State Farm only offers guaranteed acceptance final expense insurance, which has a two-year waiting period. You’ll need to look elsewhere if you want a policy that provides immediate coverage.

There is no question that State Farm is a massive and trustworthy insurance company with tens of millions of policyholders. As of 2024, State Farm was ranked as the single largest Property and Casualty insurer in the USA and ranked as the 8th largest life insurer.

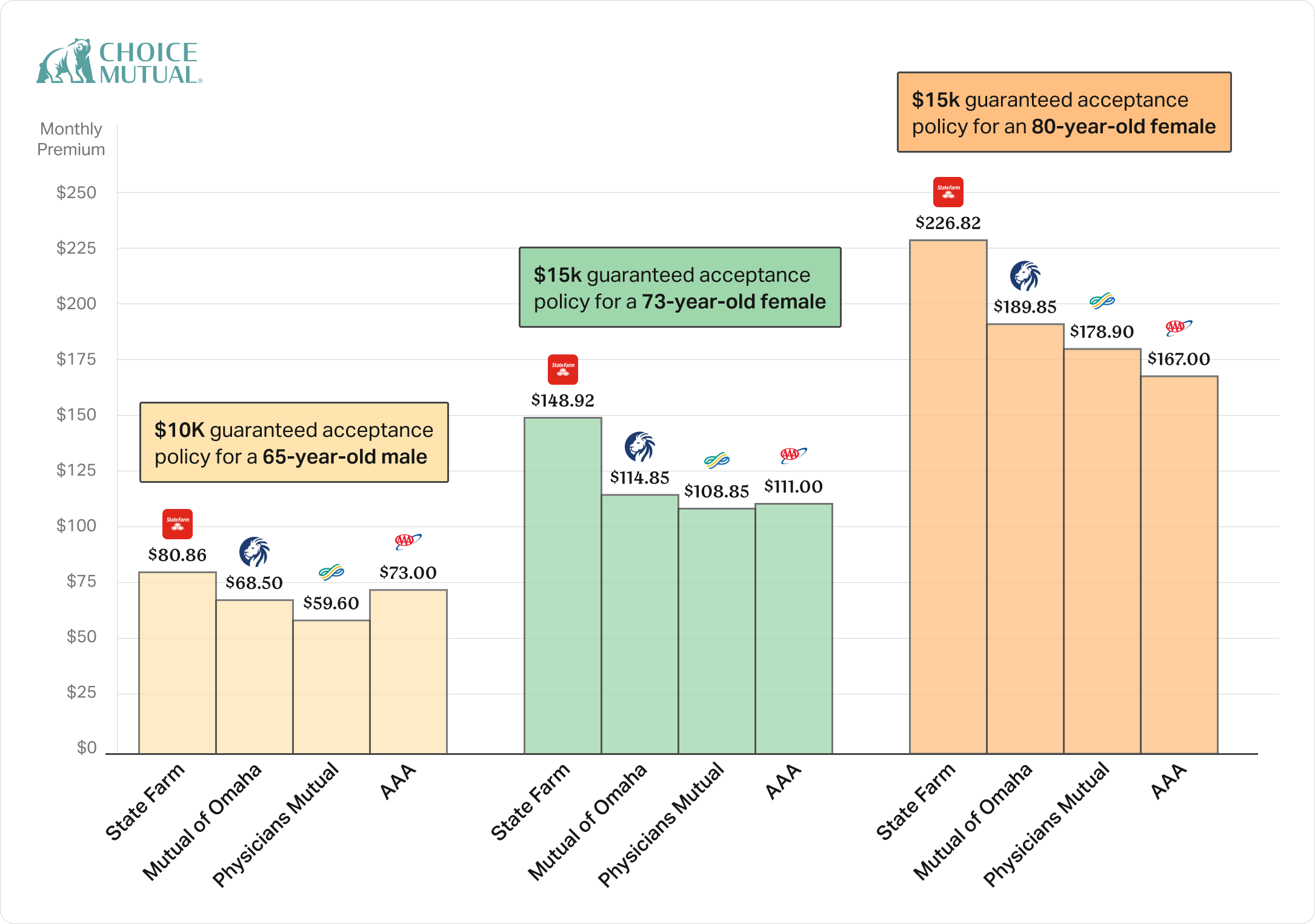

That said, this product is not worth buying (in any circumstance). The core issue is that A) it’s far more costly compared to other providers that offer the exact same plan for substantially less, and B) they don’t offer a burial policy with no waiting period.

Here are some numbers to prove the point. A 65-year-old female seeking $15,000 will pay $94.16 monthly with State Farm. The exact same policy will cost $74.50 with Mutual of Omaha, $68.80 with Physicians Mutual, or $80.00 with AAA. Remember, too, that all these companies are just as financially sound as State Farm.

Sadly, many prominent websites that most people implicitly trust, such as Forbes, Nerdwallet, and CNBC, all claim that State Farm is one of the best burial insurance companies. They are wrong. Those websites only rank State Farm as one of the best because the authors of the articles lack any meaningful knowledge about final expense insurance and because they are paid to promote it.

State Farm is a great insurance company, but this policy they offer is of no value.

- You can’t be declined due to your health history.

- Trusted brand name and best-in-class financial ratings.

- Fixed-rate and coverage lasts forever.

- 2-year waiting period.

- Much higher prices compared to other guaranteed acceptance providers.

- Does not offer burial insurance with no waiting period.

AM Best’s Financial Strength Rating (FSR) is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. The scores range from A++ to D-.

Moody’s Investors Service rates the creditworthiness of companies. The Moody’s Rating Scale has 21 possible scores ranging from “Aaa” (highest mark) down to “C” (lowest mark).

S&P Global Inc. issues credit ratings on a scale from “AAA” (highest rating) to “D” (lowest rating).

The Complaint Index compares a company’s performance to other companies in the market. The National Complaint Index is always 1.00. That means a company with a complaint index of 2.00 is twice as high as expected in the market. Reported scores are for the most recently available year and for “Individual Life” products.

The BBB rating is based on information BBB is able to obtain about the business, including complaints received from the public. BBB seeks and uses information directly from businesses and from public data sources. BBB assigns ratings from A+ (highest) to F (lowest). If a business has been accredited by the BBB, it means BBB has determined that the business meets accreditation standards, which include a commitment to make a good faith effort to resolve any consumer complaints.

How Does State Farm Final Expense Insurance Work?

State Farm’s final expense insurance is a guaranteed issue whole life policy.

You don’t have to complete a medical exam or answer health questions. However, they will only refund 110% of your premiums if you die during the first two years.

Because it’s a whole life policy, it will last forever, and the premiums will never increase and will build cash value.

Assuming you live for more than two years, State Farm will pay out the death benefit directly to your beneficiaries through a tax-free cash payment.

Your loved ones can spend on funeral costs, medical bills, debts, or other end-of-life expenses. If your family has leftover money, they get to keep it.

How Much Does State Farm Burial Insurance Cost?

State Farm guaranteed issue final expense costs $34-$261 monthly for a $10,000-$15,000 death benefit. The exact cost depends on your age, state, and the amount of coverage you want. Below is a table with some sample prices.

| Age & Gender | $10,000 | $15,000 |

|---|---|---|

| Female age 45 | $29 | $41 |

| Male age 45 | $34 | $48 |

| Female age 50 | $35 | $49 |

| Male age 50 | $41 | $59 |

| Female age 55 | $42 | $61 |

| Male age 55 | $51 | $74 |

| Female age 60 | $51 | $74 |

| Male age 60 | $63 | $92 |

| Female age 65 | $65 | $94 |

| Male age 65 | $81 | $118 |

| Female age 70 | $84 | $123 |

| Male age 70 | $104 | $152 |

| Female age 75 | $113 | $166 |

| Male age 75 | $136 | $201 |

| Female age 80 | $153 | $227 |

| Male age 80 | $176 | $261 |

| Source for monthly prices: Choice Mutual quote calculator. Rates are rounded to the nearest dollar, and are valid as of 06/10/2025. | ||

State Farm cost vs some of its competitors

What Are Consumers Saying Online About State Farm’s Burial Insurance?

Truthfully, there is no online platform, such as the Better Business Bureau, Reddit, or Google, that provides feedback (good or bad) about State Farm’s final expense life insurance. The overwhelming majority of their online reviews are about their property and casualty insurance products.

