The Requirements For Buying Final Expense Insurance For A Family Member

Nearly every final expense insurance company allows one family member to purchase coverage for another. Overall, the requirements are relatively simple:

- The insured agrees to the policy being issued.

- The insured signs the application verbally, electronically, or via paper.

- They answer the health questions if there are any (some policies have no health questions)

There is no scenario where you can bypass those requirements.

Even if you have power of attorney over your family member, that does not empower you to complete any of those tasks on their behalf. Insurance companies dictate their own rules, and they will not allow a POA to act on their own.

To buy any life insurance for another person, there generally must be what’s called “insurable interest.”

Insurable interest refers to the situation where the beneficiary of a policy would suffer a financial loss due to the death of the insured.

Fortunately, funeral costs easily satisfy this requirement, so you won’t endure any pushback or inquisition from insurance companies regarding why you want to buy final expense insurance for a family member.

If you find yourself dealing with a relative who doesn’t want anything to do with a final expense insurance policy, check into a pre-paid funeral plan for them.

How Much Does Final Expense Insurance Cost?

The cost of a burial insurance policy varies based on the applicant’s age, gender, health, state of residence, tobacco habits, and how much coverage bought.

Below is a final expense whole life insurance rates table with sample monthly premiums.

How Does Burial Insurance Work?

Burial insurance (also called final expense or funeral insurance) is a small whole life policy that is primarily meant to cover end-of-life expenses.

When your loved one dies, the insurance company will pay the beneficiary through a tax-free check. It’s important to remember that the payout money can be used for anything, such as debts or medical expenses, along with funeral bills. Also, any leftover funds stay with the beneficiaries.

In most cases, final expense policies are available for individuals aged 18-90, and you can purchase coverage ranging from $25,000 to $50,000 with most providers.

There are two basic types of final expense policies:

- Simplified issue: A simplified issue whole life plan requires you to answer health questions to qualify. No medical exam is required. If you’re approved, there is no waiting period, which means you’re fully insured for natural or accidental death once you make the first premium payment.

- Guaranteed issue: Also known as “guaranteed acceptance,” these plans don’t require you to take a medical exam or answer health questions. Because approval is guaranteed, there is a two-year waiting period. If you die during the waiting period, the insurance company will only refund your premiums plus approximately 10% interest. After two years, the full death benefit becomes payable for any reason.

The coverage is permanent because burial policies are a type of whole life insurance. Unlike AARP Life Insurance or Globe Life, whole life insurance plans last a lifetime.

Additionally, the premiums remain the same, and they accumulate cash value.

Tips To Find The Best Burial Insurance For Family Members

Every final expense insurance company has unique pricing, and they all accept and reject different health conditions. Therefore, it’s vital to compare multiple providers to find the best policy for a sibling, grandparent, or other relative.

To find the best final expense insurance policy for a family member, you should work with an independent insurance agency rather than trying to buy directly from an insurance company.

Independent insurance agencies (brokers) represent multiple providers rather than just one. They can objectively compare numerous policies to find you the best deal possible.

Whereas if you contact an insurer directly, such as Colonial Penn, you’re limiting yourself to just one option. If you don’t like what that company has to offer, there is no recourse.

Plus, final expense policies with no waiting period are overwhelmingly only sold through agencies. They are typically not sold directly online by insurance companies.

So, if you want to pay the least and have coverage that starts immediately, work with an independent broker like Choice Mutual or Family First Life.

How Much Does A Funeral Cost?

