In an era where artificial intelligence can offer instant answers to complex questions, a critical concern emerges: How accurate are these AI-generated summaries, especially when the stakes are as high as your financial well-being?

Google’s AI Overviews (AIOs), designed to provide quick answers directly in search results, are becoming a primary source of information for many.

This post reveals the findings of our data study, which examined the correctness of AIO results for 500 life insurance and 500 Medicare queries. Our results indicate a risk of misinformation in areas where accuracy prevents significant harm.

Life Insurance AI Overviews: A High-Risk Landscape

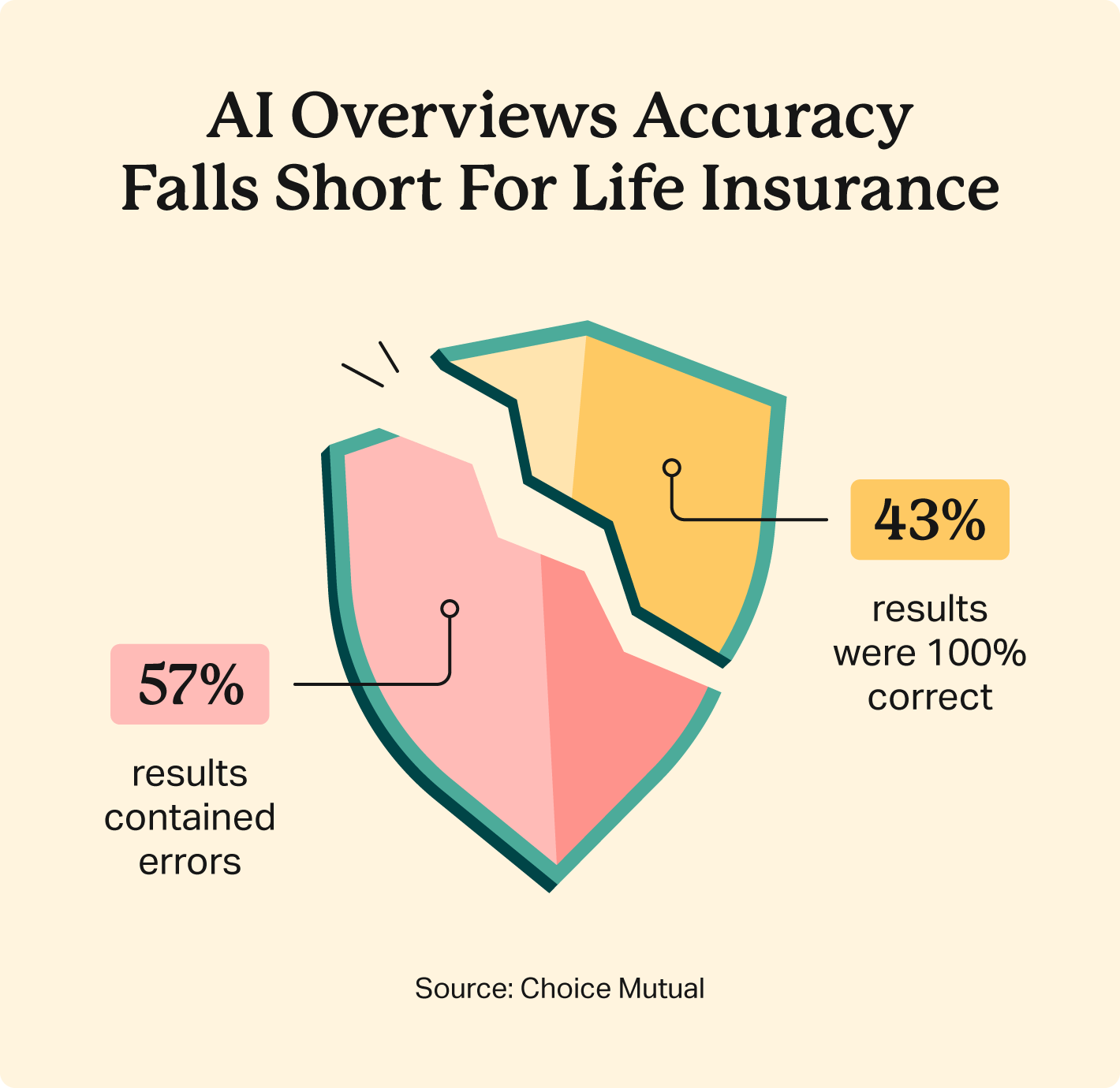

Our study discovered that over half (57%) of the AI Overview results for life insurance queries contained inaccuracies. These are often fundamental errors that will lead individuals to make ill-informed decisions about important financial protection.

As the founder and CEO of Choice Mutual, I personally reviewed the AIO results for the 500 life insurance-related queries. I relied on my 15+ years of insurance industry experience while scoring the results.

“Insurance is an integral part of every adult’s life. Handle it seriously. Wrong decisions cost someone their home, car, retirement, healthcare, thousands of dollars, or way of life for surviving loved ones.” — Anthony Martin, Founder & CEO of Choice Mutual

My primary concern — and the reason we created this data study — centers on the consequences of users receiving false information. Given the importance of the topic at hand, this ultimately causes irreparable financial harm.

To illustrate where the AI falls short, here are some examples of the exact AI Overview responses alongside my suggested corrections.

- “Younger individuals generally pay lower premiums … Women generally pay less for whole life insurance… When comparing whole life to term life insurance, whole life is generally more expensive due to its lifetime coverage and cash value component.”

- The AIO result for “cost of whole life insurance” should clarify that younger individuals always pay lower premiums. Women always pay less for all types of life insurance. Whole life insurance is always more expensive than term life.

- “These policies are typically whole life insurance, offering a smaller death benefit but with easier qualification requirements and potentially lower premiums.”

- “Guaranteed Issue Life Insurance: These policies typically have no health questions and guarantee acceptance, regardless of health conditions, but may have a graded death benefit.”

- “Waiting Periods: Some guaranteed issue policies may have a waiting period (e.g., two years) before the full death benefit is paid out.”

- The AIO for “life insurance for seniors over 85 no medical exam” needs to explicitly state that whole life insurance is the only type of life insurance coverage for individuals over 85. Also, premiums at this age range are very expensive, not lower.

- First, guaranteed acceptance policies do not exist for individuals above 85. All policies for individuals aged 86 and beyond include health questions. That aside, guaranteed issue policies never have health questions, and a graded benefit always applies during the first two years.

- All guaranteed issue policies always (no exceptions) have a 2-3 year waiting period.

- “Obtain Consent: You must get your parents’ permission to take out a life insurance policy on them. This is crucial, and they’ll likely need to sign the application.”

- The AIO result for “how to take out life insurance on a parent” should clarify that parents must sign the application 100% of the time. Signing on their behalf is a crime.

Medicare AI Overviews: Errors With Significant Consequences

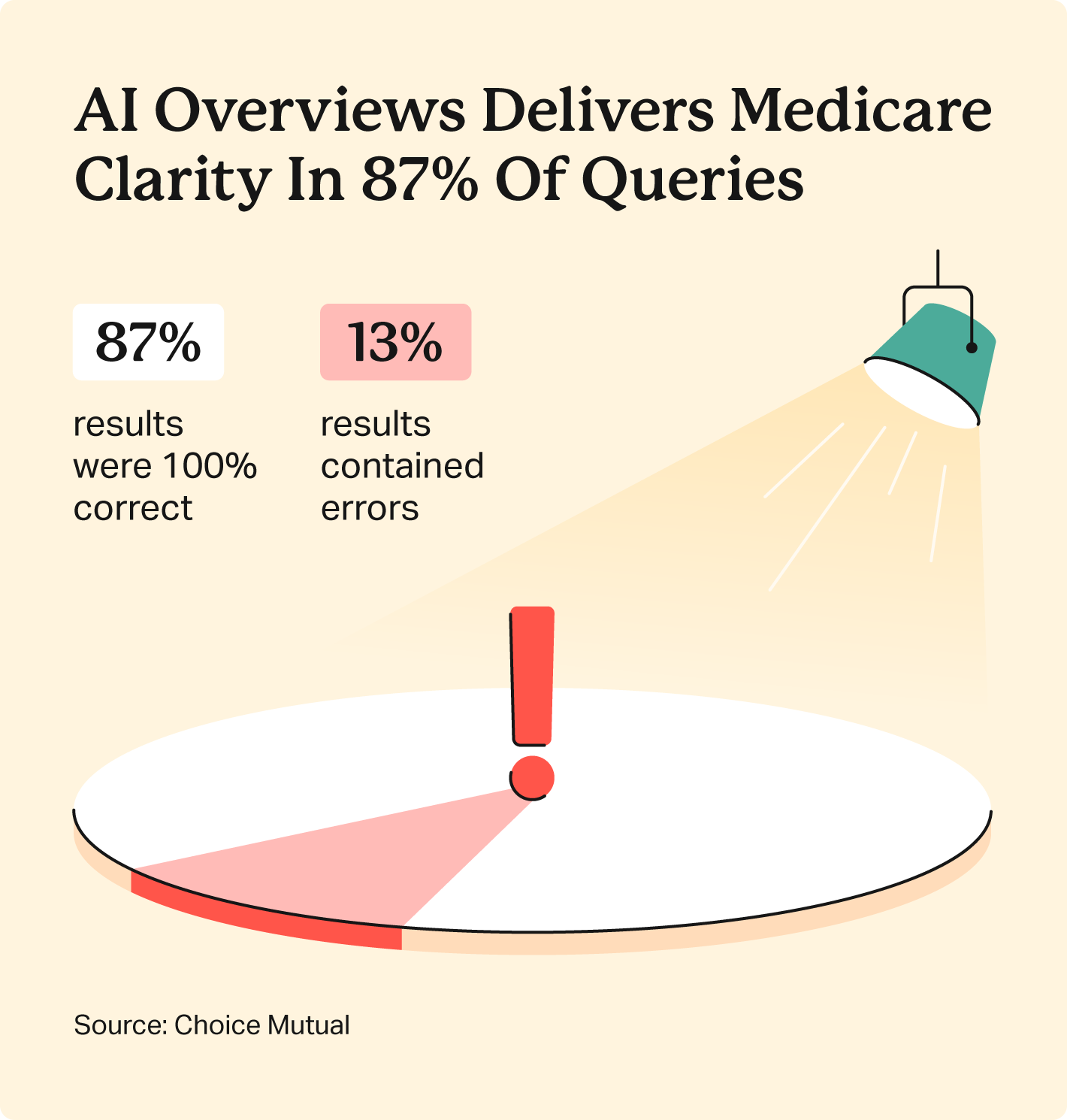

While Medicare-related AIOs showed higher accuracy (87% correct) compared to life insurance, the 13% error rate still concerns us. Even minor inaccuracies in Medicare information could lead to substantial financial penalties or a lack of needed coverage.

We consulted with Danielle Kunkle Roberts, a founding partner at Boomer Benefits, who has over 20 years of experience serving tens of thousands of policyholders. Danielle is also the 2023-2025 Chairman of the National Association of Benefits and Insurance Professionals (NABIP) Medicare Advisory Group and a bestselling author.

Danielle advises caution, stating, “Information comes from multiple sources, and some sources can be wrong. Confirm any questions or concerns with a Medicare agent looking out for your best interest.”

Below, you’ll find some AI Overview responses (or the implied information from the AIO) alongside expert clarifications from Danielle Kunkle Roberts, highlighting details the AI missed or misstated.

- “Employer Coverage: If you have health insurance through your (or your spouse’s) current employer, you may be able to delay enrolling in Medicare without penalty.”

- The AIO for “is it mandatory to sign up for Medicare at age 65” does not mention the requirement of “creditable employer-sponsored health coverage” for large employers with 20+ employees. Misinformation can lead to penalties for those working for small companies or the self-employed.

- “Medicare Part D is an optional benefit.”

- While the AIO for “who is eligible for medicare part d” acknowledges that Part D is optional, it omits significant penalties for not taking it when first eligible.

- “No, Medicare does not typically cover hearing aids.”

- The AIO result for “hearing aids covered by medicare” does not explicitly clarify that Medicare does not cover them. This causes confusion for someone actively seeking this coverage.

Why AIO Inaccuracies Matter

The implications of these errors go beyond simple inconvenience. Incorrect information about Medicare has devastating, long-term financial consequences. Our subject matter experts explain the gravity of these findings:

The AI platform Gemini falls dramatically short of its own standards. It directly contributes to consumers making poor insurance decisions based on the false information provided by Google’s AI answers, causing considerable harm.

It’s also important to recognize that Google’s own “Your Money Your Life” (YMYL) quality rater guidelines claim to “impose the strictest trust requirements on websites in YMYL categories.” Yet, given those declared standards, Google’s AI systems fall short of meeting its own benchmarks.

Danielle Kunkle Roberts warns, “Wrong information leads to lifelong penalties, coverage being dropped, or having coverage that may not suit you.” This shows the real-world impact on individuals relying on these summaries for critical decisions.

Navigating AI Overviews

The error rates our study identified show that users can’t fully trust AI Overviews when making critical financial decisions about complex, high-stakes topics, such as life insurance and Medicare.

There are many nuances between various types of life and Medicare plans, so you want to turn to a veteran agent who has deep experience in working with these plans. AI may be helpful in gathering initial information up front, but when you have done that, find a broker who has 10+ years of experience in the life or Medicare market who can fill in the gaps in your knowledge and help you find coverage that suits you.

To decide if you can trust the information, Danielle suggests, “Examine the websites being sourced. Look for ones that you trust, like Boomer Benefits, Medicare.gov, or a specific insurance company.”

Avoid making decisions based on the AI’s answer. Instead, you should seek a qualified professional specializing in the type of insurance you need. Let them provide advice.

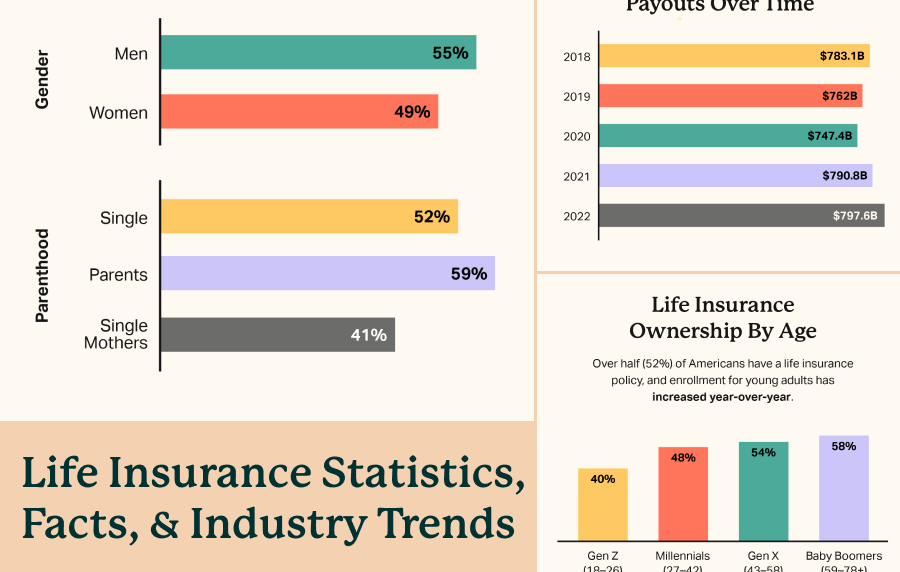

5 Most Commonly Asked Life Insurance Questions

Through our research, we identified the following questions as having the highest search volume related to life insurance. Understanding these common inquiries helps address what most people seek when considering life coverage. Below are direct, expert-backed answers to those top questions.

1) What is whole life insurance?

Whole life insurance provides coverage for your entire lifetime. It includes a cash value component that grows over time on a tax-deferred basis, which you can withdraw and use as you see fit. The premiums always remain fixed for the policy’s life.

2) How does life insurance work?

Life insurance is a contract. In exchange for your premium payments, the insurance company pays a lump sum (the death benefit) to your beneficiaries when you pass away. This benefit is tax-free and provides financial security for your loved ones, covering lost income, funeral costs, debts, and future costs.

3) What is the best life insurance for seniors?

The “best” life insurance for seniors depends on individual needs. Term life covers specific temporary needs (e.g., mortgage payoff). Permanent options, such as whole life or universal life, provide lifelong coverage and build cash value. Final expense insurance is often popular for covering funeral costs due to its lenient underwriting and fast payout of the death benefit.

4) What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (e.g., 10, 20, 30 years) and does not build cash value. Because the policy ends at some point, it’s the least expensive type of life insurance. Whole life insurance is a permanent policy that covers you for your entire life, builds cash value over time, and has fixed premiums. It will always cost more than the term insurance.

5) What is term life insurance, and how does it work?

Term life insurance offers coverage for a defined period (the “term”). If the insured dies within this term, the death benefit pays out to the beneficiaries. If they outlive the term, the policy expires with no payout. People choose it for specific financial obligations that end, such as raising children or paying off a mortgage or other debts.

5 Most Commonly Asked Medicare Questions

Our research identified the following questions as having the highest search volume concerning Medicare. Addressing these common inquiries helps clarify what most people seek when researching their healthcare options.

1) How much does Medicare cost?

Medicare costs vary. Medicare Part A (hospital insurance) is usually premium-free if you or your spouse paid Medicare taxes for a certain period. Part B (medical insurance) has a standard monthly premium. Part D (prescription drug coverage) and Medicare Advantage plans also have premiums, which vary widely.

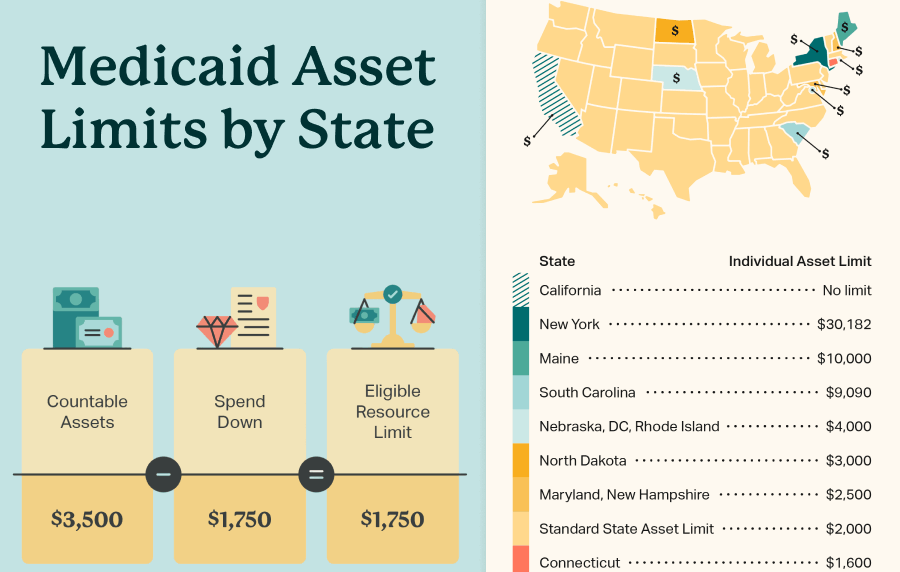

2) What is the difference between Medicare and Medicaid?

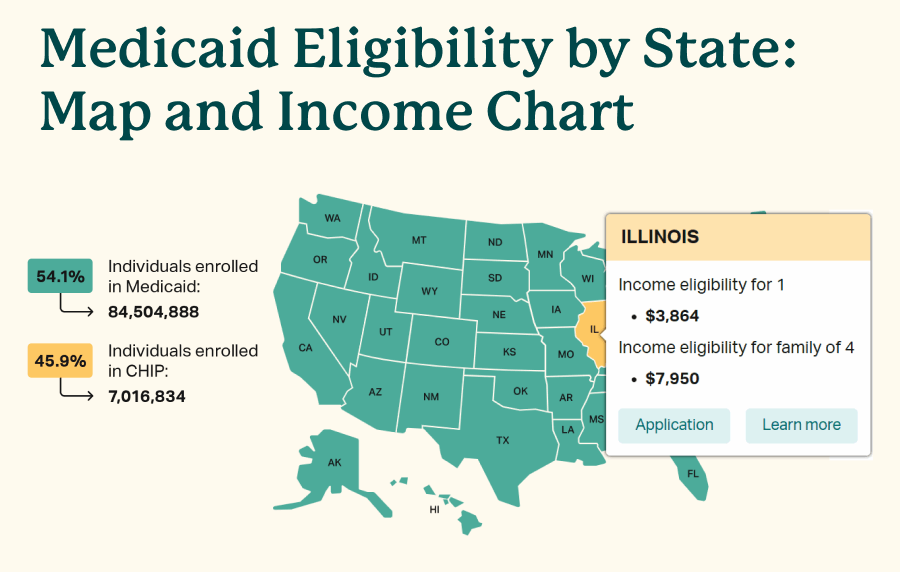

Medicare is a federal health insurance program primarily for individuals aged 65 or older and some younger people with disabilities. Medicaid is a joint federal and state program that helps with medical costs for people with limited income and resources. Medicaid eligibility requirements vary by state.

3) Does Medicare cover hearing aids?

Original Medicare (Part A and Part B) generally does not cover hearing aids or routine hearing exams. Some Medicare Advantage plans (Part C) offer supplemental benefits that include coverage for hearing aids or related services.

4) What is a Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) is another way to get your Medicare Part A and Part B benefits. Private companies approved by Medicare offer these plans. They often include additional benefits like prescription drug coverage, vision, dental, and hearing. Sometimes these cost an extra premium.

5) How does Medicare work?

Medicare is divided into parts:

- Part A covers hospital stays, skilled nursing facility care, hospice, and some home health services.

- Part B covers doctor visits, outpatient care, medical supplies, and preventive services.

- Part C is a Medicare Advantage Plan.

- Part D covers prescription drugs.

- You can choose coverage through Original Medicare (Part A & B) or a Medicare Advantage Plan (Part C) from private insurers.

Prioritize Human Expertise For Your Financial Future

Our data study revealed a warning: AI Overviews offer convenience, but their current accuracy for complex topics like life insurance and Medicare is unreliable. With a 57% error rate for life insurance and a 13% error rate for Medicare, relying solely on these AI-generated summaries exposes you to financial harm, lifelong penalties, or inadequate coverage.

Remember to verify any information from AI Overviews with trusted, human experts. Additionally, always consult with a qualified professional for decisions as important as your insurance and healthcare. They provide accurate advice tailored to your needs. Your financial security and peace of mind depend on it.

Methodology

This data study involved analyzing the AI Overview results for a total of 1,000 queries, comprising 500 high-volume life insurance-related questions and 500 high-volume Medicare-related questions.

Each AI Overview result was manually reviewed and verified for accuracy by subject matter experts in their respective fields. The results are based on their determination of whether the result was “100% correct” or “has errors.”

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Best-Selling Medicare Author

- 20+ years in the Medicare Insurance Industry

Danielle Kunkle Roberts is a founding partner at Boomer Benefits, where she and her team have been helping baby boomers navigate Medicare since 2005. She is the 2023 - 2025 Chairman of the National Association of Benefits and Insurance Professionals (NABIP) Medicare Advisory Group, where she advocates for Medicare beneficiaries at the national level to Congressional representatives and government organizations.

- Best-Selling Medicare Author

- 20+ years in the Medicare Insurance Industry

Danielle Kunkle Roberts is a founding partner at Boomer Benefits, where she and her team have been helping baby boomers navigate Medicare since 2005. She is the 2023 - 2025 Chairman of the National Association of Benefits and Insurance Professionals (NABIP) Medicare Advisory Group, where she advocates for Medicare beneficiaries at the national level to Congressional representatives and government organizations.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

(YMYL) quality rater guidelines. https://services.google.com/fh/files/misc/hsw-sqrg.pdf