How Does Cremation Insurance Work?

Cremation insurance is a type of final expense life insurance meant to pay for a cremation and other end-of-life expenses. When you die, the insurance policy will pay cash, tax-free, directly to the beneficiaries of your choice.

There are no restrictions on how they spend the proceeds. That means they can use the money to pay for your final wishes, financial debts, medical bills, or anything else. Plus, if there is any leftover money, they get to keep it.

Most companies offer coverage amounts between $2,000 and $50,000, and a medical exam is never required. Some policies are “guaranteed issue,” which means there are no health questions or underwriting of any kind. Understand that any policy with no health questions will always have a two-year waiting period and a higher cost.

If you die during the waiting period, the life insurance company will only refund your premiums plus a tiny amount of interest.

Plans with health questions cost less and fully insure you with no waiting period (if approved). That means the insurance company will pay the full death benefit if you die anytime after the policy starts.

Cremation policies are a type of whole life insurance, which means they build cash value, the premiums never increase, the death benefit never decreases in value, and the coverage lasts forever.

What Does Cremation Final Expense Insurance Cover?

A cremation final expense policy for seniors can cover all your cremation and other final costs, such as:

- Crematory fees

- Urn

- Cremation casket

- Funeral home fees

- Medical bills

- Financial debts

Remember that the money can be spent on anything, and any leftover funds stays with your family members.

Cremation Insurance Cost

Final expense insurance rates are based on your gender, age, health, tobacco history, and the amount of insurance coverage you want. Below are some sample cremation insurance monthly premiums.

How Much Does Cremation Cost?

According to the National Funeral Directors Association (NFDA), a cremation plan with a service costs $6,280, which includes a viewing. However, a direct cremation (aka “low-cost cremation”) with no funeral services costs about $2,183.

With direct cremation, you only pay for the cremation process and a container for the ashes.

Whether you have a memorial service or not, you can reduce or increase the cost depending on your funeral planning preferences.

For example, there are multiple types of cremation (with varying costs). There are also different types of cremation caskets.

The cost of cremation is definitely less than that of a funeral with a burial. The average traditional funeral with a burial, embalming, and viewing costs $9,995.

If you’re unsure how much a cremation will cost, you can always use a funeral cost calculator or meet with a funeral director. They can give you specific prices for whatever pre-planning services interest you.