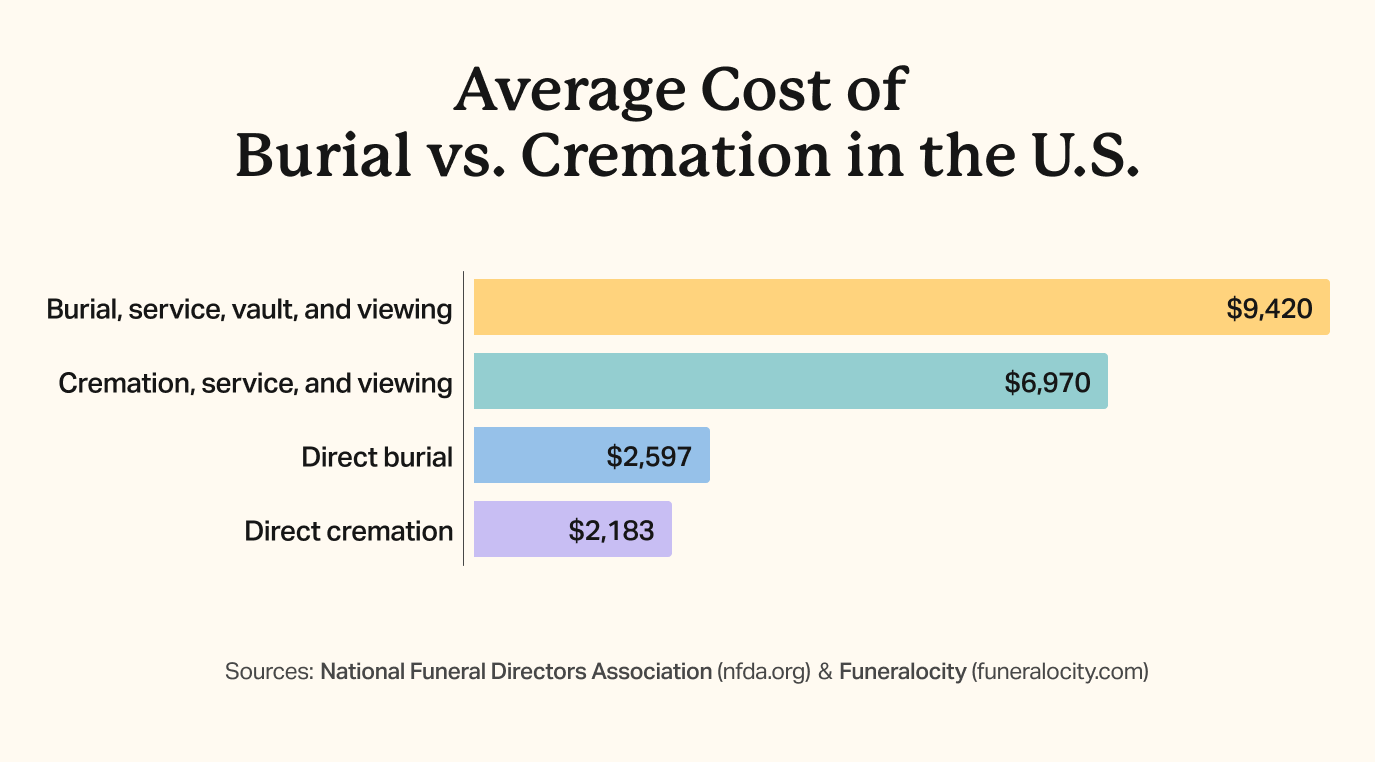

According to the National Funeral Directors Association, the average funeral costs $9,995, which includes a vault, burial, and viewing. Cremation costs are typically around $6,280 for a service and viewing.

These figures are helpful when determining how much coverage you’ll need.

Remember that you can reduce the cost of a funeral by forgoing formal services. If you opt for a “direct funeral,” the price drops significantly. Direct funerals have no memorial services. The body is simply cremated or buried immediately.

The savings are substantial. The average cost of a direct burial is $2,597. The average cost of a direct cremation is $2,183.

Frequently Asked Questions

Buying burial insurance for parents is allowed so long as they sign the application and answer the health questions (if any).

It’s impossible to legally buy life insurance for another adult without their knowledge. That’s true even if you have power of attorney over the person you want to insure. You can only buy life insurance for another person without their knowledge and consent when buying life insurance for children.

Final expense insurance is most beneficial when you only need coverage to pay for funeral expenses. If you need insurance to replace your income or pay off debts such as a mortgage, buy a term life insurance policy.

There is no such thing as family burial insurance where a single policy simultaneously insures multiple adults. However, if an adult buys a policy insuring themself, they can add on a child or grandchild rider that also provides coverage to the children. To have insurance on numerous adults, each person must have their own policy.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

power of attorney. https://www.consumerfinance.gov/ask-cfpb/what-is-a-power-of-attorney-poa-en-1149/

-

insurable interest. https://www.protective.com/learn/what-is-insurable-interest-in-life-insurance

-

direct funeral. https://www.everplans.com/articles/4-things-you-need-to-know-about-direct-burial

-

National Funeral Directors Association. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral