How Does Burial Insurance With No Waiting Period Work?

Any type of life insurance with no waiting period will pay out the entire death benefit, even if death occurs during the first two years. The cause of death can be natural or accidental, and your beneficiaries will still receive the full death benefit.

For example, let’s say you’re approved for an immediate coverage $50,000 policy, and your first payment is scheduled for July 1st. If you die on July 1st or any day thereafter from something other than suicide (that’s the only exclusion), the insurance company would have to pay out $50,000 to your beneficiaries.

How To Qualify For No Waiting Period Final Expense Coverage

To qualify for life or final expense insurance with no waiting period, you must apply with a company where you answer health questions and are subsequently approved. You don’t have to undergo a medical exam but must answer questions about your medical history.

You needn’t necessarily be in good health to qualify for an immediate coverage plan. Most people can qualify for “first-day coverage” despite having pre-existing medical conditions.

It’s usually just a matter of searching until you find a life insurance company(s) that will accept all your health conditions and approve you for immediate coverage.

What Is A Partial Life Insurance Waiting Period?

Most companies commonly refer to a partial waiting period as a “graded plan.” A partial waiting period means that only a portion of the death benefit will be paid out during the first two years.

It’s common for partial plans to have a payout of 30%- 40% during the first 12 months. Then, during months 13-24, the payout is typically 50%- 75%. The precise payout amounts vary based on the company.

Like a full no waiting period burial insurance policy, partial coverage options still require you to answer health questions to qualify (there is never a medical exam).

Some people may not be eligible for an immediate benefit type of life insurance but could qualify for a partial plan.

How To Verify If A Life Insurance Policy Has A Waiting Period

If you recently bought a life insurance policy, you must verify if there is a waiting period.

It’s important to remember that lawyers and actuaries compose insurance policies, which is why there is no straightforward, easy-to-understand language that clarifies if there is or is not a waiting period.

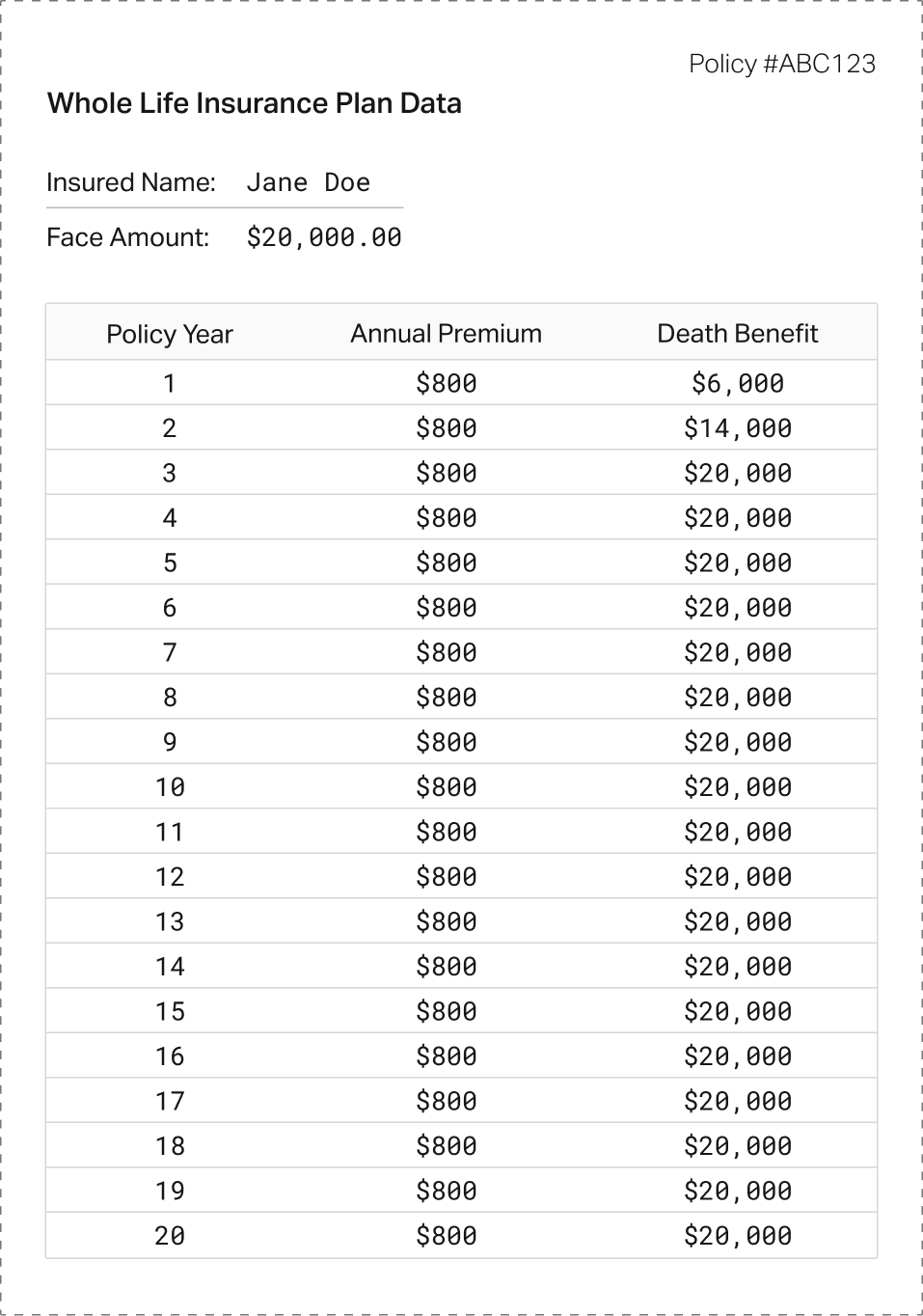

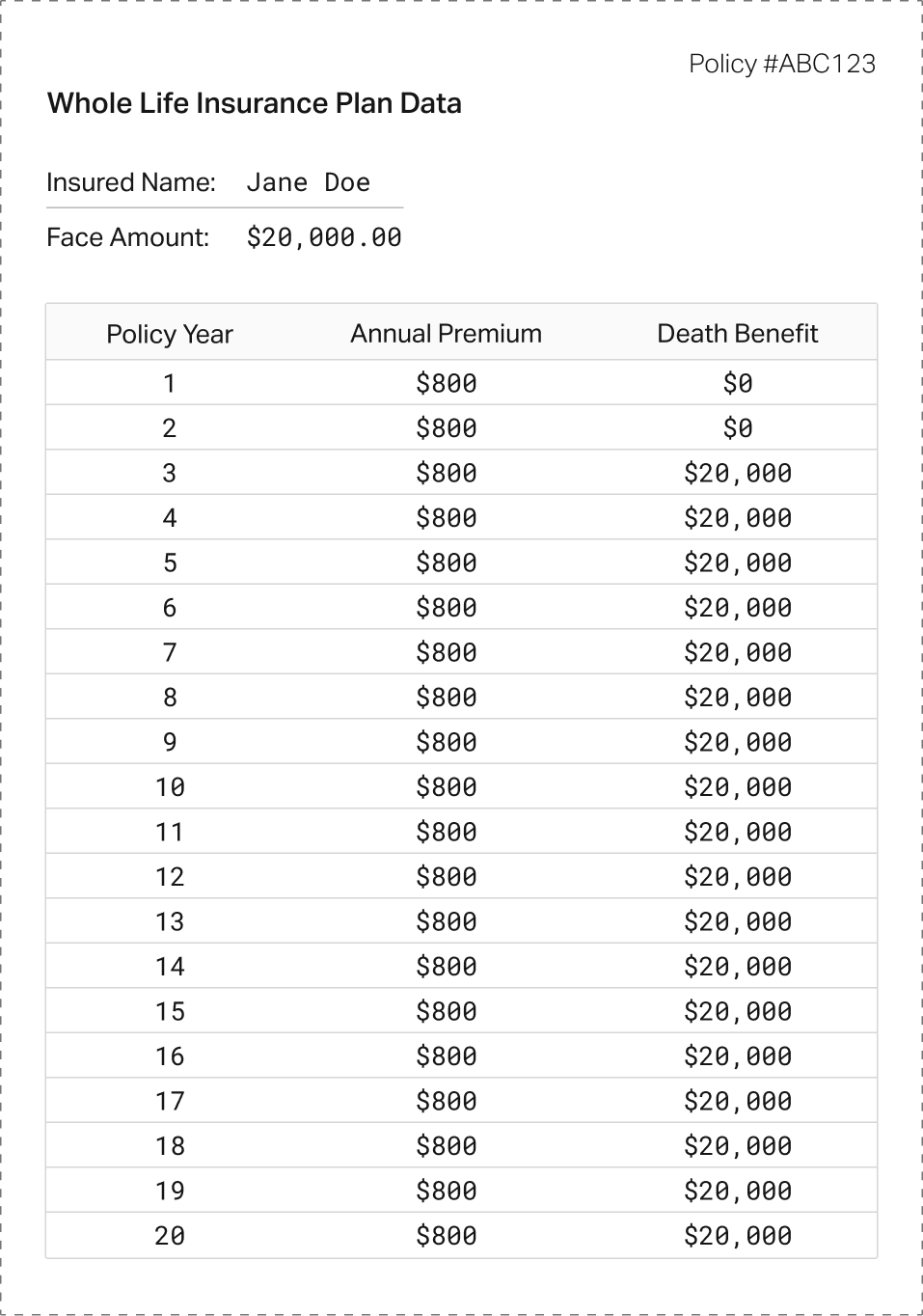

Instead, there will be a table within the policy that outlines the net death benefit for each year of the policy. Below are some examples of how these tables look.

Best Burial Insurance Companies With No Waiting Period

- $10K Policy Cost $41.01/month*

- New Applicant Ages 45-85

- Death Benefit Options $2,000-$50,000

- 2-Year Waiting Period No

- $10K Policy Cost $47.60/month*

- New Applicant Ages 40-89

- Death Benefit Options $2K-$25K

- 2-Year Waiting Period No

- $10K Policy Cost $43.99/month*

- New Applicant Ages 45-80

- Death Benefit Options $2,000-$50,000

- 2-Year Waiting Period No

Health Issues Where You Will 100% Have A Waiting Period

Unfortunately, some medical conditions are such a high risk that no insurer will offer immediate or partial coverage.

You will have a two-year waiting period if you have any of these conditions in your medical history.

- AIDS or HIV

- Alzheimer’s or dementia

- Currently in a hospital, nursing home, long-term care or skilled nursing facility

- Actively have or are being treated for cancer (excluding basal or squamous cell and certain stage 0-1 cancers)

- Hospice care

- Mental incapacity

- Home health care

- Alcohol or drug abuse (or treatment for either) within the last 24 months

- Terminal illness

- Wheelchair usage due to an illness or disease

There may be other conditions, but this is the majority of them. As you read that list, you’ll notice that many chronic illnesses are not noted. As stated earlier in this article, most conditions are insurable. It’s well worth consulting with an experienced licensed agent who can determine if you’re eligible for first-day or partial coverage.

How Do Guaranteed Acceptance Life Insurance Policies Work?

As the name suggests, a guaranteed issue life insurance policy assures that everyone is approved regardless of their health or lifestyle history. The application process does not require you to take an exam or answer questions.

It’s critically important to understand that all guaranteed acceptance policies have a mandatory two-year waiting period for natural causes of death.

If the policyholder dies within the first two years (except for accidental death), the insurer will only refund the premium payments.

All guaranteed acceptance plans are whole life insurance, which means the coverage lasts forever, premiums remain the same, and it builds cash value. Presently, guaranteed issue term life insurance does not exist with any company. Also, guaranteed policies have higher premiums than other life insurance options, and the coverage amounts are always capped at $25,000.

Is There Guaranteed Acceptance With No Waiting Period?

There is no such thing as a life insurance policy with no health questions and no waiting period.

All guaranteed issue life policies have a two-year waiting period.

Sadly, some companies will lie and make it seem like you can get a policy with no questions and no waiting period.

If there were a policy that had no underwriting and covered you immediately, every terminally ill person would buy it.

The insurance company would be out of business within months.

Burial Insurance Vs. Life Insurance

Burial insurance is a marketing expression that refers to a particular type of whole life insurance policy intended to cover funeral costs.

It’s a special type of permanent life insurance designed for seniors with pre-existing conditions that otherwise wouldn’t qualify for traditional life insurance coverages.

Burial expense policies for seniors are very different from traditional life insurance products because they will accept applicants with many health issues, you can buy a small amount of coverage, and the claim payout time is quick.

When you die, the insurance company will pay the money (tax-free) directly to your loved ones or funeral home to pay for funeral expenses, cremation expenses, medical bills, or anything else.

For even more information about how burial insurance differs from traditional life insurance, read “burial insurance vs. life insurance.”

No Exam Vs. No Health Questions

A no-exam life insurance policy differs significantly from one with no health questions. Life insurance ads that only say “no medical exam to qualify” are not guaranteed acceptance.

To set the record straight:

- No medical exam life insurance: A simplified issue policy that does not require you to undergo an exam to give a blood and urine sample. You will still have to answer health questions, which determine your eligibility. These types of policies have no waiting period if you’re approved.

- No health questions: A guaranteed acceptance policy that does not require you to answer any questions about your health or take an exam. These plans always have a two-year waiting period.

Given the prevalence of deceptive life insurance marketing (such as the Colonial Penn $9.95 plan, it’s understandable how shoppers confuse these two terms.

Tips For Getting Full First-Day Coverage

You can take some practical steps to give yourself the best chance at finding a life insurance plan that covers you in the first two years.

The goal is to find an insurance company with underwriting accepting of all your health issues.

The best way to find said insurer(s) is to work with an independent insurance broker. Independent agencies like Choice Mutual partner with multiple insurance companies for the policyholder’s benefit.

They can freely compare dozens of policies and insurance quotes on your behalf. They will look at the underwriting for each company to determine if any will approve you for immediate coverage.

If you deal with a captive agent representing only one insurer, they cannot investigate multiple companies on your behalf. If their one company doesn’t approve you, they have no recourse.

The same applies when dealing directly with an insurer, such as New York Life AARP burial insurance, TruStage, or Globe Life.

If they don’t approve you (which all three of those companies rarely approve applicants with pre-existing conditions), they certainly will not try to find you another insurer that will.

Working with an independent life insurance agent doesn’t cost you anything. Also, the insurance isn’t more expensive because you used a “middleman.” Brokers get paid by insurance companies, so their services come at no charge to you.

Eligibility Based On Medical Conditions

The table below lists various health issues and whether or not they are eligible for no waiting period life insurance.

Please remember that final eligibility is based on your age, state, and complete health history.

