Surprise! The best state to retire isn’t actually Florida, despite its high population of seniors.

Some of the best states to retire might not be what you expect, but these states treat their retirees well by checking off boxes in several major factors: affordability, health care, weather, and safety.

Whether relocating for retirement comes from the desire to cut expenses, be near family, or simply want a change of scenery, you’ll find the best locations for you on this list. Our list covers the best (and worst) states to retire to — whether you envision your days spent on a beach or in a small remote town.

Methodology

To calculate the best and worst states to retire, we researched all 50 states and the District of Columbia on various factors that affect retirees. We analyzed recent data sets and resources on FBI crime rates, tax policies for retirees, cost of living indexes, average home prices, health care, and weather conditions. We combined the rankings to assign each state a total score. The lower the rank, the better for that category.

Ranking criteria:

- Crime rates are typically calculated by dividing the number of FBI-reported crimes by the total population of a given area, and then multiplying that number by 100,000 people. We followed this formula but looked at crimes where victims were 60 years of older compared to the total senior citizen population within that state. This combines violent, property, and larceny crimes.

- For taxes, each state receives a score based on different taxation policies for retirement income and local and state tax rates on income, property, and sales.

- Cost of living (COL) index compares costs of goods, transportation, and other costs associated with everyday life. The national baseline is 100. If a state has a COL below 100, it’s less expensive to live there.

- Average home prices come from the January 2023 Zillow Home Value Index — the typical value of homes in a specified region — for all homes, which includes single-family residences and condos.

- If an affordability score is mentioned at any point, this considers the cost of living, average home prices, and tax scores.

- Health care scores come from WalletHub, which analyzed health care costs, access, and outcomes on a 100-point scale. View WalletHub’s full methodology here.

- Weather is subjective, but we’re looking for states with ideal year-round warm weather while also considering humidity, rain, snow, and other major weather conditions like wildfires and hurricanes.

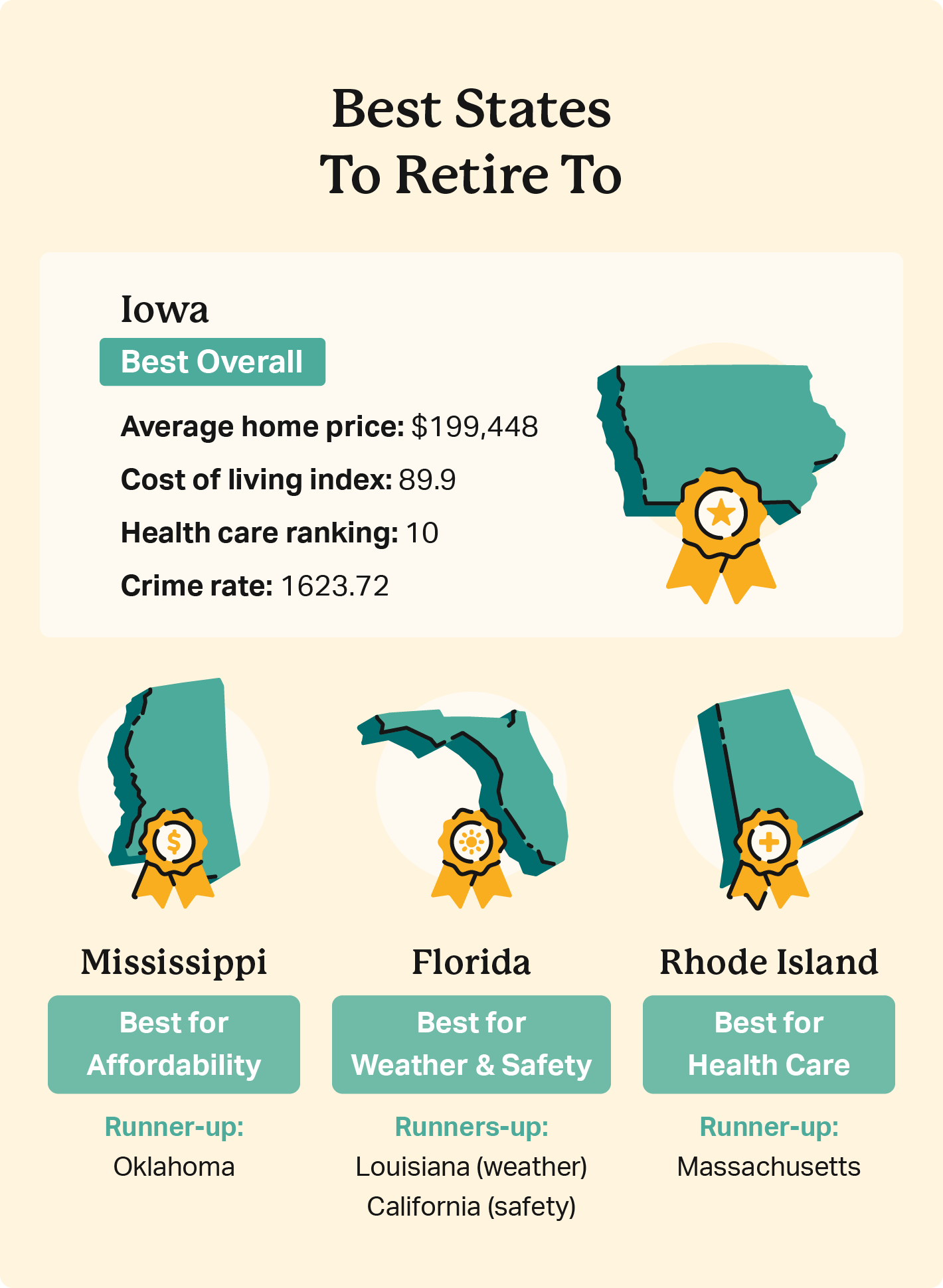

1. Iowa

Iowa ranks as the number one state to retire to. It offers an affordable cost of living and home prices and a strong economy, making it an attractive place to make retirement savings last longer.

Since health care is a top priority for retirees looking to move, Iowa may be a good choice as it ranks well for medical care and access. Iowa also holds lower crime rates for senior citizens. Although it can be cold in the winter, it’s manageable for the retiree who likes the occasional blizzard and warm, sunny summers.

- Average home price: $199,448

- Cost of living index: 89.9

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are not taxed.

- Health care ranking: 10

- Crime rate: 1623.72

- Average temperature: 48.4 F

- Severe weather incidents: 21 (within previous decade)

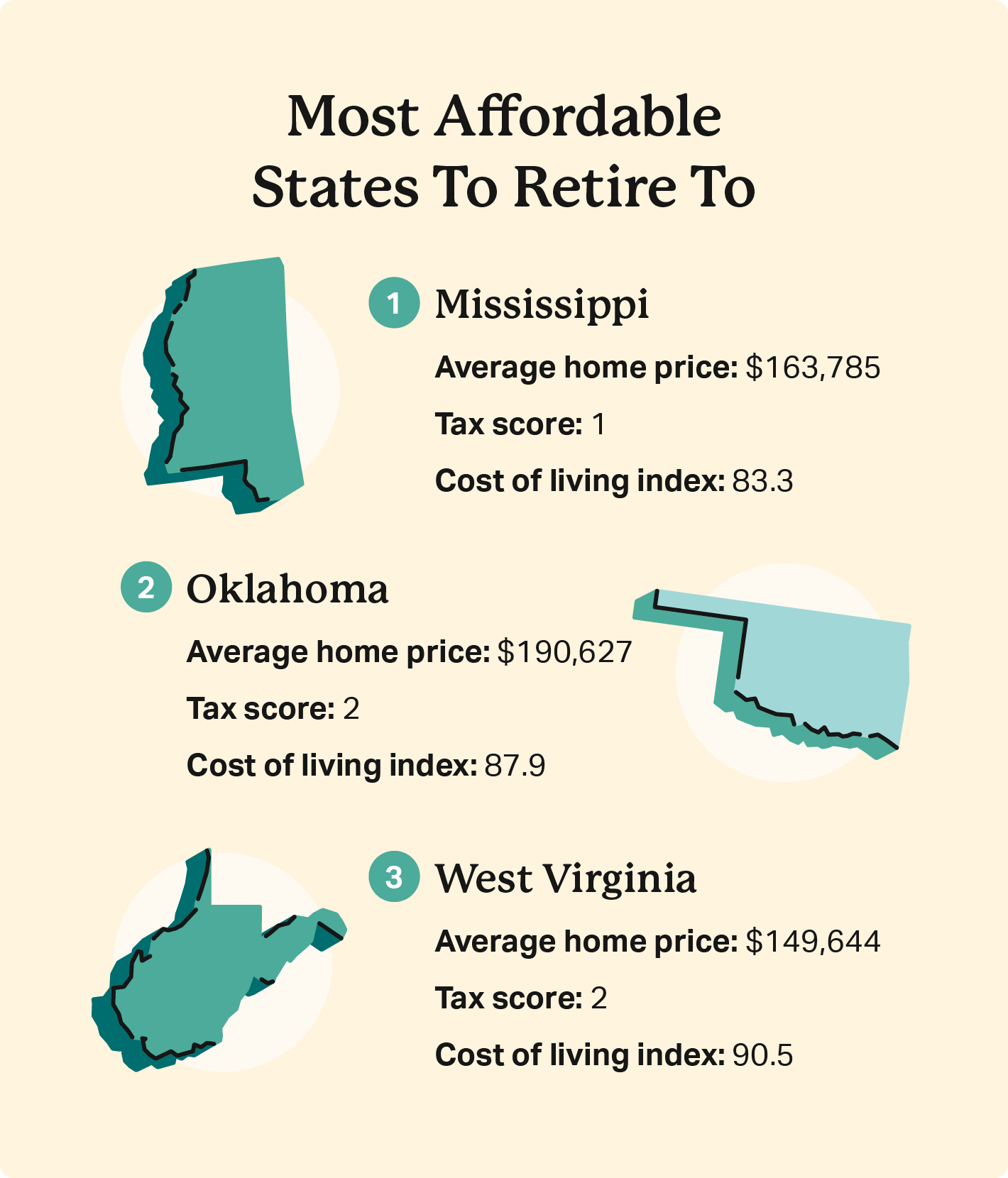

2. Mississippi

If you envision your retirement on a beach, Mississippi is a good place to do it. Mississippi is an affordable place to live with good weather — with the exception of having the highest humidity levels in the nation.

Mississippi would be the best state to retire to if it weren’t for its poor health care ranking, which unfortunately comes in as the worst in the U.S. However, one positive about Mississippi’s health care system is they rank within the top five of hospital beds per capita. Mississippi’s health care rating is something to consider if you have ailments that require frequent medical attention.

- Average home price: $163,785

- Cost of living index: 83.3

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are not taxed.

- Health care ranking: 51

- Crime rate: 1550.47

- Average temperature: 64.3 F

- Severe weather incidents: 20 (within previous decade)

3. North Dakota

North Dakota might be the coldest state on our list, but if you like a change in seasons, it may be a great place for you to retire. North Dakota sees all four seasons and very few severe weather conditions to worry about.

Beyond weather, North Dakota is the fourth safest state for senior citizens and offers great medical care at affordable rates. Sanford Medical Center ranks second regionally and is high-performing nationally, specifically in cardiology for the Bismarck campus and urology for the Fargo campus.

- Average home price: $242,246

- Cost of living index: 98.2

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are fully taxed.

- Health care ranking: 15

- Crime rate: 171.93

- Average temperature: 41.1 F

- Severe weather incidents: 5 (within previous decade)

4. Oklahoma

It’s hard to beat the affordability of Oklahoma. Houses are priced very low and the cost of living index is well below the national line, providing a positive outlook for retirees.

Though the chance of severe weather like tornadoes is higher in Oklahoma, temperatures remain pretty mild throughout the year. Oklahoma sees 232 days of sun a year on average, making it a beautiful place to spend hiking on one of the state’s several eastern mountains.

- Average home price: $190,627

- Cost of living index: 87.9

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are partially taxed.

- Health care ranking: 48

- Crime rate: 1993.77

- Average temperature: 60.4 F

- Severe weather incidents: 35 (within previous decade)

5. Illinois

Illinois is safe for seniors where retirement income isn’t taxed. Overall, it’s fairly affordable to live in Illinois. Homes and the cost of living index are below the national average. Health care ranks among the middle ground compared to other states due to higher costs and outcome rates, but retirees have good access to medical care in general. In fact, Northwestern Memorial Hospital ranks eighth for geriatric care in the U.S., and Rush University Medical Center ranks 14th.

Another northern state that butts against Lake Michigan, Illinois, faces cold winters but decent summers that aren’t overwhelmingly hot. Chicago faces the worst winters out of the state as it’s right on the lake.

- Average home price: $238,114

- Cost of living index: 94.3

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are not taxed.

- Health care ranking: 25

- Crime rate: 889.87

- Average temperature: 52.7 F

- Severe weather incidents: 30 (within previous decade)

6. Arkansas

With average home prices well under $200,000 and good tax benefits on retirement income, Arkansas is an affordable place to live on a fixed income.

If warm weather is what you desire, Arkansas is right up your alley. An average temperature of 61 F is perfect for picking up an outdoor hobby, such as golfing or soaking in a hot springs bathhouse.

- Average home price: $175,532

- Cost of living index: 90.9

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are partially taxed.

- Health care ranking: 47

- Crime rate: 2758.95

- Average temperature: 61.1 F

- Severe weather incidents: 23 (within previous decade)

7. Kansas

Just below Arkansas ranks Kansas. As a southern Midwestern state, Kansas’s average temperatures are mild — not too hot yet not too cold — compared to other states. However, Kansas is one of the worst states for tornadoes, which is something to keep in mind if you’re looking for an affordable place with decent year-round temperatures.

Kansas ranks second-best for health care out of these shortlisted states to retire to. The cost of living here is also the second lowest in the nation, making Kansas a great place to live a fixed-income lifestyle in retirement.

- Average home price: $207,814

- Cost of living index: 86.5

- Taxes for seniors: Social Security is taxed, unless your adjusted gross income is $75,000 or less (applicable for all tax filing statuses). Retirement account withdrawals are partially taxed.

- Health care ranking: 17

- Crime rate: 2279.85

- Average temperature: 55.1 F

- Severe weather incidents: 33 (within previous decade)

8. Kentucky

Kentucky earns a spot on the list of best states to retire for its affordability, tax friendliness for seniors, and safety. Seniors are fully exempt from Social Security income tax and receive significant deductions on other retirement income. Sales and property taxes are also relatively low in Kentucky.

If you love horses, you’ll fit right in retiring in Kentucky. The thoroughbred horse industry has deep roots here, and one of the biggest horse races — the Kentucky Derby — occurs every May in the state’s largest city, Louisville. Beyond horse racing events, there are plenty of outdoor activities to enjoy throughout Kentucky’s seasonal changes.

- Average home price: $191,299

- Cost of living index: 93.1

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are partially taxed.

- Health care ranking: 35

- Crime rate: 853.42

- Average temperature: 55.6 F

- Severe weather incidents: 22 (within previous decade)

9. Alabama

Alabama’s low cost of living, sunny skies, and tax-friendliness put the state within the top 10 places to retire to in the U.S.

Statewide, Alabama ranks poorly for health care due to high insurance premiums and limited access to quality medical care. However, many highly populated areas have exceptional hospitals, which is important for retirees. For example, the University of Alabama Hospital in Birmingham, Alabama, ranks within the country’s top 10 hospitals in eight specialties.

Further down the state is Alabama’s coastline if you’re looking to spend your retirement on the beach. Or, if you love college sports, you might want to stick around the middle of the state in Tuscaloosa — “Roll tide!”

- Average home price: $205,271

- Cost of living index: 87.9

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are fully taxed (with the exception of pensions).

- Health care ranking: 50

- Crime rate: 1809.83

- Average temperature: 63.7 F

- Severe weather incidents: 23 (within previous decade)

10. Florida

It’s no shock to see Florida on a list of best states to retire — after all, it’s one of the most popular states to retire to. With so many retirees flooding to Florida, you’re sure to feel a sense of community.

Florida’s cost of living index is barely above the national average, and it has no state income tax and a low tax burden for retirees, making it an affordable place to live. Florida only comes in at number 10 due to a unfavorable health care ranking and high number of severe weather conditions.

- Average home price: $386,020

- Cost of living index: 100.3

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are not taxed.

- Health care ranking: 40

- Crime rate: 4.50

- Average temperature: 71.5 F

- Severe weather incidents: 32 (within previous decade)

11. South Dakota

For retirees looking to stay active outdoors and lead a slow-paced life, South Dakota should be high on your list. South Dakota’s average temperature is on the lower side due to its winter months, but extreme weather conditions like droughts or wildfires are sparse here.

Overall, South Dakota is a quiet, safe place to settle down in retirement. Low crime rates make it a safe place to live for seniors. Retirees can adventure out on long scenic drives or hike through the state’s picturesque landscapes.

- Average home price: $284,93

- Cost of living index: 101

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are not taxed.

- Health care ranking: 23

- Crime rate: 1716.73

- Average temperature: 45.8 F

- Severe weather incidents: 8 (within previous decade)

12. Indiana

Whether you want a quiet rural life or a busy urban experience in retirement, Indiana checks quite a few boxes for many retirees.

In Indiana, you’ll find an affordable cost of living, plus benefits from low tax rates and untaxed Social Security. Indiana features well-rated hospitals but there are only a few of them, hence the state’s mediocre health care ranking. You’ll see snow in Indiana, but nothing like neighboring Michigan.

- Average home price: $222,394

- Cost of living index: 90.6

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are fully taxed.

- Health care ranking: 31

- Crime rate: 1684.56

- Average temperature: 52.5 F

- Severe weather incidents: 23 (within previous decade)

13. Michigan

Michigan rounds out the list of best states to retire. Low cost of living, good senior tax benefits, acceptable health care rankings, and low crime rates draws retirees to Michigan.

Home prices are well below the national average, and it’s one of the most affordable places in the country for medical care. So, if ice fishing in the colder months sounds like paradise to you, Michigan might be the best state for you to retire to.

- Average home price: $218,938

- Cost of living index: 91.3

- Taxes for seniors: Social Security is not taxed and retirement account withdrawals are partially taxed.

- Health care ranking: 18

- Crime rate: 1623.50

- Average temperature: 45.3 F

- Severe weather incidents: 12 (within previous decade)

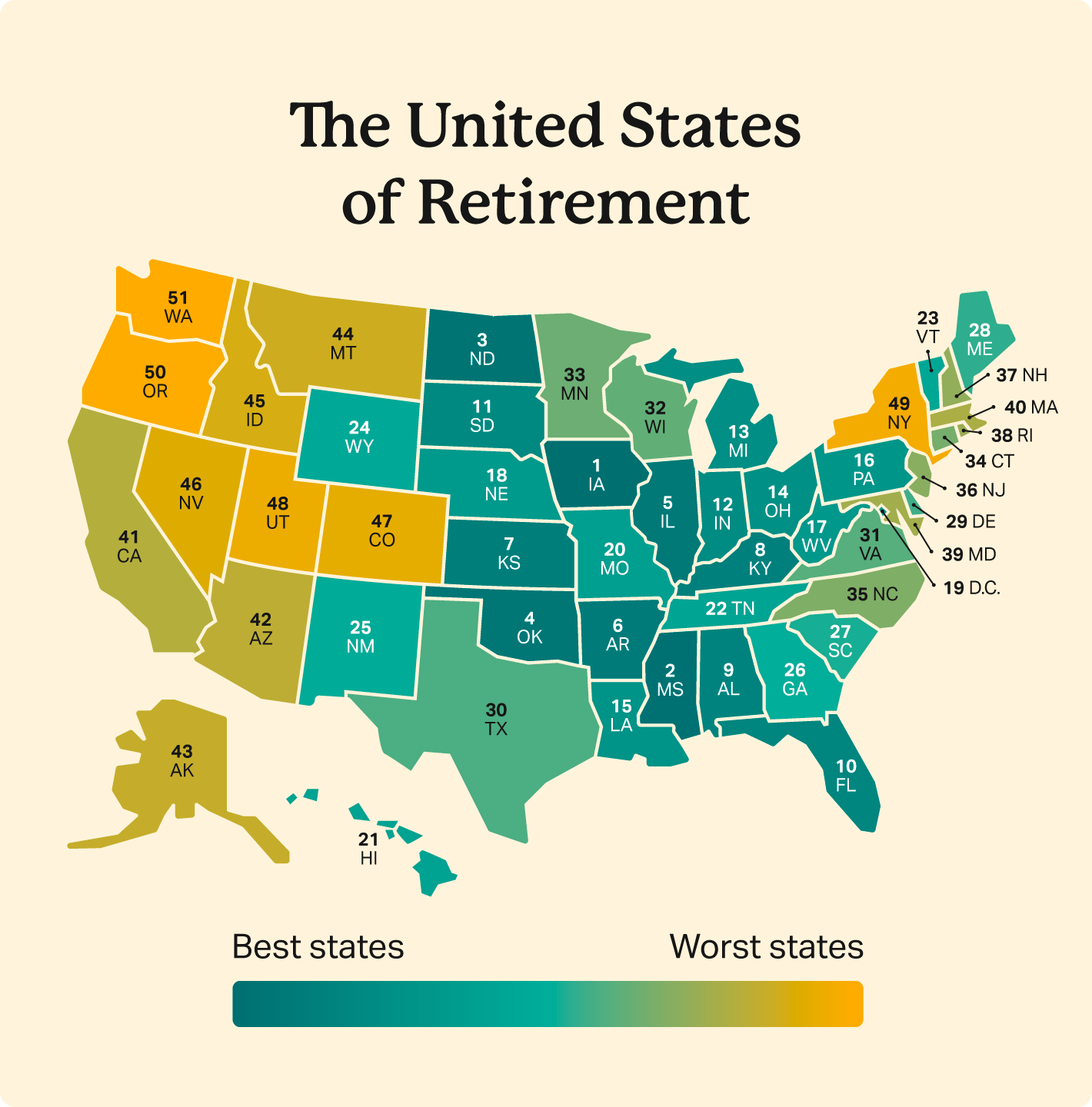

7 Worst States to Retire to

Looking at a combination of affordability, crime, weather, and health care, the worst states to retire to are (shown in descending order):

- Washington

- Oregon

- New York

- Utah

- Colorado

- Nevada

- Idaho

The states on this list all hold cost of living indexes over the national line and average home prices of nearly half a million dollars. These western states also see a high number of severe weather conditions, such as wildfires. They also rank poorly for crimes against seniors.

However, many of these states have decent health care ratings. Specifically, Colorado ranks within the top 10 best states to retire to for health care, and Utah follows shortly after.

The Best States To Retire: Full Ranking

The table below shows how each state ranks for retirees. If one aspect is more important to you — such as weather or taxes — sort that column to bring the highest-ranking states to the top of the table.

| Overall Rank | State | Total Score | Home Price Rank | Cost of Living Rank | Taxes Score | Health Care Rank | Weather Rank | Crime Rank |

|---|---|---|---|---|---|---|---|---|

| 1 | Iowa | 65 | 7 | 8 | 3 | 10 | 22 | 15 |

| 2 | Mississippi | 78 | 2 | 1 | 1 | 51 | 4 | 19 |

| 3 | North Dakota | 89 | 15 | 24 | 3 | 15 | 28 | 4 |

| 4 | Oklahoma | 96 | 5 | 4 | 2 | 48 | 10 | 27 |

| 5 | Illinois | 99 | 14 | 20 | 2 | 25 | 30 | 8 |

| 6 | Arkansas | 101 | 3 | 11 | 2 | 47 | 9 | 29 |

| 7 | Kansas | 101 | 10 | 2 | 3 | 17 | 26 | 43 |

| 8 | Kentucky | 102 | 6 | 17 | 2 | 35 | 25 | 17 |

| 9 | Alabama | 104 | 8 | 3 | 2 | 50 | 8 | 33 |

| 10 | Florida | 105 | 35 | 27 | 1 | 40 | 1 | 1 |

| 11 | South Dakota | 110 | 21 | 29 | 1 | 23 | 13 | 23 |

| 12 | Indiana | 110 | 12 | 10 | 3 | 31 | 23 | 31 |

| 13 | Michigan | 110 | 11 | 13 | 2 | 18 | 27 | 39 |

| 14 | Ohio | 113 | 9 | 14 | 3 | 32 | 21 | 34 |

| 15 | Louisiana | 111 | 4 | 16 | 2 | 49 | 2 | 38 |

| 16 | Pennsylvania | 117 | 17 | 32 | 2 | 12 | 48 | 6 |

| 17 | West Virginia | 118 | 1 | 9 | 2 | 46 | 14 | 46 |

| 18 | Nebraska | 120 | 16 | 19 | 4 | 24 | 16 | 41 |

| 19 | District of Columbia | 121 | 49 | 50 | 3 | 14 | N/A | 5 |

| 20 | Missouri | 123 | 13 | 7 | 3 | 36 | 24 | 40 |

| 21 | Hawaii | 125 | 51 | 51 | 3 | 3 | 3 | 14 |

| 22 | Tennessee | 129 | 22 | 6 | 2 | 42 | 20 | 37 |

| 23 | Vermont | 130 | 28 | 41 | 4 | 6 | 44 | 7 |

| 24 | Wyoming | 132 | 27 | 21 | 1 | 38 | 43 | 2 |

| 25 | New Mexico | 132 | 20 | 12 | 3 | 33 | 32 | 32 |

| 26 | Georgia | 133 | 24 | 5 | 1 | 43 | 11 | 49 |

| 27 | South Carolina | 134 | 19 | 18 | 2 | 45 | 6 | 44 |

| 28 | Maine | 136 | 30 | 39 | 4 | 9 | 42 | 12 |

| 29 | Delaware | 136 | 32 | 36 | 2 | 30 | 12 | 24 |

| 30 | Texas | 137 | 23 | 15 | 2 | 44 | 5 | 48 |

| 31 | Virginia | 139 | 33 | 30 | 2 | 19 | 33 | 22 |

| 32 | Wisconsin | 139 | 18 | 23 | 3 | 22 | 31 | 42 |

| 33 | Minnesota | 139 | 26 | 26 | 4 | 4 | 29 | 50 |

| 34 | Connecticut | 142 | 31 | 43 | 4 | 8 | 47 | 9 |

| 35 | North Carolina | 142 | 25 | 22 | 3 | 39 | 18 | 35 |

| 36 | New Jersey | 146 | 43 | 40 | 3 | 16 | 41 | 3 |

| 37 | New Hampshire | 148 | 41 | 37 | 2 | 11 | 39 | 18 |

| 38 | Rhode Island | 150 | 37 | 42 | 4 | 1 | 40 | 26 |

| 39 | Maryland | 151 | 34 | 44 | 3 | 5 | 37 | 28 |

| 40 | Massachusetts | 156 | 47 | 47 | 3 | 2 | 46 | 11 |

| 41 | California | 158 | 50 | 48 | 4 | 29 | 7 | 20 |

| 42 | Arizona | 159 | 38 | 33 | 3 | 34 | 15 | 36 |

| 43 | Alaska | 160 | 29 | 45 | 1 | 41 | 34 | 10 |

| 44 | Montana | 161 | 40 | 28 | 3 | 27 | 38 | 25 |

| 45 | Idaho | 162 | 42 | 31 | 2 | 26 | 45 | 16 |

| 46 | Nevada | 168 | 39 | 35 | 1 | 37 | 35 | 21 |

| 47 | Colorado | 169 | 46 | 34 | 2 | 7 | 50 | 30 |

| 48 | Utah | 169 | 45 | 25 | 3 | 13 | 36 | 47 |

| 49 | New York | 170 | 36 | 49 | 3 | 20 | 49 | 13 |

| 50 | Oregon | 178 | 44 | 46 | 3 | 21 | 19 | 45 |

| 51 | Washington | 184 | 48 | 38 | 2 | 28 | 17 | 51 |

Frequently Asked Questions

Mississippi, Oklahoma, and West Virginia are the most affordable states to retire to. These states have low living costs, average home prices below $200,000, and decent retirement tax benefits.

If a low tax burden is your main concern, Alaska is your place to retire. Alaska has no income tax, including retirement income such as Social Security, pensions, and retirement account distributions. Property and sales taxes are also very low. However, Alaska’s cost of living index is much higher than the national average at 127.

For a state with a decent cost of living index and low tax burden, look to Wyoming. Wyoming also has no income tax, tax on Social Security, and low property and sales tax rates.

The following states do not tax any form of retirement income:

- Alaska

- Florida

- Illinois

- Mississippi

- Nevada

- New Hampshire

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Twenty-six states do not tax Social Security but do partially or fully levy retirement accounts and pension withdrawals, leaving 13 states that tax all forms of retirement to some degree.

What Is The #1 Retirement State?

Iowa is the best overall state to retire to. But if you’re looking for a state to meet a specific requirement, there are plenty of options. For example, Rhode Island has the best health care system rating in the country, but it’s an expensive state to buy a house or live in. Each factor varies by state, so it’s best to do your research before committing to a new destination.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 19 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 19 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 14 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 14 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

high population of seniors. https://www.consumeraffairs.com/homeowners/elderly-population-by-state.html

-

FBI crime rates. https://cde.ucr.cjis.gov/LATEST/webapp/#/pages/home

-

tax policies for retirees. https://smartasset.com/retirement/retirement-taxes

-

cost of living indexes. https://worldpopulationreview.com/state-rankings/cost-of-living-index-by-state

-

average home prices. https://www.zillow.com/research/data/

-

health care. https://wallethub.com/edu/states-with-best-health-care/23457/

-

weather conditions. https://worldpopulationreview.com/state-rankings/best-weather-by-state

-

here. https://wallethub.com/edu/states-with-best-health-care/23457

-

232 days of sun. https://www.currentresults.com/Weather/Oklahoma/sunshine-by-month.php

-

eighth for geriatric care. https://health.usnews.com/best-hospitals/rankings/geriatric-care

-

worst states for tornadoes. https://www.policygenius.com/homeowners-insurance/when-is-tornado-season-in-kansas/#:~:text=Kansas%20is%20one%20of%20the,the%20National%20Oceanic%20Atmospheric%20Administration.

-

top 10 hospitals in eight specialties. https://health.usnews.com/best-hospitals/area/al/university-of-alabama-hospital-at-birmingham-6530304

-

Federal Bureau of Investigation. https://cde.ucr.cjis.gov/LATEST/webapp/#/pages/home

-

Smart Asset. https://smartasset.com/retirement/retirement-taxes

-

World Population Review. https://worldpopulationreview.com/state-rankings/cost-of-living-index-by-state

-

Zillow. https://www.zillow.com/research/data/

-

Wallet Hub. https://wallethub.com/edu/states-with-best-health-care/23457

-

Current Results. https://www.currentresults.com/Weather/Oklahoma/sunshine-by-month.php

-

US News. https://health.usnews.com/best-hospitals/rankings/geriatric-care

-

Policy Genius. https://www.policygenius.com/homeowners-insurance/when-is-tornado-season-in-kansas/#:~:text=Kansas%20is%20one%20of%20the,the%20National%20Oceanic%20Atmospheric%20Administration.

-

US News. https://health.usnews.com/best-hospitals/area/al/university-of-alabama-hospital-at-birmingham-6530304

-

World Population Review. https://worldpopulationreview.com/state-rankings/best-weather-by-state