Economists project that more than $100 trillion of wealth will flow from baby boomers to their heirs in the next 25 years.

It’s being called the “Great Wealth Transfer,” and it’s already underway.

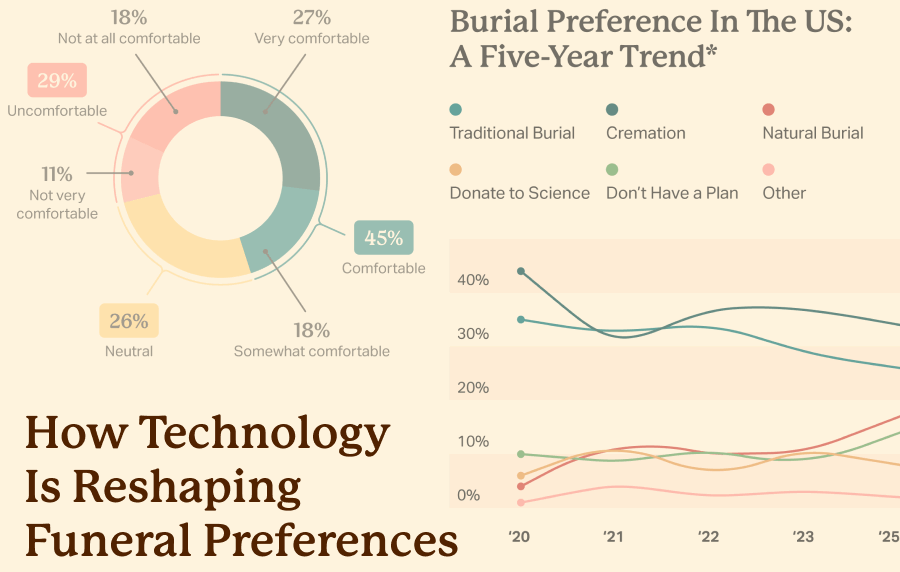

Of course, not every family will participate in this transfer, and the financial burdens of aging remain steep for millions of Americans, including funeral planning.

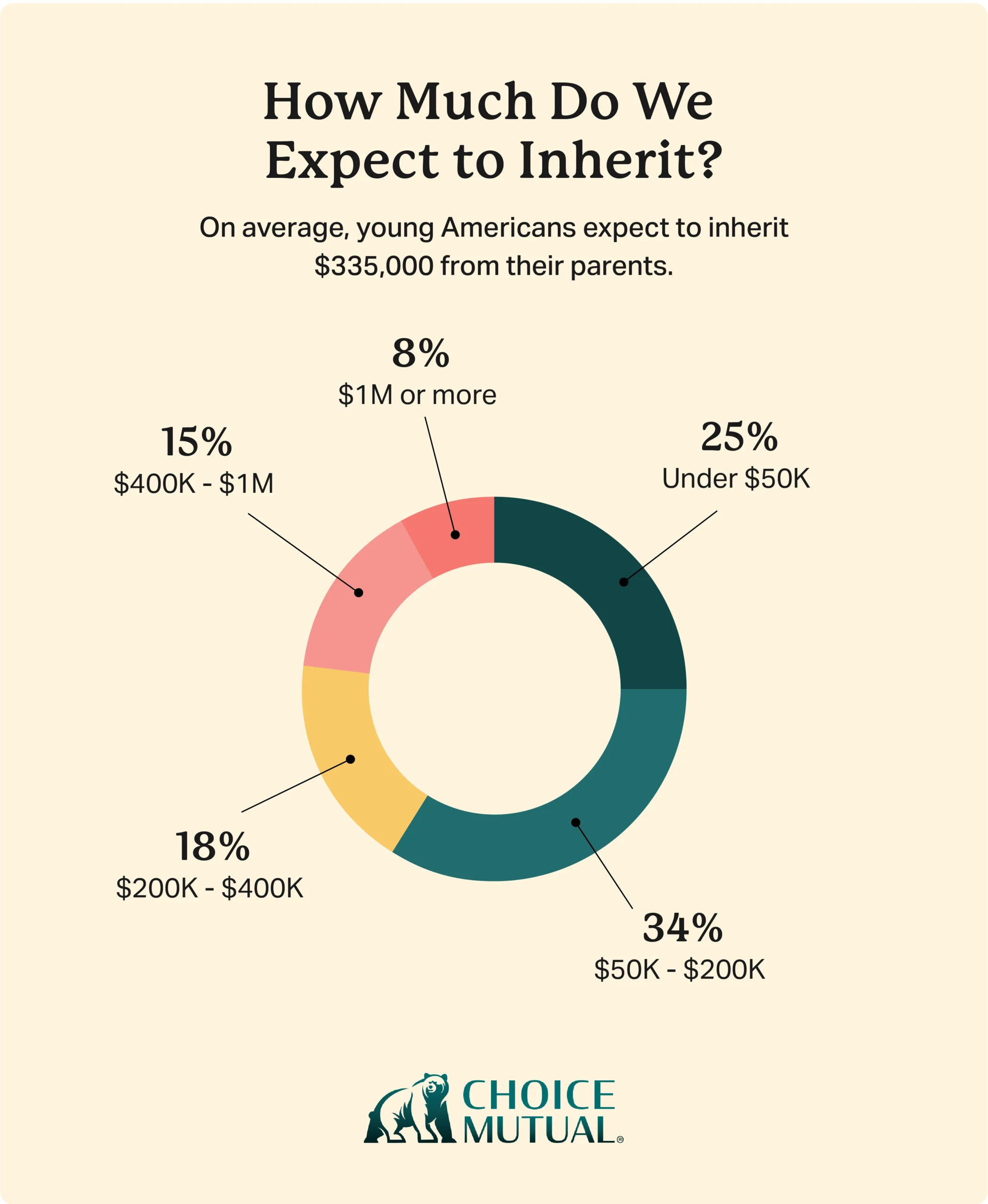

Young Americans, of either the millennial or Gen Z generation, expect to inherit, on average, $335,000. Additionally, nearly 1 in 5 expect to inherit between $200,000 and $400,00, while 8% expect $1,000,000 or more.

This is not just wishful thinking. Sixty-one percent of those surveyed have had a direct conversation with their parents about an expected inheritance or have seen a will or trust.

As an extension of this optimism, 74% of heirs say they’re confident their parents’ future medical and long-term care costs won’t significantly reduce their inheritance.

Still, Many Children Expect To Be Financially Burdened By Parents

Despite lofty expectations of inheritance, more than half (53%) of young Americans expect to be financially burdened in some way by their aging parents.

Sixty percent feel anxious about this possibility, and 52% say the expectation is already affecting their financial planning, even in early adulthood.

One in three of those we surveyed say they resent their parents for not being in a better financial position than they are.

A Look Inside Americans’ Expected Inheritance

As a result of strong economic growth, affordable housing markets, and flourishing equity markets, baby boomers have been dubbed the wealthiest generation that has ever lived. It’s because of this that experts believe a substantial amount of wealth is set to be passed down to younger generations in the coming years.

While many Americans look to the future as they make financial decisions and plan, we wanted to learn more about this transfer of wealth and how Gen Zers and millennials are preparing for it. To do this, we surveyed more than 1,200 people across the U.S. and asked a variety of questions about their expectations for an inheritance, plans for the new funds, and more.

Overall, we learned that 66% of Americans either expect to or have already received an inheritance from their parents. When asked about the specifics of this inheritance, 73% of people expect to receive cash, while 69% are expecting real estate.

Additionally, nearly 2 in 5 people say they will inherit investment positions. Another nearly 1 in 5 Americans are expecting other types of property, while 1 in 6 people are planning to receive ownership stakes.

When it comes to the value of items inherited, 25% of people expect to receive $50,000 or less, while nearly 1 in 5 are planning to inherit between $200,000 and $400,000 from their parents. In general, we found that the average American who is expecting an inheritance thinks they will receive about $334,850.

How People Plan To Spend Their Inheritance

After learning about what young Americans expect to receive, we turned our attention to their plans for this inheritance. Leading the way as the most common plan is putting the money into savings, which nearly 3 in 4 people say they will do. Similarly, 57% of people plan to use their new funds for investments.

For 2 in 5 people, housing or home improvements are their top priority when it comes to spending their inheritance. Claiming the fourth most common plan is paying off debt, as 39% of Gen Zers and millennials say it is. Rounding out the top five for plans is another method of saving — saving to pay it forward to their own children.

Sometimes, a portion of the inheritance is expected to be used for the care of an aging parent. When it comes to end-of-life expenses, you could be faced with much more than you anticipated. We found that nearly 1 in 2 Americans either plan to or already have supported their parents in some way.

Additionally, 53% of those people expect to be burdened by the financial responsibility. This has led to 1 in 6 people feeling resentment toward their parents for not being in a better financial position.

How Expectations Of An Inheritance Influence Americans

While it’s no surprise that young Americans are planning ahead for their inheritance and how the funds will be spent or saved, we did find it surprising how many people are being influenced by it before it’s even received. Overall, we found that nearly 1 in 6 people feel less stress in life than they otherwise would by knowing what they will receive from their parents.

For some, this knowledge has influenced their financial decisions, with nearly one in ten people feeling less pressure to save money now. Similarly, 9% of people say they lead a more fulfilling lifestyle than they otherwise would.

For 1 in 12 people expecting an inheritance, they report feeling less pressure to earn money now, knowing what they will receive in the future. This extends into spending as well, as 1 in 10 Gen Zers and millennials say they carry more debt than they otherwise might because they plan to use their inheritance to pay it off.

Methodology

In this study, we set out to gain insight into the Great Wealth Transfer. To do this, we surveyed Americans between the ages of 18 and 43 to determine people’s expectations for inheritance. We asked a variety of questions including: do you expect to receive an inheritance, how much do you plan to inherit, how has the idea of receiving an inheritance influenced your life, how will not receiving an inheritance impact you, and more.

- Nationally licensed life insurance agent with over 15 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 15 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

Choice Mutual often cites third-party websites to provide context and verification for specific claims made in our work. We only link to authoritative websites that provide accurate information. You can learn more about our editorial standards, which guide our mission of delivering factual and impartial content.

-

$100 trillion of wealth. https://www.cerulli.com/press-releases/cerulli-anticipates-124-trillion-in-wealth-will-transfer-through-2048

-

dubbed the wealthiest generation that has ever lived. https://www.allianz.com/en/economic_research/insights/publications/allianz-global-wealth-report-2024/financial-assets-surprising-relief.html