Which Companies Offer Funeral Insurance In New York?

The states regulate insurance products rather than the federal government. Because of that, final expense policies vary by state.

The most significant issue seniors have when shopping for burial insurance in New York is a severe lack of choices.

Most insurers refrain from offering their products in New York to avoid overburdensome regulations.

That said, below is a table with an overview of which final expense companies are available in New York.

How Much Does Burial Insurance In New York Cost?

The average cost of end-of-life insurance in New York is approximately $55-$110 per month for a $10,000 death benefit. The price you pay is based on your exact age, gender, health, tobacco usage (if any), and the death benefit.

Below is a whole life rate table showing some sample premiums for New York.

Is There A Law In New York That Makes 75 The Maximum Age For Life Insurance?

No law in New York requires life insurance companies to stop offering coverage after age 75. However, there is a law exclusive to New York that places age limits on what they call “senior life plans”.

New York’s definition of a “senior life plan” is a modified policy that has a 2-3 year waiting period. For those types of policies, the minimum age of availability is 50, and the maximum is 75.

For example, the Colonial Penn 9.95 plan is available to individuals aged 50-85 in all states except New York. Due to that law, Colonial Penn only sells the 9.95 plan to seniors 50-75 who live in New York.

Thankfully, some companies offer burial insurance for those over 75, but the options are limited. Seniors over 80 in New York can still obtain coverage, but 85 is the absolute oldest. Just remember that all plans above age 75 have health questions.

Why Is It So Hard To Find Life And Burial Insurance In New York?

Consumers in New York shopping for final expense insurance quickly realize it’s a challenging process. The typical response from companies and brokers is that they do not offer coverage in New York.

So why is that?

The problem with New York is the burdensome regulations not present in other states. For decades, insurance regulators have held the false belief that the more rules and regulations they impose on insurers to protect consumers, the better off they are.

In reality, the exact opposite is true.

Because of the oppressive regulations in the state, insurance companies choose not to offer coverage there. It’s much harder for them to be profitable, and they would rather avoid the headaches (and lawsuits) that come with trying to comply with all the regulatory requirements that other states simply do not have.

For example, Mutual of Omaha used to offer its Living Promise coverage in New York. However, they removed it from the state in 2018 because of New York laws. Similarly, Foresters Financial used to offer final expense insurance in New York. However, they, too, removed it from the state for the same reasons.

Ultimately, New York laws result in citizens having approximately 80% fewer final expense insurance options compared to all other states.

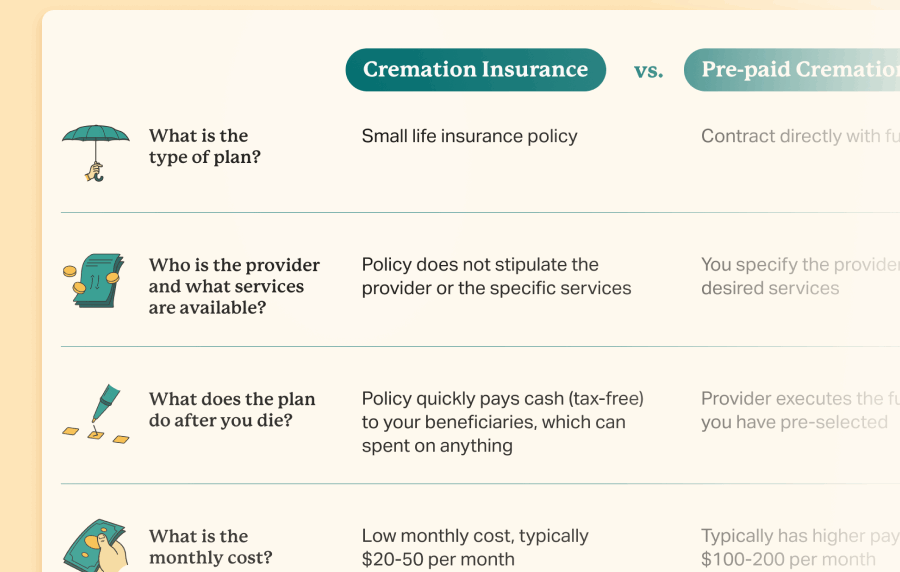

How Does Final Expense Insurance Work?

Final expense insurance is a small whole life insurance policy that covers end-of-life expenses. The top burial insurance companies typically offer $2,000-$50,000 in coverage.

They don’t require medical exams, and seniors with complicated health histories can still qualify.

Most policies only require you to answer a few health questions, and some plans offer guaranteed acceptance with no questions asked.

Opting for a guaranteed life insurance plan will be more expensive and have a two-year waiting period.

The fine print is straightforward, as these plans are whole life insurance.

The price never changes, the death benefit will never decrease, and the coverage lasts forever. In addition, cash value will grow over time, which the policyholder can access and spend in any way they desire.

The insurance company will pay the death benefit directly to your beneficiaries or a funeral home when you die.

When you die, the insurance company will pay your beneficiaries the death benefit (tax-free), which can be spent on funeral expenses, medical bills, debts, or any other expenditure.

If your loved ones don’t need all the money for funeral costs, they can keep the remaining money.

How Much Does A Funeral Cost In New York?

| Service Type | Average Cost |

|---|---|

| Burial Service | $8,573 |

| Direct Burial (No Service) | $4,999 |

| Cremation Service | $6,498 |

| Direct Cremation (No Service) | $2,392 |

| Funeral with service data source: NFDA General Price List Study Direct funeral data source: Funeralocity |

|

A funeral cost calculator can be very helpful in accurately estimating your final expenses.

The Free Look Period In New York And The FTC Funeral Rule

The New York DFS mandates that all life insurance policies include a “free look” provision that is a minimum of 10 days but may go as long as 30.

This clause grants the policy owner the right to review and refuse a newly issued policy for any reason. Furthermore, if you return the policy within the free look period, the insurer must refund you any premiums paid.

On a national level, the Federal Trade Commission established the Funeral Rule that governs funeral service providers. This law requires them to provide consumers with written prices and allows them to pick and choose which products and services they want.

Additionally, funeral homes must accept products from outside sources, such as caskets, urns, or flowers.

Where To Buy Final Expense Insurance In New York

Especially since New York is such a challenging state, it’s critical you find a reputable independent broker that represents multiple insurance companies.

Brokers such as Choice Mutual, Heartland Financial Group, or Family First Life, compare all companies side by side to find the one that is best for them.

Alternatively, you could buy directly from an insurance provider, but those are few and far between. If your goal is not to work with an agent, the AARP burial insurance program is likely your best option to investigate.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

states regulate insurance. https://www.iii.org/publications/commercial-insurance/how-it-functions/regulation

-

NFDA reports. https://nfda.org/news/media-center/nfda-news-releases/id/8134/2023-nfda-general-price-list-study-shows-inflation-increasing-faster-than-the-cost-of-a-funeral

-

New York DFS. https://www.dfs.ny.gov/consumers/life_insurance

-

Funeral Rule. https://www.ftc.gov/news-events/topics/truth-advertising/funeral-rule

-

law exclusive to New York. https://www.dfs.ny.gov/consumers/life_insurance/types_of_policies

-

Funeralocity. https://www.funeralocity.com/average-funeral-price

- Data sourced from Choice Mutual quote calculator for a 65-year-old applicant who does not use tobacco. Data is valid as of 10/30/2025.

- Data sourced from Choice Mutual quote calculator using a 365-day rolling average (10/31/2024-10/31/2025).

- Data sourced from 2023 NFDA General Price List Study.