How Does Mortgage Life Insurance Work?

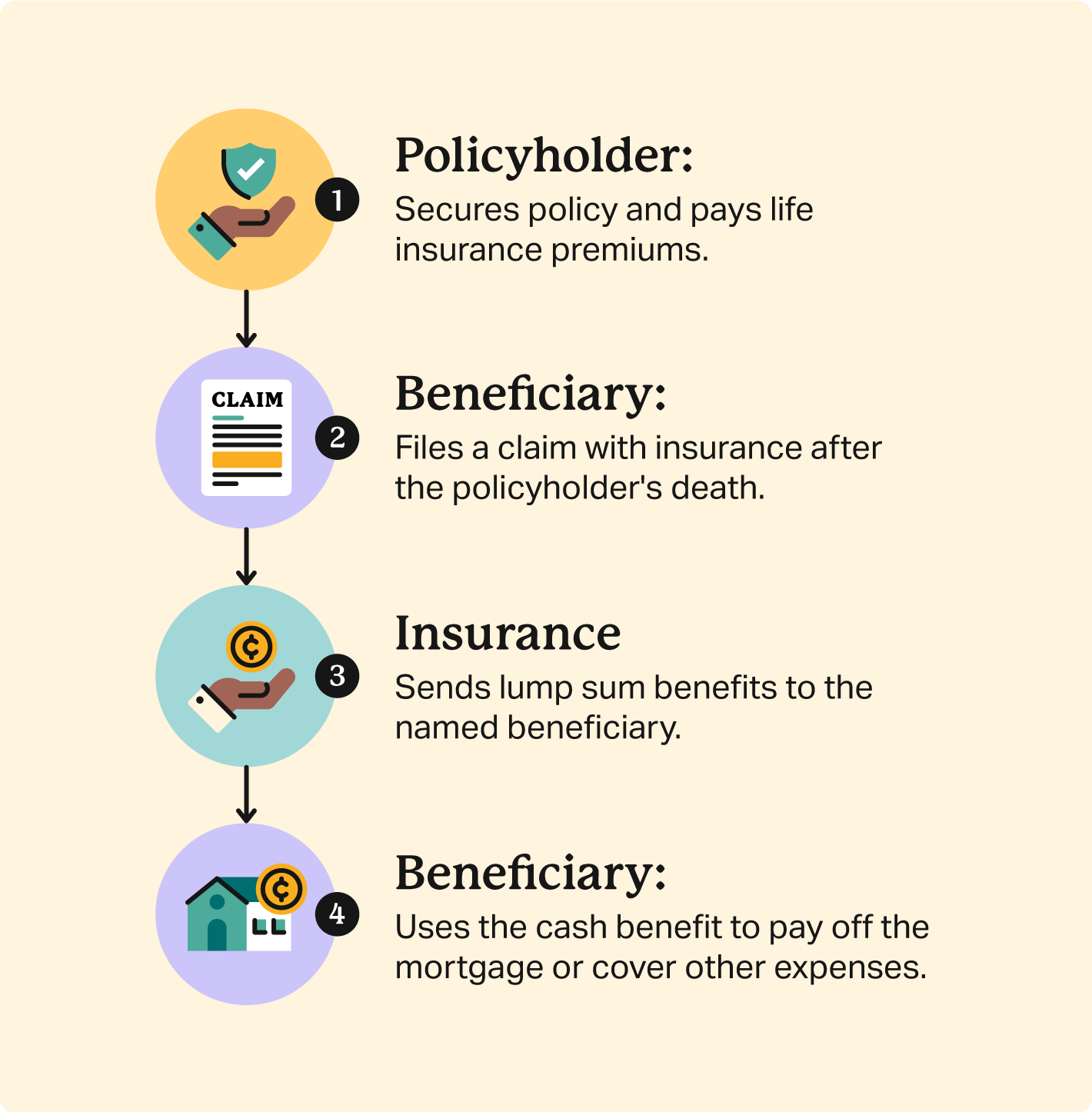

Mortgage protection insurance works just like other life policies. It pays a lump sum benefit in the event of the homeowner’s death. A named beneficiary receives the payment, which is intended to pay the home’s remaining mortgage balance. However, the beneficiary can use the funds as they like.

