Planning your own funeral and memorial service probably isn’t your idea of a fun way to spend a weekend. Most people don’t do it, leaving the deceased’s closest surviving family members to handle these morbid tasks.

The usual way of doing things makes sense when someone young dies suddenly and unexpectedly. But one of the only things worse for your survivors than losing you is having to decide what to do with your body, how to honor your life, and how to pay for it—during some of the most difficult moments in their lives.

It takes courage to confront your death, so we commend you if you’re thinking about making your own final arrangements. Most importantly, your loved ones may be relieved to know that they’re carrying out your wishes and not guessing what you would have wanted.

Read on to learn everything you need to plan or skip ahead to the complete checklist.

1. Choose A Funeral Home Or Mortuary

One of the first things your family will have to decide if you don’t make your own final arrangements is who should pick up your body.

It’s an important decision because once a particular funeral home or mortuary picks up your body from your place of death, there’s often a hefty fee to transfer it. That means that your survivors may be locked into that company’s facilities, services, and pricing.

| Funeral Homes | Mortuaries |

|---|---|

| Full range of services including: arranging + hosting a funeral and memorial gathering, helping place an obituary in the local paper | More focused on preparing the body for burial or cremation. |

| Typically more expensive | They may charge less than funeral homes |

You’ll want to see what’s available in your area, whether they offer all the services you and your loved ones are likely to want, and what different facilities charge. You may want to pick a first, second, and third choice in case places go out of business, change significantly, or are unavailable at the time of your death.

2. Decide On Burial, Cremation, Or Both

You have quite a few options for what happens to your body after you die—perhaps more than you realize. Ask yourself the following questions:

- Do you want to be buried or cremated immediately (direct burial or direct cremation), or should there be a funeral first?

- If you want a funeral, do you want your body to be placed in a casket?

- If so, do you want your body to be embalmed (preserved)? You’ll need to choose this option if you want an open-casket funeral. It’s optional if you want a closed casket.

- Do you want an open-casket or closed-casket funeral?

- Do you want to be buried or cremated?

- If you want to be buried:

- Should it be a traditional burial in a vault or a natural burial?

- If you want to be cremated:

- Should it happen before or after the funeral?

- Which cremation process would you prefer, such as traditional flame cremation or alkaline hydrolysis (water cremation)?

- Do you want your cremated remains to be buried, scattered, kept in an urn at home with your loved ones, or some combination of those options?

All of these choices have different prices and environmental impacts.

| Direct cremation (no funeral service) | $2,000 to $4,000 |

| Cremation with a funeral | $6,500 to $8,500 |

| Direct burial (no funeral service) | $3,500 to $4,000 |

| Burial with a funeral | $8,000 to $10,000 |

The cost of cremation compared to the price of a traditional burial, along with religious beliefs and cultural traditions, usually guides people’s decisions about burial vs. cremation.

Consider registering as an organ donor

Registering as an organ donor in your state may allow you to do one last good deed. You could save the lives of up to eight people and improve the lives of another 75 by donating your organs. That’s a pretty incredible way to leave a legacy.

Your choice to donate your organs could restore someone’s sight, help a burn victim, or get someone off dialysis, to name just a few positive outcomes. But it’s important to tell your family about your decision so they won’t be caught off guard and can help ensure your wishes are carried out. Remember, every minute counts in saving organs after death.

Your doctors will still do everything possible to save your life. Also, organ donation usually won’t prevent your family from having an open-casket funeral.

Consider donating your body to science

If you aren’t an organ donor, donating your body to science is another option for helping others. Your anatomical gift can help train students and professionals in surgical procedures, health education, mortuary science, and medical device development.

To donate your body to science, it’s a good idea to choose your recipient organization and register in advance because some programs only accept pre-registered donations.

You’ll usually need to choose a place within 150 miles of your home. Examples of businesses that accept anatomical gifts include:

- Mayo Clinic

- Northern Michigan University Center for Forensic Anthropology

- Stanford Medicine

- University of Arizona College of Medicine Tucson

- University of California

- University of Michigan Medical School

- University of Minnesota Medical School

- Western Carolina Forensic Osteology Research Station

Recipient organizations for body donation exist throughout the United States.

You’ll also want to talk with your family about your wishes since some organizations will not accept body donations against a family’s wishes, even if you’ve registered with that program.

While your family can still mourn your loss with a funeral or memorial service, they may not have possession of your body, meaning an open-casket funeral may not be an option. The recipient may cremate your remains after use but may not be able to return the cremains to your family. Policies vary by program.

Body donation not only helps others but can also save your family from the expense of burial or cremation. Some anatomical gift programs hold annual memorial services for their donors’ families and friends. This can be an excellent way to connect with others who are grieving and whose loved ones made the same choice.

You’ll need to make alternate arrangements if your body isn’t eligible for donation when you die. Possible reasons why your anatomical gift could be rejected include not being close enough to a facility that can accept your body, dying with an infectious disease, dying of sepsis, dying in an accident, or exceeding a certain weight.

3. Select The Type of Funeral Service

How do you want your friends and family to come together to mourn you? What type of funeral service do you prefer? Who would you like to be there? Planning an end-of-life event is a lot like planning a wedding, except it’s often done at the last minute, and, of course, the vibe is less upbeat.

Consider the tone of the event you’d like people to honor you, what fits your personality, and what would be most helpful to those you will leave behind.

Here are a few more things to think about when choosing a service type.

Funeral vs. celebration of life

A funeral is a traditional, formal, structured event that often includes religious and cultural rituals. It’s usually held at a funeral home, where the deceased’s body is usually present and placed front and center in a coffin or urn, along with opulent floral arrangements like standing sprays and wreaths.

At a funeral, religious leader or funeral director leads the service, which typically includes a eulogy. It may also include music and prayers, Bible verses, or poems. Also, attendees often wear black.

A celebration of life, on the other hand, is a modern event that may not include religious or cultural elements. It isn’t held at a funeral home but rather at a more casual and upbeat location. The deceased’s body is usually not present, and there is little to no structure to the event.

The celebration of life gathering may include a slideshow and allow attendees to share their favorite stories about their deceased friend or relative. People usually dress casually and may wear something that honors the deceased, like their favorite color.

Memorial service vs. celebration of life

A memorial service is a more traditional way of communing with others who want to support each other and remember their friend or family member. It often comes right after a funeral or burial service and tends to be a more somber occasion.

A celebration of life is a more modern way of dealing with someone’s passing. It tends to reflect more on the positive ways the deceased impacted others and less on a sad event.

It might be held several weeks or months after the death when feelings of grief may be less intense. It might be a simple gathering at a park, someone’s house, or a restaurant with less planning and expense.

A celebration of life can also be a good choice if it’s possible that family and friends from out of town won’t be able to gather on short notice for a funeral or memorial.

You don’t have to choose only a memorial or only a celebration of life. Each event can serve a different purpose. Your loved ones might want to do both.

You can always plan more than one event and leave it up to your survivors what they want to do when the time comes.

4. Plan Out Your Funeral Service Details

If you’re going to have a funeral, where should it be held? The most common options are a funeral home or a house of worship, but it can even be held at someone’s home.

Funerals usually follow certain rituals. If you’ve served in the military or been a member of a fraternal society, cultural organization, or religious group, you might choose to use their rituals — which often means they’ll send people to carry out your funeral service.

In fact, if you’re a veteran, you may be eligible for benefits that can help pay for your final expenses.

It’s also possible that you don’t want a funeral held in your honor. There’s nothing wrong with that. But let your loved ones know so they don’t have to plan or pay for something you didn’t even want. Here are a few more decisions you’ll want to make.

Create a guest list

The important people in your life may change between now and your death. However, it’s worth creating a list now of everyone you would want to be informed of your death.

It will help your survivors know whom to notify and give everyone who cared about you a chance to attend your funeral.

Select the attire

What do you want people to wear? All black? Formalwear? Bright colors? Your favorite sports team’s gear? Anything they want?

