Home

Pinpoint the perfect final expense insurance policy for your needs.

Free tools, practical resources, and expert guidance written by human professionals - never AI - to help you understand your options and find your most affordable policy.

Free tools, practical resources, and expert guidance written by human professionals - never AI - to help you find your most affordable policy.

See Instant Quotes

Compare prices among these and

more

of America’s most trusted

life insurers

more

of America’s most trusted

life insurers

Choice Mutual insurance agency specializes in funeral insurance across all 50 states.

Instant Quotes

See real final expense insurance quotes from 25+ reputable companies in less than 60 seconds.

Hassle-Free Service

Shop freely without enduring calls from commission-hungry agents, and apply only when you’re ready.

Policy Transparency

Match with the plans that actually meet your needs, not pedaled a single product from one particular insurer.

Expert Guidance

Receive impartial expert advice to help you get the most affordable plan with whichever provider suits you best.

Featured In

Why Customers Prefer Choice Mutual

|

What Customers Want

|

Choice Mutual

|

Most insurance agencies

|

Insurance companies

|

Other insurance websites

|

|---|---|---|---|---|

|

Compare 15+ companies

|

|

|

|

|

|

Instant online quotes

|

|

|

|

|

|

Salary-based advisors

|

|

|

|

|

|

Live agent support

|

|

|

|

|

|

Impartial advice written by experts

|

|

|

|

|

|

Simple online application

|

|

|

|

|

|

Thousands of 5-star reviews

|

|

|

|

|

|

Burial insurance specialization

|

|

|

|

|

|

Highest level of transparency

|

|

|

|

|

Instantly compare funeral insurance quotes from top insurance providers.

See Instant QuotesProviding trusted insurance services worthy of five star ratings.

Anthony Martin is the BEST!!

I would like to personally thank Anthony Martin who not only made contacting him very easy but he gave sound advice and also was exceptionally professional. I have been struggling for a couple of weeks with basically no help except about 100 phone calls. No one took the time to explain my options. Once my first application was declined he went right ahead with the next and I was approved for exactly what I wanted. Other companies were just trying to sell me more then I really wanted or needed. I will definitely refer Anthony to my friends and family. I will always contact him for any advice. We need more people like Anthony in the business world.

Thank you so much.

Thank for your quality services!

Without question, seeking quality life insurance coverage for your family can be cumbersome. However, our representative with Choice Mutual - Anthony Martin - went above the norm in clearly articulating various life insurance products, making this a truly pleasant experience. More importantly Martin's "Can Do" attitude, professionalism and knowledge associated with life insurance coverage options were instrumental and made a huge difference in securing life insurance for my mother.

Recommended

First time in all these years of dealing with insurance people that I felt that I had an honest and caring person on the other end of my conversation.

Brian was excellent

Brian was excellent in his quick response to my request, explained everything very well, and I was able to get my policy right away. He checked back with me more than once to make sure I was clear on everything. My wife had recently passed way, and I was anxious to get a policy that can be used by my sons to help alleviate the cost of my burial. This gave me some much needed peace of mind. Brian seemed genuine and sincere in his concern for me. Thanks Brian!

You rock!

Anthony from the start had an amazing professional demeanor that put me at ease right away. He answered all of my questions and concerns. 100% satisfied. Thank you so much for your patience and your time! You rock!

I was inquiring about final expense

I was inquiring about final expense insurance online. I was immediately contacted by Anthony who took my information. He was very professional , polite, and a pleasure to talk with. He handled all aspects of the policy, submitted it and responded back to me within minutes. The whole process was virtual painless and pleasant. I recommend Anthony highly.

About Final Expense Insurance

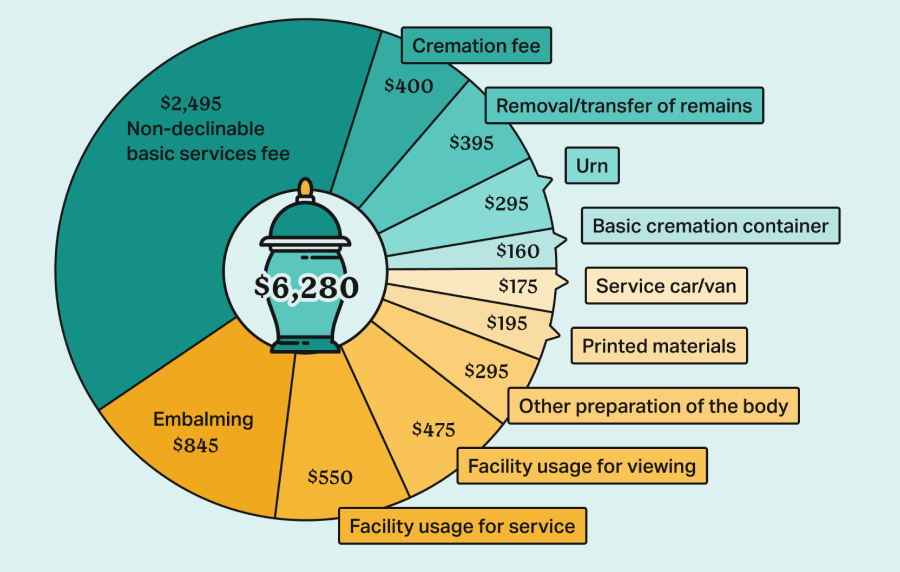

Also known as burial insurance or funeral insurance, final expense insurance is an insurance policy with affordable premiums designed to cover funeral expenses and other associated costs when you die.

Upon your passing, the insurance company will provide a tax-free payout to your chosen beneficiaries, giving you peace of mind that your funeral expenses won’t burden your loved ones.

Benefits

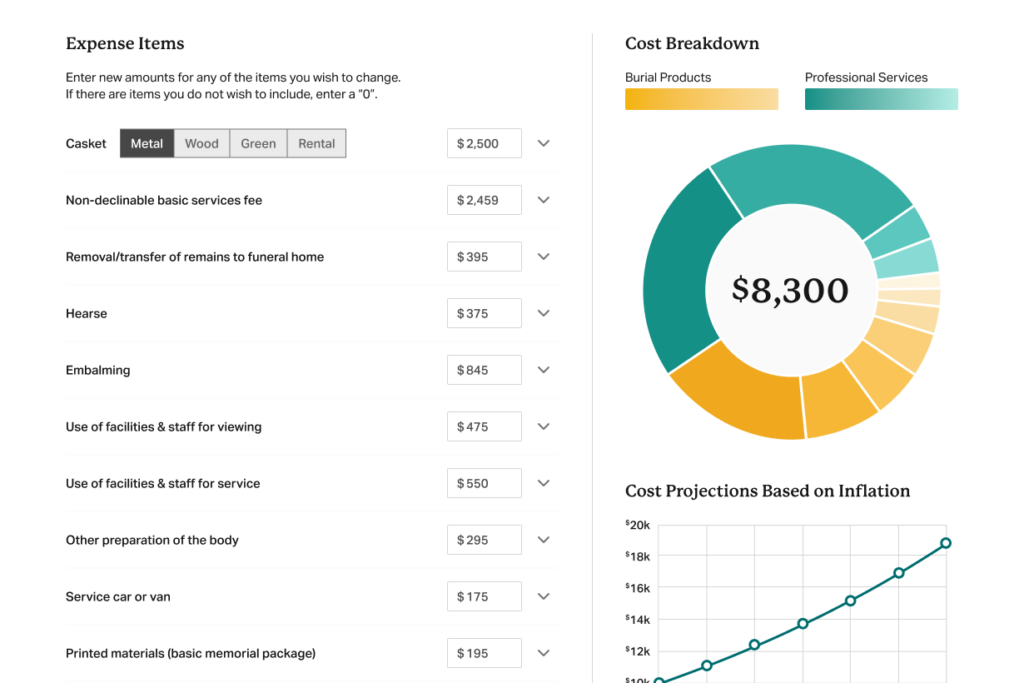

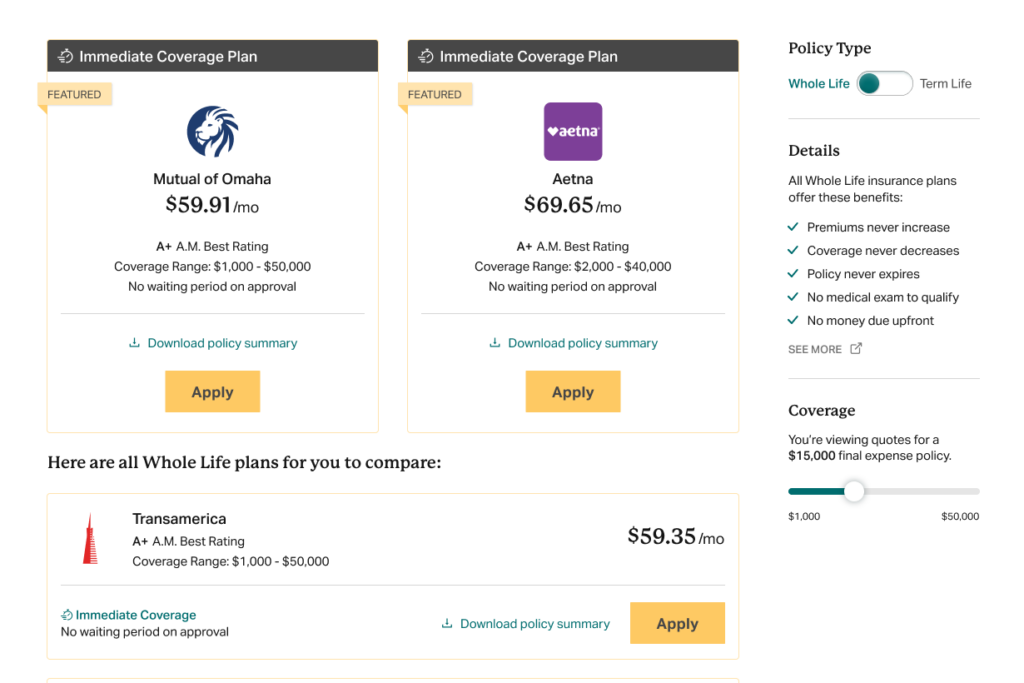

- Coverage typically ranges from $1,000 to $50,000

- Serious health issues will not prevent acceptance

- Your loved ones can spend money with no restrictions

- Most policies have no waiting period

- No health exams required

- Rates are locked in for life and cannot increase

- Coverage is guaranteed to never decrease or expire

- No immediate payment required when you apply

- Fast cash payout typically within 24-48 hours

- Builds cash value

The Choice Mutual Difference

Most Popular Articles

More Articles by Topic

LIFE INSURANCE BASICS

COST CONSIDERATIONS

Now you can compare quotes and find your ideal policy with our easy-to-use mobile app.

- No sign-up or contact information required

- Save your quotes to revisit later

- Completely free to use