Groceries, utilities, rent or mortgage payments… the list of bills Americans face goes on and on. For millions of working adults, however, the financial stress comes from supporting more than just themselves. They are paying for childcare, helping aging parents, and trying to stay financially stable. This growing group is often referred to as the sandwich generation.

At Choice Mutual, we work closely with families every day as they financially prepare for the future of their aging loved ones. That’s why we set out to learn where this sandwich generation feels the squeeze most as they support both their children and their parents.

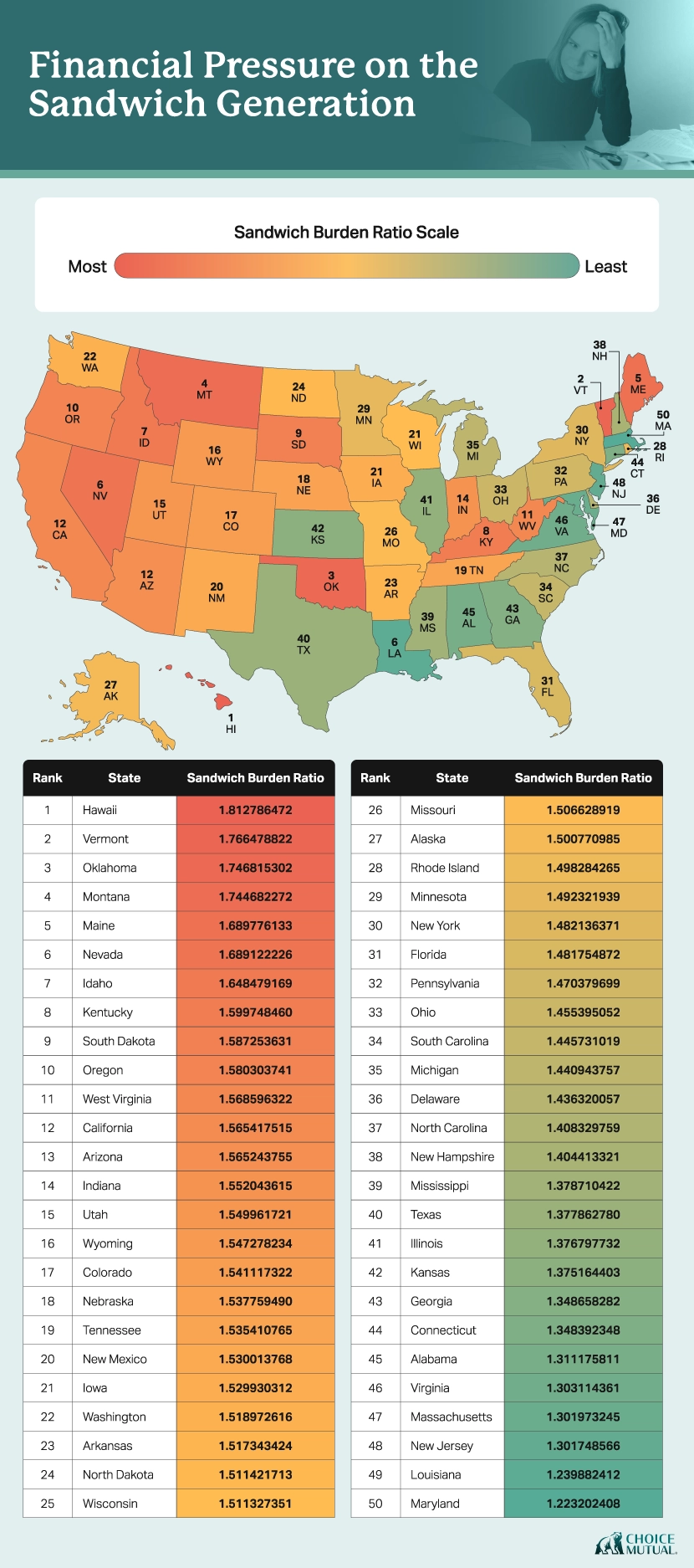

To do this, we first collected each state’s median household income for a married couple with two children, the living wage for a household that includes childcare costs, and the average cost of a full-time home health aide. Using this data, we then calculated a sandwich burden ratio to show which states are under the most financial pressure. Read on to learn which states are feeling the squeeze most.

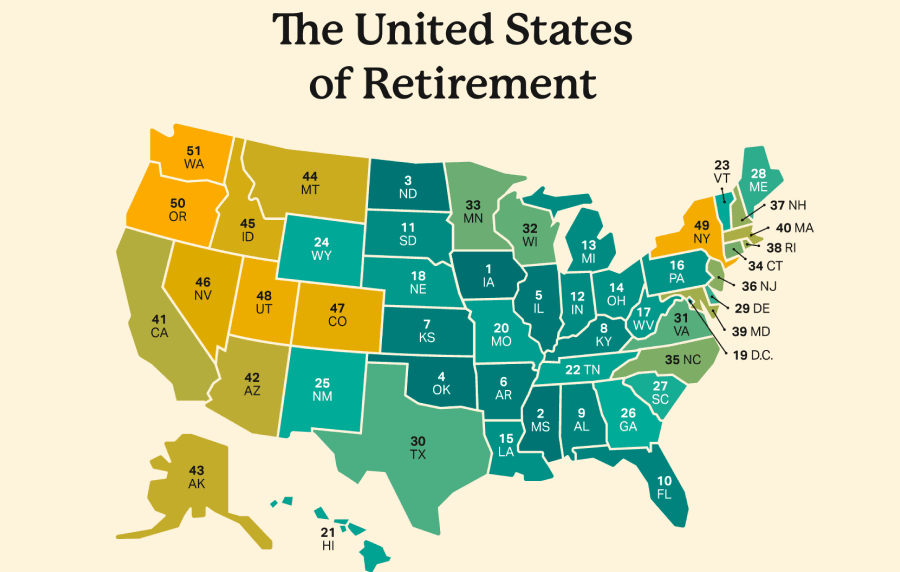

States Under The Most Financial Pressure

Overall, we found that the national cost of child care and senior care is 1.5 times the median household income, resulting in a sandwich burden ratio of 1.5. When comparing this to the state-by-state ratio, we found that half the country experiences an even greater burden.

Leading the way with a sandwich burden ratio of 1.813 is Hawaii, where both the cost of living ($147,178) and the cost of child and elder care ($124,554) are among the highest in the country. While household incomes are higher than average, they still don’t keep pace with those costs.

This leaves Hawaii families with a larger share of their income dedicated to caregiving than families in other parts of the country.

Coming in second place is Vermont, where the average cost of child and elder care is the highest in the country at $138,752 annually, which is more than the median household income in the state ($137,525). Following closely behind, with a sandwich burden ratio of 1.747, is Oklahoma, which ranks third-lowest in median household income ($105,583).

Caregiving costs, on the other hand, are middle of the pack, ranking 29th overall. However, given the lower salary available, the burden remains heavy.

While the burden felt can vary from one family to another, depending on their personal circumstances, some parts of the country are likely to experience less financial pressure. Leading the way with the lowest sandwich burden ratio of 1.223 is Maryland.

While care costs rank 19th overall at $108,450, Maryland has the third-highest median household income ($171,396), meaning a smaller percentage of earnings is dedicated to caregiving needs.

Louisiana is up next with a ratio of 1.240, as child and elder care costs are the lowest in the country ($66,617). Following closely behind in third place is New Jersey, with a sandwich burden ratio of 1.302, the second-highest household income ($173,628), and much more flexibility to cover the average care costs of $118,904.

On average, it would cost $103,904 per year to support both child care and elder care. While most families can budget for this expense, we discovered that if the average family were required to pay for child and elder care at the same time, they would accumulate about $64,000 in annual debt.

Cost Of Child And Elder Care Across The U.S.

While our sandwich burden ratio takes into account median incomes and cost of living, we wanted to dive deeper into the care costs themselves. Leading the way with the highest average care costs is Vermont at $138,752 annually, making it the only state where caregiving costs exceed the median household income ($137,525).

Colorado ($129,805), Minnesota ($129,780), and Washington ($129,160) follow closely behind with similarly pricey caregiving costs, earning them second, third, and fourth place, respectively. Up next is Massachusetts, which is a rare state where care costs are very high, ranking fifth overall, but an even higher income ($187,255), ranking first overall in the country, helps to offset the burden.

When looking at both types of care individually, we find that Massachusetts ranks first in the U.S. for the most expensive child care at $39,767 per year. Vermont and Connecticut follow this with annual prices of $39,224 and $35,743, respectively. For elder care, South Dakota ranks first with an annual total of $100,672. Vermont is up next at $99,528 a year, followed by Minnesota in third place ($98,384).

Methodology

To determine state-level incomes and cost burdens, we used three primary data sources.

- We determined each state’s median household income for a married couple with two children using the U.S. Census Bureau’s American Community Survey of 2023.

- We used “living wage” thresholds determined by MIT, which express the minimum required income to cover basic needs in each state, for different types of family units. Again, we focused on the most common family unit, which is two working parents and two children. This living wage data already accounts for the cost of child care.

- We used data from CareScout for the average cost of a full-time home health aide, which is currently the most common type of paid senior care.

The Sandwich Burden Ratio is calculated by adding the required income for a living wage and the cost of a home health aide, then dividing by the median income. So this ratio expresses what the estimated cost to get by would be, then divides it by actual income trends.

The Sandwich Burden Deficit is calculated by subtracting from the median household income both the required living wage income and the cost of a home health aide. It’s important to note that it may be rare for a couple in the sandwich generation to bear these cost burdens all at once in the same year. So the deficit should be taken less as a probable annual deficit and more as a proxy for financial pressure in that given area.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.