If you’ve ever been concerned about how your family would handle paying for your funeral, exploring your options for covering those costs in advance may bring you peace of mind. A prepaid funeral plan through a local funeral home will enable you to take control and ensure that your funeral arrangements are paid for and executed exactly how you want.

We spoke with industry expert J Scott Burke, a licensed funeral director and co-founder of FEX Contracting, to understand how prepaid funeral plans work, the benefits and disadvantages, and alternative options worth considering.

What Is A Prepaid Funeral Plan?

A prepaid funeral plan is an arrangement you make with a funeral home to pay for your funeral services and goods in advance. It’s like pre-ordering your own funeral and can be a smart addition to your estate planning checklist.

Locking in a prepaid funeral plan protects you from rising costs further down the road. Once signed, you can pay in full upfront, set up installments, or use a combination depending on your budget. Installment payment plans usually span over three, five, or ten years.

The primary providers of prepaid funeral plans are funeral homes themselves. They typically offer various plan options, allowing you to customize details and choose services that align with your wishes and budget.

Some life insurance companies may offer products specifically designed to cover funeral expenses. There also might be smaller independent funeral service providers in your area who offer prepaid options.

What’s Covered?

Prepaid funeral plans can cover various expenses related to your final wishes, including embalming, casket, funeral home costs, and more. The total dollar amount covered will depend on the total of the projected costs of your specific funeral. The amount could range from $2,000 to $10,000, on average.

The details will vary depending on the plan you choose and the funeral home you work with. Your prepaid funeral contract will list the items that are “guaranteed,” which means the cost of these items is guaranteed to be fully covered regardless of what they may cost in the future.

Commonly covered items include:

- Funeral home fees: This includes staff services, use of facilities for visitation or the ceremony, and administrative costs.

- Basic services: Embalming, dressing, and transportation of the body are usually included.

- Casket or urn: Depending on your choice (burial or cremation), the plan may cover the cost of the casket or urn.

- Death certificate fees: Handling the process of obtaining official death certificates can also be part of the plan.

Some plans might offer optional add-ons, such as:

- Funeral ceremony: Flowers, music, catering, and other ceremony elements can be included, depending on your preferences.

- Clergy or officiant fees: If you plan to have a religious ceremony, your prepaid plan can cover the cost of the officiant.

- Vault or burial plot: This typically needs to be purchased separately from the cemetery, though some plans might offer bundled options.

- Memorial service: Costs associated with a post-funeral gathering can be included in some plans.

Be sure to read your plan’s fine print before signing to understand what’s covered and any exclusions. Sales tax and gratuities may be added separately from your plan.

Types Of Plans

Not all prepaid funeral plans are alike. These are the three most common ways to set one up.

- Pre-need insurance policy: This functions similarly to life insurance but is specifically designed for funeral expenses. You pay the premiums over time, and the death benefit goes towards your funeral costs. Since it’s technically a type of life insurance policy with the funeral home as the beneficiary, there is a qualification component you must pass. The representative at the funeral home will ask you some questions about your health history, but you cannot be turned down. They will accept everyone regardless of what ailments you may have.

- Revocable trust: This allows you to set aside funds for your funeral in a trust account. You retain control over the money and can change the plan as needed. A major benefit of this option is that the funds in the trust typically avoid probate, expediting access to the necessary money for the funeral home. But, a revocable trust does not offer any tax advantages.

- Irrevocable trust: This option offers the strongest guarantee of protecting your funds for funeral expenses. You place your funds in the trust, and once established, you generally cannot take the money back. This also means the IRS or creditors won’t see that money as taxable income. The money can only be accessed once the trust’s predetermined circumstances have been met.

If you go with the pre-need policy option, the results of your health history screening results will impact how quickly your coverage could take effect. If you’re deemed healthy, you’ll most likely receive immediate coverage. The other result would be graded coverage, which means you’re not covered during the first 12 months.

During the 12-month waiting period for graded coverage, you would receive a refund equal to all the payments you’ve made (plus interest). After 12 months, 70% of the funeral expense would be paid out. The remaining 30% could still be paid out, but that is subject to the outcome of the contestability clause.

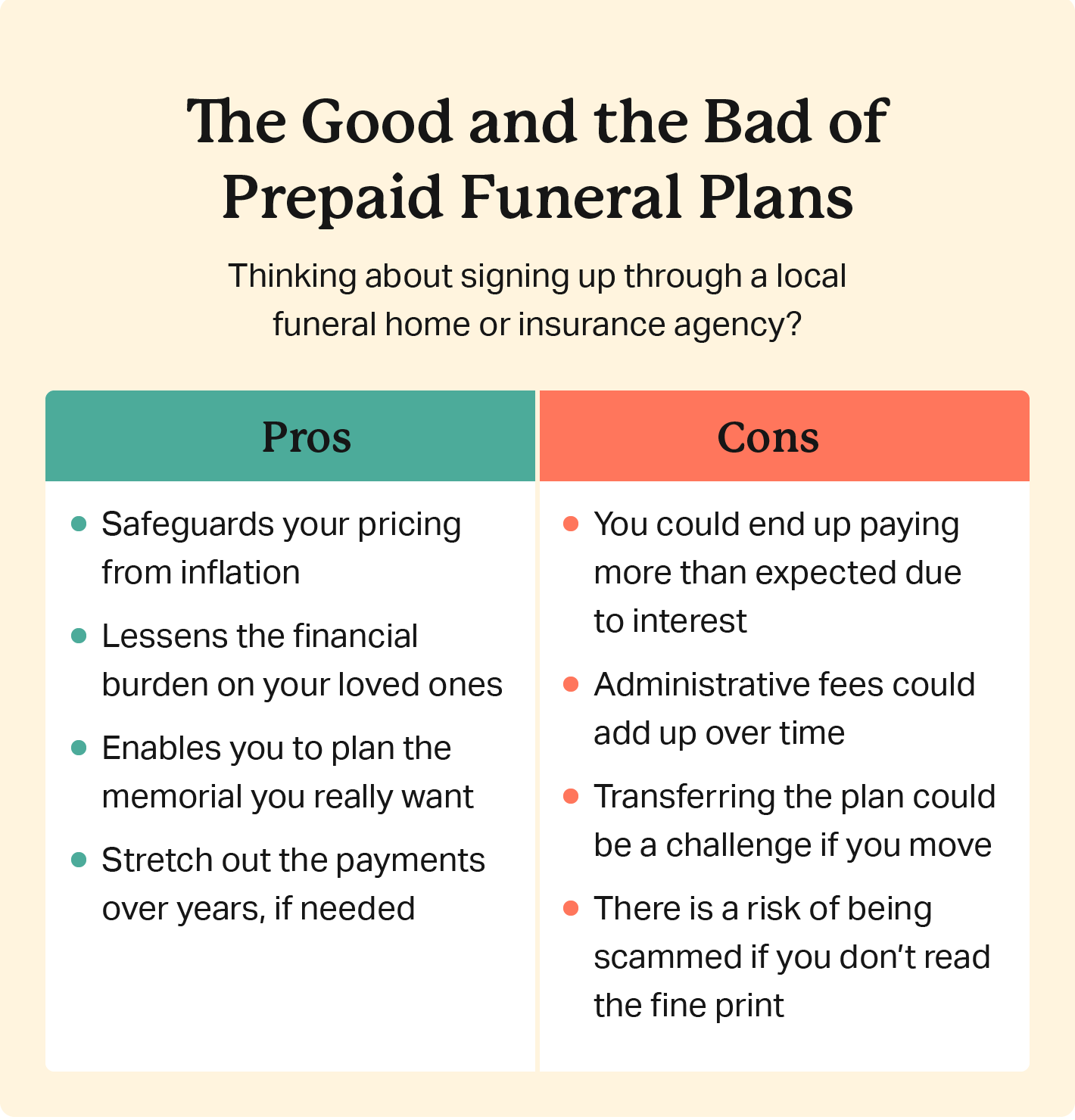

Pros And Cons

Like any investment, paying off your funeral costs in advance has potential benefits and disadvantages.

Pros

- Protection against inflation: You pay for everything upfront or in installments, locking in the cost at today’s prices and protecting your loved ones from inflation.

- Peace of mind for your family: Your family doesn’t have to worry about the financial burden or making difficult decisions during a difficult time. They can focus on grieving.

- Plan out your personal wishes: You get to decide what kind of funeral you want, including things like burial or cremation, the casket or urn, and any ceremony details.

- Payment options over time: You can better strategize how you’ll cover the costs associated with funeral planning.