| Health Condition | Eligibility |

|---|---|

| AIDS or HIV | Waiting period |

| Alcohol or drug abuse | <2 Yrs: Waiting period >2 Yrs: Immediate |

| Alzheimer’s disease | Waiting period |

| Amputation due to disease | Immediate |

| Angina (chest pains) | Immediate |

| Anxiety | Immediate |

| Arthritis | Immediate |

| Assistance with activities of daily living (ADL’s) | Immediate |

| Asthma | Immediate |

| Atrial fibrillation (Afib) | Immediate |

| Bipolar disorder | Immediate |

| Blindness | Immediate |

| Blood clots | Immediate |

| Blood thinners | Immediate |

| Bone marrow transplant | <5 Yrs: Waiting period >5 Yrs: Immediate |

| Cancer | Many variables to consider |

| Chronic bronchitis | Immediate |

| Chronic kidney disease | Immediate |

| Circulatory/heart surgery | Immediate |

| Cirrhosis | Immediate |

| Congestive heart failure (CHF) | Immediate |

| COPD | Immediate |

| Covid | Immediate |

| Crohn’s disease | Immediate |

| Cystic fibrosis | Immediate |

| Defibrillator | Immediate |

| Dementia | Waiting period |

| Depression | Immediate |

| Diabetes (Type 1) | Immediate |

| Diabetes (Type 2) | Immediate |

| Diabetic coma | Immediate |

| Diabetic nephropathy | Immediate |

| Dialysis | Immediate |

| Emphysema | Immediate |

| Enlarged prostate | Immediate |

| Epilepsy | Immediate |

| Fibromyalgia | Immediate |

| Graves disease | Immediate |

| Heart attack | Immediate |

| Hepatitis A | Immediate |

| Hepatitis B | Immediate |

| Hepatitis C | Immediate |

| High blood pressure | Immediate |

| High cholesterol | Immediate |

| Home health care | Waiting period |

| Hospice care | Waiting period |

| Insulin shock | Immediate |

| Insulin usage | Immediate |

| Lupus | Immediate |

| Mini stroke (TIA) | Immediate |

| Multiple sclerosis | Immediate |

| Nephropathy | Immediate |

| Neuropathy | Immediate |

| Obesity | Immediate |

| Organ transplant | <5 Yrs: Waiting period >5 Yrs: Immediate |

| Oxygen equipment | Immediate |

| Pacemaker | Immediate |

| Pancreatitis | Immediate |

| Parkinson’s disease | Immediate |

| Retinopathy | Immediate |

| Rheumatoid arthritis | Immediate |

Schizophrenia| Immediate |

|

| Seizure issues | Immediate |

| Sickle cell anemia | Age 0-49: Waiting Period Age 50+: Immediate |

| Sickle trait | Immediate |

| Sleep apnea | Immediate |

| Stroke | Immediate |

| Systemic lupus | Immediate |

| Terminal illness | Waiting period |

| Transient ischemic attack (TIA) | Immediate |

| Tumors (cancerous) | Many variables to consider |

| Tumors (noncancerous) | Immediate |

| Ulcerative colitis | Immediate |

| Wheelchair due to an illness or disease | Waiting period |

How Does The “Contestability Clause” Work?

Life insurance policies that provide full or partial coverage during the first two years will always contain the incontestability clause. The incontestability clause grants the insurer the right to investigate death claims within the first two years (it’s one year in some states).

Before paying the claim to your beneficiaries, the insurance company will order all your medical records. Their goal is to determine if the applicant truthfully answered the health questions when they applied.

If your medical records showed that you had a declinable condition when you applied, they would not pay your claim. Instead, they will void the policy and refund your premiums.

Alternatively, they will pay the full death benefit if your medical records confirm that you didn’t have any declinable conditions when you applied.

It’s important to remember that the insurance company is not concerned about your health issues after the policy is issued.

They are only concerned with your health history before you apply. Your health conditions that arose after the policy was issued are irrelevant.

Truthfully, contestable claims are rare, and most result in a total payout.

However, there are some claim denials because the insurance company found that the applicant rightfully didn’t qualify in the first place due to a misrepresentation of their health.

Check out this example contestability clause from an actual policy to see how it reads.

Remember that you can get no waiting period burial insurance, but it will still contain the contestability clause.

Frequently Asked Questions

Most burial policies have no waiting period, but some do. The only ones with no waiting period don’t require a medical exam. However, you must answer questions about your health history to determine if you’re eligible for immediate coverage.

If there is a waiting period, it will always be two years or more. No company offers a policy with a waiting period of less than 24 months.

Just like full immediate coverage, you must answer health questions to get partial coverage in the first two years. No exam is required, but you’ll have to complete a health questionnaire and subsequently be approved by the insurance company.

Plans with no health questions must have a waiting period to protect the insurance company. Since they know nothing about the applicant’s health, the waiting period protects them from those on their deathbed buying a policy and collecting thousands of dollars shortly afterward.

You don’t have to take a medical exam to qualify for immediate coverage. However, you will have to answer questions about your health.

Absolutely not. If there are no health questions, there will always be a two-year waiting period.

Final expense insurance is a type of whole life insurance primarily meant to cover your end-of-life expenses. These policies offer peace of mind, knowing that you won’t leave a financial burden on your loved ones when you die. When you die, the insurance provider will pay a cash benefit to your family members so they can pay for your end-of-life costs. Any leftover money is theirs to keep and does not go to the funeral home. It’s common to hear a final expense policy referred to as “burial insurance,” “funeral insurance,” or “cremation insurance.”

If you don’t have insurance to cover the cost of a funeral, there are a few ways to pay for a funeral. You can set up a pre-paid funeral plan at a funeral home, put it on a credit card, or use crowdfunds using websites like GoFundMe. Some states offer Medicaid funeral assistance, but not many. Also, Social Security only pays $255 for the death of a loved one, which is nowhere near enough to pay for burial costs.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

accidental death. https://www.investopedia.com/terms/a/accidental-death-benefit.asp#toc-what-is-considered-accidental-death

-

incontestability clause. https://www.policygenius.com/life-insurance/what-is-the-life-insurance-contestability-period/

-

Social Security. https://www.ssa.gov/survivor