Which Companies Offer Burial Expense Insurance In Maryland?

Most people are unaware of the fact that insurance (all types) is governed by the states rather than the federal government. Therefore, final expense policies in the USA vary by state.

Below is a table that outlines which burial insurance companies offer plans in Maryland.

How Much Does Burial Insurance Cost In Maryland?

While the average cost of funeral insurance is approximately $50-$100 monthly, the net price you pay is determined based on factors such as gender, age, health, and how much coverage you choose.

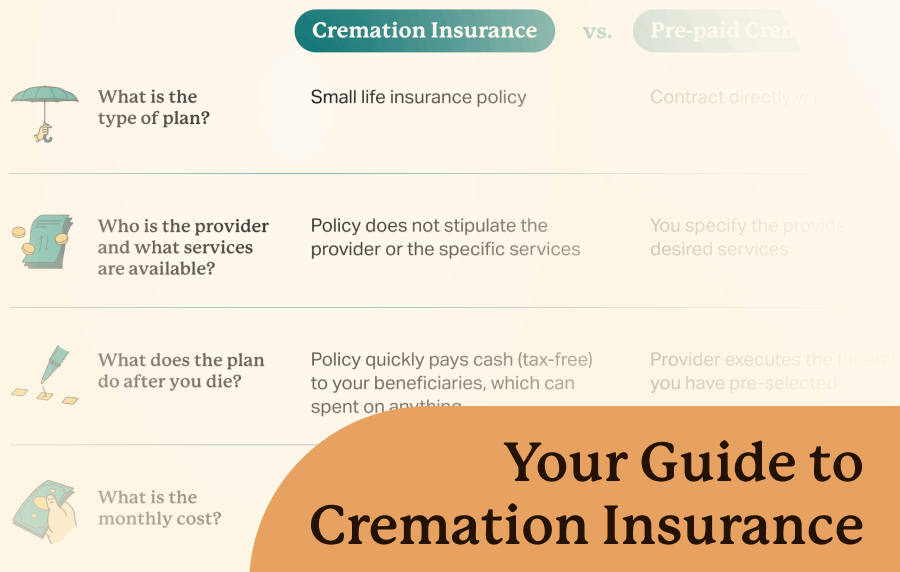

How Do Final Expense Insurance Plans Work?

Burial expense insurance is a type of life insurance (whole life) that is designed to cover all your burial and other final expenses. It’s life insurance, so ultimately, the insurer will pay out cash when you die. The money is paid tax-free to your beneficiaries.

That provides them with the funds necessary to carry out your funeral arrangements. Additionally, if any funds remain after the funeral expenses are paid, your loved ones can keep them and use them as they see fit.

Burial policies don’t require a medical exam, and pre-existing conditions won’t cause a decline. Some plans require you to complete a health questionnaire, which determines whether you’re approved and the final price you pay.

On the other hand, there are guaranteed acceptance policies that have no health questions. Please note that guaranteed issue life insurance policies always have a two-year waiting period. Any non-accidental death during the waiting period will result in the insurer refunding only your premiums. They will not pay out the death benefit.

Because these are whole life insurance policies, the payment will never increase, coverage lasts for the policyholder’s lifetime, and the death benefit won’t decrease.

How Much Does A Funeral Cost In Maryland?

| Service Type | Average Cost |

|---|---|

| Burial Service | $8,023 |

| Direct Burial (No Service) | $5,694 |

| Cremation Service | $6,103 |

| Direct Cremation (No Service) | $2,419 |

| Funeral with service data source: NFDA General Price List Study Direct funeral data source: Funeralocity |

|

Those average funeral costs are valid, but remember that your preferences will greatly influence the actual price you pay.

The Free Look Period In Maryland And The FTC Funeral Rule

According to the Maryland Department of Insurance, every life insurance policy has a free look period that lasts at least ten days. During these ten days, you have the right to cancel a policy, and the insurer must refund any premiums you’ve paid.

This provision is especially helpful at protecting Maryland residents from burial insurance scams or if they simply change their mind.

Additionally, the FTC Funeral Rule governs funeral homes and grants you specific rights. For example, it requires funeral homes to provide you with prices in either written or verbal format when you request them.

You have the right to buy products from third parties, and you don’t have to accept prepacked funerals they may offer you (you can choose à la carte whatever you want).

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

NFDA General Price List Study. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral

-

Funeralocity. https://www.funeralocity.com/average-funeral-price

-

Maryland Department of Insurance. https://insurance.maryland.gov/consumer/documents/publications/militaryinsurance.pdf

-

FTC Funeral Rule. https://consumer.ftc.gov/articles/ftc-funeral-rule

- Data sourced from Choice Mutual quote calculator for a 65-year-old applicant who does not use tobacco. Data is valid as of 08/30/2025.

- Data sourced from Choice Mutual quote calculator using a 365-day rolling average (08/31/2024-08/31/2025).

- Data sourced from 2023 NFDA General Price List Study.