First Step: Determine Your Funeral Arrangements To Estimate The Net Cost

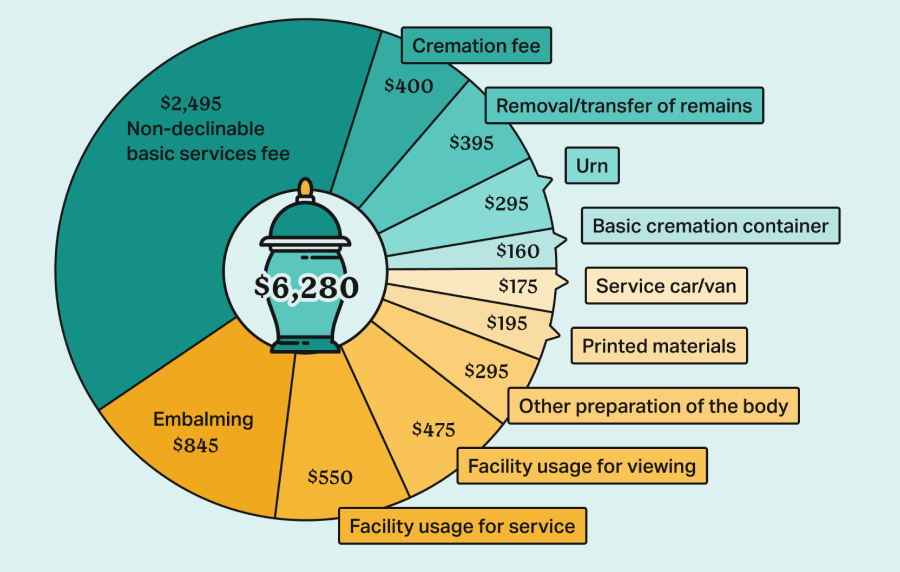

Funeral costs vary depending on your preferred arrangements, location, whether you choose burial or cremation, and more. Additional expenses, such as a viewing, refreshments, and printed obituaries, can add up quickly, so it’s essential to determine your final wishes and start budgeting for your funeral.

A funeral cost calculator can be especially helpful in accurately estimating the cost of your desired funeral. Also, contact multiple facilities to compare available services and their prices to find the best fit for your budget.

1) Get Final Expense Insurance Coverage

Final expense insurance is a type of whole life insurance that covers the cost of end-of-life expenses like funeral arrangements. It’s also commonly called funeral or burial insurance.

These policies finance burial costs with tax-free payouts to the deceased’s loved ones or their chosen funeral home. Families can then carry out last wishes without having to pay for a funeral themselves.

While burial insurance covers funeral arrangements, beneficiaries can technically spend it on anything, like paying off debt. This provides peace of mind for beneficiaries during a difficult time, as they can retain any remaining funds not applied to final expenses or estate costs.

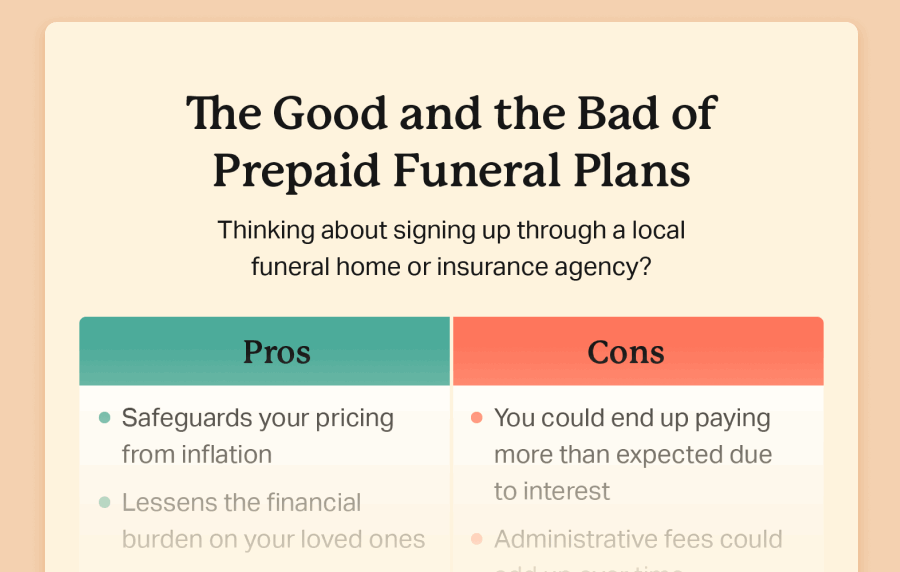

2) Prepaid Funeral Plan

With a prepaid funeral, you plan all the arrangements in advance. Once you do, the funeral home will reveal the final cost and will generally allow you to pay it in full or over 3, 5, or 10-year periods if you’re under 85 years old.

One of the most significant benefits of a prepaid burial plan is that it protects against inflation. If you die well into the future, your family won’t have to pay what a funeral costs 20 or 30 years from now.

The biggest downside of a prepaid funeral is the monthly cost. Most people cannot afford to pay cash in full up front, so they opt to make monthly payments. The monthly payments are usually $125-$300.

3) Life Insurance

All types of life insurance pay out a tax-free death benefit to your beneficiaries. There are never any restrictions on how the money is spent. If you have an existing life insurance policy, you can rest assured that your loved ones can use the payout money to cover your funeral expenses.

4) Use A Personal Savings Account

Personal savings accounts are a good place to start collecting funds for funeral expenses. Early saving allows contributions to compound with interest.

High-yield savings accounts are convenient liquid assets with annual percentage yields (APY) as high as 5%. Many banks offer high-yield savings accounts, so shop around and compare rates locally or online.

Payable on death accounts are another FDIC-insured savings option you can withdraw from as you need. A beneficiary automatically receives the funds at the time of death, so there’s no wait to cover expenses.

Experienced investors can also explore higher ROI opportunities like blue chip stocks or real estate. These are relatively secure investments over a long period of time, but they’re not very liquid if you need access to the cash quickly. It’s always wise to consult a financial advisor before investing.

5) Payable On Death Account

Payable on death accounts (also known as “POD account”, “Totten Trust”, or “Transfer on Death account”) are another FDIC-insured savings option that you can withdraw from as needed. A beneficiary automatically receives the funds at the time of death, so there’s no wait to cover expenses.

6) Pay With A Personal Loan Or Credit

In a pinch, you can also use a personal loan or credit card to cover funeral costs. These options charge interest, which means you’ll ultimately overpay for your services, but they can make the expense more manageable with monthly payments.

Some lenders offer funeral loans with no interest for a set number of months. This is a great way to access extra cash with little wiggle room to repay the debt without collecting interest charges.

7) Set Up A Funeral Trust

You can place funds in a funeral trust account that is managed by a funeral service provider, bank, or trust company and specifically designated to cover funeral-related costs. While it ensures these expenses are pre-funded, it does not identify the arrangement wishes of the deceased, so it’s important to clarify your wishes elsewhere among your personal documents.

8) Rely On Proceeds From The Estate

You can rely on your estate being liquidated as a means to pay for your funeral expenses. This is a less-than-ideal option because, due to probate, it can often take many months before an estate is processed and funds become available.

Low Cost Funeral Options

There are many alternative funeral options that, while not traditional, cost much less.

- Green funeral: A green funeral (aka natural burial) is when there is no embalming, liner, or vault. Only biodegradable materials are used so that the body will decompose naturally. A green burial usually costs about $2,597.

- Home funeral: A home funeral is where friends and family provide after-death care in a private residence rather than a funeral home. It’s a cost-effective option that’s legal in most states. This means you can celebrate the life of your loved one where they’re most comfortable and save on funeral home service expenses.

- Direct funeral: A direct funeral is when you have absolutely no memorial services of any kind. The body is immediately cremated or buried. Direct funerals are substantially less expensive. A direct burial costs roughly $5,138, whereas a direct cremation costs $2,202.

- Donate your body to science: If eligible, you can donate your body to science. Please note that every organization that has a body donation program sets its own requirements, and not everyone will qualify. Be sure to validate that the desired organization to which you want your body donated will accept you. For example, MayoClinic will not accept a person who has had multiple organs donated after their death.

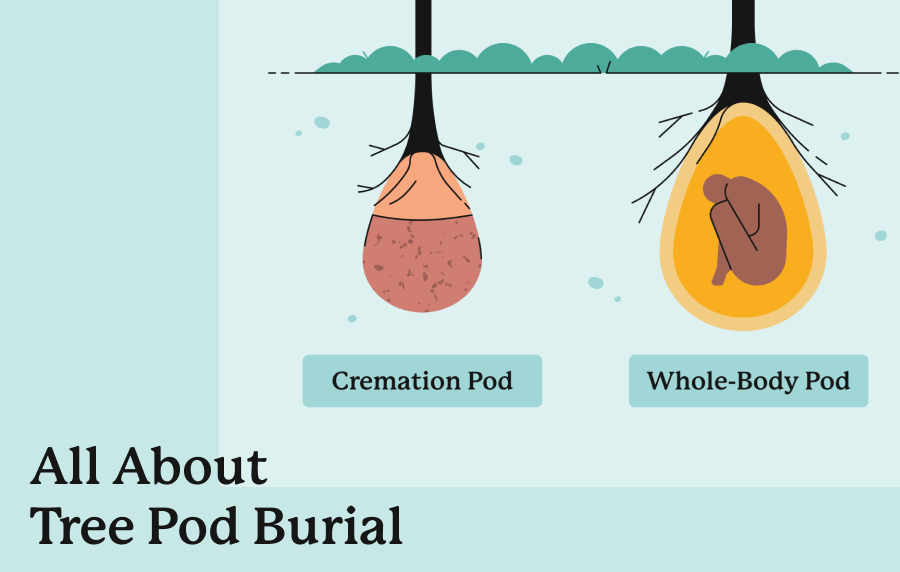

- Tree pod burial: In tree pod burials, cremated remains are placed in an organic fiber pod, along with other organic materials, and then buried in the ground, with a young tree planted above. All in, a tree pod burial will cost approximately $2,500.

Explore Resources To Pay For A Funeral Without Money

Several federal, nonprofit, and local organizations provide resources for families to pay for a funeral and reduce their financial burdens during difficult circumstances. Here are some resources to connect with if you’re trying to pay for a funeral without money:

- Veterans Benefits: Veterans and surviving spouses may qualify for a free burial.

- Social Security Survivors: Surviving spouses and dependents of Social Security benefits may receive a $225 lump sum in death benefits and monthly benefits.

- Employer Survivor Benefits: Surviving spouses of federal and civil service retirees may qualify to receive up to 55% of the retiree’s monthly benefits.

- FEMA Disaster Relief: Select funeral expenses for loved ones lost in a major disaster or emergency may be covered by the Federal Emergency Management Administration (FEMA).

- Victim’s Assistance: State Crime Victims Compensation Programs may provide financial assistance for crime victims’ medical or burial costs, and other related expenses.

- Call 211: A helpline for community services that can connect you with local organizations and assistance.

- Crowdfunding: A fundraising method that relies on small donations from a large pool of donors via sites like GoFundMe.

Frequently Asked Questions

Funeral homes offer prepaid services that require payment in full prior to any ceremony or burial. Some funeral homes may be willing to negotiate installment payments, but it’s not a guarantee.

If you’re worried about paying the full funeral cost at once, plan ahead and consider prepaid funeral arrangements or burial insurance.

Traditionally, the deceased’s estate or family will pay for a funeral, but nobody’s required to cover the bill. If no one takes charge of funeral planning, the executor of the deceased’s will or their closest relative (appointed executor by a probate court if necessary) manages the estate’s assets to collect the necessary funds.

If there are already funeral arrangements at the time of death, the person who signed that contract is responsible for paying the funeral home. This may be the deceased who agreed to a prepaid plan or a spouse who purchased companion plots with them.

Families can release the deceased’s body to the state or county coroner, who will either bury or cremate the remains. At this point, loved ones may be able to receive cremated remains for a small fee. If no one claims the remains, the coroner will bury them in a common grave.

There are federal and local organizations available that may be able to help families cover burial costs if they can’t afford a funeral, so explore local resources if you’d like to plan a funeral.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

annual percentage yields (APY) as high as 5%. https://www.investopedia.com/best-high-yield-savings-accounts-4770633

-

Veterans Benefits:. https://www.benefits.va.gov/compensation/claims-special-burial.asp

-

Social Security Survivors:. https://www.ssa.gov/pubs/EN-05-10008.pdf

-

Employer Survivor Benefits:. https://www.opm.gov/support/retirement/faq/survivor-benefits/

-

FEMA Disaster Relief:. https://www.fema.gov/pdf/media/factsheets/2011/dad_funeral.pdf

-

Victim’s Assistance:. https://www.benefits.gov/benefit/4416

-

Call 211:. https://www.211.org/

-

GoFundMe. https://www.gofundme.com/

-

Payable on death accounts. https://www.wellsfargo.com/the-private-bank/insights/planning/wpu-tod-advantages-disadvantages/

-

funeral loans. https://lendingusa.com/borrowers/funeral/

-

funeral trust. https://www.bankrate.com/insurance/life-insurance/funeral-trusts/

-

home funeral. https://www.homefuneralalliance.org/what-is-a-home-funeral.html

-

MayoClinic. https://www.mayoclinic.org/body-donation/making-donation