Any type of life insurance can be used to cover a mortgage. However, mortgage protection insurance is typically a term life insurance policy that matches the length of your mortgage agreement, usually 15 or 30 years, or as many years as you have left on your loan. There are two types of term insurance:

- Level term insurance: policy payouts and premiums remain the same throughout the term.

- Decreasing term insurance: policy payout size decreases over time with consistent premium costs.

You could utilize a permanent life insurance policy (whole life or universal life) to cover your mortgage. However, it would be far more costly than a term life policy, and you don’t need a permanent policy to cover a temporary liability.

It’s essential to note that if you live a term policy, it will expire, leaving you uninsured. You would not receive any money back, nor would the death benefit be paid out. You would simply be uninsured. Term policies can be converted to permanent coverage, but that would radically increase the cost.

Mortgage Life Insurance Vs. Traditional Life Insurance

Mortgage life insurance policies aren’t actually any different than traditional life insurance. Policyholders have the option to choose their coverage, term, and beneficiary in either case.

The only difference is the policyholder’s intention to pay off the mortgage balance. With this purpose in mind, the mortgage life policy might match coverage with the mortgage balance and align the policy’s term with the mortgage repayment schedule.

A mortgage life insurance policyholder can name any beneficiary they like, but they’re likely to choose someone who will be responsible for the house after their death. These beneficiaries are likely to use the cash benefit to cover the mortgage, but they can ultimately spend it as they see fit.

