- You can buy a small amount of term life insurance (as low as $5,000).

- No medical exam is required to qualify.

- The policy does not build cash value, which is good because it won’t interfere with Medicaid eligibility.

- Misleading introductory prices.

- The rates increase every five years.

- It’s tough to find what the prices will be at ages 76, 81, and 86.

AM Best’s Financial Strength Rating (FSR) is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. The scores range from A++ to D-.

Moody’s Investors Service rates the creditworthiness of companies. The Moody’s Rating Scale has 21 possible scores ranging from “Aaa” (highest mark) down to “C” (lowest mark).

S&P Global Inc. issues credit ratings on a scale from “AAA” (highest rating) to “D” (lowest rating).

The Complaint Index compares a company’s performance to other companies in the market. The National Complaint Index is always 1.00. That means a company with a complaint index of 2.00 is twice as high as expected in the market. Reported scores are for the most recently available year and for “Individual Life” products.

The BBB rating is based on information BBB is able to obtain about the business, including complaints received from the public. BBB seeks and uses information directly from businesses and from public data sources. BBB assigns ratings from A+ (highest) to F (lowest). If a business has been accredited by the BBB, it means BBB has determined that the business meets accreditation standards, which include a commitment to make a good faith effort to resolve any consumer complaints.

Globe Life Insurance Rate Charts & Cost Calculator

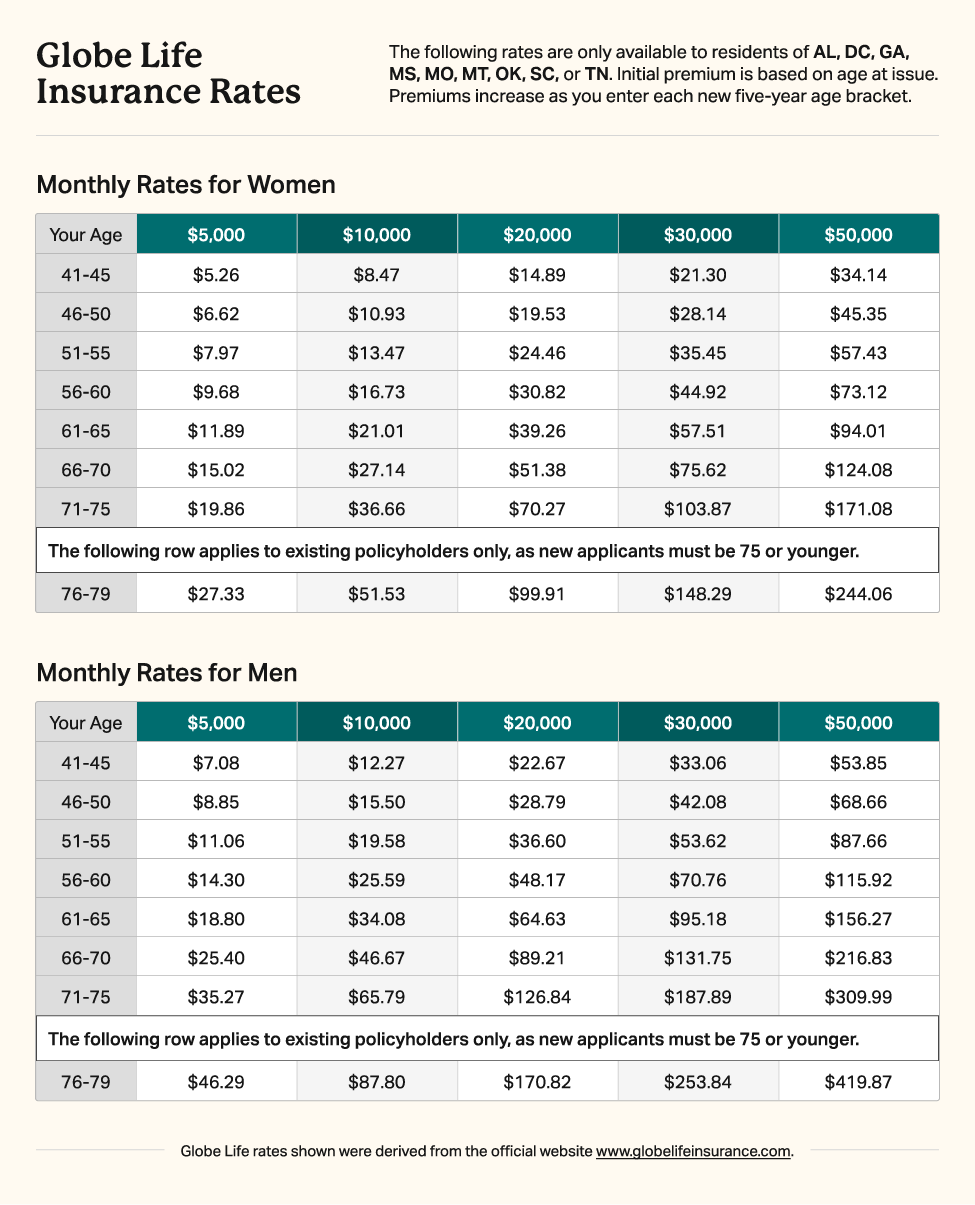

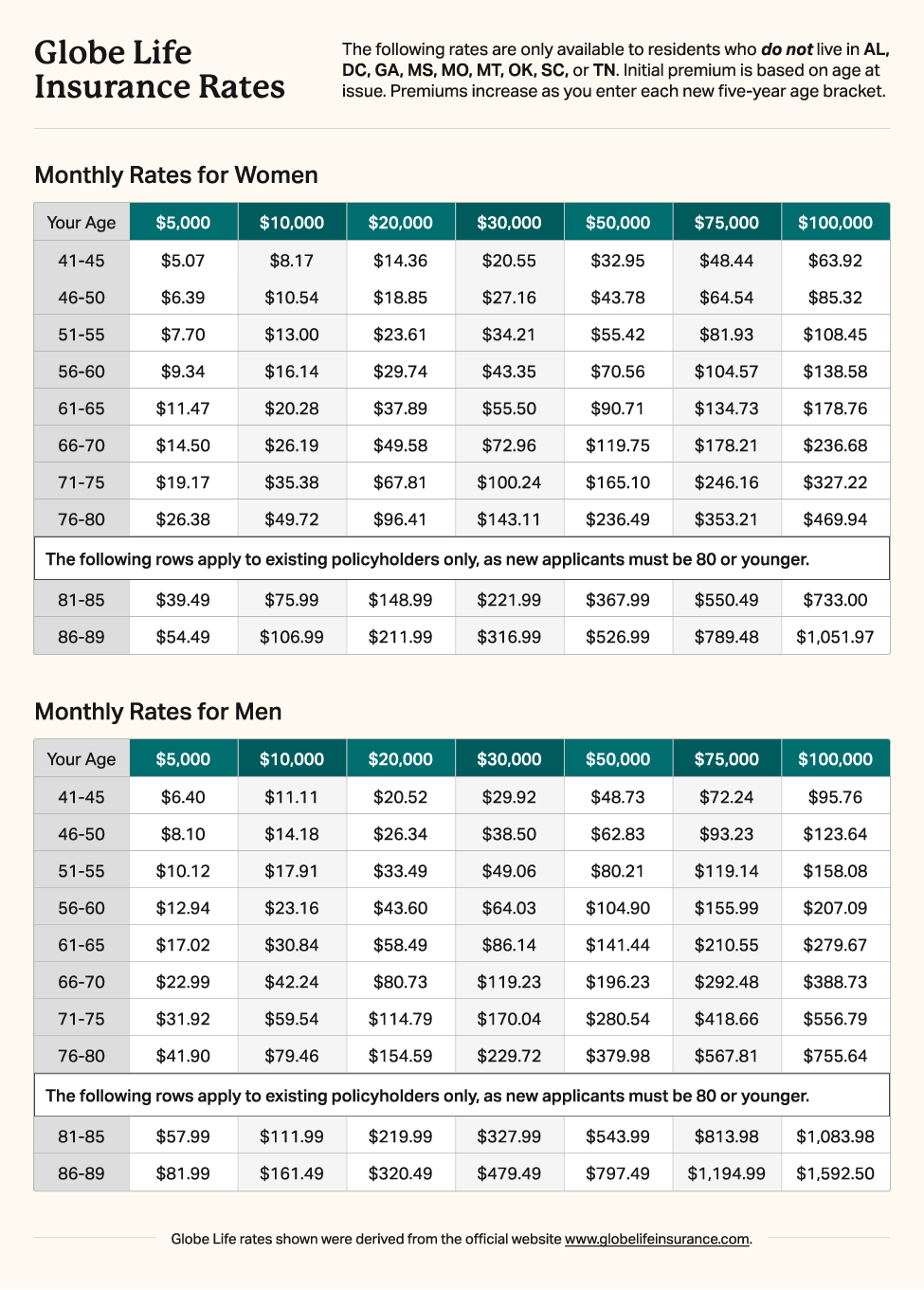

The rate charts below show the monthly cost of Globe Life coverage for residents in various states, according to their official website. Alternatively, you can view prices in your state by using this handy cost calculator.

Does Globe Life Insurance Really Cost $1 Per Month?

The $1 per month life insurance offer from Globe Life is a marketing gimmick. $1 is the cost only for the first month of coverage. Your actual price will begin starting in the second month.

How Does Globe Life Insurance Work?

Globe Life sells an increasing premium term life policy that expires on your 80th or 90th birthday. How long the policy lasts depends on which state you live in. Be it 80 or 90, when the policy ends, you’re no longer insured and don’t get any money back.

Globe prices their coverage using a five-year age group system. Everyone in each age bracket pays the same rate. For example, people ages 51-56 all have the same premium.

In addition, your rate will increase as you enter each new age bracket. For example, a 66-year-old female who lives in Nevada will pay $49.58 monthly for a $20,000 policy. On her 71st birthday, she will enter a new age bracket, and her price will automatically jump to $67.81.

To qualify for Globe life insurance, you don’t have to take a medical exam, but you will have to answer health questions. There is no waiting period if approved, meaning you’re fully covered the day you make your first payment.

Because it’s a term policy, it will not accrue cash value like permanent life insurance does.

Is Globe Life Insurance Worth Buying?

Globe Life is not ideal for people seeking life insurance to cover funeral costs for two principal reasons.

First, buying term life insurance to cover funeral costs is risky because most seniors live longer than a term policy lasts. If your policy expires before you do, your family will have to come out of their pockets to pay for your end-of-life expenses. That’s why you should seek a permanent whole life final expense policy to ensure you have coverage indefinitely.

The second big issue is that it’s tough to qualify for Globe’s coverage. They decline most seniors with common pre-existing conditions. Even if you wanted to roll the dice and buy a term policy to cover final expenses, there’s a slim chance Globe Life would approve you if you have common health issues among seniors.

As a side note, if you want a term policy for any reason, multiple companies offer lower prices (that don’t increase over time) than Globe Life.

Frequently Asked Questions

Globe life insurance rates increase every five years. Every time you enter a new five-year age bracket, your premium jumps accordingly.

The monthly cost of Globe Life insurance is between $1.99 and $1,592. Your price will depend on your age, gender, state of residence, health, and how much coverage you select.

Globe life insurance is term coverage that ends at age 80 or 90. The age limit depends on which state you live in. For example, Globe coverage expires at age 80 in Alabama, but it ends at age 90 in Texas.

Globe Life does offer whole life insurance for children and adults. Globe’s child coverage can be quoted and bought on their website. However, Globe only quotes and sells their adult whole life insurance through the mail. You cannot buy their adult simplified whole life insurance online.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

- official website. https://www.globelifeinsurance.com/adult

- A.M. Best. https://news.ambest.com/PR/PressContent.aspx?altsrc=1&RefNum=33731&URatingId=3213454#:~:text=AM%20Best%20has%20affirmed%20the,)%20%5BNYSE%3A%20GL%5D.

- S&P Global. https://home.globelifeinsurance.com/about/financial-strength-and-insurance-ratings

- BBB. https://www.bbb.org/us/tx/mc-kinney/profile/insurance-companies/globe-life-inc-0875-2425

- Trustpilot. https://www.trustpilot.com/review/globelifeinsurance.com

- Google. https://www.google.com/search?client=firefox-b-1-d&q=globe+life+mckinney+texas+google#lrd=0x864c15e097e61a35:0xf574b4d6237060dd,1,,,,

- Yelp. https://www.yelp.com/biz/globe-life-and-accident-insurance-company-mc-kinney

- Facebook. https://www.facebook.com/GlobeLifeInsurance/reviews_given

- NAIC Complaint Index. https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=91472&REALM=PROD&COCODE=91472&REALM=PROD

- BBB Score & Accreditation. https://www.bbb.org/us/tx/mc-kinney/profile/insurance-companies/globe-life-inc-0875-2425