Sometimes, people aren’t sure what to wear to a funeral, memorial, or celebration of life. If they know what you would have preferred, it can help them choose an outfit that they feel will honor you appropriately.

Choose the foods and drinks

Some people won’t have much appetite after you die. Others will be starving after sitting through a service. Either way, no event is complete without food and drinks, so think about what you’d like to be served.

Your hosts could serve appetizers, lunch, dessert, or all three. If you have a favorite cuisine, restaurant, or family recipe, start there. Maybe you’d like everyone to enjoy your favorite chocolate chip cookies and coffee or street tacos and beer.

Speaking of beer, consider whether you want alcohol served at this event. If you have friends or relatives who behave poorly after drinking, you might want to skip it.

Select flowers and other decor

You might want to choose specific types of flowers that are traditionally used in funerals or have particular meanings. Examples include cut lilies, peace lily plants, roses, and carnations.

You might want to choose your favorite flowers. It may be challenging to select a specific florist or exact arrangements, but you can at least give your loved ones an idea of what you’d like.

Some people also like to have a table at the funeral parlor or memorial service entrance displaying meaningful objects like trip mementos, collectibles, or sports memorabilia.

Survivors often like attendees to sign a guest book and perhaps leave a condolence message or write down a special memory on a card or in the guest book.

Make a playlist

This step is optional, but some people like the idea of having their favorite songs played at their memorial service or celebration of life. If that sounds like you, make a playlist of meaningful songs.

It might be best to make it a written list that you email to loved ones because any music service you use may not be accessible after you pass.

Choose your favorite photos

Many people display oversized photos of the deceased on easels at remembrance services. Obituaries often include photographs, too. And it’s become common to play a slideshow of the deceased showing the important people and occasions in their life.

Putting together a folder of your favorite high-resolution photos can make these tasks easier for your loved ones — and make sure your legacy isn’t a grainy photo you dislike.

Identify helpers

Family and friends alone can’t handle all the tasks involved in the various ceremonies and commemorations that follow a person’s death.

They have too many logistical details to deal with, like getting death certificates and closing accounts. They’re going through one of the worst emotional experiences of their lives and may not be eating or sleeping well.

Perhaps most importantly, they want to be present at each event so they can process their emotions, take in the experience, and interact with guests. It will be a big help if you identify church or synagogue members, neighbors, or businesses who can help set up tables and serve food.

Optional graveside service

Instead of or in addition to a funeral, you might want to have a graveside service if your body or cremated remains will be buried.

Some choices you should think about here include:

- whether you want your body transported in a hearse

- whether you want a funeral procession

- who should conduct the ceremony

- whether you’d like to have attendees place flowers in your grave

- how the weather might impact your wishes

5. Select Your Casket Or Urn

Picking out a casket or urn can be fraught with emotion for your survivors and result in them spending more money than you would have liked. While you might be okay with being buried in a wholesale-priced casket from Costco, your loved ones might feel it’s disrespectful to order your coffin online or try to get a good deal on this purchase.

They also might not know — funeral homes are required by law to tell them — that they don’t have to purchase your casket or urn from the funeral home, where the price may be marked up to double what you would pay by shopping around and making an outside purchase.

So order your urn from Amazon, so your loved ones don’t have to wonder whether they’re choosing something you would have approved. (Some options are surprisingly high quality and affordable; you can even get them engraved.)

Choose a cemetery or mausoleum

Some people want to be laid to rest in a particular cemetery or mausoleum where other family members have been placed. Other people may not know.

Here are some things to consider when choosing a cemetery or mausoleum:

- Location. If your survivors will want to visit your grave, think about places that would be convenient and peaceful for them to visit.

- Cost. Plots in some cemeteries (and vaults in some mausoleums) are more expensive than others. The specific location you choose may also affect the price. For example, a cemetery plot beneath a large shade tree may command a premium price.

- Ownership. Is the cemetery or mausoleum privately or publicly owned? There can be advantages and disadvantages to both.

- Security. Is the property well-protected and located in a safe area? Unfortunately, some people will vandalize headstones and rob graves if they think they can get away with it.

- Financial stability. Research whether the cemetery has had any financial problems and find out how they provide for the care of the grounds and headstones. Some cemeteries have an endowment fund that provides for ongoing maintenance. Endowments don’t always have as much money as they should, though, and they can be mismanaged. With or without an endowment, a place with financial troubles may cut corners and neglect the maintenance they’re supposed to perform.

| IMPORTANT: Under the Federal Trade Commission’s funeral rule, funeral homes and cemeteries must provide you with a price list upon request. Many places publish their price lists online, so you don’t even have to ask — but make sure you’re looking at the current year’s prices. |

Expect nothing less than full-price transparency from any establishment you consider making your final arrangements with. It’s the law.

6. Select A Burial Plot — Or Don’t

Preselecting and prepaying for a cemetery plot might seem like a good idea, especially if you want to be buried alongside other family members. Before going this route, you should research the widespread fraud related to these purchases.

Burial plots are double-sold more often than you might think. Many families have prepared to enter their loved ones in a prepaid plot, only to find that another body was already there.

It might be a better idea just to let your loved ones know what kind of burial plot you’d like — under a tree, with a nice view, that sort of thing.

Choose a headstone, gravestone, or grave marker

Decide how to mark your future burial plot. Your headstone, gravestone, or grave marker can be flat or upright, made of metal (bronze) or stone (granite). You can also decide what photo, epitaph, or other text should appear on it.

Keep it simple and classic, or get inspired by these funny headstones.

Like urns and caskets, you can shop around for these items. You don’t have to buy them directly from a cemetery or funeral home. Finding your own provider can save a lot of money.

Pick out your final outfit and accessories

Whether you’re going to have an open or closed-casket funeral, be buried or cremated, you might want to choose what you’ll wear. Some people prefer a dress or suit, while others choose a favorite sports jersey.

You might also want to place memorable items in your casket that your loved ones would be okay with not inheriting, like a less-valuable item from your favorite collection, a copy of your favorite book, or a wedding photo.

Certain items are too hazardous to bury or cremate, so keep that in mind when making your selections.

7. Write Your Own Obituary

How do you want to be remembered? Your obituary will be read by people who knew you and by future generations.

Publishing an obituary in the newspaper is optional, of course. But if you want one, you can write it yourself to ensure it includes everything important.

The longer your obituary, the more it will cost to publish—in print, at least. So you may want to get an idea of typical lengths and prices for your local paper and include that cost in your final expense planning because it could be several hundred dollars.

8. Share Your Final Wishes With Your Loved Ones

Talk through your choices with the people who are most likely to be in charge of carrying out your final wishes. If your children don’t favor embalming and burial, but that’s what you want, have a conversation with them about why it’s important to you.

If you haven’t already, you should have similar conversations about your will and your medical power of attorney or advance directive.

Discuss who should receive your most important possessions and assets and why you’ve made those choices. Explain what kind of lifesaving care you want.

If you explain your choices beforehand, you may prevent confusion, hurt feelings, and conflicts that would otherwise occur in your final days and after your death.

It’s also helpful to ensure that your loved ones know what to do when someone dies and what advance arrangements you’ve made and paid for.

9. Put Your Last Wishes In Writing

All the advance planning you do won’t help unless your loved ones know about it and agree to follow your wishes. Everything you want and arrange needs to be in writing, stored in multiple places, and distributed to people you trust.

Don’t rely on just telling one person what you want. Depending on how much time passes between your planning and your death and their physical and mental state when you die, they may not remember what you said or be unable to fulfill your wishes.

Along with writing everything down or typing everything up, you may want to keep a copy on a shared cloud service, email your plans to multiple people, or use an online planning service.

Keep the possibilities of loss, destruction, technological failure, and services going out of business in mind. Also, make sure you backup your wishes in different places that won’t all be vulnerable to the same type of loss.

10. Estimate Your Final Expenses

Now that you know what you want, it’s time to figure out how much it will cost. Use our funeral cost calculator to estimate your final expenses and determine your insurance needs. Our calculator uses national median prices, but you might want to change the numbers based on what you’ve found in your research.

