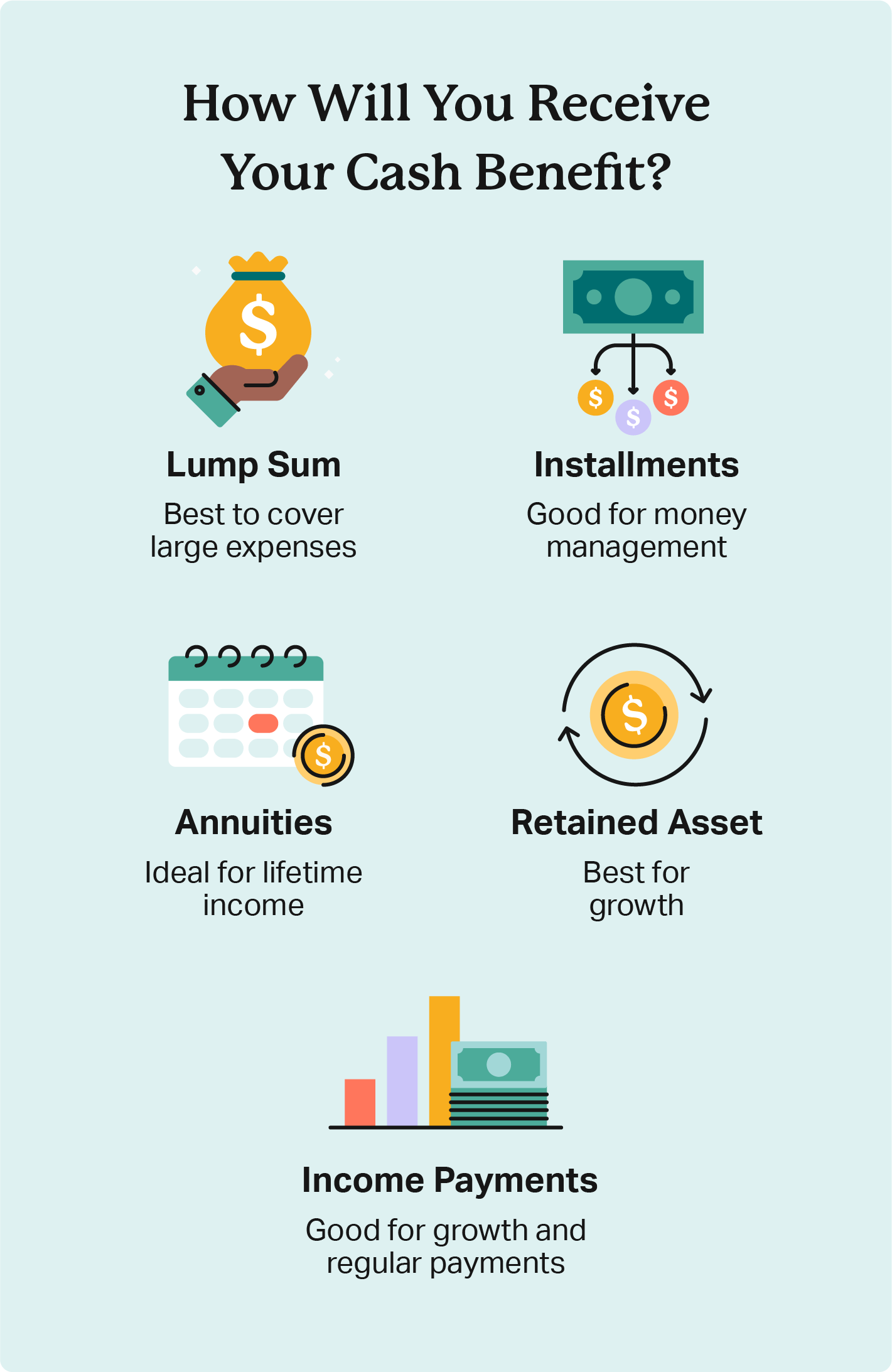

Beneficiaries submit a claim to the life insurance company once they confirm a policy is active. Most policies pay out with a lump sum, but other options may be available to you.

- Lump sum payout: pays the death benefit in full after the claim is approved

- Installments: makes periodic payments on a fixed schedule until the full benefit is paid

- Income payments: places the full benefit into a taxable account to accrue interest, and beneficiaries choose their payment schedule and amount

- Annuities: option to convert the policy into an annuity for guaranteed, ongoing income payments

- Retained asset: transfers the payout into an interest-bearing account that the beneficiary can access as a checking account

How Long Does It Take Life Insurance To Pay Out?

