If you can qualify for the no-waiting-period option with Mutual of Omaha (most applicants do, despite many pre-existing conditions such as diabetes), you should buy it immediately. That’s because Mutual of Omaha is regularly among the lowest-cost providers, and they allow you to buy up to $50,000 in coverage, which is much higher than most other insurers.

Also, Mutual of Omaha excels at servicing existing policyholders. That’s a big reason why they ranked #6 in the most recent J.D. Power U.S. Individual Life Insurance Study for customer satisfaction.

You can make virtually any change to your policy (beneficiary, address, payment info) verbally or via an electronic signature. Approved claims are paid quickly, and when you call them, you’re rarely on hold for more than 1-2 minutes.

- Very low rates compared to other companies.

- Most applicants are eligible for immediate coverage despite pre-existing conditions.

- You can buy up to $50,000 in coverage, much higher than most providers.

- To qualify for no waiting period coverage, you must speak with a licensed insurance agent.

- They do not allow policyholders to mail in monthly payments or use a debit or credit card.

- You cannot reduce your coverage if you need to lower your premium someday.

AM Best’s Financial Strength Rating (FSR) is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. The scores range from A++ to D-.

Moody’s Investors Service rates the creditworthiness of companies. The Moody’s Rating Scale has 21 possible scores ranging from “Aaa” (highest mark) down to “C” (lowest mark).

S&P Global Inc. issues credit ratings on a scale from “AAA” (highest rating) to “D” (lowest rating).

The Complaint Index compares a company’s performance to other companies in the market. The National Complaint Index is always 1.00. That means a company with a complaint index of 2.00 is twice as high as expected in the market. Reported scores are for the most recently available year and for “Individual Life” products.

The BBB rating is based on information BBB is able to obtain about the business, including complaints received from the public. BBB seeks and uses information directly from businesses and from public data sources. BBB assigns ratings from A+ (highest) to F (lowest). If a business has been accredited by the BBB, it means BBB has determined that the business meets accreditation standards, which include a commitment to make a good faith effort to resolve any consumer complaints.

How Does Mutual Of Omaha Final Expense Insurance Work?

Mutual of Omaha’s final expense insurance is a whole life insurance policy with coverage amounts from $2,000 up to $50,000. When you die, they will pay out a tax-free cash payment to your loved ones or funeral home for burial costs, cremation, outstanding debts, or other end-of-life expenses. Also, your beneficiaries keep any leftover money,

There are three plans you can qualify for depending on your health and how you apply:

- Level benefit (no waiting period)

- Graded benefit (2-year waiting period)

- Guaranteed acceptance (2-year waiting period)

With all plans, no medical examination is required. Whole life insurance guarantees that it will last forever, the premium will remain the same, and the coverage will not decrease. Additionally, it builds cash value that the policy owner can withdraw at any time.

The immediate coverage option (level benefit)

United of Omaha’s final expense policy for seniors offering full day-one coverage for natural or accidental death is called “Living Promise.”

Mutual of Omaha Living Promise whole life insurance has two health ratings- the level death benefit and the graded death benefit.

The level benefit has no waiting period, meaning you’re fully insured for natural or accidental death on the day you make your first payment.

To qualify for the level plan, you must be able to say no to all these health questions and have a height-to-weight ratio within these guidelines.

At no extra cost, the policy automatically comes with an accelerated death benefit rider that allows you to access the full death benefit while you’re alive if you’re diagnosed with a terminal illness or confined to a nursing home for 90 days or more and expected to remain there.

For a small additional fee, you can add an accidental death benefit rider that will result in a 200% payout of the death benefit if you die from an accident.

You cannot buy this policy directly from Mutual of Omaha Life Insurance Company. It’s only sold through licensed Mutual of Omaha agencies such as Choice Mutual.

The graded plan

The graded plan is modified whole life insurance coverage. If you die during the first two years (except from an accident), Mutual of Omaha will refund 110% of your premiums. It’s also more costly than the level benefit option.

Mutual of Omaha will offer you the graded plan if you have any of these health conditions.

Guaranteed acceptance

The guaranteed acceptance option does not have health questions, so you can’t be denied for any pre-existing conditions. However, as is the case with all guaranteed issue life insurance, a mandatory two-year waiting period applies.

Any offer you receive from Mutual of Omaha, whether through the mail or directly from their website, is subject for their guaranteed acceptance policy.

How Much Does Mutual of Omaha Burial Insurance Cost?

Below is a Mutual of Omaha life insurance rate chart with some sample final expense insurance quotes.

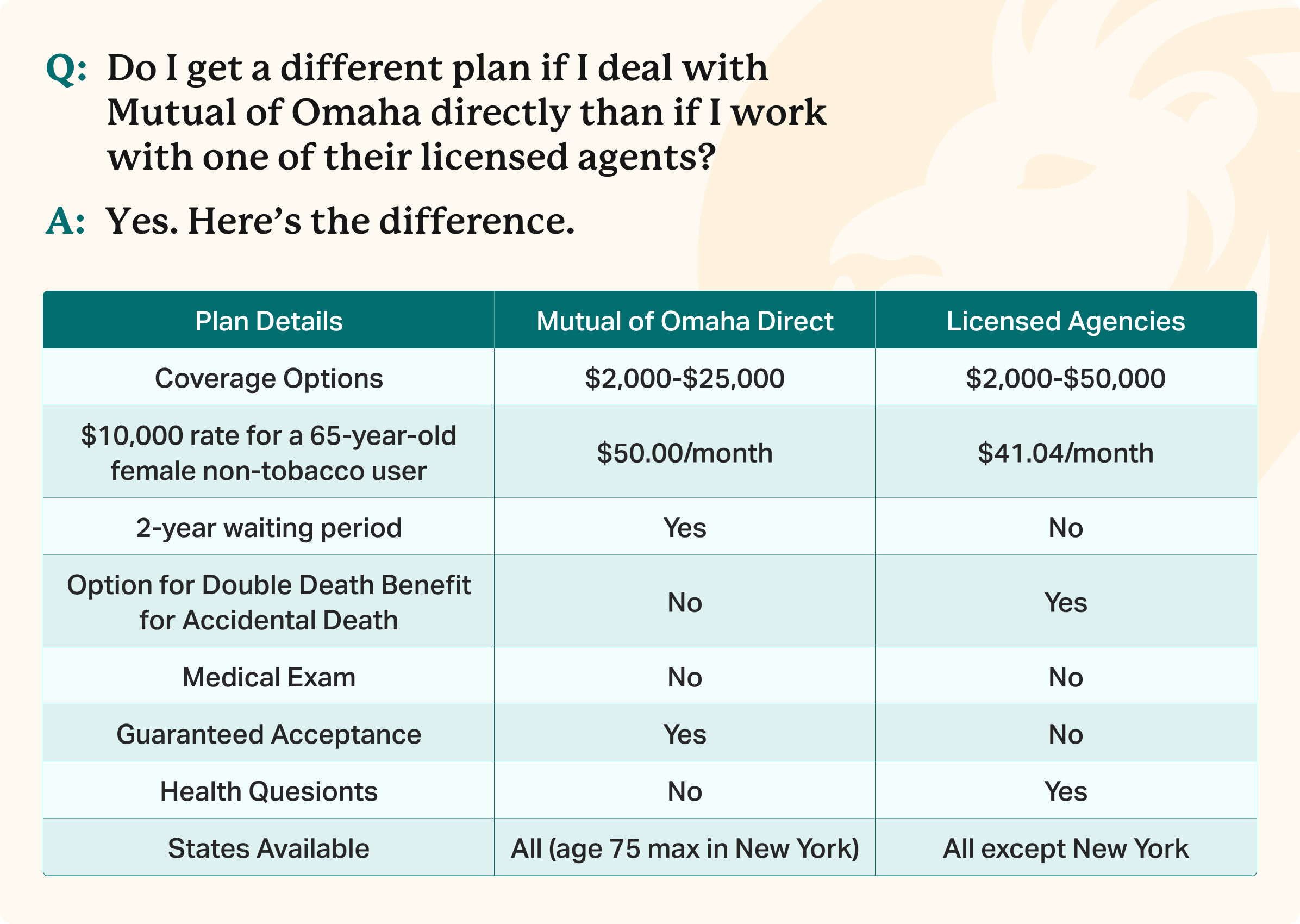

The Difference Between Working With A Licensed Mutual Of Omaha Agent Vs. Going Directly To The Company

Mutual of Omaha Burial Insurance Vs. Some Of Its Competitors

- $10K Policy Cost $43.99/month*

- New Applicant Ages 45-80

- Death Benefit Options $2,000-$50,000

- 2-Year Waiting Period No

- $10K Policy Cost $47.00/month*

- New Applicant Ages 50-80

- Death Benefit Options $5,000-$50,000

- 2-Year Waiting Period No

- $10K Policy Cost $64.81/month*

- New Applicant Ages 45-80 (50-75 in NY)

- Death Benefit Options $10,000-$15,000

- 2-Year Waiting Period Yes

Tips For Finding The Best Burial Insurance

No single life insurance company has the best life insurance for everyone (including Mutual of Omaha). It’s simply impossible.

When shopping for a burial insurance policy, it is crucial to compare offers from multiple providers, as each company has different pricing and underwriting criteria.

It’s also helpful to remember that nearly all funeral insurance policies are sold only via licensed agents.

Insurance providers that allow you to buy their products directly from them (rather than via an agent) typically only offer guaranteed issue life insurance plans that make you wait two years before you’re covered. Colonial Penn, AAA, and USAA are notable examples, in addition to Mutual of Omaha.

Those options can be bought online. However, they are all guaranteed acceptance plans with a two-year waiting period.

Consulting with a reputable independent agency representing numerous companies is the soundest way to find the best permanent life insurance to cover funeral expenses.

Independent agencies offer the following benefits:

- Only independent agencies have the least expensive plans that afford the peace of mind of not enduring a two-year waiting period before you’re insured.

- An independent agency will compare offers from multiple insurance companies to see which has the best plan for you.

If you try to “not deal with an agent,” be prepared to pay more and wait two to three years before you’re insured.

Independent agents are your advocates. They exist to find you the best final expense policy regardless of which insurer issues the policy.

Frequently Asked Questions

In short, it’s because they require it. Mutual of Omaha only sells its immediate coverage policy via licensed agencies; it does not sell it directly to consumers. They have a strict requirement that agents must verbally read all the health questions to the client. Applicants cannot complete the health questions unassisted, whether via text, mail, or online. It must be done verbally.

It’s important to note that the final expense policy Mutual of Omaha agents can sell differs from the policy the company sells directly to consumers. Agents can only sell the Living Promise policy that has health questions and no waiting period (if you’re approved). When you call the company directly, the only plan they can offer is the policy without a health questionnaire and a two-year waiting period. Ultimately, why Mutual of Omaha does it this way is a mystery. Only their board of directors knows.

Truthfully, you should let an agent diagnose whether you’ll qualify. The underwriting is simple, but there are nuances that only an agent will know. That being said, review these health questions. If you have any of those conditions, you will not qualify for the no waiting period option.

You can buy some Mutual Of Omaha life insurance for seniors online. However, understand that the only product they sell 100% online without talking to an agent is a guaranteed acceptance policy with a two-year waiting period and a maximum coverage amount of $25,000. To secure a no waiting period policy, you must verbally speak with a licensed Mutual of Omaha agent.

Mutual of Omaha Living Promise is not a guaranteed acceptance whole life policy. Your eligibility is based on your current and past health conditions. While there is no medical exam to qualify for a Living Promise policy, you must answer health questions. If approved, there is no waiting period.

Yes, Mutual of Omaha will check your MIB file when you apply for their no waiting period coverage. Mutual of Omaha qualifies people for their Living Promise plan by:

- Asking the health questions

- Checking your prescription history

- Analyzing your MIB file

If your MIB file contains inaccurate information, you can correct it. Go to the MIB website to order your report. Once you get it and identify the errors, contact MIB to fix it.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

MIB website. https://www.mib.com/disclosuretransfer/disclosureservice/formrequest

-

their website. https://www.mutualofomaha.com/life-insurance/whole-life-insurance/quote

-

Moody's. https://www.mutualofomaha.com/about/financial-strength/ratings

-

S&P Global. https://www.mutualofomaha.com/about/financial-strength/ratings

-

BBB. https://www.bbb.org/us/ne/omaha/profile/insurance-companies/mutual-of-omaha-0714-104000434

-

Trustpilot. https://www.trustpilot.com/review/mutualofomaha.com

-

Google. https://www.google.com/maps/place/United+of+Omaha+Life+Insurance+Co./@41.2919772,-96.3930632,11z/data=!4m10!1m2!2m1!1sMutual+of+Omaha!3m6!1s0x87938faddb631741:0x1c63fb3068a9098d!8m2!3d41.2585725!4d-95.9622597!15sCg9NdXR1YWwgb2YgT21haGEiA4gBAZIBEGluc3VyYW5jZV9hZ2VuY3ngAQA!16s%2Fg%2F1hc7zdp8w?entry=ttu

-

Yelp. https://www.yelp.com/biz/mutual-of-omaha-omaha-6

-

NAIC Complaint Index. https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=69868&REALM=PROD&COCODE=69868&REALM=PROD

-

BBB Score & Accreditation. https://www.bbb.org/us/ne/omaha/profile/insurance-companies/mutual-of-omaha-0714-104000434

-

J.D. Power U.S. Individual Life Insurance Study. https://www.jdpower.com/business/press-releases/2024-us-individual-life-insurance-study

-

A.M. Best. https://news.ambest.com/pr/PressContent.aspx?refnum=35832&altsrc=2