Clocking out of work one last time is something many working Americans fantasize about. Although the idea of gaining an extra 40 hours a week to do whatever you want sounds enticing, it’s not always the end of the story for some retirees. From an increased cost of living to a desire for something to do, not all Americans are staying retired.

At Choice Mutual, we have some insight into how seniors are spending their later years. With many returning to or remaining in the workforce past 67, we wanted to gain a deeper understanding of where this trend is most prevalent. To achieve this, we analyzed data from the U.S. Census Bureau’s American Community Survey, spanning the years 2013 to 2023, in more than 100 cities and all 50 states.

Using this data, we tracked changes in the labor force participation rate to determine where Americans are delaying retirement the most. Additionally, we calculated the average number of hours seniors are working in the U.S. and where the highest percentage of older workers are still clocking in. Read on to learn more about what we discovered.

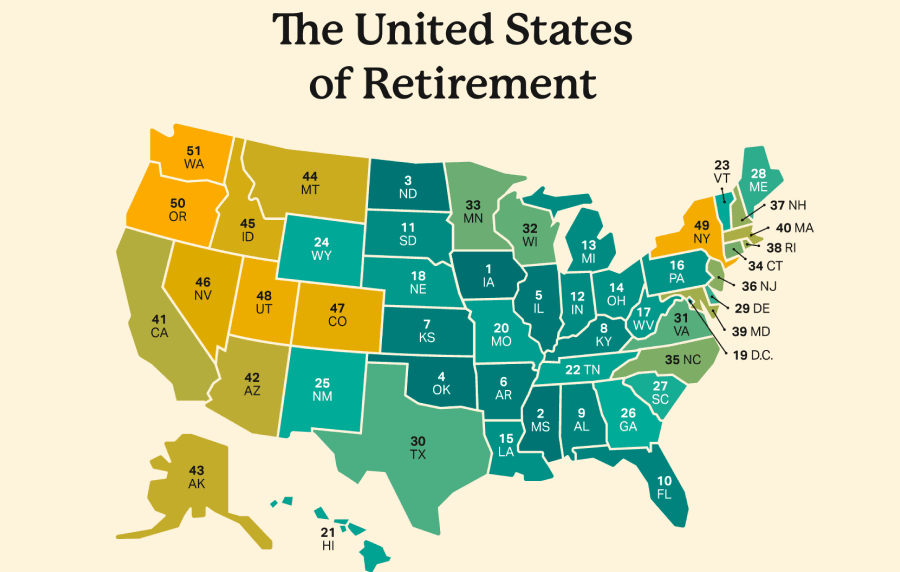

Cities and States Staying in the Labor Force Longest

Retirement doesn’t look the same everywhere. While older Americans in some cities find purpose in their jobs and a desire to keep working, others stay on the payroll to make ends meet. When analyzing U.S. Census Bureau data, we discovered that two situations are at play for older generations remaining in the workforce.

First, workers are choosing to stay employed past the age of 67. Second, people have retired and re-entered the workforce for some reason.

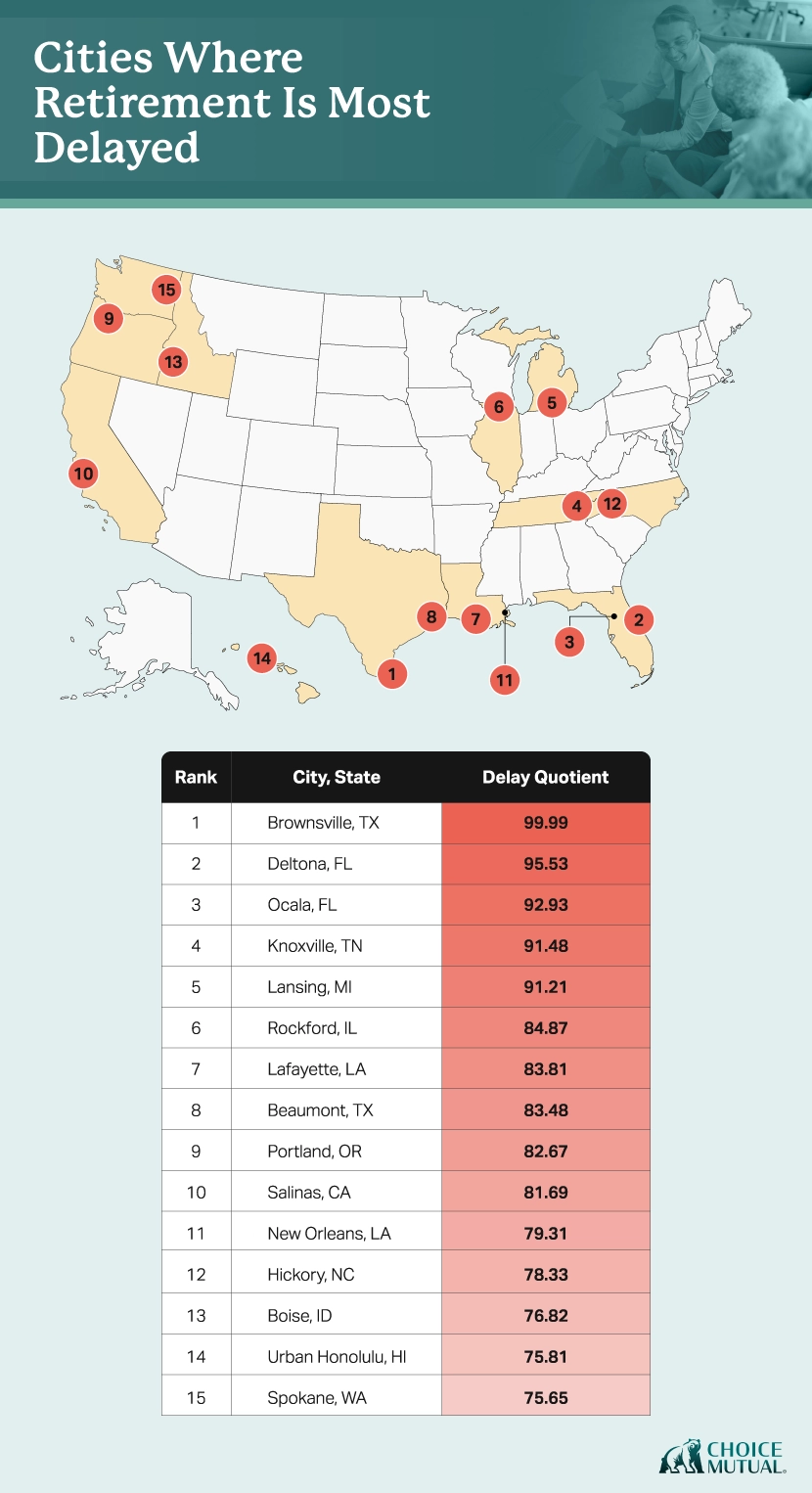

Whatever the cause may be, it is clear that seniors are continuing to work past what we consider retirement age. When looking at this on a local level, we found that residents of Brownsville, TX, are the most likely to remain in the workforce after turning 67.

Although Florida is often viewed as a retirement destination, two cities claim the top spots for the longest retirement delays. In second place is Deltona, FL, followed by Ocala, FL, in third place. We remain in the eastern portion of the U.S., with our fourth-place city, Knoxville, TN.

In addition to an overall ranking of cities, we sought to identify which major cities are home to seniors who continue to work in the workforce. Leading the way is Portland, OR. This is followed by New Orleans, LA, Milwaukee, WI, North Port, FL, and Riverside, CA, rounding out the top five cities for delayed retirement.

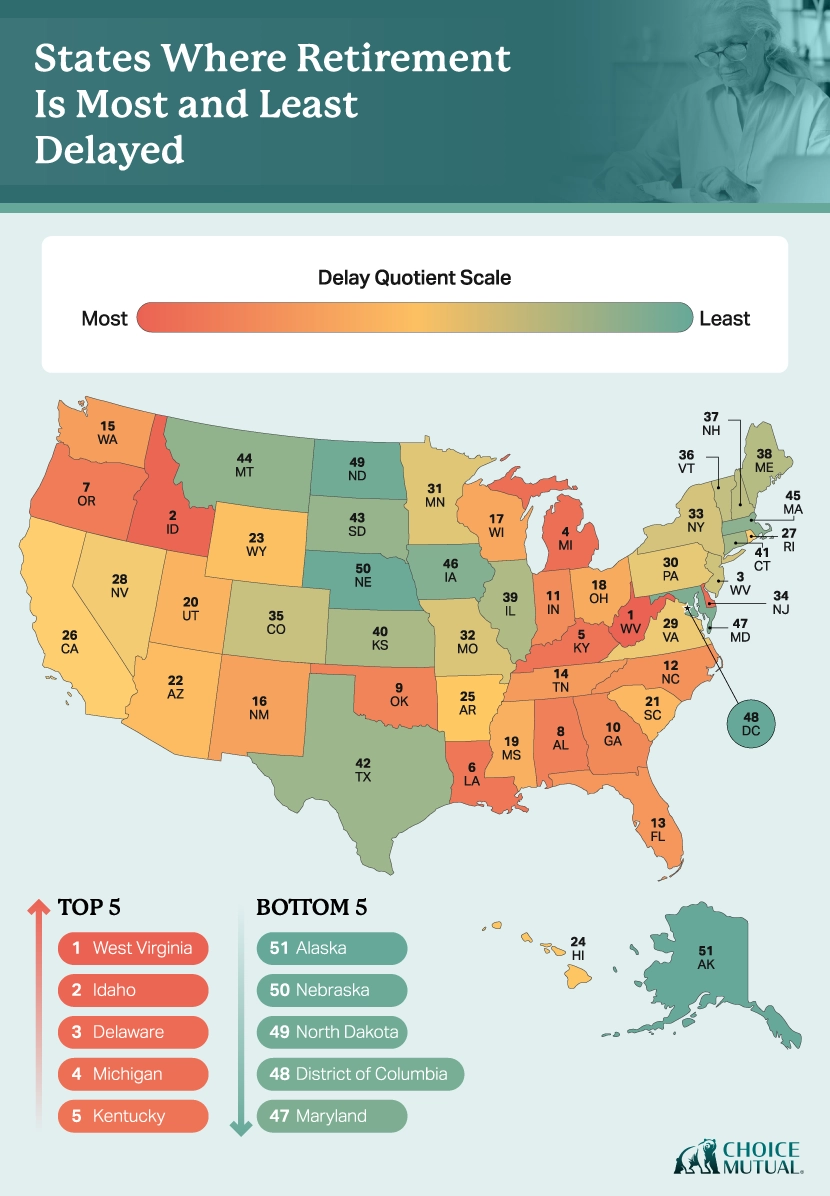

At the state level, we found that retirement is most delayed in West Virginia, Idaho, and Delaware. On the other hand, Alaska, Nebraska, and North Dakota are home to the least delays in retirement. When examining the number of workers in their 70s by state, we found that Nebraska leads the way. This is followed by Vermont, Connecticut, and South Dakota in second, third, and fourth place, respectively.

Where Seniors Are Working the Longest Hours

It can be common for older Americans to keep a part-time job to stay active, make a little extra money, or because they simply enjoy the work they do. For some seniors in the labor force, however, the hours they clock are closer to that of a full-time job. Overall, the average American over the age of 66 works about 31 hours a week.

When examining the average time worked in major cities across the U.S., we found that Houston, TX, seniors are putting in the most time, at 33.71 hours per week. Houston is not the only Texas city where seniors spend lengthy hours, though. In fact, there are four Texas cities among the top 10 on our ranking, as Dallas (33.31) and San Antonio (32.96) claim second and third place, respectively, for the number of hours worked.

In fourth place is the nation’s capital, Washington, D.C., with the average person over the age of 66 clocking 32.83 each week. Oklahoma City, OK, is next in fifth place, averaging 32.53 hours per week, followed by another Texas city, Austin, at 32.51 hours each week.

Methodology

In this study, we set out to assess in what parts of the country people aged 67 and older are still in the labor force or have returned to the labor force after retiring. We chose those who are 67 or older because this is when Social Security benefits are paid at 100% of the eligible monthly benefit.

Using the Census Bureau’s American Community Survey results from 2013 to 2023 (excluding 2020), we analyzed data for 143 cities and all 50 U.S. states.

Where Retirement is Most Delayed

We define “delayed” retirement as either retirement after the age of 67 or an unretirement event, where a person is retired but then returns to the workforce. To establish trends in delayed retirement, we tracked the change in labor force participation rate (LFPR) for a given age group in a specific year within each geographic area.

For example, we found that in 2014 the LFPR for 69-year-olds in Chicago was 25.8, and the following year, in 2015, the LFPR for 70-year-olds was 21.7. Although not a true longitudinal study, analyzing strands like this allowed us to create a proxy for longitudinal data.

We measured these one-year changes for every age group in every city and state, across every year of our data, to create average drops in LFPR per geography. These average drops were then normalized into the delay quotient. A city or state with a low average drop, meaning relatively few people leave the workforce despite growing older, indicates that retirement is delayed in that area.

The average hours were calculated as the average hours worked by all workers aged 67 or older.

- Nationally licensed life insurance agent with over 16 years of experience

- Personal annual production that puts him in the top .001% out of all life insurance agents in the nation.

Anthony Martin is a nationally licensed insurance expert with over 16 years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

- Nationally licensed life insurance agent with over 20 years of experience

- Best selling Amazon author.

Jeff Root is a nationally licensed life insurance expert with over 20 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

- Nationally licensed life insurance agent with over 15 years of experience

- Best selling Amazon author of five insurance sales books.

David Duford is a nationally licensed insurance expert with over 15 years of experience. He has personally helped more than 15,000 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.