- Option to plan for a loved one: You can set up a plan for someone else without them being involved. For example, if your parent or spouse is terminally ill, you can walk into a funeral home and preplan everything.

Cons

- Potential for Overpayment: If interest rates on the plan are lower than inflation, you could end up paying more into the plan than the eventual cost.

- Funeral Home Fees: Management and administrative fees associated with the plan can add up, especially with financed monthly payments.

- Limited Portability: Most plans are tied to a specific funeral home, and if you move or your family chooses a different location, transferring the plan might be difficult. (Setting up a revocable trust for your plan could solve this potential problem.)

- Risk of scams: There have been instances of funeral homes embezzling money from prepaid funeral plans and leaving the surviving family members holding the bag when they tried to file a claim.

How Much Do Prepaid Funeral Plans Cost?

You can expect a prepaid burial plan to cost $2,000-$10,000. If you opt to make monthly installments, expect to pay $125-$300 per month, depending on the total cost, age, and installment period. Similar to the cost of funerals in general, the cost of a funeral preplan is heavily influenced by your preferences, age, and region.

Below is a more detailed breakdown of the average cost of prepaid funerals depending on how you want to be remembered:

- Direct cremation (no funeral service): $2,000-$4,000

- Cremation with a funeral: $6,500-$8,500

- Direct burial (no funeral service): $3,500-$4,000

- Burial with a funeral: $8,000-$10,000

As you can see, what type of funeral you prefer will greatly influence how much your pre-paid funeral plan costs.

Single premium vs. monthly installments

There are two basic types of payment plans to consider for a prepaid funeral plan: Single premium and monthly installments. The single premium option requires you to immediately cut a check for the full amount of your funeral. By doing so, no further payments are needed. Or you can opt to make monthly installment payments over several years.

The typical installment periods are three, five, and ten years if you are 85 and below. This can be useful if cutting a check to cover the total amount isn’t feasible for you. If you opt for monthly payments, your total payments will most likely exceed the total cost of your prepaid plan due to interest rates and fees.

If you are over the age of 86, you will most likely only be given the option of a single premium.

Are prepaid funeral plans covered by Medicaid?

Prepaid funeral plans are not specifically covered by Medicaid. In fact, most Americans don’t have access to any Medicaid funeral assistance.

However, prepaid funeral plans can be useful in helping you qualify for your state’s Medicaid asset limits. If your prepaid plan is set up in a trust, those funds are not counted toward the total value of your personal assets measured when determining your Medicaid eligibility.

How To Pay For Your Plan

If you opt for the single premium options, your lump sum contribution will go into either a trust or a life insurance policy, both of which earn interest. The interest that accrues over time is why you are able to lock in rates now since it offsets the future cost of your funeral.

If you choose the monthly payment plan, your money will be paid to a life insurance company. In most cases, the funeral home will set you up with a pre-need funeral insurance plan.

A pre-need policy is actually a life insurance policy where the funeral home is the beneficiary. Note that you will not be allowed to make someone other than the funeral home as the beneficiary.

Funeral director J Scott Burke advises, “Under no circumstances should you ever make a payment directly to a funeral home. If your money goes to a life insurance company or a bank, there is no way your money can be embezzled.”

What is the contestability clause?

A contestability clause is present in every pre-need funeral insurance policy, and it grants the life insurance company the right to investigate the claim before paying out the benefit. Essentially, they want to make sure you answered the health questions accurately when you originally applied.

Applicable only to those who’ve opted to make monthly payments, the insurance company will order a copy of your medical records. If there is no evidence that you answered the questions improperly, they will pay the claim in full, including the full cost of your funeral.

If they find evidence of a health issue(s) that contradicts your answers on the health questionnaire, they will not pay the claim. Instead, they will simply refund the money you have paid thus far, and your family will have to find a way to pay for your funeral through some other means.

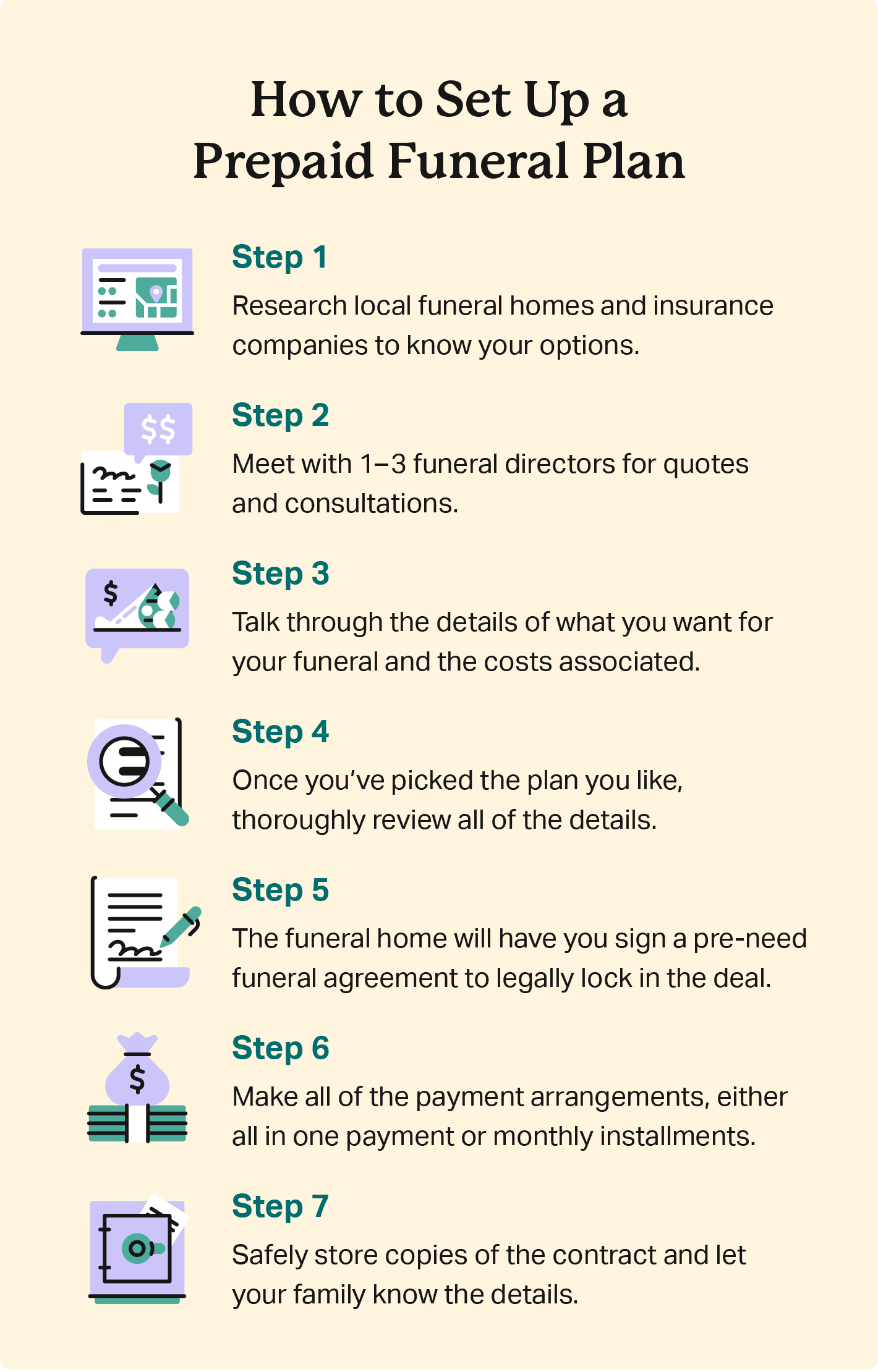

7 Steps To Planning A Prepaid Funeral

Taking the time to research, discuss, and plan ahead will allow you to ensure that your preferences are known and understood. Knowing where to start may be daunting, but we are here to help empower you to take control.

Follow these simple steps to establish a prepaid funeral plan for your future.

- Research available options in your area:

- Research different funeral homes or insurance companies to discover what their prepaid funeral plan options are. Consider factors like location, reputation, and available services.

- Don’t feel pressured to choose the first plan you find. Get quotes from different funeral homes to compare options and pricing.

- Schedule a consultation:

- Contact one or more of the funeral homes on your preferred list to schedule a consultation with a funeral director.

- Plan and customize:

- Discuss your funeral wishes in detail during your consultation. This should include the type of funeral service (burial, cremation, etc.), the desired casket or urn, and any specific ceremony preferences.

- The funeral director will present several plan options based on your needs and budget. You can customize most plans to include specific services, unique details, and preferred products or vendors.

- Review and understand the costs:

- Carefully review the plan details, including a breakdown of the covered items, any additional fees, the total cost, and cancellation policies. Now is also the time to ask questions about your payment options.

- Finalize the agreement:

- Once you’re comfortable with the plan details and costs, you’ll sign a pre-need funeral agreement, which serves as a legal contract outlining the specifics of your arrangements.

- Funding the plan:

- Depending on your chosen payment option, you’ll need to make the necessary arrangements to fund the plan. This could entail a lump sum payment, setting up monthly installments, or using a designated funeral trust account.

- Keep copies and share information:

- Save copies of the signed agreement and any plan documents for your records. Be sure to inform your family members about your prepaid funeral plan, including where you’ve stored the documents and the funeral home’s contact details.

Other Funeral Funding Options

If a prepaid funeral doesn’t sound like a good fit for you or your budget, there are other options you can pursue to ensure you take care of the financial aspect of your future funeral.

Funeral trust

You can elect to set up a funeral trust (often done with the help of an attorney) where the deposited funds are specifically earmarked for your funeral expenses. You can elect these trusts to either be revocable or irrevocable.

Payable on-demand accounts

A payable on-demand account (aka POD) is a special bank account set up through a traditional bank or credit union. The account holder designates beneficiaries to receive the funds in the account upon death. Sometimes also referred to as Totten trusts, you are free to deposit and/or withdraw funds from this account any time you please.

If you do not want to prearrange a funeral plan formally, a POD account is a great way to set aside funds for your funeral because it avoids probate. Your beneficiaries must simply provide evidence of the account holder’s death (usually via a death certificate), and the funds can be procured.

Potential downsides of a POD account include:

- If you have unpaid debts or taxes, the funds in your POD account may be vulnerable to claims by creditors and/or the government. In fact, the funeral home bill is legally ahead of the IRS in the line of creditors.

- If you live in a community property state, your surviving spouse has the right to half of the assets in your POD account. The only time that is not the case would be if the funds were acquired before the marriage.

Joint bank account

If a bank account has one owner and they die, the funds are unavailable until the estate is settled, which can take months. However, if two people are on the bank account and one passes away, the surviving account owner still has full access to the funds in the account.

Buying final expense insurance

Final expense insurance, commonly known as burial insurance or funeral insurance, is generally a whole life insurance policy with small death benefit options and little to no underwriting. It offers monthly payments ranging from $125-$300. Seniors, regardless of health, can qualify, and the benefits on these plans usually pay out within 24-48 hours.

Depending on your health upon sign-up, you may have to endure a full or partial waiting period before your benefits kick in. Some senior final expense insurance plans will cover you 100% on day one, but many burial insurance companies won’t pay out the full death benefit unless your policy has been in effect for two years.

The main difference between final expense life insurance and a prepaid funeral plan is the insurance policy will pay out a tax-free cash benefit directly to your beneficiary(s). The money is not paid to a funeral home unless you were to name them as the beneficiary.

There are never any restrictions on how the money is used, so it can be used for other expenses, such as unpaid debts if needed. And any leftover money stays with your loved ones to use as they see fit.

Existing life insurance

If you currently have a life insurance policy, the proceeds from it can certainly be used for your funeral costs. Double-check your account to see how much coverage you have to ensure it will provide enough payout to cover your desired services.

In addition, be sure to verify which type of life insurance it is. Some forms of life insurance expire after several years (called term life insurance). Another type of coverage operates as a pseudo-investment account (called universal life insurance), which may require large payments later in life.

No matter how you choose to do it, planning for your final expenses will help remove that burden from your loved ones. A prepaid funeral plan can become a gift of relief for both you and your family.

Plan Ahead For You and Your Loved Ones

Taking the time to plan your own funeral can be intimidating, but doing so can provide you and your loved ones some peace of mind. Doing the same for a loved one, whether it’s a parent, spouse, or any special person in your life, becomes a gift you can give them.

Frequently Asked Questions

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that are known to provide accurate information. You can learn more about our editorial standards, which guides our mission of delivering factual and impartial content.

- FEX Contracting. https://fexcontracting.com/

- payable on-demand account. https://www.investopedia.com/terms/p/payableondeath.asp