Nevertheless, this does not detract from the fact that State Farm is not an ideal company for those seeking final expense insurance.

Better Companies To Consider For Final Expense Life Insurance

As noted above, State Farm burial insurance is a terrible deal that nobody should buy. Many other companies offer lower rates for the same type of policy. Additionally, State Farm does not offer final expense insurance with day-one coverage, unlike many other providers.

Below are three excellent companies to consider, which are all far superior to State Farm if you need burial insurance.

- $10K Policy Cost $41.01/month*

- New Applicant Ages 45-85

- Death Benefit Options $2,000-$50,000

- 2-Year Waiting Period No

- $10K Policy Cost $48.00/month*

- New Applicant Ages 45-85 (varies by state)

- Death Benefit Options $3,000-$20,000

- 2-Year Waiting Period Yes

- $10K Policy Cost $55.00/month*

- New Applicant Ages 45-85

- Death Benefit Options $3,000-$25,000

- 2-Year Waiting Period Yes

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

State Farm final expense insurance. https://www.statefarm.com/insurance/life/whole-life/guaranteed-issue-life-insurance

-

S&P Global. https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3205015

-

BBB. https://www.bbb.org/us/il/bloomington/profile/insurance-companies/state-farm-insurance-company-0724-6000391

-

Trustpilot. https://www.trustpilot.com/review/www.statefarm.com

-

Google. https://www.google.com/search?q=State+Farm+Insurance%3A+Corporate+Headquarters&sca_esv=f583aec8b3671997&sca_upv=1&ei=nK2qZqGfAcGBm9cP-5WQ0A4&ved=0ahUKEwih3ce8ndKHAxXBwOYEHfsKBOoQ4dUDCA8&uact=5&oq=State+Farm+Insurance%3A+Corporate+Headquarters&gs_lp=Egxnd3Mtd2l6LXNlcnAiLFN0YXRlIEZhcm0gSW5zdXJhbmNlOiBDb3Jwb3JhdGUgSGVhZHF1YXJ0ZXJzMhEQLhiABBiRAhjHARiKBRivATIFEAAYgAQyCBAAGBYYHhgPMgYQABgWGB4yCBAAGBYYHhgPMgYQABgWGB4yBhAAGBYYHjIGEAAYFhgeMgsQABiABBiGAxiKBTILEAAYgAQYhgMYigUyIBAuGIAEGJECGMcBGIoFGK8BGJcFGNwEGN4EGOAE2AEDSJ0HUNYEWNYEcAF4AZABAJgBXKABXKoBATG4AQPIAQD4AQL4AQGYAgKgAmrCAgoQABiwAxjWBBhHwgINEAAYgAQYsAMYQxiKBcICDhAAGLADGOQCGNYE2AEBwgIZEC4YgAQYsAMY0QMYQxjHARjIAxiKBdgBAsICGRAuGIAEGLADGEMYxwEYyAMYigUYrwHYAQLCAhMQLhiABBiwAxhDGMgDGIoF2AECmAMAiAYBkAYSugYGCAEQARgJugYGCAIQARgIugYGCAMQARgUkgcBMqAH4gs&sclient=gws-wiz-serp#lrd=0x880b7010bdb79b1d:0x94213f20eb8e6cda,1,,,,

-

Yelp. https://www.yelp.com/biz/state-farm-corporate-office-bloomington

-

NAIC Complaint Index. https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=69108&REALM=PROD&COCODE=69108&REALM=PROD

-

BBB Score & Accreditation. https://www.bbb.org/us/il/bloomington/profile/insurance-companies/state-farm-insurance-company-0724-6000391

-

Property and Casualty insurer. https://www.reinsurancene.ws/top-100-u-s-property-casualty-insurance-companies/

-

8th largest life insurer. https://content.naic.org/sites/default/files/research-actuarial-life-fraternal-market-share.pdf

-

A.M. Best. https://news.ambest.com/PR/PressContent.aspx?altsrc=3&RefNum=35317&URatingId=-1

-

Moody's. https://www.statefarm.com/about-us/company-overview/why-state-farm

-

Better Business Bureau. https://www.bbb.org/us/il/bloomington/profile/insurance-companies/state-farm-insurance-company-0724-6000391/customer-reviews

-

Reddit. https://www.reddit.com/r/StateFarm/