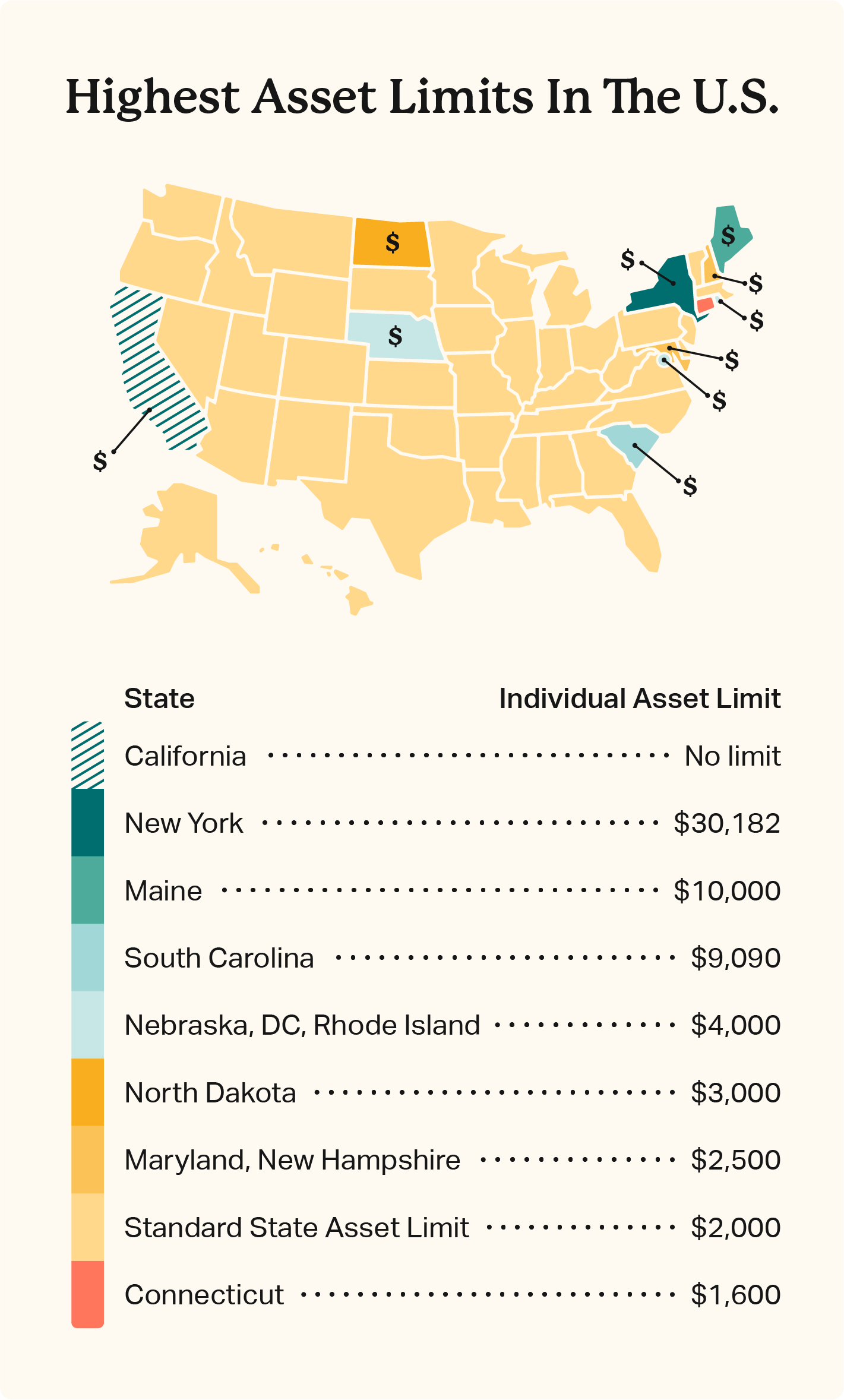

Medicaid asset limits vary by state and typically only apply to seniors and disabled people. Connecticut has the most strict asset limit at $1,600/$2,400 for singles/couples, while California has removed its asset limit for all eligible groups beginning in 2024.

Asset limits restrict Medicaid coverage to low-income families that need assistance most, but states have free reign to adjust asset and income limits as they see fit for their populations.

Compare asset limits by state below to see if you qualify. Resource and income limits may change from year to year, so always confirm eligibility guidelines with your state authority.

Asset Limits For Medicaid

Asset limits are the dollar value of countable assets like bank accounts, stocks, and bonds. Seniors and disabled people enrolled in regular Medicaid typically have an asset limit of $2,000 as an individual and $3,000 as a couple, though it varies by state.

Resource limits for disabled Medicaid recipients who work or receive long-term care, nursing support, or institutionalized care may vary.

It’s not as common, but some states enforce asset limits for other eligibility groups. This is particularly true for medically needy individuals and parents/caretakers receiving Medicaid assistance.

Meanwhile, many states have increased their asset limits to support Medicaid recipients. California eliminated Medicaid asset limits for all eligible persons in 2024, while Maine provided additional exemptions to effectively increase asset limits to $10,000/$15,000 for singles and couples.

| State | Individual Asset Limit | Couple Asset Limit |

|---|---|---|

| Alabama | $2,000 | $3,000 |

| Alaska | $2,000 | $3,000 |

| Arizona | $2,000 | $3,000 |

| Arkansas | $2,000 | $3,000 |

| California | No limit | No limit |

| Colorado | $2,000 | $3,000 |

| Connecticut | $1,600 | $2,400 |

| Delaware | $2,000 | $3,000 |

| District of Columbia | $4,000 | $6,000 |

| Florida | $2,000 | $3,000 |

| Georgia | $2,000 | $4,000 |

| Hawaii | $2,000 | $3,000 |

| Idaho | $2,000 | $3,000 |

| Illinois | $2,000 | $3,000 |

| Indiana | $2,000 | $3,000 |

| Iowa | $2,000 | $3,000 |

| Kansas | $2,000 | $3,000 |

| Kentucky | $2,000 | $4,000 |

| Louisiana | $2,000 | $3,000 |

| Maine | $10,000 | $15,000 |

| Maryland | $2,500 | $3,000 |

| Massachusetts | $2,000 | $3,000 |

| Michigan | $2,000 | $3,000 |

| Minnesota | $3,000 | $6,000 |

| Mississippi | $2,000 | $3,000 |

| Missouri | $2,000 | $3,000 |

| Montana | $2,000 | $3,000 |

| Nebraska | $4,000 | $6,000 |

| Nevada | $2,000 | $3,000 |

| New Hampshire | $2,500 | $4,000 |

| New Jersey | $2,000 | $3,000 |

| New Mexico | $2,000 | $3,000 |

| New York | $30,182 | $40,821 |

| North Carolina | $2,000 | $3,000 |

| North Dakota | $3,000 | $6,000 |

| Ohio | $2,000 | $3,000 |

| Oklahoma | $2,000 | $3,000 |

| Oregon | $2,000 | $3,000 |

| Pennsylvania | $2,000 | $3,000 |

| Rhode Island | $4,000 | $6,000 |

| South Carolina | $9,090 | $13,630 |

| South Dakota | $2,000 | $3,000 |

| Tennessee | $2,000 | $3,000 |

| Texas | $2,000 | $3,000 |

| Utah | $2,000 | $3,000 |

| Vermont | $2,000 | $3,000 |

| Virginia | $2,000 | $3,000 |

| Washington | $2,000 | $3,000 |

| West Virginia | $2,000 | $3,000 |

| Wisconsin | $2,000 | $3,000 |

| Wyoming | $2,000 | $3,000 |

Countable vs. Exempt Assets For Medicaid

Countable assets are typically your liquid resources — bank balances, certificates of deposit, stocks, bonds, and more. Cash and cash equivalents are considered as part of your Medicaid asset limit.

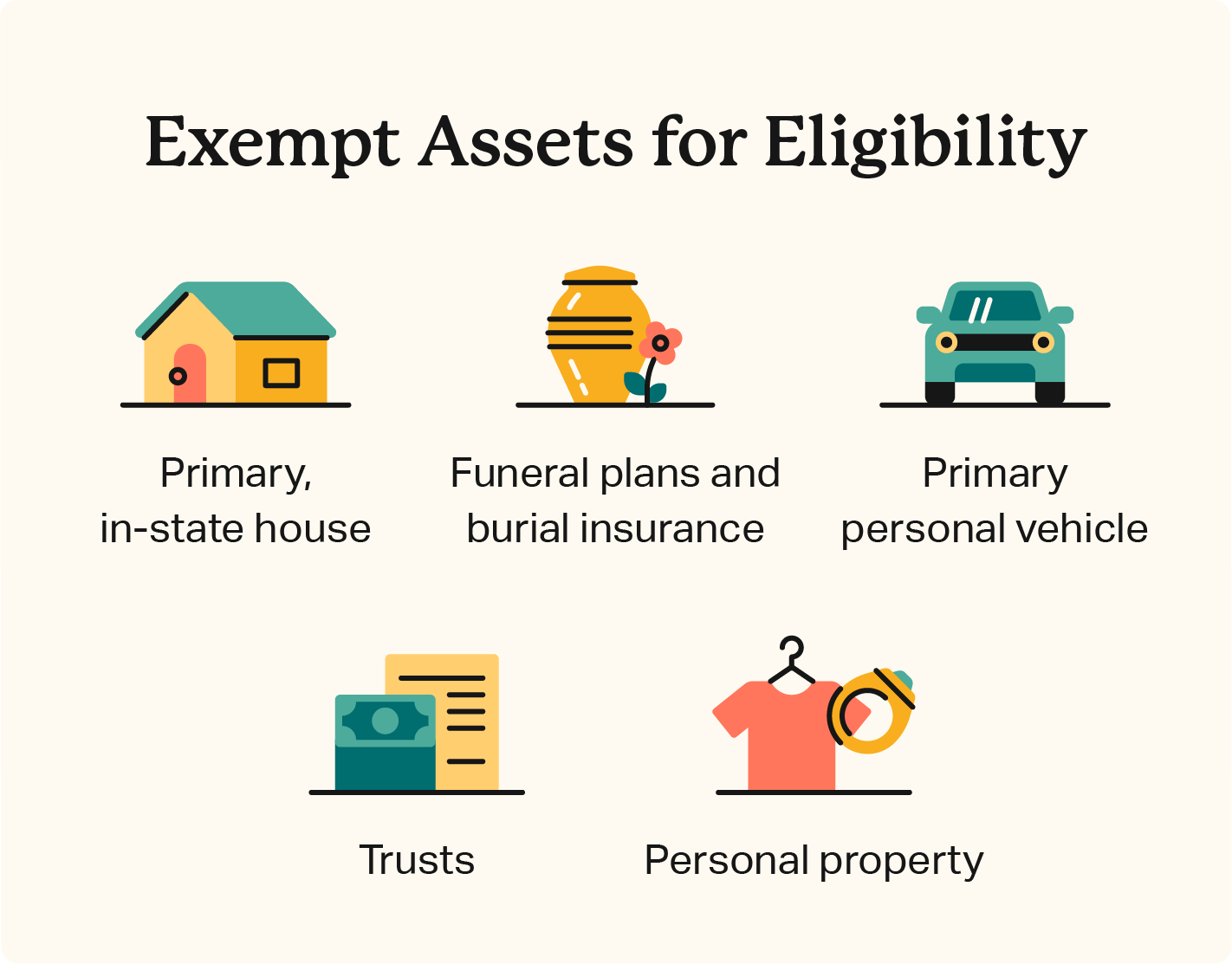

The value of exempt assets doesn’t count toward asset limits. This includes personal property and lifestyle assets, such as:

- Primary residence

- Personal vehicle

- Burial insurance

- Preplanned funeral agreements

- Jewelry

- Decor

- Clothes

State guidelines vary, and some are more or less generous with countable vs. exempt assets.

