How Does Burial Insurance For Seniors Work?

Burial insurance for seniors, also frequently called “final expense insurance” or “funeral insurance,” is a kind of life insurance meant to cover your burial and other final expenses. When you die, the death benefit pays out quickly to your loved ones so they can pay for your funeral.

Unlike traditional life insurance policies, burial policies have smaller coverage options- usually $50,000 or less. No medical exam is required to qualify, and seniors can still obtain a new policy despite having severe health issues.

Since these are a type of whole life insurance, the coverage will last your entire life, and the premiums will never increase. Also, the death benefit won’t decrease, and it builds cash value.

There are two types of final expense insurance policies for seniors. Be sure to consider the pros and cons of each option when choosing which plan is best for you:

- Simplified issue: This type of policy has underwriting. You don’t have to take a medical exam, but you must answer health questions. These plans are generally the least expensive and can offer immediate peace of mind because the full death benefit pays out starting on day one (no waiting period).

- Guaranteed issue: Commonly referred to as “guaranteed acceptance,” this policy type has no health questions because your approval is guaranteed. There’s always a two-year waiting period for non-accidental death and more expensive premium payments than simplified issue policies. If you die during the waiting period, the insurance company will only refund your premiums plus a tiny amount of interest.

What Does Burial Insurance Cover?

A senior burial insurance policy can cover all the expenses associated with your funeral plans, including but not limited to:

- Funeral services

- Burial costs

- Cremation costs

- Funeral home fees

- Headstone or other memorial monuments

- Medical bills

- Transportation expenses

- Credit card debts or other outstanding debts

Also, any money your loved ones don’t spend on your final expenses is theirs to keep.

How Much Does Final Expense Insurance For Seniors Cost?

The cost of burial insurance varies depending on your precise age, gender, tobacco usage (if any), health conditions, state of residence, and the coverage amount.

Burial insurance for seniors over 50

Burial insurance for seniors over 60

Burial insurance for seniors over 70

Burial insurance for seniors over 80

It’s advisable to obtain a free quote from a life insurance company or agency to see accurate life insurance rates based on the aforementioned factors. Estimates like the ones shown above are just ballpark figures.

Should Seniors Buy Funeral Insurance?

If you have no other means to pay for your funeral costs, burial insurance is an optimal way to ensure your final expenses don’t become a financial burden on your family. Once the policy starts, you can rest easy knowing that your family will receive the funds necessary to cover your final bills whenever you die.

However, a burial expense policy may not be necessary if any of the following apply to you:

- Have a pre-paid funeral.

- Have cash set aside specifically for your final expenses.

- Prefer to donate your body and have no desire for any funeral services (Keep in mind that not everyone can donate their body to science).

- Have an existing permanent life insurance plan (not term life insurance) with a sufficient death benefit to cover your end-of-life expenses.

Aside from covering funeral costs, it’s common for seniors to buy burial insurance to leave money for loved ones.

How To Apply For A Final Expense Policy

To apply for a final expense insurance policy, you’ll need to contact an insurer directly or work with a licensed insurance agency. The requirements are very straightforward: You must physically be located in the USA and have either an SSN or a TIN.

Expect them to gather basic information such as name, DOB, mailing address, SSN/TIN, beneficiary names, and payment information. Also, if you’re trying to get a policy with no waiting period, you must complete a health questionnaire.

Applications can often be signed verbally or electronically, which greatly expedites the process. Once your application is approved (typically less than 24 hours), you should receive a paper policy via US mail in less than two weeks.

Buying burial insurance for an elderly parent

You can buy a final expense policy for a parent or grandparent, but there will be additional steps. First, the insured (your parent or grandparent) must consent to the policy, which is done by them signing the application.

Secondly, they must answer the health questions if you’re applying for a policy with no waiting period. Please note that even if you have a power of attorney over your parent or grandparent, it does not empower you to answer the questions and sign on their behalf.

You can absolutely speak with an insurance agent to ask questions and get price estimates without your parents. However, you’ll need their participation in the application process when you formally apply for the policy.

Frequently Asked Questions

Depending on your state of residence, everyone 18-85 can obtain a guaranteed acceptance burial policy that will not decline you based on your past or current medical conditions (there will be a two-year waiting period). You can still obtain a new funeral life insurance policy outside of that age range, but you’ll have to answer health questions to do so.

Many companies offer burial insurance for seniors over 80. The options vary based on your precise age, health, and state of residence. Also, if you’re over 85, there are no guaranteed issue life insurance policies. At age 86+, all policies require you to answer health questions because your eligibility depends on your medical history.

Term life is often attractive to seniors on a fixed income due to its lower cost than a whole life insurance policy. However, a term life policy is not an ideal senior life insurance policy to cover burial expenses because the coverage typically expires around age 80. It begs the question- what good is a policy that is cheaper if you outlive it? If you want to cover your funeral service expenses, it’s recommended that you seek out permanent life insurance products so you know that you’ll always have coverage for the cost of a funeral.

Ideally, you should buy enough coverage to sufficiently pay for your desired funeral. The National Funeral Directors Association recently reported that the average burial costs $9,995, which includes a vault and viewing. They also reported that a cremation costs $6,280.

Filing a death claim for final expense insurance is exactly the same as a traditional life insurance policy. It starts with your family members making a phone call to the insurer, notifying them that the insured died. They will send the beneficiary claim forms that need to be signed and returned with a copy of the death certificate. Once they receive that paperwork, they have what’s required to process the claim and pay out the money.

When comparing a burial policy vs life insurance, it’s helpful to remember that burial or funeral insurance is a type of life insurance. To be more specific, burial insurance plans are a particular type of permanent life insurance with small coverage options and a fast claim payout.

Final expense insurance pays a tax-free cash benefit to your beneficiaries. They can use the money as they see fit and keep what’s left over. Your family members will never incur a tax burden because of the policy payout.

Cash value in permanent policies is like a behind-the-scenes savings account accumulating value over time. Every time you make a payment, a majority of your payment goes toward the insurance cost. At the same time, a small amount goes into the cash value account. As the cash value grows, policyholders may elect to borrow from it at any time. All whole life final expenses policies have cash value.

90 is the age limit for life insurance. Even though there are options for ages 86-90, there are only a handful of companies available, and they vary by state. It’s worth noting that many companies offer life insurance for seniors with no medical exam up to age 80.

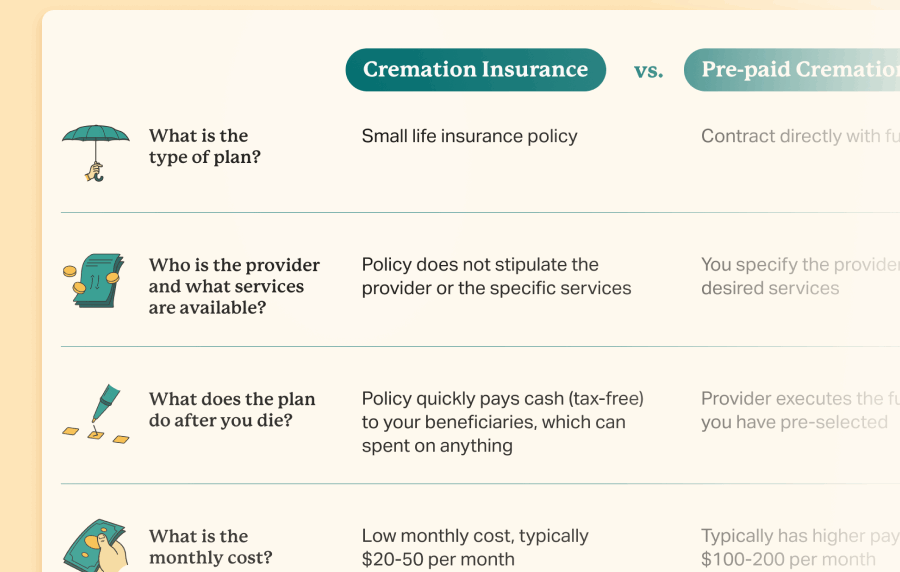

There is no difference. Keep in mind that “burial insurance” is just a marketing expression. It is also commonly referred to as “funeral insurance,” “final expense life insurance,” “cremation insurance,” or “end-of-life insurance.” All these names have the same meaning.

Colonial Penn life insurance coverage is a poor choice for seniors of all ages. Everyone indeed pays $9.95 per month, but it buys an extremely low amount of coverage. For example, Colonial Penn’s life insurance quotes tool shows that a 72-year-old male only gets $627 of life insurance for $9.95. Also, all Colonial Penn policies have a two-year waiting period, which is something Jonathan Lawson fails to mention in the TV advertisements. While Colonial Penn has good financial strength and great brand recognition, they are not the best life insurance for seniors simply because their prices are much too high compared to other providers.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

National Funeral Directors Association. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral

-

Cash value. https://www.investopedia.com/terms/c/cash-value-life-insurance.asp

-

donate their body to science. https://www.sciencecare.com/how-does-the-body-donation-process-work

-

permanent life insurance. https://www.prudential.com/personal/life-insurance/life-insurance-101/permanent-life-insurance

-

Colonial Penn’s life insurance quotes tool. https://colonialpenn.com/quote