Statistics On Life Insurance At A Glance

No matter your walk of life in this country, it’s a good idea to cover your dependents and loved ones with a life insurance policy. But, many Americans (42%) hesitate to get life insurance because they believe it costs too much (even though consumers overestimate costs by 3-6 times the actual rates).[10]

Worse, they might avoid it altogether because of procrastination. Explore key facts to learn more about life insurance as a tool for financial security below.

- Covering burial and final expenses is the #1 reason that Americans purchase life insurance, with 60% stating it’s important to them.[10]

- 64% of women say “paying for burial expenses” is the top reason they have life insurance, compared to 56% of men.[10]

- 23% of Americans only consider life insurance for burial and final expense coverage.[10]

- Whole life insurance premiums vary with age, health, and policy size. Monthly costs for a high-value $100,000 policy range between $156 for a 35-year-old woman up to $1,856 for an 85-year-old man.

- $197,000 is the average life insurance policy size for new contracts in 2022.[4]

- 33% of men feel they are very knowledgeable about life insurance, compared to just 22% of women.[10]

- Roughly a quarter of men (20%) and women (27%) consider life insurance as a way to supplement retirement income.[10]

- Almost one-third (30%) of Americans would suffer a financial hardship within one month of the unexpected death of a wage earner, while 38% only have a six-month runway.[10]

- The number of policyholders who prefer direct or digital channels rose from 38% to 54% because of the COVID-19 pandemic.[16]

- 68% of people with dependents enrolled in life insurance feel financially safe compared to 47% of people without a policy.[13]

- Almost half (4 in 10) of people with life insurance wish they had purchased policies when they were younger.[12]

How Many People Have Life Insurance?

Currently, 52% of Americans own a life insurance policy (about 172.5 million people), though 41% of total adults (insured and uninsured) believe their coverage is insufficient. Additionally, over 100 million Americans are uninsured or underinsured.[10]

Several factors affect the decision to purchase life insurance coverage, like:

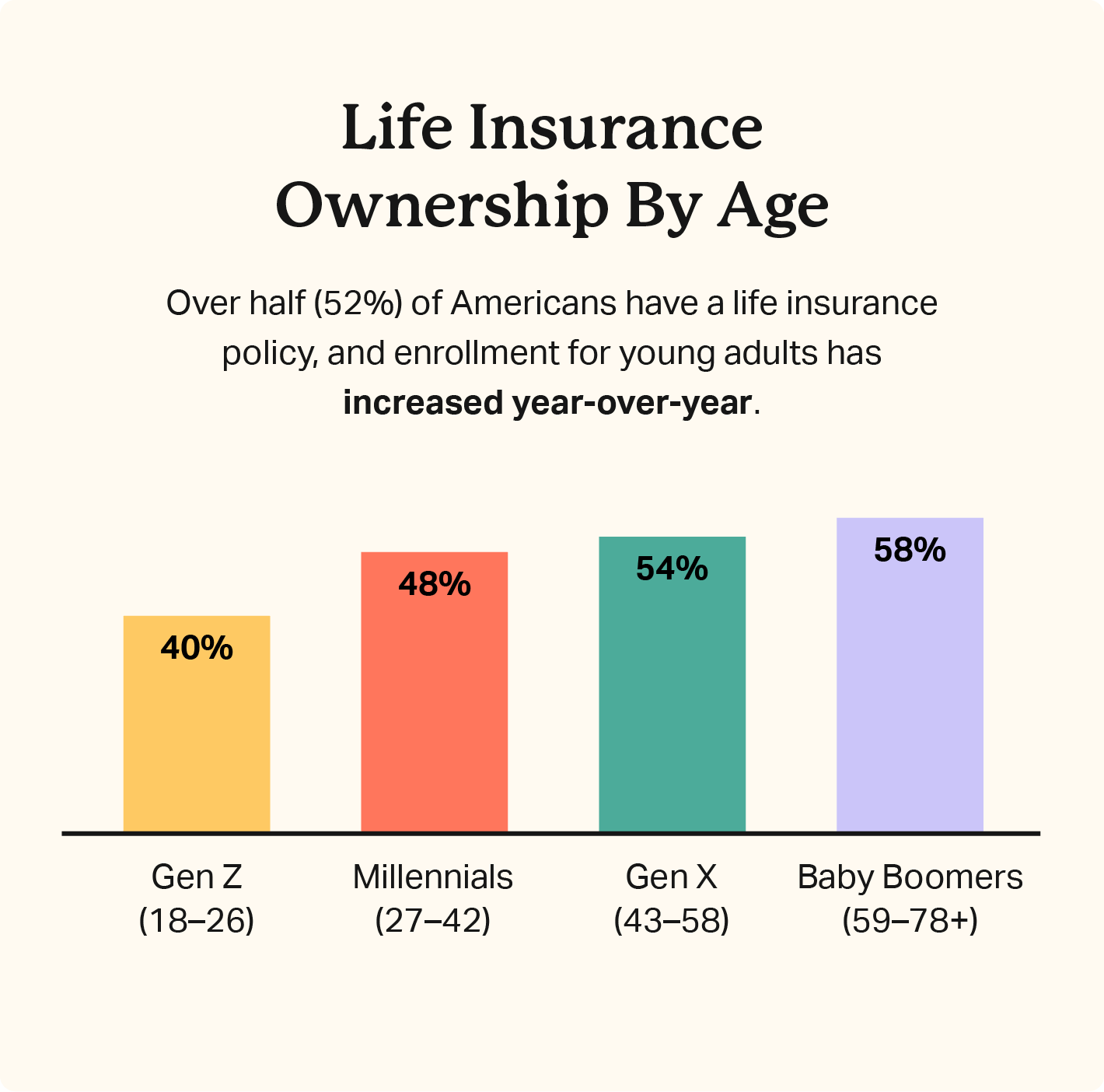

- Age: Younger Americans are increasingly interested in insurance to protect their families, though older adults have the highest enrollment rates.

- Income level: Higher-income consumers and higher-net-worth individuals may be more focused on asset protection and estate planning, making them more likely to buy life insurance.

- Employment: Many Americans have insurance through their employer. This number lowers as Americans get older and reach retirement age.

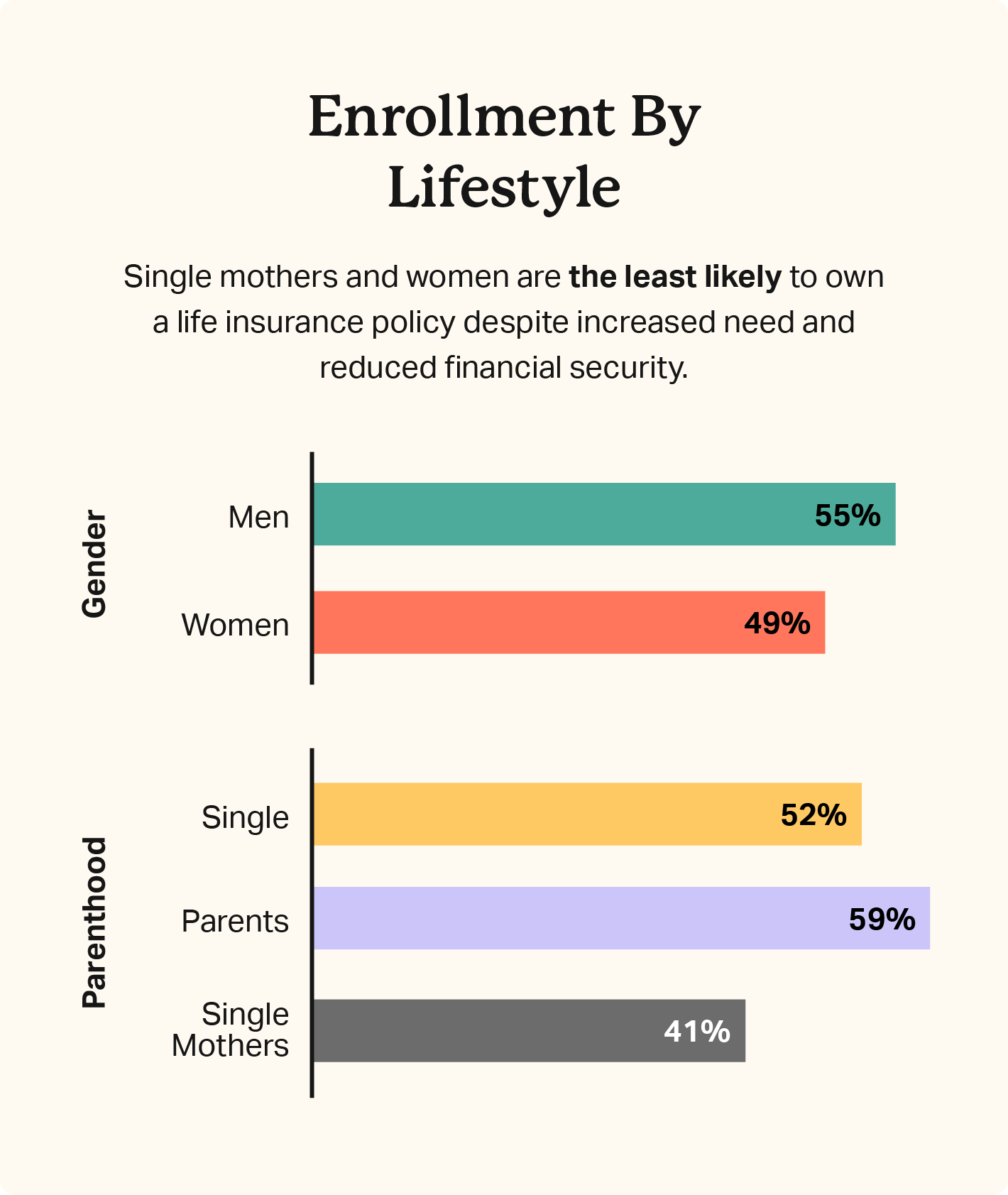

- Gender: Women are more likely to worry about familial well-being but less likely to purchase life insurance than men.

- Marital status: Married people are more likely to buy life insurance than single individuals, possibly due to the added responsibilities of marriage, like joint mortgages and finances, as well as children.

Age, however, is the biggest determinant of whether someone will purchase life insurance. As baby boomers continue to fill out the 60+ age demographic, more will depend on their retirement savings and other means of post-career income.

- 1 in 3 people have life insurance because it’s provided by their employer.[14]

- More than one-third (36%) of uninsured Americans haven’t purchased insurance because they don’t know what type or how much they need.[10]

- 39% of Americans plan to buy a life insurance policy within the next year, and Millennial (50%) and Gen Z (44%) populations are the most interested.[18]

- 40% of young adults ages 18-26 have a life insurance policy.[19]

- Gen Z ages 18-26: 40%

- Millennials age 27-42: 48%

- Gen X ages 43-58: 54%

- Baby Boomers ages 59-78+: 58%

- Just 41% of single mothers have life insurance, though 59% of single mothers believe they need more life insurance, in part to cover their increased financial need as independent providers.[18]

- Parents of minors are far more likely to have active life insurance policies (59%) compared to everyone else (52%).[10]

- Men are more likely to be insured than women in America, at 55% and 49%, respectively.[10]

- Women (51%) are more likely to be uninsured than men (45%), and women’s life insurance ownership has declined year-over-year for five years.[14]

- 2 in 3 (67%) consumers say they would be more loyal to insurers if premiums were lower.[17]

- More customers are shopping online, and nearly a quarter (24%) of adults would prefer to compare and purchase a new policy entirely online without an in-person appointment.[17]

- Social media is a growing resource for finance and life insurance insights, with a majority of consumers browsing Facebook (62%) and YouTube (58%) for information.[10]

US Life Insurance Industry Statistics

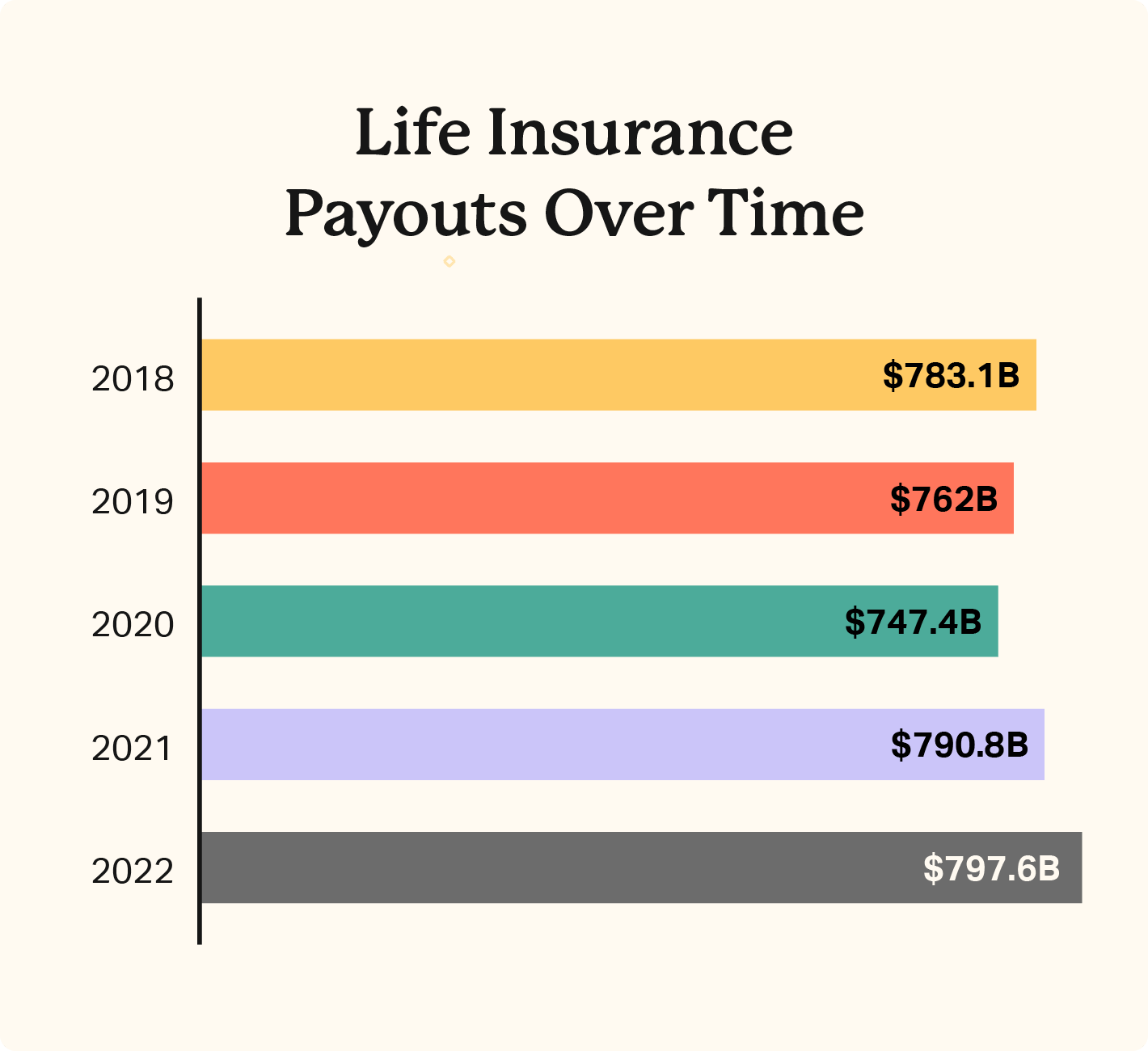

Life insurance is a sizable part of many Americans’ plans for their own future, and the industry is booming. L&H insurance currently accounts for 32% of all direct insurance premiums, and direct premiums as a measure of sales growth increased to $879 billion in 2022 from $819 million the previous year.[1]

Life expectancy is the lowest it’s been in decades, which means policyholders aren’t living as long, either. Reduced life expectancy means that insurance companies could see a continued increase in payouts in the coming decades.

- Life & Health (L&H) benefits payments totaled $797.6 billion in 2022, a 0.86% year-over-year increase and a 1.8% increase from 2018 — despite declining in 2019 and 2020.[6]

- Only one-third of consumers know that insurance brokers need accreditation.[6]

- The 10 largest L&H companies collectively share 52.8% of the market.[6]

- MetLife has the largest share of direct premiums written, with $111.9 billion in 2022, or a 12% market share — about $35 billion more than any other company.[6]

- In 2022, the L&H insurance sector held around $8 trillion in assets.[6]

- Expenses in the L&H sector rose 9.5% overall from 2021 to 2022.[6]

- Total benefits paid decreased in 2022 as mortality rates from COVID-19 settled from 2021.[6]

- To raise capital, insurance companies cumulatively offered $2.5 billion in public equity in 2022 — almost half of 2021’s $4.4 billion value.[6]

- L&H net investment income decreased slightly to $199 billion in 2022 after a record-high surpassing $200 billion in 2021.[6]

Common Life Insurance Misunderstandings

Life insurance can help supplement retirement income, replace the income of a top-wage earner, and create a sense of stability after a loved one passes away. Still, many Americans don’t have it. Let’s break down a few common myths that deter people from getting the life insurance coverage they need.

1. The IRS will take taxes out of my life insurance benefit payout.

Even though 1 in 3 Americans believe this myth, death benefits from life insurance are not taxable. However, you will have to report and pay taxes on any related interest you receive.

2. Insurance is just too expensive for most family budgets.

More than half of Americans overestimate the cost of insurance despite 42% listing cost as their top reason to avoid coverage.[15]

3. Life insurance policies cost more than $1,000 annually.

This isn’t quite accurate, even though 43% of millennials think so. In reality, a policy for a healthy 30-year-old could cost around $170 annually.[12]

4. Technology advancements will lead fewer people to rely on insurance.

As many as 64% of insurance customers say they’d adopt new technology in exchange for lower premiums, while 49% would do so for improved services.[17]

5. Most insurance customers are technology-averse.

At least 56% of consumers store some of their personal data in the cloud, and more than half of customers now prefer digital channels.[17]

6. Customers are more focused on privacy than premiums.

Nearly 9 in 10 (87%) consumers would comfortably share their personal information and lifestyle details to lower their premiums.[17]

7. Almost half of all insurance claims aren’t paid out.

While consumers believe that around 60% of claims are successful, in reality, it’s more than 90%.[17]

Compare Companies and See Your Options

If you’re not covered, it’s time to start thinking about end-of-life expenses and making sure that your loved ones don’t fall into financial turmoil after facing an unexpected bill.

Learn more about final expenses and life insurance and compare coverage today so you can make a choice that protects your family and their finances in the event of an emergency.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

Life expectancy. https://www.hsph.harvard.edu/news/hsph-in-the-news/whats-behind-shocking-u-s-life-expectancy-decline-and-what-to-do-about-it/