Rules about how your spouse’s personal property and assets contribute to an asset limit also vary. Couples have increased asset limits since all countable assets owned by either party are considered for eligibility. However, asset limits are still quite low and don’t allow families a lot of flexibility when it comes to savings and emergencies.

Federal and state spousal impoverishment programs are available to support the partners of Medicaid recipients. These allow additional resources for partners of Medicaid recipients receiving long-term or institutional care like assisted living.

Medicaid Eligibility

Asset limits are a small factor of Medicaid eligibility that mostly affect Aid to the Aged, Blind, or Disabled (AABD). Eligibility varies depending on the state and eligibility group but generally considers:

- Income limits

- Health condition

- Age

- Asset limits

Eligible groups that may qualify for Medicaid include:

- Children

- Pregnant people

- Seniors

- Disabled people

- Parents and caretakers

- Expanded adults (19-64)

Federal Medicaid guidelines require coverage for select groups, including children, pregnant people, and the Aged Blind, and Disabled (ABD).

Low-income adults without a disability aged 19-64 may also qualify for coverage under Medicaid Expansion. So far, 41 U.S. states have adopted expanded coverage, excluding:

- Alabama

- Florida

- Georgia

- Kansas

- Mississippi

- South Carolina

- Tennessee

- Texas

- Wisconsin

- Wyoming

What To Do If You Exceed Medicaid Financial Eligibility Limits

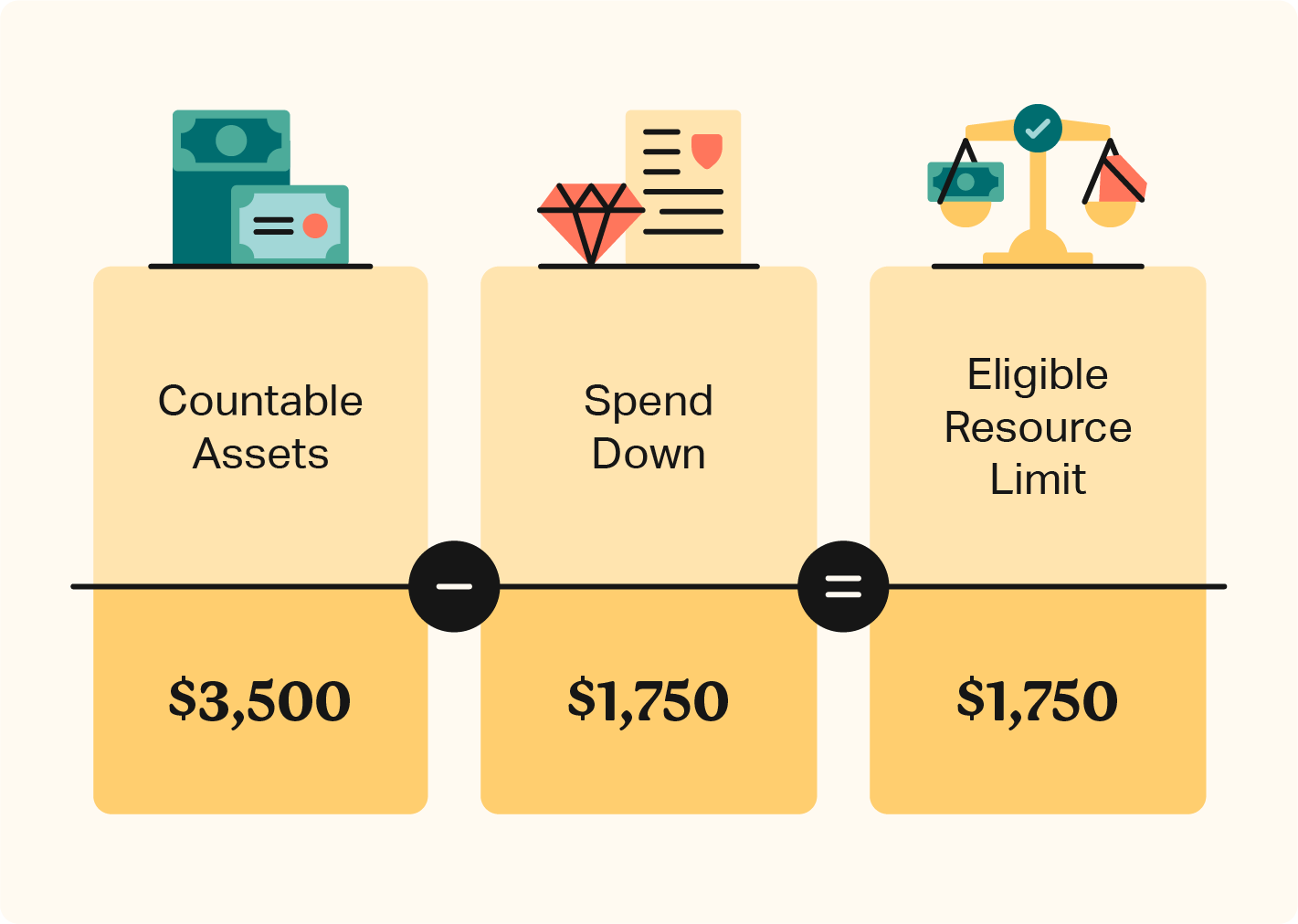

Medicaid resource limits are tight, and additional assets like an end-of-year bonus or raise at work can affect your eligibility. If you have too many countable assets to qualify, you have a few options.

Medicaid spend down

Spend down involves using or reallocating your liquid assets to reduce your countable resources and meet eligibility requirements.

You can spend your money outright on debt or physical items like jewelry. Debt repayment is ideal since it reduces liabilities and may decrease monthly payments. However, something like jewelry or art can still contribute to your wealth without impacting your health care.

Alternatively, you can purchase exempt services like final expense insurance. This allocates money to your future end-of-life care and estate to guarantee your final expenses are covered while reducing your current liquid assets.

