What Is State Regulated Life Insurance?

There is no such thing as a state regulated life insurance program. These mailers are a very deceptive form of marketing to sell you life insurance.

The life insurance options they would offer you have no connection to any government entity.

They are just prospecting tools to generate sales leads for insurance agents in your area.

If you return these cards, a life insurance agent will show up at your door and call you.

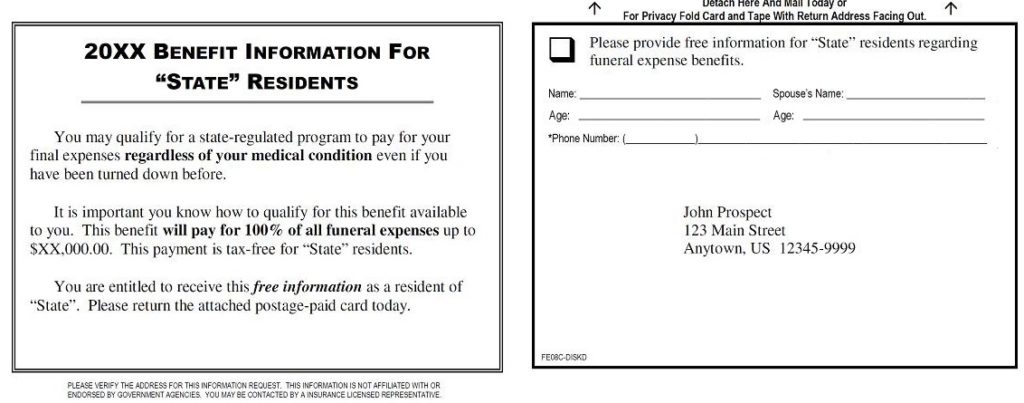

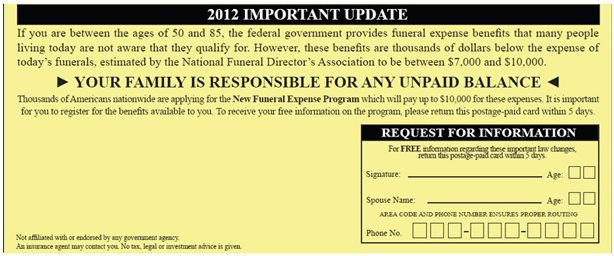

Keep in mind that these mailers may be worded slightly differently depending on where you live.

For example, you may see various messages such as the following:

- New Texas funeral expense benefit

- 2024 new state regulated life insurance program

- State-regulated life insurance program to pay for your final expenses

- Florida state regulated burial program

No matter how it’s phrased, it’s not actually connected to a government agency.

Below are two such examples.

If you respond to any of these advertisements, expect the following:

- Agents will appear at your door and attempt to sell you life insurance for final expenses.

- Agents will call you to book a time to meet with you to sell you life insurance.

Often, these leads are given to multiple agents for months or even years which means the harassment may continue for quite some time.

Are These Sponsored By The Government?

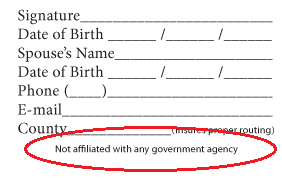

In no way, shape or form are any of these offers affiliated with any government agency or state-run program.

All of these mailers will have a disclaimer at the bottom in fine print that indicates it’s not affiliated with any government agency (like the example shown).

You might be wondering- Why do they say “state regulated life insurance program to pay final expenses” if it’s a lie?

They do it to gain your trust by making you think it’s from the government.

Most people naturally trust the government to a high degree.

Everyone knows a government entity will not steal your identity or money.

When you call the IRS or Social Security, you give them your SSN without hesitation because you know it’s in safe hands.

Government is far from perfect. However, what can be said with the utmost confidence is that they won’t scam you in some illegal way.

At the end of the day, the whole government affiliation perception directly increases the number of people who send the cards back in.

That results in more sales leads which is why they do it.

It’s clever, but not in an honest way.

Here’s what they mean by “state regulated”

When these advertisements use the words “state regulated,” it’s just a play on words.

All insurance is governed at the state level.

When an insurance company wants to offer an insurance product in your state, it must get prior approval from your state’s department of insurance.

The insurance company must provide the DOI with the rates, application, and a host of other financial information on the product.

Ultimately, the department of insurance will approve the product once its requirements have been satisfied.

That is the rationale they employ to justify using the words “state regulated.”

It’s technically not a lie.

However, it’s incredibly misleading to make people think that some government body in your state is managing this program and “regulating” it.

Nobody at any government level knows anything about this “offer.”

Your state does not matter

Many of these mailers will reference your specific state to enhance the deception further.

For example, you might see:

- 2024 benefit information for North Carolina citizens only

- Benefit information for Mississippi citizens only

- Virginia burial program just released

Using a person’s state in the creatives increases the number of responses.

What is an outright lie are their claims that their life insurance programs are exclusive to people in a given state.

The life insurance products they would offer you (if you respond to their ads) are not unique to your state.

In most cases, the plans they would provide you are identical and available in all states (or nearly all of them).

It’s just another means of deception to make you think it’s related to the government (your state government, to be more specific).

It’s definitely not.

Are These Mailings A Scam, Or Are They Legit?

No, these mailers are not a burial insurance scam.

Are they honest business practices? No, definitely not.

But consider this.

If you respond to one of these advertisements, you will be inundated with insurance agents trying to sell you life insurance.

They will be licensed insurance agents who do actually sell life insurance. You don’t necessarily need to be wary that they will steal your identity or money.

But do you want to do business with a company that advertises in such a deceptive way?

If You Need Life Insurance To Cover Your Final Expenses, Here’s A Better & Safer Way To Do It

If you need funeral expense life insurance to ensure your burial costs don’t burden your family, there’s an easy and safe way to find it.

Find a reputable independent agency licensed in your state.

Make sure they represent ten or more final expense insurance companies, so they can compare multiple providers to find you the best deal.

Here are some things you can do to ensure you find a reputable agency to help you.

- Check for online reviews (Facebook, Google, Yelp, Trustpilot)

- Verify they are accredited and A-rated with the BBB

- Look at your state department of insurance website to verify they are licensed

Once you find a qualified agency, tell them your needs and let them go to work for you.

The downside to working with an insurance company directly (such as Colonial Penn or Globe Life) is that their products are often expensive and have a two-year waiting period before you’re insured.

That’s why it’s critically important to work with a reputable independent broker that can compare various insurance companies on your behalf.

Choice Mutual can help

If you’re in the market for burial life insurance, give us a chance to earn your business.

Final expense coverage for seniors is all we do, and we work with over 20 highly-rated companies.

We are licensed in all 50 states and DC, and we have thousands of 5-star reviews online from very satisfied customers.

We treat people with respect and never pressure people.

So if you want some expert-friendly help, give us a call at 1-800-644-2926.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

$255 from Social Security. https://www.ssa.gov/planners/survivors/ifyou.html

-

governed at the state level. https://en.wikipedia.org/wiki/Insurance_regulatory_law