Cremation Insurance For Seniors Vs Pre-Paid Cremation

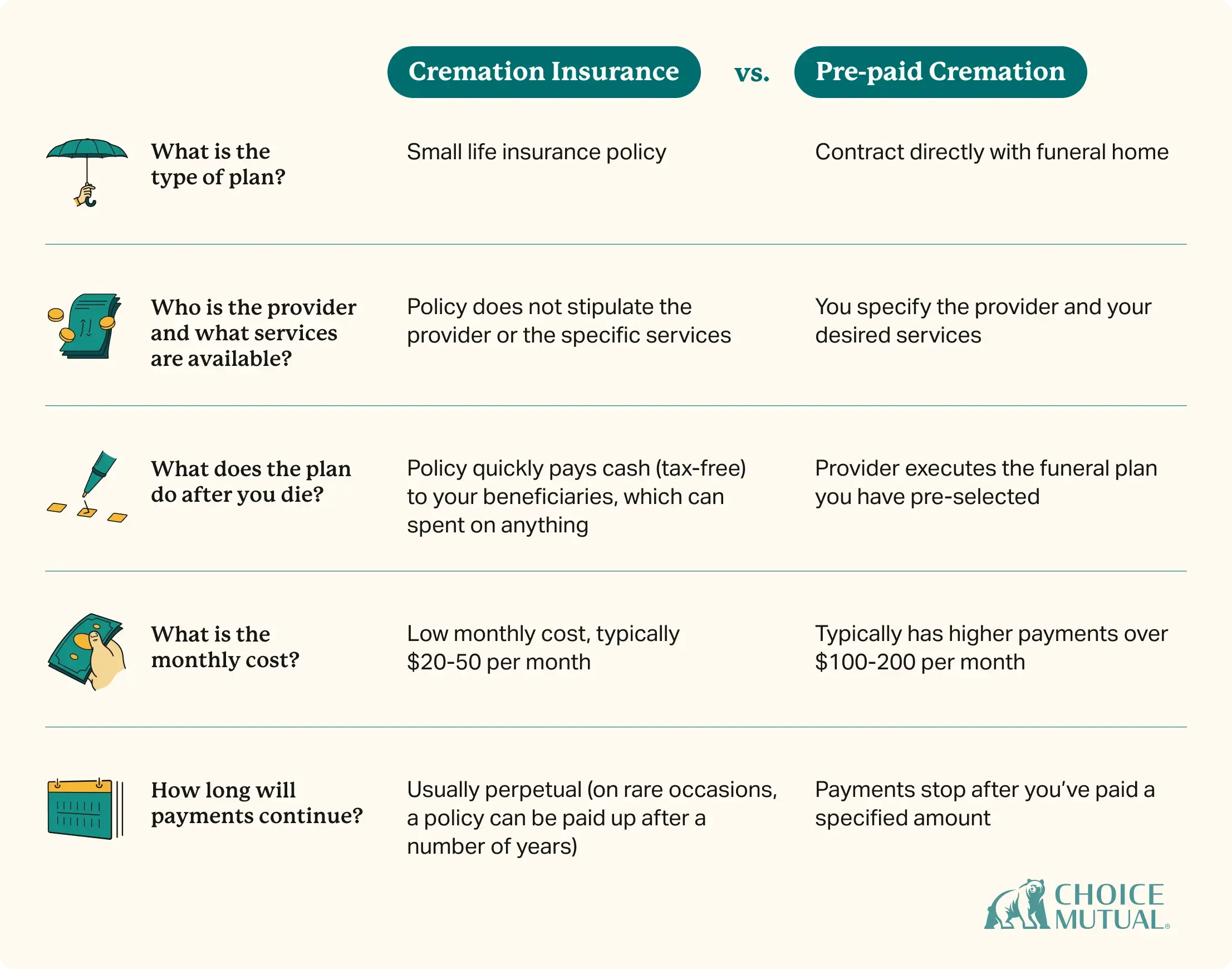

Cremation insurance is merely a small face-value life insurance policy that quickly pays a cash benefit to your loved ones so they don’t have to come out of their own pocket to pay for your end-of-life costs.

A pre-paid cremation is a plan you buy from a local funeral home. You fully design what type of cremation and other funeral services you prefer. Then, they will allow you to pay it off in one payment, or you can make installments over many years. Once you’ve made all the payments, you’re done, and your funeral is forever paid for. When you die, the funeral provider will execute the plan you designed.

Truthfully, if you can afford a pre-paid cremation, it’s a superior option to a cremation insurance policy. That’s because, with a pre-paid cremation plan, you’ve designed the funeral services and provided a way to pay for it. A cremation final expense policy only provides cash to pay for the cremation services. Your family would still need to make decisions about how your funeral would be carried out.

Sadly, many seniors on a fixed income cannot afford a pre-paid cremation, which is why they opt for cremation insurance instead, since it’s much less expensive.

Frequently Asked Questions

Purchasing cremation insurance is typically done with an insurance broker who represents numerous insurance companies. They can compare insurance quotes from many providers to find you the best policy. Alternatively, some insurance companies sell their products directly to the consumer. For example, Colonial Penn and Globe Life deal directly with consumers rather than relying on agents to sell their life insurance policies.

If you don’t have cash to set aside for your cremation services, a cremation policy is an excellent way to ensure your end-of-life costs don’t burden your family. In addition to providing peace of mind that your funeral costs won’t become a financial burden, the funds can also be used for medical bills, debts, or anything else.

Life insurance proceeds can be used for anything, including funeral costs. That means your beneficiaries can use the money for cremation expenses, medical bills, or debts. Plus, any leftover money they don’t use for funeral bills is theirs to keep and use as they see fit.

To file a claim for a cremation policy, the beneficiary must call the insurance company. The insurance provider will require a copy of the death certificate and have the beneficiary sign a form certifying their identity. The payout time for a final expense is typically a few business days once a claim is approved.

Cremation insurance is just another name for final expense insurance. Whether the term is cremation insurance, final expense, burial insurance, or funeral insurance, they all mean the same thing. They are all just marketing expressions describing a small life insurance plan primarily meant to cover end-of-life expenses.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

National Funeral Directors Association. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral

-

pre-paid cremation. https://www.dignitymemorial.com/cremation/prepaying-for-a-cremation