$10,000 Whole Life Insurance Policy Rates

Whole life insurance is a type of permanent life insurance that will never expire. It guarantees that the premium will never change and the death benefit won’t decrease.

Additionally, it will build cash value, which you can borrow and use any time you want.

| Age | Female | Male |

|---|---|---|

| 40 | $21 | $23 |

| 45 | $23 | $26 |

| 50 | $24 | $31 |

| 55 | $28 | $36 |

| 60 | $33 | $43 |

| 65 | $41 | $54 |

| 70 | $53 | $70 |

| 75 | $71 | $97 |

| 80 | $98 | $134 |

| 85 | $136 | $193 |

| 86 | $171 | $236 |

| 87 | $206 | $277 |

| 88 | $239 | $317 |

| 89 | $260 | $357 |

| Source for monthly prices: Choice Mutual quote calculator. Rates are calculated at a non-tobacco rating, rounded to the nearest dollar, and are valid as of 06/27/2025. | ||

$10,000 Guaranteed Acceptance Life Insurance Policy Rates

With a guaranteed acceptance policy, there are no health questions or exams. Because approval is guaranteed, there is a two-year waiting period. Death in the first two years will only result in a refund of your payments plus interest (typically 10%). Guaranteed issue policies are always a type of whole life insurance.

| Age | Female | Male |

|---|---|---|

| 45 | $28 | $36 |

| 50 | $30 | $40 |

| 55 | $38 | $45 |

| 60 | $43 | $57 |

| 65 | $50 | $69 |

| 70 | $64 | $87 |

| 75 | $89 | $113 |

| 80 | $127 | $157 |

| 85 | $158 | $193 |

| Source for monthly prices: Choice Mutual quote calculator. Rates are for Mutual of Omaha's guaranteed acceptance whole life policy, rounded to the nearest dollar, and are valid as of 02/19/2025. | ||

$10,000 Term Life Insurance Policy Rates

A term life policy is a form of temporary life insurance (hence the name “term”). The policy lasts for a limited number of years, such as 5, 10, 20, or 30, or it may last until a certain age, such as 65 or 80. As a general rule, term policies will terminate around age 80.

Once the policy ends, you’re no longer insured and won’t get a refund of your premiums. Depending on the company, the price may change as you age or remain the same. For example, Globe life term policies have a price increase every five years.

| Age | Female | Male |

|---|---|---|

| 50 | $13 | $19 |

| 55 | $16 | $24 |

| 60 | $20 | $30 |

| 65 | $25 | $40 |

| 70 | $31 | $53 |

| 75 | $41 | $71 |

| Source for monthly prices: Choice Mutual quote calculator. Rates are calculated at a non-tobacco rating, rounded to the nearest dollar, and are valid as of 02/19/2025. | ||

Best Companies For A $10,000 Life Insurance Policy

- $10K Policy Cost$41.01/month*

- New Applicant Ages45-85

- Death Benefit Options$2,000-$50,000

- 2-Year Waiting PeriodNo

- $10K Policy Cost$55.00/month*

- New Applicant Ages45-85

- Death Benefit Options$3,000-$25,000

- 2-Year Waiting PeriodYes

- $10K Policy Cost$51.10/month*

- New Applicant Ages18-85

- Death Benefit Options$5,000-$100,000

- 2-Year Waiting PeriodNo

How Your Health Factors Into The Cost

Most $10,000 life insurance plans will be a type of final expense insurance, and there are two basic options:

- With health questions: You must complete a health questionnaire to qualify (no required exam). Your eligibility is based on your prior medical history. You could either get approved, declined, or offered a plan with a partial or complete waiting period. How you answer the questions determines the final cost. For example, expect to pay 30-40% more if you respond with a “yes” answer to the question about tobacco usage.

- No health questions: Your approval is guaranteed, but the premiums are more expensive, and there is a two-year waiting period. Any tobacco usage or prior health issues will not change the premium.

To get the lowest price and coverage with no waiting period, you must apply for a policy that involves answering questions about health.

Understand that burial insurance for seniors has very lenient underwriting. Most seniors can still qualify for a no waiting period policy despite previous health issues.

Speaking with a licensed insurance agent who can compare multiple providers to find you the best price is highly advisable.

Frequently Asked Questions

Yes, $10,000 is enough coverage to pay for a funeral. According to the NFDA, a typical burial service will cost $9,995. Granted, your funeral preference may be such that the price can be higher or lower. But based on the average figures, $10K will get the job done.

Mutual of Omaha offers very low prices, but they may or may not be your best option, depending on your circumstances. Every company accepts and rejects different health issues, so comparing multiple companies is essential before settling on one.

Our Insurance Review Methodology

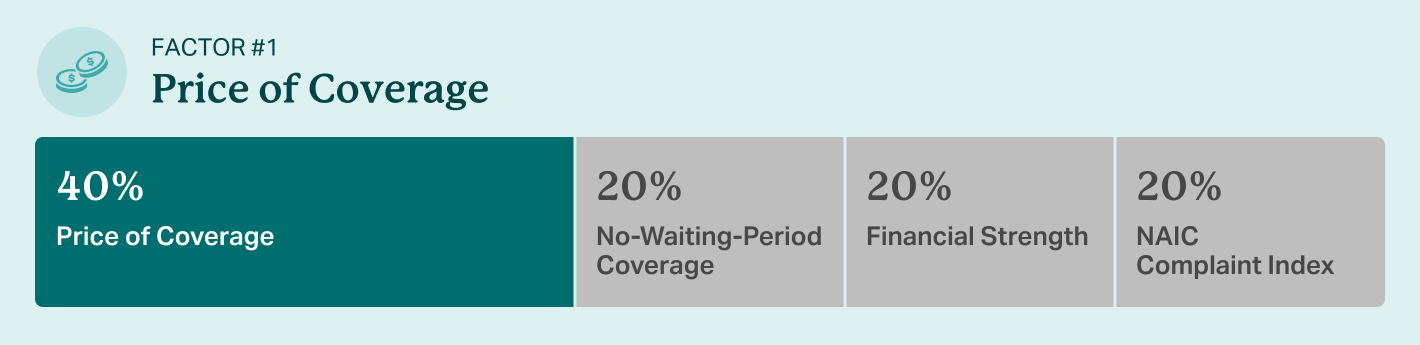

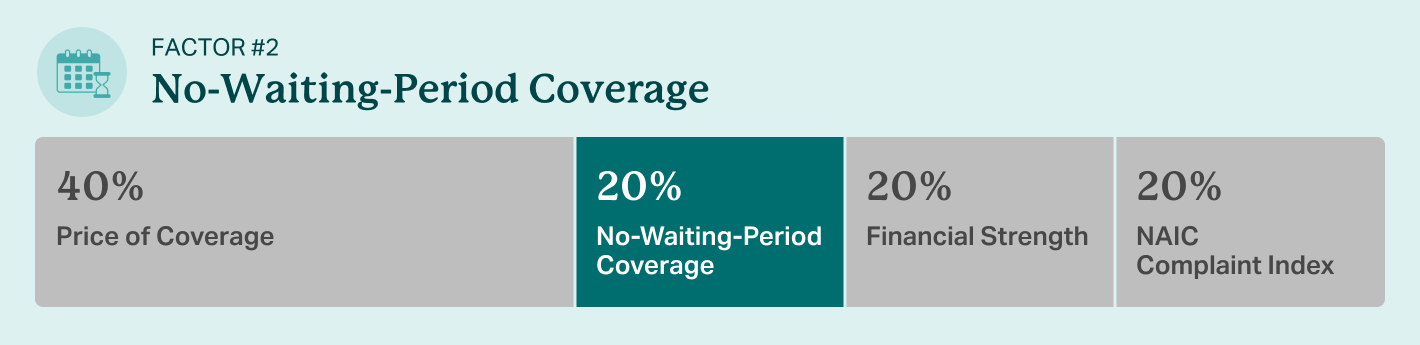

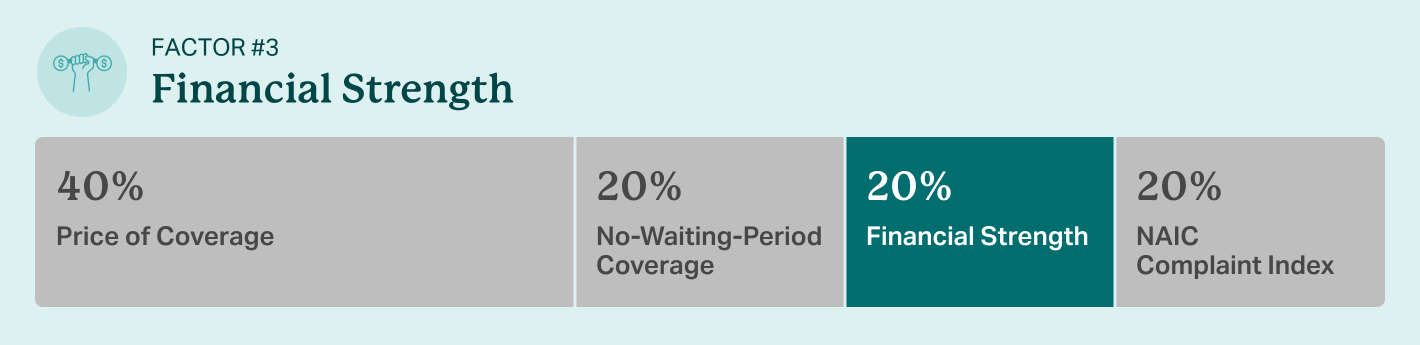

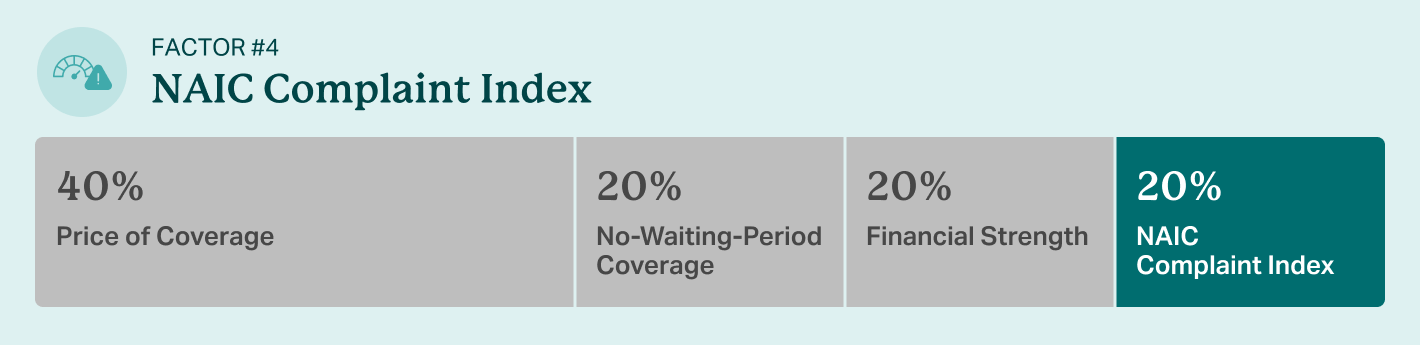

Every company we review has an overall score that illustrates how well it stands out in the market relative to its competitors. These scores are not subjective. Instead, we utilize a defined 5-star scoring system that applies a weighted average of particular factors, all of which are outlined below and on our review methodology page.

We measure the price of a company’s most popular they promote relative to its competitors. The closeness of their cost to other companies determines the final score. Read a full breakdown of the price of coverage factor on our review methodology page.

This factor assesses whether a company offers immediate coverage and, if so, how difficult it is to qualify for it. Read a full breakdown of the no waiting period coverage factor on our review methodology page.

A company’s financial strength is based on its rating with A.M. Best. Read a full breakdown of the financial strength factor on our review methodology page.

The National Association of Insurance Commissioners’ complaint index measures an insurer’s frequency of consumer complaints compared to the rest of the market. The score the insurer receives is based on how it stacks up to the median score of other insurers. Read a full breakdown of the NAIC complaint index factor on our review methodology page.

Why trust Choice Mutual?

When we review products, our findings are unbiased and free of any influence from partnerships or methods of compensation. All findings, good or bad, are solely the derivative of our objective analysis of any given product or company.

As noted on our review methodology page, our researchers evaluate the financial stability of the insurer, policy costs, product limitations, state availability, customer satisfaction, waiting periods (if applicable), and other relevant factors. We aggregate all this cumulative data to develop objective overall scores based on pre-defined weighted factors.

In addition, a qualified expert who is well-qualified to speak on the matter will provide opinion-based feedback about the company or product being reviewed.

For over a decade, Choice Mutual has been an insurance agency specializing in final expense life insurance. Our expertise in this type of insurance is well-documented in numerous authoritative publications, some of which are listed below:

Choice Mutual’s mission is to provide consumers with unbiased expert commentary and explanations of the topics being discussed. We want our readers to be armed with information and tools that cannot be found anywhere else on the internet, so they can truly make an informed decision.

All content on this website is written by Anthony Martin, who is a licensed life insurance agent with over a decade of expertise in this industry and has been quoted as an expert source hundreds of times by many reputable news outlets.

Per our editorial guidelines, we have never, and will never, use artificial intelligence to create our content. Every word printed on this website is produced and curated 100% by human beings who have firsthand experience with the subject matter.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

NFDA. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral