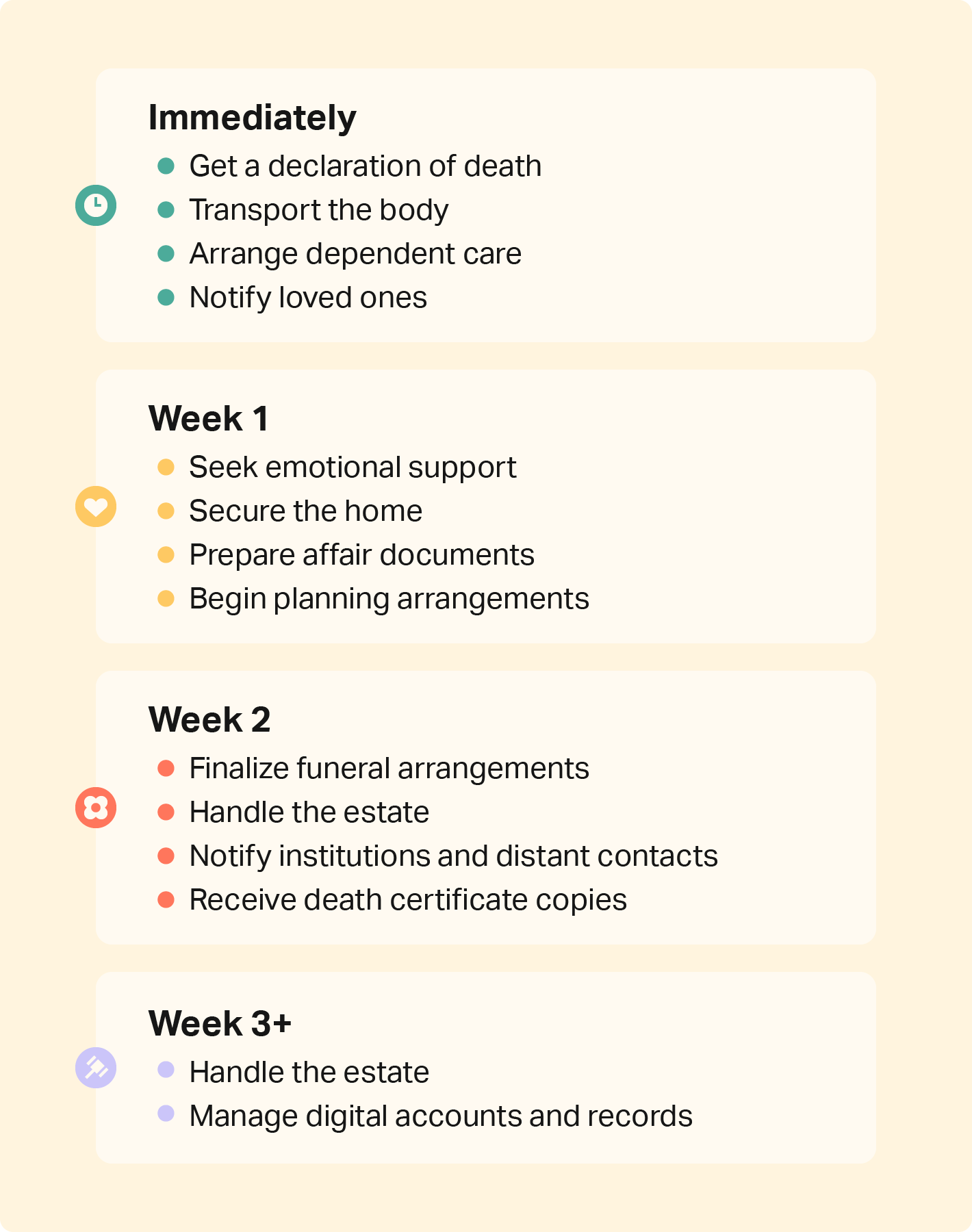

Knowing what to do when someone dies really only comes from unfortunate experiences, and balancing your own grieving process with this responsibility isn’t easy. The weeks following someone’s death are emotionally trying, but there are several items that need to be addressed immediately.

This checklist will help you organize the steps to manage your loved one’s affairs with compassion.

1. Get An Official Declaration Of Death

The death certificate is the most crucial document you need to get after someone dies. This official document legally certifies that someone is no longer living.

It allows you to close bank accounts, cancel subscriptions, claim a life insurance benefit, and much more.

According to the CDC, a doctor, medical examiner, or coroner typically certifies the death.

The company that handled the final arrangements — usually a mortuary, funeral home, or crematorium — will prepare and formally file the death certificate with the National Vital Statistics System.

It’s also common for a physician or other health care provider to file a death certificate. But it’s not something you can do yourself.

If you’re a doctor, you might have someone else, like the county coroner, issue the declaration of death.

2. Arrange Transportation For The Body

While it’s not a pleasant task, somebody must move your loved one’s body. Medical staff typically helps with this process if the death happened in a hospital or hospice care facility.

Otherwise, you may need to contact a funeral director (aka mortician) to take the body to the funeral home, mortuary, or crematorium.

You’ll need to handle organ donation quickly if your loved one is an organ donor. The mortician, health care provider, or medical facility will help you contact the proper authorities.

3. Ensure Dependents Have Care

Someone must assume immediate care of children, adults, and pets who relied on the deceased for their basic needs.

Reach out to the deceased individual’s close relatives and friends who can supervise and protect dependents — at least temporarily.

Ideally, the deceased will have named guardians in their will. Those people should step in as soon as possible.

If the person who passed away did not make arrangements ahead of time, the court might get involved. In a worst-case scenario, dependents could end up in foster care.

Don’t forget that kids need help dealing with bereavement, too.

4. Tell Family And Friends

Relaying the bad news of a loved one’s passing to family and friends won’t be easy. But despite your reservations, it’s important not to delay this task.

Begin by making an immediate call list including immediate family, best friends, and caretakers. You could enlist another close friend or relative to help you contact those who need to know first through phone calls, emails, or texts.

Next, contact their employer — especially if your loved one held a demanding job, like teachers or medical professionals.

Follow up by telling other close friends, coworkers, and individuals who may need to know about the death immediately. You or someone else will also be responsible for writing the obituary.

5. Secure The Home

In the chaos of death, doors or windows may be left open or unlocked and security systems turned off.

Ask someone trustworthy to secure the deceased person’s residence. House sitting, trash removal, yard maintenance, plant watering, and mail gathering are also important.

Keep people from visiting or moving into the space. This can cause a number of complications including theft, property damage, or refusal to leave. It will be easier to manage the estate if no one new is living there.

6. Find Emotional Support

It’s important to get emotional support when grieving the death of someone close to you. Friends and family who’ve experienced similar losses are usually more than happy to listen and help however they can.

Grief support groups are another helpful resource to cope with the death of someone you were close to, and many are free.

Grief counselors certified by the American Academy of Grief Counseling may be helpful. The American Red Cross also offers help finding emotional and financial support after a death.

Community connections with churches or other religious groups are good places to seek support and talk to people with shared values and beliefs about death.

It’s also valid to want to be alone while you grieve. If so, you can still find support through podcasts, books, Reddit posts, and YouTube videos about grief. They can help you process what you’re going through and feel less alone.

7. Prepare To Settle Their Affairs

Estate executors and surviving loved ones are responsible for taking care of the financial and estate affairs in the weeks and months after death.

You’ll want to collect several documents that the deceased may have left to prepare for this process, including:

- A will

- Account statements

- Debt records

- Identification documents

- Tax returns

- Credit reports

There are also a few legal documents for the executor to retrieve. If there’s a will, they need to get a letter of testamentary to administer the estate. The process varies between states but always requires a petition to the deceased’s county probate court.

Surviving spouses and next of kin will need a letter of administration or representation from a probate court to administer the estate.

If the deceased didn’t have a will, the probate court will appoint an attorney to act as executor of the estate and distribute the assets according to state intestacy laws.

When the estate is insolvent and doesn’t have enough money to cover all the bills the deceased owed, state law determines who gets paid and in what order.

One of the great things about final expense insurance is that it isn’t part of the deceased’s estate. It doesn’t have to go through probate, creditors can’t take it, and it’s not taxed. The beneficiaries can get the money almost right away after the policyholder dies.

8. Make Final Arrangements

Within a couple of days, you’ll want to handle final arrangements for the deceased. Here’s an overview of steps involved:

- Review final wishes: Find existing funeral, burial, or cremation plans, or make your best guess to honor their wishes and any survivors’ wants.

- Check your budget: Consider financial resources provided to cover burial costs including prepaid funeral plans, transfer-on-death (TOD) accounts, and life insurance policies.

- Shop around: Compare quotes between funeral home providers and their services for the best price and plan.

- Decide how to handle the body: Choose between burial (traditional green, backyard), cremation (flame, water), and entombment.

- Plan funeral and memorial services: Decide what services are best for the deceased’s wishes and comforting grieving loved ones.

The deceased may have any number of plans predetermined to smooth the planning and financial burdens of final arrangements. Loved ones and the executor are also great resources for service planning, but it may require some compromises to plan a compassionate and affordable service.

9. Notify Extended Contacts And Institutions

Loved ones of the deceased will usually know the key people to share the sad news with. But what about the less obvious people?

To figure out whom to contact, make a list. Identify all the types of people the deceased knew so that you can fill in the names. Here are the main categories and some examples.

- Frequent acquaintances: anyone who will be concerned when your loved one doesn’t show up to their next class, meeting, or gathering, including tennis instructors, book club members, volunteer groups, senior center regulars, and religious group members

- Professional contacts: people like former coworkers, colleagues, and members of a professional organization the deceased was active in

- Old friends: those who knew your loved one back in the day, like childhood friends, high school and college friends, and military friends

- More distant relatives: people your close relatives may not have told yet, like stepsiblings or second cousins

It’s also important to notify relevant organizations and institutions that the deceased had connections with.

- Health care providers: anyone the deceased regularly saw who might not have been notified, like a primary care physician, dentist, massage therapist, or mental health professional

- Financial institutions: organizations that managed the deceased’s financial accounts like banks, lenders, and insurance providers

- Service providers: subscription services like utility, internet, phone, or meal preparation companies who will continue to bill and provide services unless notified

- Post office: USPS and other delivery companies should be updated and provided with a new address

Be sure to also forward important mail and register the deceased with “do not call” lists to protect the deceased from scammers and identity theft.

10. Copy And Distribute Death Certificate

Here’s a list of places where the executor may need to send an official death certificate and why:

- Social Security Administration: If the deceased received any Social Security benefits, it’s a high priority to notify the SSA to avoid or minimize overpayments and fines. You can also check eligibility and apply for survivor benefits.

- Pension administrator: If the deceased received a pension, the administrator needs to know. If applicable, benefits will be stopped or changed to spousal or survivor benefits.

- Annuity provider: Like pension payments, annuity payments either cease at death or transfer to a spouse or other beneficiary. Annuity payments received after death will need to be returned.

- Family court: Let the court know if the deceased was responsible for child support or alimony payments. The deceased’s estate may be responsible for additional payments. If the custodial parent dies, the court may need to order that child support be redirected to the new guardian.

- Financial advisor: The deceased’s financial advisor can help marshal the assets. They will also want to know that their client has passed away.

- Financial institutions: If the deceased set up transfer-on-death designations, account assets can be paid to beneficiaries as soon as the bank or brokerage receives the death certificate. These assets won’t go through probate. However, you may not want to notify them right away. Freezing or closing the account could mean automatic payments stop going through. Essential bills, like the deceased’s mortgage, won’t get paid, which could create major problems. It’s also essential to collect the deceased’s last paycheck and make sure it includes any vacation or personal time they haven’t used.

- Life insurance company: Track down any life insurance policies the deceased owned to access funds for beneficiaries.

- Other insurance companies: Keep some types of insurance active for now, such as homeowners, renters, flood, earthquake, and auto, to protect the deceased’s assets until the new owner takes the title. You can discontinue other policies like health insurance or health care sharing ministries.

- Government agencies: Prevent fraud and contact the state department of motor vehicles to cancel the deceased’s driver’s license, the U.S. State Department to cancel their passport, and the local voter registration agency to remove the deceased’s name from voter rolls. Then notify the IRS of the death.

- Credit agencies: Notify Experian, Equifax, and TransUnion to prevent fraud.

- Veterans Affairs: Contact the VA if the deceased served in the military and was honorably discharged. The VA provides benefits to help families with burial and memorial services at VA cemeteries.

11. Handle Online Accounts And Digital Records

Some companies don’t make it easy to learn how to close a deceased person’s email, social media, or other online accounts. Even when they do, it can be stressful to find the right instruction and contact pages yourself.

This list of links can help you get started.

If your loved one had an email account (there’s a good chance they had several), the service provider will probably need a copy of the death certificate to close the account.

They are unlikely to grant you access because of their privacy policies.

If you do nothing, the provider will close the account after a long enough period of inactivity, but closing it proactively is a good way to prevent hackers from taking over and stealing personal info or spamming your loved one’s contacts.

Social media

Similar to email, you might want to close active social media accounts because hackers may try to take over the account if you leave it open.

New activity on a deceased person’s account can be confusing and disturbing to loved ones, friends, and colleagues who suddenly see new messages or content from the person who has passed away.

If you don’t want to close the account and lose access to old photos and posts, some companies will let you memorialize them instead.

Frequently Asked Questions

Co-signers, co-owners, and the deceased’s estate are responsible for remaining debts. These obligations must be repaid from existing assets before beneficiaries receive their inheritance.

For example, if someone dies with a mortgage, the estate must continue payments to avoid foreclosure. If heirs can afford the payments, the mortgage servicer might transfer the loan to them. If the home is sold, the proceeds pay off the mortgage lender and other creditors.

Only what’s left will go to heirs. If there’s any good news here, federal student loans get wiped out when you die. Some private student lenders discharge loans at death, too.

If your loved one incurred medical debt before passing away, their estate should pay any medical bills they owe. However, if the unpaid debt is larger than the estate’s value, the court decides which creditors get paid first and how much they get.

Consumers have rights under federal law about medical debt collection. Learn your state’s laws about who is responsible for the deceased’s medical debt, including laws about Medicaid recovery. Talk to an elder law attorney if you need help.

You may need a lawyer when someone dies if their estate is complex. For example, if the deceased has a lot of assets, has an invalid will, or has relatives contesting the will, a probate attorney may be able to help.

Final Arrangements With Grace

Knowing what to do when someone dies isn’t intuitive, and there are several legal and emotional phases of post-death planning. See if your loved one had final expense insurance or prepaid arrangements to reduce the financial and emotional burden of planning.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

According to the CDC. https://www.cdc.gov/nchs/nvss/writing-cause-of-death-statements.htm

-

National Vital Statistics System. https://www.cdc.gov/nchs/nvss/index.htm

-

Grief support groups. https://psychcentral.com/health/online-grief-support-groups#comparison

-

American Academy of Grief Counseling. https://aihcp.net/american-academy-of-grief-counseling/

-

American Red Cross. https://www.redcross.org/virtual-family-assistance-center.html

-

survivor benefits. https://www.ssa.gov/benefits/survivors/

-

annuity payments. https://www.annuity.org/annuities/beneficiaries/

-

Then notify the IRS of the death. https://www.irs.gov/businesses/small-businesses-self-employed/deceased-taxpayers-protecting-the-deceaseds-identity-from-id-theft

-

Experian. https://www.experian.com/blogs/ask-experian/reporting-death-of-relative/

-

Equifax. https://www.equifax.com/personal/help/relative-death-contact-credit-bureaus/

-

TransUnion. https://www.transunion.com/blog/credit-advice/reporting-a-death-to-tu

-

burial and memorial services at VA cemeteries. https://www.va.gov/burials-memorials/

-

Yahoo. https://help.yahoo.com/kb/SLN2021.html

-

Gmail. https://support.google.com/accounts/troubleshooter/6357590?hl=en

-

Hotmail. https://answers.microsoft.com/en-us/outlook_com/forum/osecurity-oother/closing-a-hotmail-account-for-deceased-individual/9b6d84a2-86de-40b0-b7e8-f6326c8a4fd3?auth=1

-

Outlook. https://support.microsoft.com/en-us/office/accessing-outlook-com-onedrive-and-other-microsoft-services-when-someone-has-died-ebbd2860-917e-4b39-9913-212362da6b2f

-

Facebook. https://www.facebook.com/help/408583372511972/

-

Instagram. https://help.instagram.com/264154560391256

-

Twitter. https://help.twitter.com/en/rules-and-policies/contact-twitter-about-a-deceased-family-members-account

-

Pinterest. https://help.pinterest.com/en/contact

-

Snapchat. https://support.snapchat.com/en-US/i-need-help?start=5640758388326400

-

Reddit. https://reddit.zendesk.com/hc/en-us/articles/204579509-How-do-I-delete-my-account-

-

LinkedIn. https://www.linkedin.com/help/linkedin/answer/124752

-

Nextdoor. https://help.nextdoor.com/s/contactus?language=en_US&subCat=Deleting%20my%20account&cat=My%20neighbor%20account

-

YouTube (part of Google). https://support.google.com/accounts/troubleshooter/6357590?hl=en

-

their estate should pay any medical bills they owe. https://www.experian.com/blogs/ask-experian/what-happens-to-medical-debt-when-you-die/

-

medical debt collection. https://www.consumerfinance.gov/about-us/blog/know-your-rights-and-protections-when-it-comes-to-medical-bills-and-collections/

-

Medicaid recovery. https://www.medicaid.gov/medicaid/eligibility/estate-recovery/index.html

-

may need a lawyer when someone dies. https://www.alllaw.com/articles/nolo/wills-trusts/executor-need-hire-lawyer.html