Assisted living centers provide housing for individuals that need assistance with day-to-day tasks. Individuals pay rent for their room and a monthly service fee to cover meals, assisted care, and other provided services.

The median is $4,500 a month, but costs vary depending on the assistance required and the facility’s location.

Cost Of Assisted Living

The median assisted living cost for a one-bedroom, private residence is $54,000 annually. This estimate includes three specific costs:

- Move-in fee: a one-time entrance fee.

- Rent: a monthly room cost.

- Services: a monthly cost covering meal and care services.

Couples can share a one-bedroom apartment to save on a second rent. Each individual in assisted living is responsible for a monthly service fee based on the care and health services provided. These may include:

- Medical expenses.

- Activities of daily living (ADLs) assistance.

- Utilities (internet, laundry, etc.).

- Transportation.

- Personal expenses.

- Recreational activities.

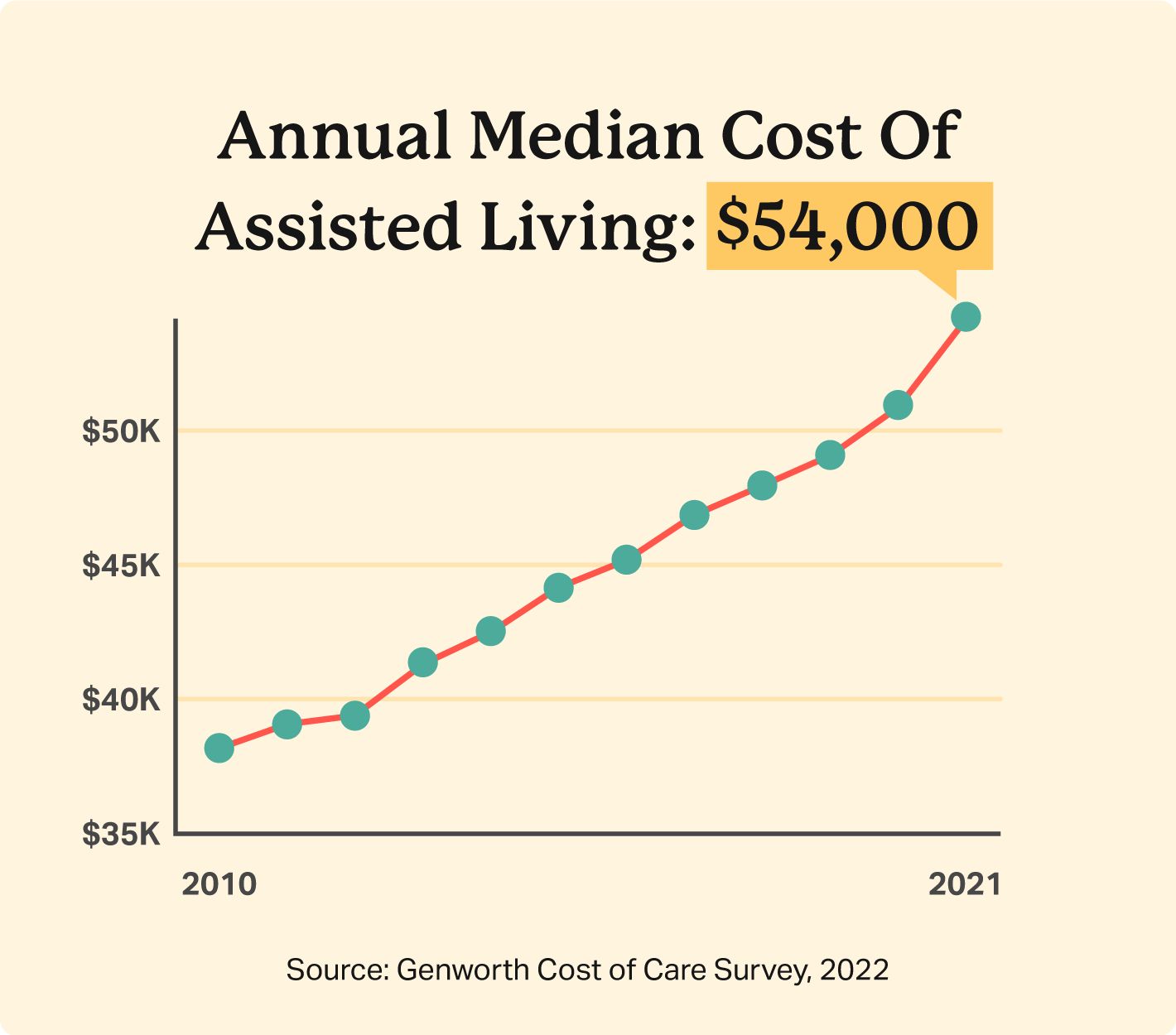

The median cost increased by 5.41% between 2020 and 2021, and annual cost increases are typical. Cost increased at a 4.40% compound annual growth rate over a five-year period between 2017 and 2021.

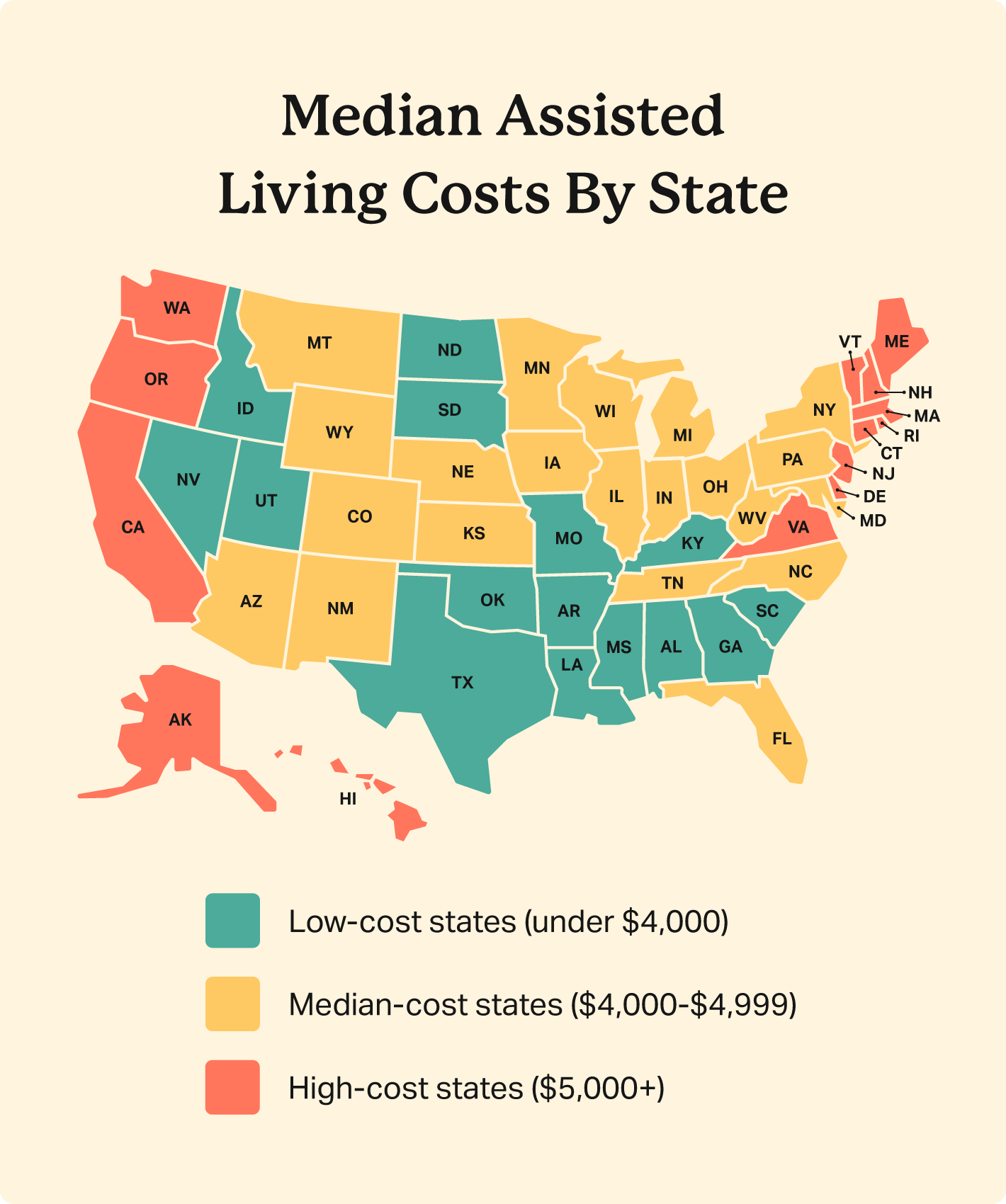

Assisted Living Costs By State

Location is an important cost factor, and median costs vary significantly between states. While the national median cost is $54,000, the highest state median cost is 128% higher than the lowest state median.

Most expensive states for assisted living:

- Alaska: $81,960.

- Rhode Island: $81,915.

- Massachusetts: $78,000.

Least expensive states for assisted living:

- Missouri: $36,000.

- South Dakota: $40,200.

- North Dakota: $40,695.

| State | Monthly | Annual |

|---|---|---|

| Alabama | $3,503 | $42,030 |

| Alaska | $6,830 | $81,960 |

| Arizona | $4,000 | $48,000 |

| Arkansas | $3,760 | $45,120 |

| California | $5,250 | $63,000 |

| Colorado | $4,750 | $57,000 |

| Connecticut | $5,129 | $61,551 |

| Delaware | $5,995 | $71,940 |

| Florida | $4,000 | $48,000 |

| Georgia | $3,535 | $42,420 |

| Hawaii | $5,375 | $64,500 |

| Idaho | $3,838 | $46,050 |

| Illinois | $4,488 | $53,850 |

| Indiana | $4,283 | $51,390 |

| Iowa | $4,367 | $52,404 |

| Kansas | $4,580 | $54,960 |

| Kentucky | $3,448 | $41,370 |

| Louisiana | $3,748 | $44,979 |

| Maine | $5,865 | $70,380 |

| Maryland | $4,900 | $58,800 |

| Massachusetts | $6,500 | $78,000 |

| Michigan | $4,250 | $51,000 |

| Minnesota | $4,508 | $54,090 |

| Mississippi | $3,500 | $42,000 |

| Missouri | $3,000 | $36,000 |

| Montana | $4,450 | $53,400 |

| Nebraska | $4,076 | $48,915 |

| Nevada | $3,750 | $45,000 |

| New Hampshire | $6,053 | $72,630 |

| New Jersey | $6,495 | $77,940 |

| New Mexico | $4,498 | $53,970 |

| New York | $4,580 | $54,960 |

| North Carolina | $4,010 | $48,120 |

| North Dakota | $3,391 | $40,695 |

| Ohio | $4,635 | $55,620 |

| Oklahoma | $3,855 | $46,260 |

| Oregon | $5,045 | $60,540 |

| Pennsylvania | $4,100 | $49,200 |

| Rhode Island | $6,826 | $81,915 |

| South Carolina | $3,612 | $43,338 |

| South Dakota | $3,350 | $40,200 |

| Tennessee | $4,105 | $49,260 |

| Texas | $3,998 | $47,970 |

| Utah | $3,500 | $42,000 |

| Vermont | $5,250 | $63,000 |

| Virginia | $5,250 | $63,000 |

| Washington | $6,000 | $72,000 |

| West Virginia | $4,160 | $49,920 |

| Wisconsin | $4,600 | $55,200 |

| Wyoming | $4,169 | $50,025 |

What’s Included In Assisted Living?

Assisted living facilities provide senior housing and daily assistance while supporting the senior’s independence. As people age, they need more help with activities of daily living (ADLs), but they may not need round-the-clock care. Assisted living meets this middle-ground need between home health care and nursing homes.

ADL services provided commonly include:

- Eating assistance.

- Hygiene and grooming aid.

- Medication management.

- Bathroom assistance.

- Housekeeping and maintenance.

- Recreation and socialization.

This assistance improves a resident’s quality of life and boasts several health and social benefits. It also prevents inexperienced loved ones from shouldering responsibility for assistance and reduces caregiver burnout.

Assisted living is not suitable for seniors that need full-time care or specialized health services.

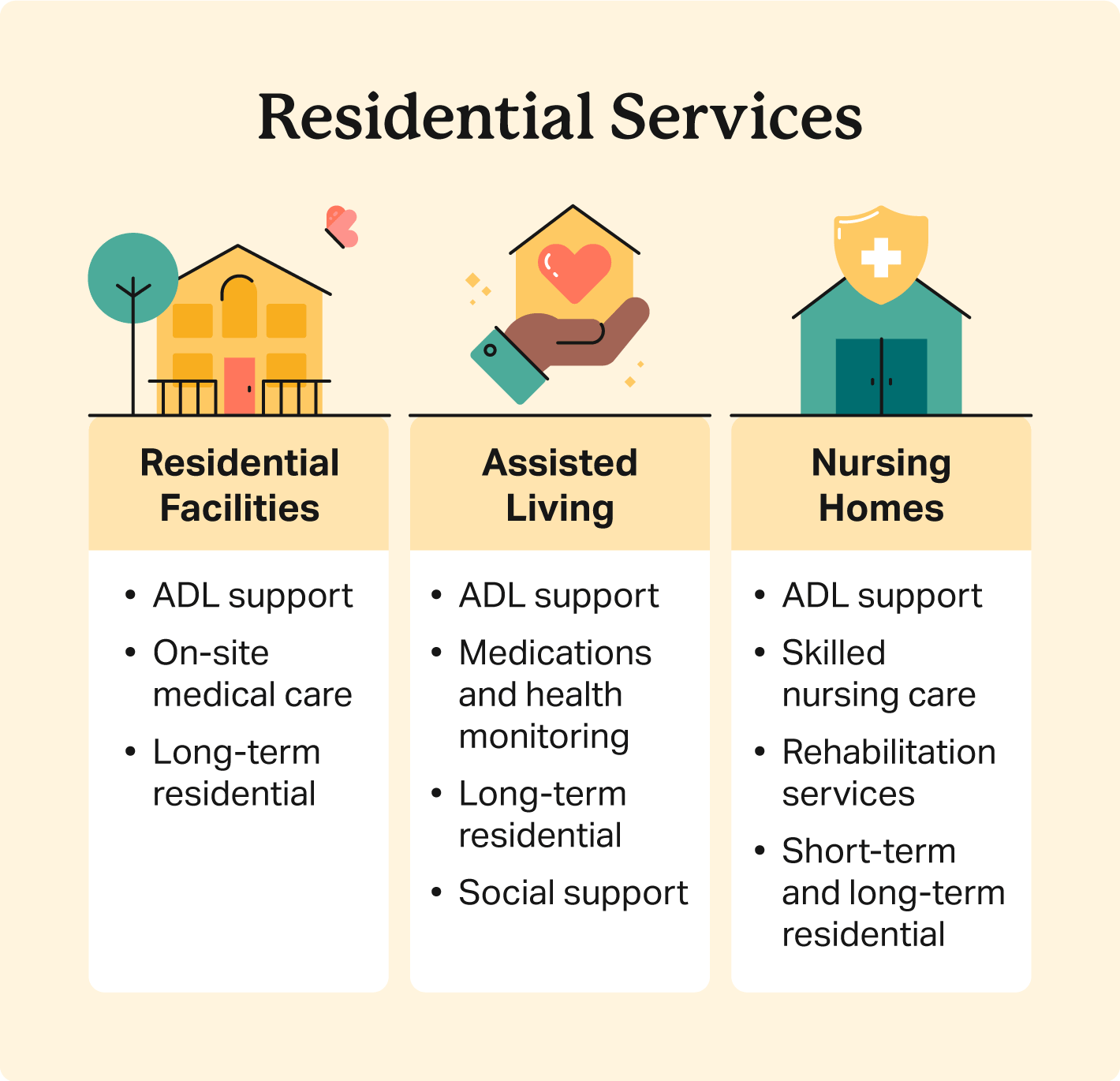

Other Senior Care Services & Costs

A few senior care facilities are available depending on the amount of specialized assistance an individual needs. These include:

- Residential facilities: private facilities that provide 24/7 care assistance and meals. These don’t provide on-site medical care.

- Assisted living: residential communities that offer private rooms and different levels of support, including medical care, personal care, and social support.

- Nursing homes: facilities with skilled nursing staff to provide full-time medical care and rehabilitation services.

Various home and community care providers that don’t offer housing, but still support senior well-being and independence.

- Homemaker service: home maintenance and care services, including cooking, cleaning, and errands.

- Home health aide: provide daily care services for those aging at home, including ADLs and health monitoring.

- Adult day health care: community-focused support for supervised socialization and recreation.

| Service | Median Cost |

|---|---|

| Assisted living | $4,500 (monthly) |

| Nursing home | $260-$297 (daily) |

| Homemaker service | $26 (hourly) |

| Home health aide | $27 (hourly) |

| Adult day health care | $78 (hourly |

How To Pay For Assisted Living

Many families pay for assisted living costs with private funds, including savings or retirement income. At a median monthly cost of $4,500, this isn’t accessible to all families at a median monthly cost of $4,500. However, there are assistance programs to help seniors and their families cover the costs of assisted living.

Health insurance

Existing health insurance plans may contribute to assisted living care, depending on your care needs and policy. These generally only apply to health care services, so you may not cover rent and personal care costs.

Medicare may pay for health care expenses like injection fees. It won’t pay for ADL assistance like bathing.

Medicaid may cover assisted living health costs, depending on Medicaid state coverage, but not all assisted living communities accept Medicaid.

Long-term care insurance may cover assisted living costs once the policyholder can’t perform two ADLs without assistance.

Private health insurance policies may cover health care costs but won’t finance personal care assistance.

Life insurance

Life insurance generally provides a death benefit when the policyholder passes, but there are ways to access permanent life insurance cash benefits while the policyholder is alive. Then you’re free to use these funds as you see fit — including purchasing assisted living care.

Withdrawing cash value from the account treats the policy as a savings account, so you can access the accumulated cash you need, but it reduces your death benefit.

Surrendering your policy to the life insurance company allows you to take out a larger sum, but you forfeit the policy and won’t receive any death benefits.

Selling the policy through a life settlement also allows you to receive a large lump sum in exchange for forfeiting your policy, but it’s less than your death benefit.

Personal credit and assets

If you don’t have the finances upfront, you can tap into various personal credit lines to pay for assisted living. You may also consider selling existing assets to make up the cost difference.

Home equity is the value someone owns in their house compared to the balance owed to the lender. You can tap into this with a home equity loan, which allows you to keep the home. You can also sell the property for a larger sum but lose ownership.

Private loans may also be an option but not a long-term solution. A personal loan can help cover move-in costs, while a bridge loan can help cover costs while you wait for a home or other asset to sell.

Veterans assistance

Eligible service members, veterans, and their spouses may qualify for monthly pension funds with an increased allowance for daily care assistance. Maximum benefits vary based on assets, income, needs, and dependents.

| Annual Pension Rate | Without Dependents | With 1 Dependent/Spouse |

|---|---|---|

| Without Assistance | $16,037 | $21,001 |

| With Household Benefits | $19,598 | $24,562 |

| With Aid and Attendance Benefits | $26,752 | $31,714 |

Senior Assistance With Life Insurance

Aging affects our health and mobility in ways that increase our need for daily assistance. Assisted living facilities provide necessary care services without sacrificing a senior’s independence, but with a median cost of $4,500 a month, retirement income isn’t always enough.

Permanent life insurance accumulates cash value that families can access to pay rising care costs. Untapped benefits are paid out to a beneficiary to cover funeral costs or contribute to an inheritance, so you know your family is always taken care of.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that are known to provide accurate information. You can learn more about our editorial standards, which guides our mission of delivering factual and impartial content.

- The median is $4,500 a month. https://pro.genworth.com/riiproweb/productinfo/pdf/131168.pdf

- Activities of daily living (ADLs). https://www.ncbi.nlm.nih.gov/books/NBK470404/

- 4.40% compound annual growth rate. https://www.genworth.com/aging-and-you/finances/cost-of-care/cost-of-care-trends-and-insights.html

- vary significantly between states. https://www.genworth.com/aging-and-you/finances/cost-of-care.html

- help with activities of daily living (ADLs. https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

- senior care facilities are available. https://www.nia.nih.gov/health/residential-facilities-assisted-living-and-nursing-homes

- monthly pension funds. https://www.va.gov/pension/veterans-pension-rates/