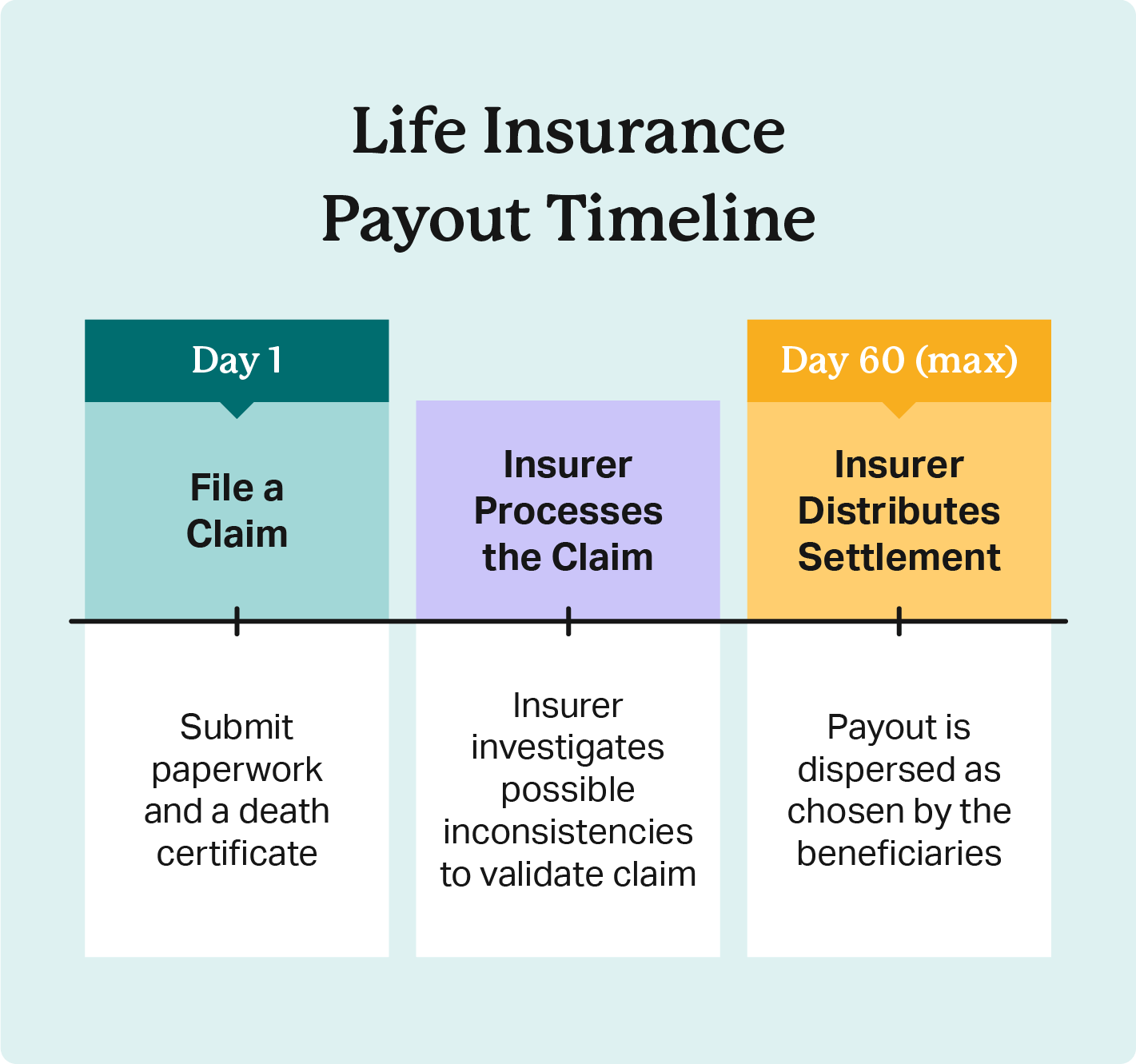

Insurers typically pay out within 30-60 days after they receive a valid claim. There isn’t a time limit to file your claim after the policyholder’s death, but the longer you wait, the longer your payout will take.

You can file a claim as soon as you have a certified death certificate copy. The process is simple:

- Confirm the active life insurance policy.

- File a claim with the insurer’s paperwork and a death certificate copy.

- Wait for settlement distribution.

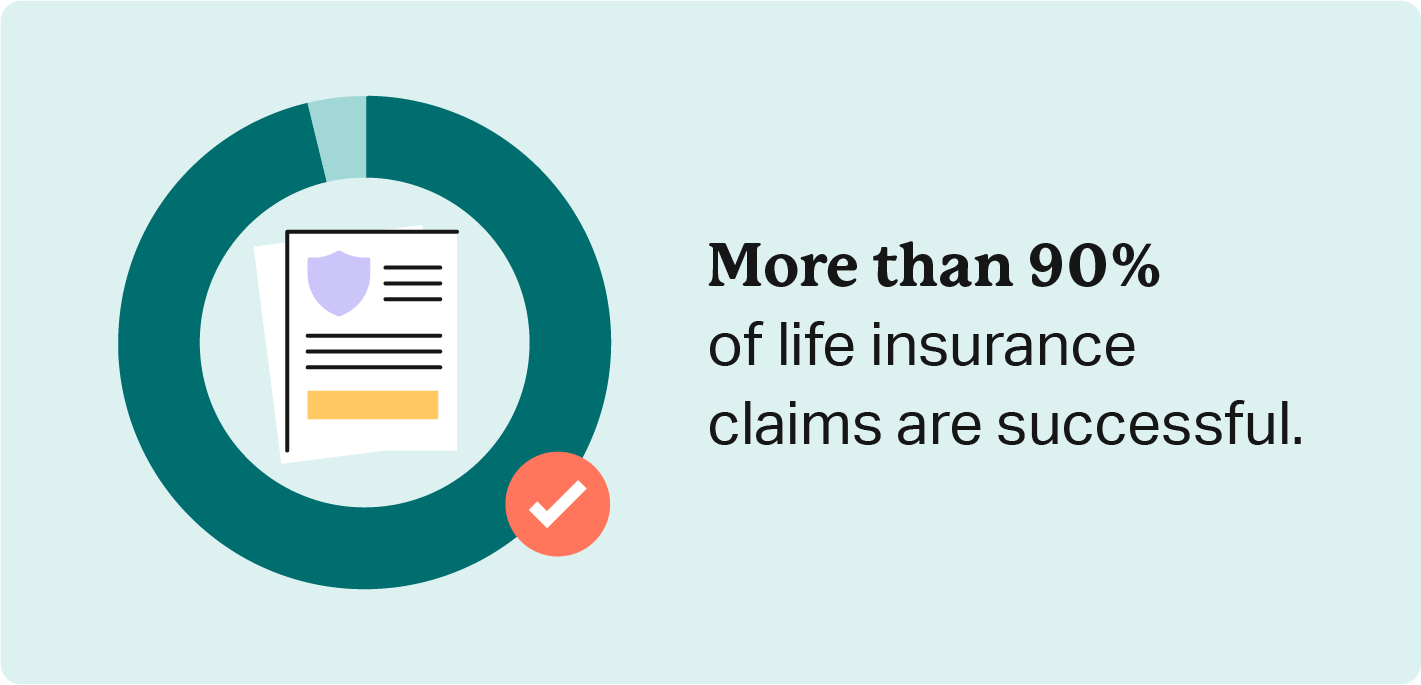

Submitting a claim is straightforward, and most life insurance claims are approved.

Factors that affect payout

A delay in filing your claim is most likely to stall your payout, but several other issues can impact claim processing and payment.

- Payout method: You won’t get your full payout in 60 days if you choose installments, an annuity, or another non-lump-sum option.

- Beneficiaries: Arranging benefits with multiple beneficiaries or establishing inheritance takes longer than payments to a single beneficiary.

- Documentation: Lacking documentation like a certified death certificate or correct and proper claim form can delay your case.

- Death cause: Suspected murder, injury tied to illegal activity, or unnatural deaths may invalidate the life insurance policy or require police investigation for approval.

- State laws: Your state’s guidelines may shorten or lengthen the amount of time an insurer has to process and pay a valid claim.

- Fraud: Suspected fraud, including false information with the policy or claim, can trigger an investigation that delays the payout.

- Policy date and details: Some policies include clauses that deny benefits within a certain number of years after the policy is purchased or for specific causes of death like suicide.

Find The Life Insurance Coverage You’re Looking For

Life insurance supports families in the event of the policyholder’s death with a cash benefit to cover final expenses or debt or provide financial security for their loved ones. Understanding the average life insurance payout and timeline can help you determine how much coverage you need.

Want to learn more? Explore quotes to compare life insurance prices and coverage among America’s most trusted providers.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.