Be aware that Medicaid has a look-back period that evaluates all asset transfers you and your spouse made over a five-year period prior to Medicaid application. Penalties may apply to any gifted transfers of assets sold below market value.

Alternative state assistance

States, counties, and municipalities often manage additional social services that may support your financial and medical needs. Contact your local health and human services department to explore non-Medicaid support options government and nonprofit agencies provide.

Provided services may include:

- SNAP food stamps and nutritional assistance

- Child care assistance

- TANF temporary financial assistance

- Home energy assistance

- Housing and shelter assistance

How To Apply For Medicaid

You can apply for Medicaid assistance through the federal Health Insurance Marketplace regardless of your resident state. State Medicaid agencies also assist applicants.

Most states accept online and paper applications submitted in person or by mail. Phone assistance is also available. Contact your state’s Medicaid or Health and Human Services office to learn more.

Protect Your Coverage and End-Of-Life Plan

Medicaid asset limits can be strict, and many low-income individuals who need medical coverage may exceed the typical $2,000 limit. If this is you, there are options to spend down your liquid wealth and meet eligibility requirements.

Meet with a qualified financial advisor to discuss your options and consider exempt assets like burial insurance for seniors to finalize your funeral plans and preserve medical coverage.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

California eliminated Medicaid asset limits. https://www.dhcs.ca.gov/Get-Medi-Cal/Pages/asset-limits.aspx

-

spousal impoverishment programs. https://www.medicaid.gov/medicaid/eligibility/spousal-impoverishment/index.html

-

require coverage for select groups. https://www.medicaid.gov/sites/default/files/2019-12/list-of-eligibility-groups.pdf

-

SNAP. http://www.fns.usda.gov/snap/supplemental-nutrition-assistance-program-snap

-

TANF. https://www.acf.hhs.gov/ofa/map/about/help-families

-

Home energy assistance. https://www.acf.hhs.gov/ocs/low-income-home-energy-assistance-program-liheap

-

Health Insurance Marketplace. https://www.healthcare.gov/medicaid-chip/getting-medicaid-chip/