Buying a four-bedroom home, raising a family, retiring, and then downsizing to a more manageable two-bedroom is the plan for many empty nesters in the U.S. Unfortunately, downsizing in America has become more difficult with rising housing prices and a lack of inventory in some parts of the country.

At Choice Mutual, we know that you have many financial decisions to make as you get older, so we decided to gain more insight into the downsizing strain felt across the country. To do this, we analyzed Zillow’s Home Value Index data across 100 real estate markets and used historical data to determine where older Americans are struggling most in this next phase of their lives.

Read on to learn more about where downsizing strain is most significant, where homes have appreciated the most and least, which cities offer the largest inventory of smaller homes, and more.

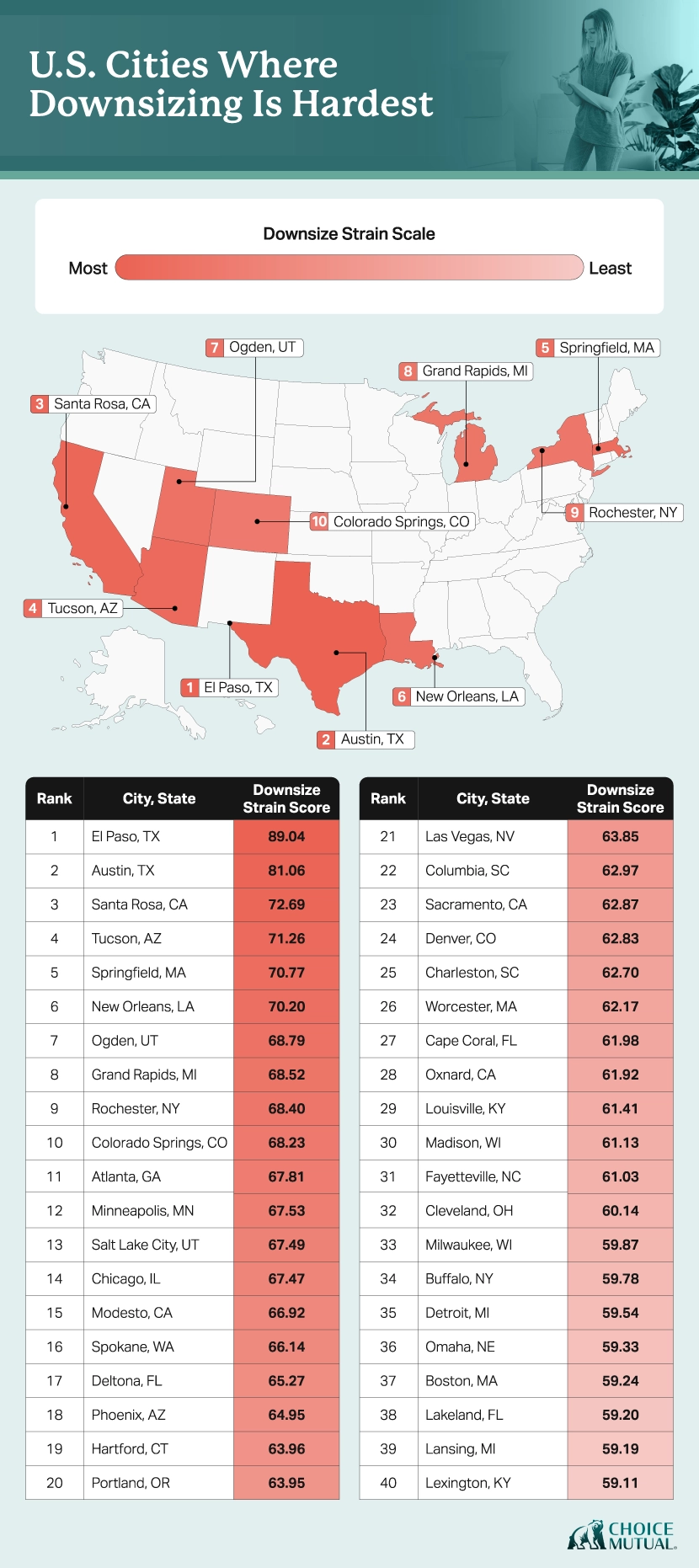

Where Downsizing Is Hardest In America

To understand where downsizing is most difficult, we first collected the average value of a four-bedroom home in each city. We then analyzed the average appreciation over 25 years and compared this profit to the average value of a two-bedroom home in the same city.

Finally, we analyzed the current inventory of four-bedroom homes in each city compared to the availability of two-bedroom homes. Using all this information, we calculated a downsizing strain score, with higher scores indicating greater strain.

Topping our ranking for downsizing strain is El Paso, TX, with a score of 89.04. While the average four-bedroom home has increased in value by $152,689 over the past 25 years, the average two-bedroom home in El Paso costs about $156,669.

In addition to smaller homes costing more than the profit earned, we also found a severe lack of inventory for smaller homes, with 23 times more four-bedrooms than two-bedrooms in the city.

Up next is another Texas city. Nearly 600 miles to the east, Austin residents are also feeling the strain of downsizing. Earning a score of 81.06, Austin homes have appreciated in value more ($294,588) than those in El Paso. However, the cost of a two-bedroom is significantly higher at $363,196.

Although Austin, TX, has a better ratio of larger to smaller homes, the average price of a two-bedroom is only $129,847 less on average, making downsizing more difficult.

Coming in third for downsizing strain is Santa Rosa, CA, with a score of 72.69. While the average four-bedroom home has appreciated by $585,971, the 10th-highest appreciation among the cities analyzed, the cost of a two-bedroom is the fifth-highest overall at $627,620.

In the end, this price difference requires the average downsizer to spend more than $40,000 out of pocket to move into a smaller home.

While many people across the country are feeling the strain of downsizing, others are finding it easier to find a smaller home that fits their needs. At the other end of the scale, Birmingham, AL, residents face the least strain, as larger homes have appreciated by $219,142, and the average two-bedroom home is priced at $112,706.

Second place for the least downsizing strain is Pittsburgh, PA, where the average two-bedroom costs about $146,234, leaving more than $113,000 in profit after selling a four-bedroom home. In Miami, FL, the profit is even greater, averaging $229,351 after purchasing a smaller home.

Additionally, Miami has a much larger inventory of smaller homes than other parts of the country, and we discovered that for every 1 four-bedroom home, there are 2 two-bedroom homes.

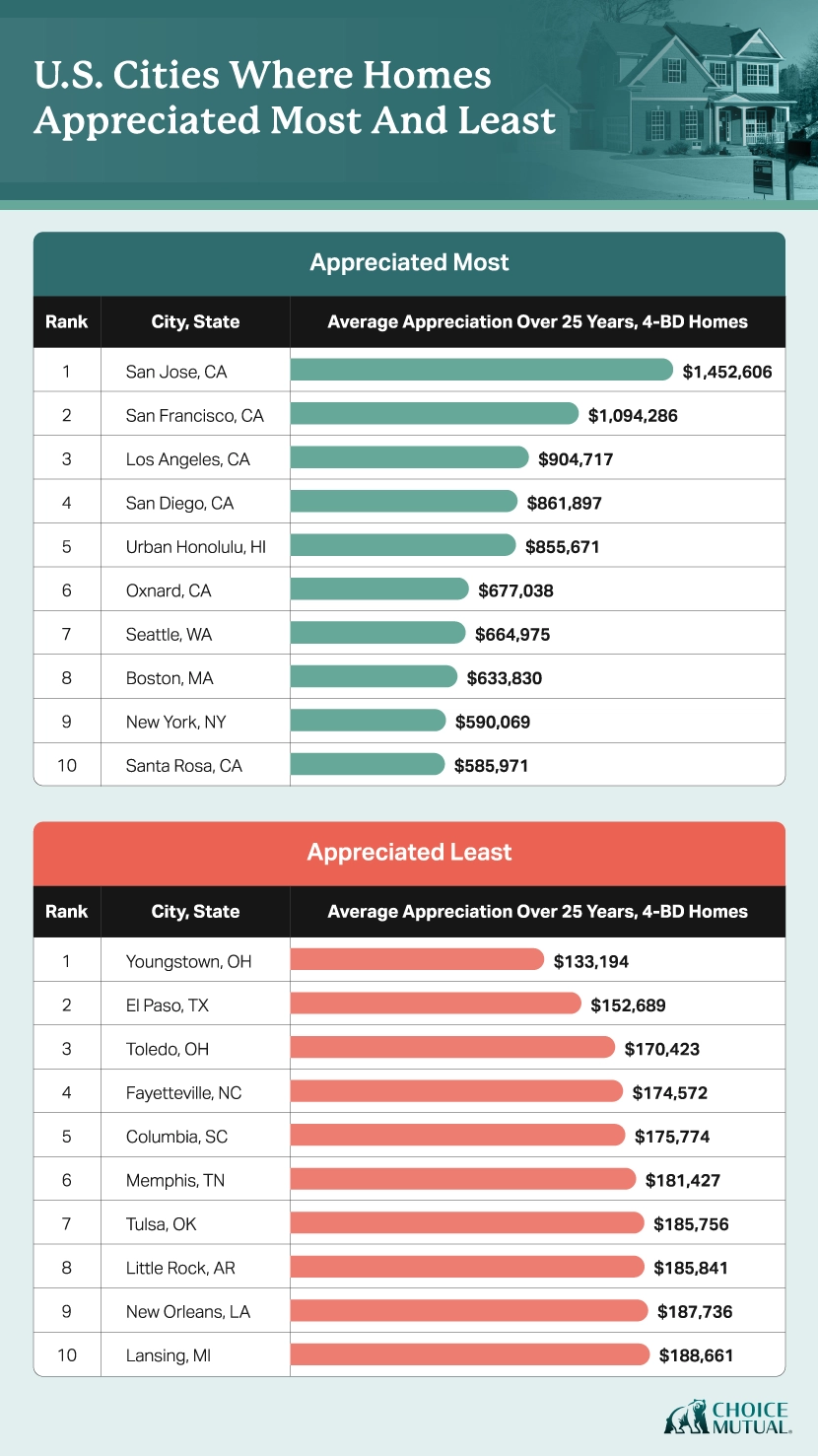

How Home Values and Inventory Compare Across The U.S.

In addition to our downsizing strain score, we wanted to highlight where in the U.S. home values have seen the most growth and where inventory for downsizing is greatest. Up first for appreciation of four-bedroom homes is San Jose, CA, with an average profit of $1,452,606 over the past 25 years.

California cities continue to lead the way, with San Francisco, CA, ranking second at $1,094,286, followed by Los Angeles, CA, at $904,717, and San Diego, CA, at $861,897. Coming in fifth place for home-value appreciation is Urban Honolulu, HI, where the average four-bedroom has appreciated by $855,671.

On the other end of the spectrum, Youngstown, OH, has seen the least growth in the value of larger homes over the past 25 years, at $133,194 on average. This is followed by El Paso, TX ($152,689), and Toledo, OH ($170,423) in second and third place, respectively.

When viewing inventory, we created a ratio to show the number of four-bedroom homes relative to the number of two-bedroom homes. Overall, we found downsizing in Urban Honolulu, HI, would be easiest based on inventory, as for every 1 four-bedroom home, there are nearly 8 two-bedroom homes.

Boston, MA, is up next, with the second-highest inventory: nearly 4 two-bedrooms for every 1 four-bedroom home in the city. For third place, San Francisco, CA, and New York, NY, tie with an average of 3 smaller homes for every 1 larger home.

Methodology

This research examines downsizing affordability across 100 major U.S. metropolitan areas by comparing 25 years of home-value appreciation (January 2000 to September 2025) against current small home prices and availability. The analysis uses a composite Downsizing Strain Score to rank markets from easiest to hardest for empty nesters attempting to sell family homes and purchase smaller properties.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.