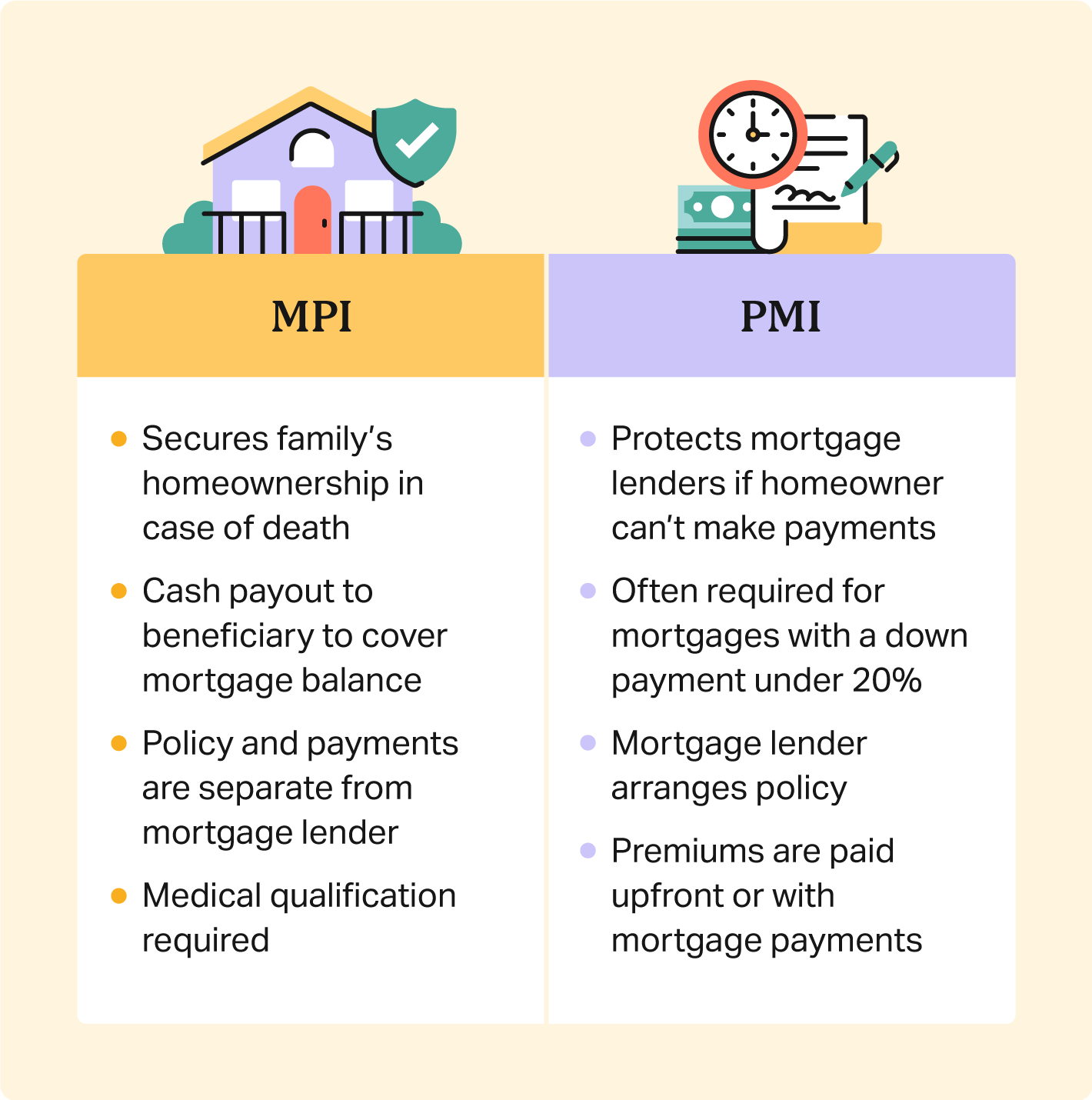

Is Mortgage Life Insurance the Same Thing As PMI?

Mortgage life insurance is not the same as private mortgage insurance (PMI).

Private mortgage insurance is arranged by the mortgage lender to protect its interests in the event that the homeowner is unable to make their mortgage payments. Lenders often require it if the homeowner has a down payment of less than 20% of the loan amount. The homeowner pays PMI premiums upfront or as part of their mortgage payments.

Mortgage life insurance is designed to ensure the lender is paid. However, it activates in the event of the borrower’s death, not in the case of missed payments. It also secures homeownership for the homeowner and their family rather than protecting the lender.

When And Where To Buy

The best time to buy mortgage protection insurance is after you buy your house.

If you decide MPI is right for you, you have a few buying options:

- Life insurance broker: Most life insurance agents sell mortgage life insurance policies. It’s advisable to find a broker who represents multiple insurers because they can compare each one and find the best policy to suit your needs.

- Directly from the insurer: Although not often possible or recommended, some life insurance companies do sell policies directly to consumers, rather than through licensed agents.

- Home-buying team: While your real estate agent and lender aren’t insurance brokers, they likely have industry connections. Connect with your home-buying team for trusted insurance recommendations.

Offers Through The Mail After Closing On A Real Estate Purchase

Without question, when you close on a home or refinance, you will receive specialized offers through the mail advertising mortgage protection insurance.

Please note that in no way, shape, or form are these offers special, unique, or affiliated with your lender in any way. Similar to “state-regulated life insurance” advertisements, these mortgage protection life insurance offers that you will receive are merely deceptive forms of advertising.

If you respond to one, a life insurance agent will likely call you or visit your door to attempt to sell you life insurance. The policies they offer are not unique or specialized for those who have recently purchased a home.

Frequently Asked Questions

Mortgage life insurance costs vary depending on your age, policy amount, type of policy, health history, gender, and state of residence. Some policyholders will pay $50 per month, whereas others may pay $300. It all depends on the aforementioned factors.

You can usually secure a new MPI term life policy up to age 80. For universal life, 85 is the oldest age at which any company offers a policy. Lastly, the age limit for purchasing a new whole life policy is 90. Just remember that the older you are, the more challenging it can be to find the right policy (and the most affordable price).

Yes, life insurance policies can pay off a mortgage. Beneficiaries of any life type insurance policy use the payout money for any reason (no restrictions), including a mortgage balance.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

Private mortgage insurance. https://www.consumerfinance.gov/ask-cfpb/what-is-private-mortgage-insurance-en-122/