What Expenses Can Be Deducted?

Funeral expenses that an estate pays are tax-deductible toward the decedent’s total taxable estate. These expenses are only deductible reimbursements on the federal estate tax return (Form 706).

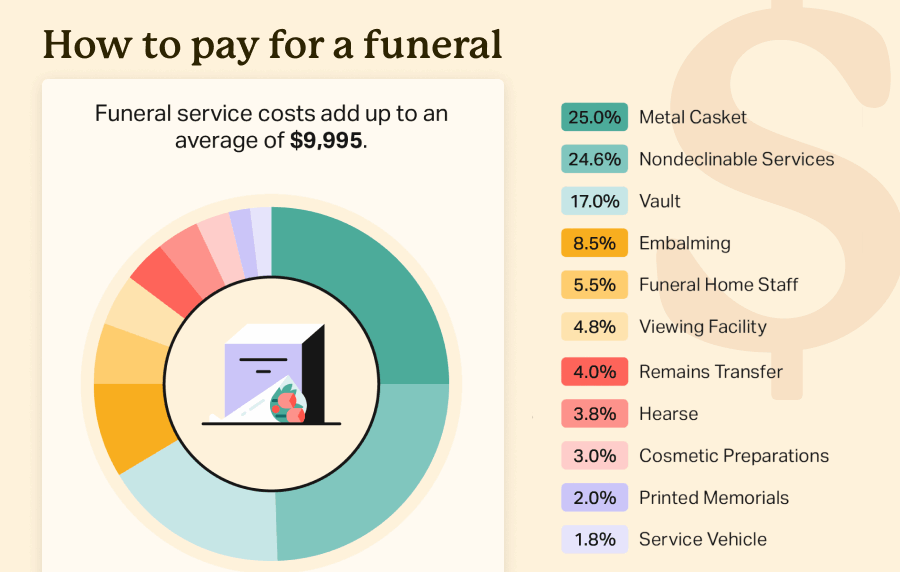

According to the IRS, itemized funeral expense deductions must be reasonable and necessary. This may include, but is not limited to, the following:

- The casket or urn

- Interment and burial plot costs

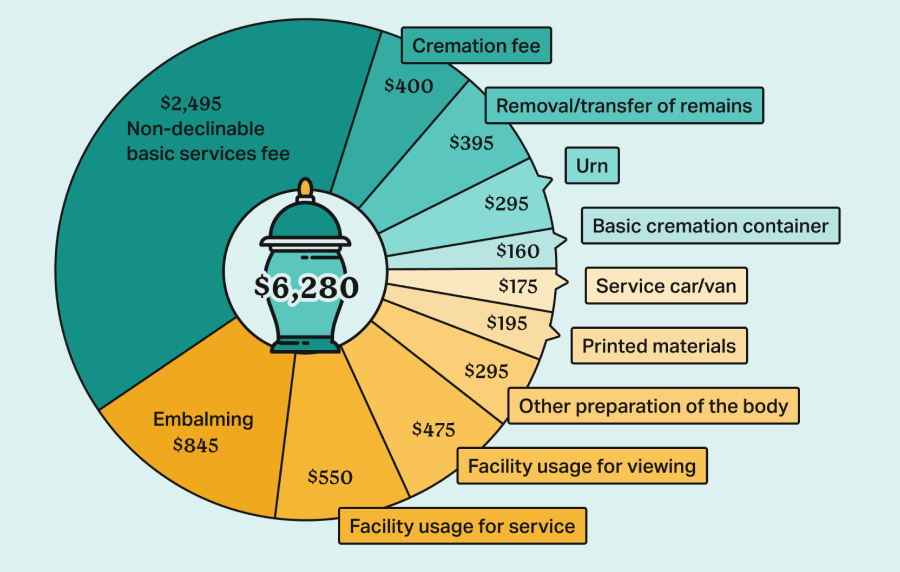

- Cremation expenses or embalming fees

- Tombstone or grave markers

- Funeral home service and director fee

- Minister/religious leader service fees

- Transportation services to the grave site

- Floral and catering services

- Other costs associated with memorial services

As for filing a tax return of a decedent’s final income, medical expenses may qualify as deductible expenses. Executors can claim them on Form 1040 or 1040-SR as long as the medical expenses were paid before the decedent’s death or within one year after their death for themself, their spouse, or dependents.

Funeral Expenses That Can’t Be Deducted

Individuals can’t deduct funeral expenses from their taxable income. For estates, some funeral and burial-related expenses are considered unnecessary and may not be deductible. This may include travel expenses to the funeral, such as flights and car rentals for funeral guests.

Additionally, any reimbursed amounts, such as through death benefits payable by the Department of Veterans Affairs (VA) or the Social Security Administration (SSA), are not deductible as funeral expenses.

Funeral expenses not paid by the decedent’s estate also cannot be deducted. This means that if a loved one of the deceased person pays for the funeral, the expenses do not qualify as tax-deductible for estate tax returns.

Estate Tax Deductions for Funeral Expenses by State

Federal tax rules are separate from state rules, and tax-deductible funeral expenses vary from state to state. That said, 12 states and Washington, D.C. still impose state estate tax even if an estate doesn’t have to file federal estate taxes. Each one also has a different taxable threshold for deductions.

Listed below are the states with estate taxes, as well as each of their exemption levels as of 2024:

| State/District | Estate Tax Threshold |

|---|---|

| Washington | $2.2 million |

| Oregon | $1 million |

| Hawaii | $5.5 million |

| Minnesota | $3 million |

| Maryland | $5 million |

| Illinois | $4 million |

| District of Columbia | $4.5 million |

| Connecticut | $13.6 million |

| New York | $6.9 million |

| Vermont | $5 million |

| Maine | $6.8 million |

| Massachusetts | $2 million |

| Rhode Island | $1.8 million |

| Source: American College of Trust and Estate Counsel | |

How Estates Can Claim Deductions

There are particular rules that estates must follow to claim deductions on their tax returns. The three major funeral expense rules are as follows:

1. Use IRS Form 706: U.S. Estate Tax Return

Executors of a decedent’s estate must use Form 706 to claim funeral expenses and deductions on their tax returns. You cannot deduct funeral costs on an income tax return for estates and trusts (Form 1041). Below is a breakdown of their differences:

- Taxable Income (Form 1041): Concerns the income an estate earned post-death and does not allow for deductible funeral expenses.

- Taxable Estate (Form 706): Involves calculating the estate’s value for estate tax purposes and does allow for deductible funeral expenses, among other things.

2. Meet the filing threshold

Estates can only claim funeral expenses if the gross estate, including exemptions and adjusted taxable gifts) exceeds $13,610,000, which is the 2024 filing threshold. If the gross estate is less than the threshold, estates are not required to file a tax return. Unfortunately, they also cannot claim the funeral expenses as a tax deduction.

3. Exclude reimbursements

Itemized funeral expenses must exclude any amount reimbursed to the estate. This refers to any type of federal aid, such as death benefits from the SSA or VA, and any payment reimbursements from insurance policies.

How To Save On Nondeductible Funeral Expenses

Fortunately, there are still ways you can save on funeral costs if you’re not able to deduct the expenses from your taxes.

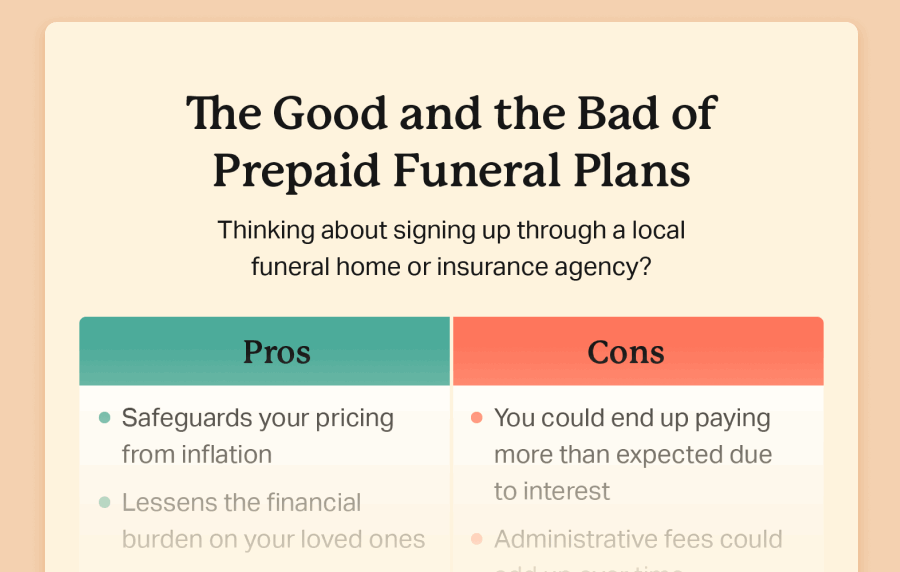

- Preplanned funerals: Prices of funeral packages and burial sites can increase over time. By purchasing and coordinating them early, you may be able to lock in the current price, saving money in the long run.

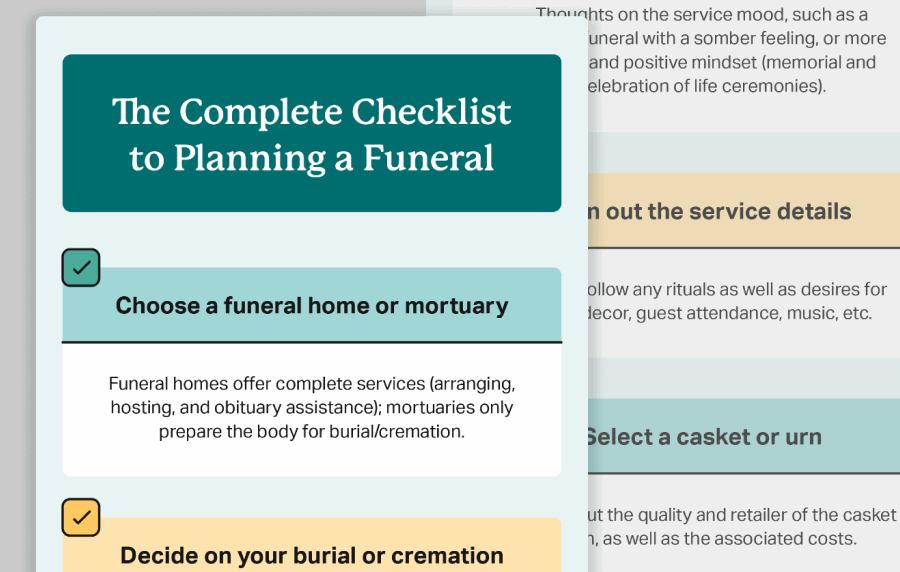

- Affordable funeral options: You can opt for cremation or nontraditional burial options, such as green burial, which are cheaper alternatives. Also, choosing smaller, more simplistic memorial services can help cut costs.

- Funeral Insurance: You can compare burial insurance policies covering end-of-life expenses. Many policies are easy to qualify for since they don’t require medical exams, and most companies accept applicants with pre-existing conditions.

- Disaster relief funds: If your family member or loved one passed away due to a federally declared natural disaster, you may qualify for FEMA disaster financial assistance. These tax-free funds cover reasonable and necessary expenses, including funerals.

Frequently Asked Questions

In most cases, no. Since the IRS deems life insurance a personal expense, premiums do not qualify as tax deductions. There are exceptions to this, depending on unique circumstances. It’s best to consult a tax professional in these cases.

No. Since payouts of burial insurance policies are tax-free, heirs are not subject to taxes. Generally, beneficiaries do not have to pay taxes on insurance payouts.

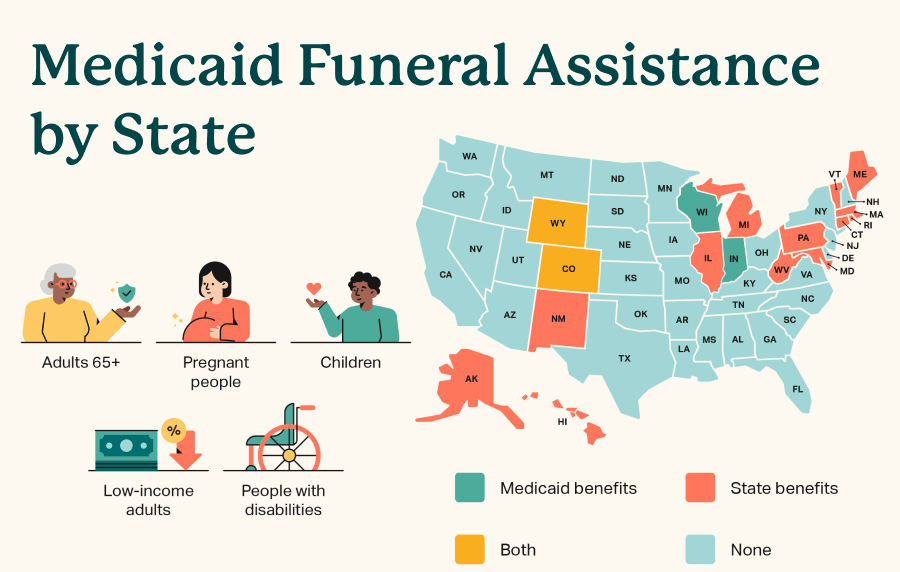

No. Medicare and Medicaid do not cover expenses related to burial, cremation, or funerals. They only cover hospital or medical-related costs. Though some states do consider Medicaid as an eligibility factor for funeral assistance.

Final expense insurance is not taxable. Your beneficiaries won’t even need to report the proceeds on their tax return because the IRS does not consider the payout money as income.

No, you cannot write off donations for funeral expenses. For donations or “charitable contributions” to be tax-deductible, the recipient must be a qualifying charitable organization through the IRS.

Medical and dental expenses paid before death by the decedent can be deducted on their final income tax return as long as the deductions are itemized.

Disclaimer: This content is for informational purposes and should not substitute advice from a tax professional.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

cannot claim burial or funeral expenses. https://www.irs.gov/taxtopics/tc502

-

Form 706. https://www.irs.gov/pub/irs-pdf/f706.pdf

-

2024 filing threshold. https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

-

FEMA disaster financial assistance. https://www.fema.gov/fr/node/615958

-

American College of Trust and Estate Counsel. https://www.actec.org/resources-for-wealth-planning-professionals/state-death-tax-chart/