If you have no reason to think your death is imminent, you might want to bump up your estimate by 3% per year for the number of years you think you might live. Inflation will likely mean that future final expenses cost more than they do today — which is one reason people buy pre-paid funeral plans.

Once you’ve planned out your entire funeral and costs, the next step is putting together a plan to make sure your final expenses don’t fall on your family.

You have four basic options to pay for your final expenses.

Permanent life insurance

Permanent life insurance, unlike term life insurance, doesn’t expire when you reach a certain age. It guarantees that your loved ones will get money when you die.

Life insurance to pay for burial expenses is a popular option, mainly because it provides immediate protection as soon as you pay for your policy (most of the time).

There are even policies that were designed specifically to cover end-of-life costs. They are often referred to as “burial insurance for seniors” or “final expense life insurance.”

They are small policies that provide just enough coverage to pay for final expenses. These policies are particularly helpful for folks over age 80 who likely can’t qualify for a traditional life insurance policy because of their health.

The cost of burial policies is generally affordable, too, since the face amounts are low.

Savings account

With this option, you save a set amount every month until you have enough to cover all your final expenses.

You should only plan to use a savings account to cover your final expenses if you are very financially disciplined and have enough income or assets to do four things:

- Save up enough money to cover your final expenses.

- Put the money in a high-interest savings account or certificate of deposit to help it keep up with inflation.

- Leave the money alone, no matter what other financial need arises

- Name primary and contingent beneficiaries by filling out a form with your bank. That lets your heirs quickly and easily receive the money when you die.

The obvious drawback to this option is that if you pass away before you’ve saved enough — or if you have to spend down your assets to qualify for Medicaid — your family will have to come up with the difference.

Prepaid burial plan

A prepaid burial contract is an arrangement between you and a specific funeral home. Basically, you completely design your funeral service with them, and they tell you how much it will cost.

You can pay the entire cost upfront or make a series of monthly payments. The older you are, the less time the funeral home will give you to pay for your contract. Payments typically end up costing $100 to $500 per month.

The contract is backed by a form of life insurance. However, it’s different from an individual policy you’d buy directly from a life insurance company. The policy will only pay out to the funeral home when you die.

On an individual policy, you could choose specific individuals, like your children or spouse, to receive the death benefit. They could then use the money however they wanted — which has its pluses and minuses.

Funds from the deceased estate

Although not recommended, you could rely on your family liquidating your house, investments, or other valuable property to pay for your final expenses. The advantage of this is possibly earning a tax deduction for covering the funeral expenses.

For several other reasons, however, this isn’t the best option. It should be a last resort.

It will take a lot of time for your family to liquidate your estate. In the short term, your family will have to come up with the money to cover your final expenses — which might mean taking on high-interest debt.

First, your assets must go through probate, which can easily take months. Selling your assets can take even longer. It’s not always easy to sell a house, for example. Plus, you might want to leave your valuable assets to your heirs instead of having them sold off.

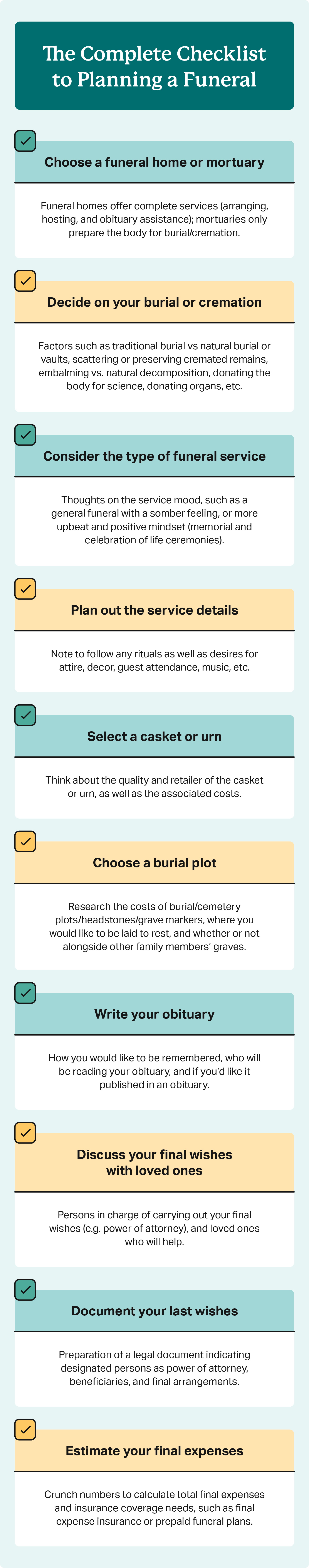

Funeral Planning Checklist

Frequently Asked Questions

There’s no set age for when you should plan your funeral, but the earlier, the better. You don’t want to put it off until it’s too late, such as after developing a terminal illness. Many people decide on plans for their own funeral around the time they’re nearing retirement, which is generally the same time most decide to create a will.

Funeral costs vary by location, provider, and your choices about the service and the body. For a viewing, funeral service, burial, and burial vault, the national median cost in 2023 was $9,995, according to the National Funeral Directors Association. For a viewing, funeral service, and cremation, the cost was $6,280.

Prepaying for your funeral and burial can remove the burden of these expenses from your surviving loved ones. If you’re going to pay for pre-need arrangements, it’s essential to choose a reputable company that places your money with a bank or life insurance company. You may be able to pay for the arrangements over several years with interest charges, or you can pay in a lump sum. As an alternative, consider purchasing burial expense insurance.

No. Both are ways of remembering someone who recently passed away. But a memorial service is usually a more somber event, while a celebration of life is meant to be more upbeat. Also, a memorial service often comes shortly after death, directly after the funeral, while a celebration of life may take place several weeks or months later.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

Registering as an organ donor. https://www.organdonor.gov/sign-up

-

save the lives of up to eight people. https://www.organdonor.gov/learn/what-can-be-donated

-

anatomical gift can help train students and professionals. https://www.ucop.edu/uc-health/initiatives/anatomical-donation-program.html#:~:text=How%20does%20one%20donate%20to,to%20you%2C%20documenting%20your%20wishes.

-

Mayo Clinic. https://www.mayoclinic.org/body-donation/making-donation

-

Northern Michigan University Center for Forensic Anthropology. https://nmu.edu/frost/donations

-

Stanford Medicine. https://med.stanford.edu/anatomy/donate.html

-

University of Arizona College of Medicine Tucson. https://bodydonation.med.arizona.edu/

-

University of California. https://www.ucop.edu/uc-health/initiatives/anatomical-donation-program.html#:~:text=How%20does%20one%20donate%20to,to%20you%2C%20documenting%20your%20wishes.

-

University of Michigan Medical School. https://medicine.umich.edu/dept/anatomical-sciences/anatomical-donations-program/procedures-making-anatomical-gift

-

University of Minnesota Medical School. https://med.umn.edu/research/anatomy-bequest-program/how-donate

-

Western Carolina Forensic Osteology Research Station. https://www.wcu.edu/learn/departments-schools-colleges/cas/social-sciences/anthsoc/foranth/forensic-anthro-facilities.aspx

-

Recipient organizations for body donation. https://anatbd.acb.med.ufl.edu/usprograms/

-

Possible reasons why your anatomical gift could be rejected. https://med.stanford.edu/anatomy/donate/faqs.html

-

wholesale-priced casket from Costco. https://www.costco.com/funeral-caskets.html

-

double-sold. https://www.portlandmercury.com/news/2010/10/29/2991578/metros-tale-of-the-twice-sold-graves

-

more often. https://www.nbcchicago.com/news/local/family-in-shock-after-cemetery-double-sells-burial-plot/161471/

-

another body. https://www.usatoday.com/story/money/business/2015/05/21/double-sold-burial-plot/27706885/

-

funny headstones. https://www.boredpanda.com/funny-tombstones-epitaphs/?utm_source=google&utm_medium=organic&utm_campaign=organic

-

National Funeral Directors Association. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral